After a strong end to 2023, the prospects for equity markets and active stock selection are now encouraging. However, investors should remain flexible - 2024 may have more surprises in store.

As 2022 drew to a close, most investors predicted a weaker US economy in 2023. How could this not come to pass, given the dizzying rise of US interest rates from 0.25% to 4.5% in just nine months? Many pinned their investment hopes not on the US, but on a newly reopened China.

In fact, the US economy grew by around 2.5% in 2023 – significantly more than its 1.9% growth in 2022. China, meanwhile, faces a deflating property bubble and weak consumer confidence, raising fears of a debt-deflation spiral.

Also confounding expectations, equity markets were the winning asset class in 2023, despite the failure of three US regional banks, war in Ukraine, US-China tensions and the Israel-Hamas conflict. Most striking was the performance of the ‘Magnificent Seven’, the largest US-listed technology companies. In aggregate, these rose 107% ($, total return), primarily due to high expectations for the disruptive potential of generative artificial intelligence (AI). The rest of the S&P 500 – the ‘S&P 493’ – returned a more modest 9.9% ($, total return).

2023: Spectacular but highly concentrated equity returns

| The Magnificent 7* | 107.0% |

| ‘S&P 493’+ | 9.9% |

| MSCI World Equally Weighted Index | 17.3% |

| S&P 500 | 26.3% |

| MSCI All Countries World Index (ACWI) | 22.8% |

| Bloomberg Global Aggregate | 5.7% |

Past performance is not a reliable indicator of future results and may not be repeated.

A friendly environment for equities

Forecasting in a complex world is challenging, particularly when a pandemic has created an economic cycle with little modern-day precedent. These are unusual times, and we are mindful to keep our portfolios well-balanced and flexible.

Nonetheless, gauging the outlook for the world economy and for markets is a key element in our investment approach, alongside identifying the most promising companies within our five global investment themes.

Our central outlook is for disinflation and a soft landing, but there are risks of a surprise decline in growth or a return of inflationary pressures. We believe it is increasingly likely that interest rates and long-term bond yields have peaked. If they have, history is on the side of further upside to equity markets over the coming year. At the end of the Federal Reserve’s (Fed’s) last six hiking cycles, equities rose 5 out of 6 times in the following 12 months[1]. The exception was 2000, when the Dot.com bubble began to implode.

We also believe that much of the post-pandemic inflation was due to constrained supply chains, not excess demand. Given this, deep or prolonged economic weakness may not be needed to return economies to equilibrium.

Our central case is for the global economy to slow but avoid recession, with a soft landing in the US and potentially a mild recession in Europe and the UK.

Company profits tend not to fall sharply outside of a recession. If a soft landing, or even ‘no landing’, can be achieved, the weakest point for earnings may be behind us.

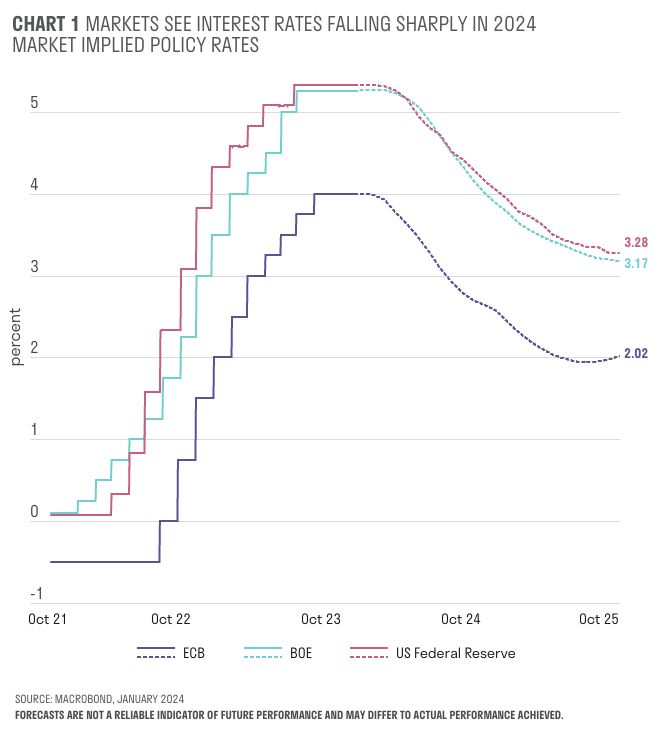

Most importantly, we now expect the Fed to cut interest rates by 1.5% in 2024. A combination of moderate growth, sharply declining inflation, easier monetary policy and lower long-term rates is exceptionally friendly for equities.

More surprises in 2024?

As 2023 demonstrated, we must be ready for the unexpected - yet it is clear that many investors are no longer well positioned for unpleasant surprises. The bearish consensus at the end of 2022 has given way to widespread optimism, despite global equity markets being more than 20% higher (in dollar terms)[2], and supported by higher multiples rather than profit growth. Markets have abandoned expectations of higher-for-longer interest rates, and are forecasting a relatively rapid rate-cutting cycle.

Are they being too optimistic? Outside of a recession, the Fed has not cut interest rates as far or fast as markets are now pricing. Should recession strike or growth disappoint, profit forecasts could prove to be too high, forcing investors to rotate rapidly into defensive areas of the market.

Alternatively, we might see a resurgence of inflation. Economic growth could re-accelerate in response to looser financial conditions, while escalating conflict could disrupt supply chains or cause energy prices to spike. Mindful of the lessons of the 1970s and early 1980s, when interest rates were lowered too soon, a pick-up in inflation could force the Fed to raise interest rates yet again.

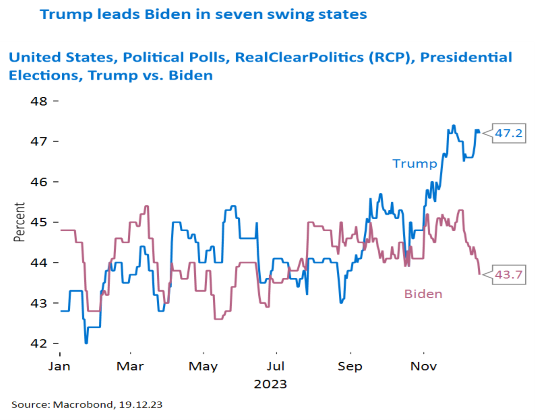

Politics and geopolitics may also hold surprises, as more than half the world’s population goes to the polls in 2024. A second Trump presidency in the US would most likely raise tariffs and re-freeze US-China relations, while Taiwanese elections could soften or harden the tone for cross-strait and US-China relations. At the same time, further developments Ukraine and the Middle East – whether positive or negative – could cause significant moves in commodity markets.

Attractive opportunities waiting in the wings

The outlook is improving, but the post-Covid economic and market cycle has been hard to predict. In particular, higher valuations and bullish investor positioning warrant some caution in portfolio construction.

The rally in equities since October has been among the sharpest since the Global Financial Crisis of 2008. Looking back at the past two decades, the US technology sector’s outperformance in 2023 is rivalled only by 2009 and 2020[3]. Our analysis suggests that the Magnificent Seven will continue to have higher sales growth and better cash margins than the rest of the market, and are deserving of their premium valuation. Each, however, has very different prospects – they are, after all, very different businesses. We see considerable opportunity to add value from stock selection within these companies.

Any widening of market interest beyond the Magnificent Seven would be beneficial for overall equity returns and for active stock pickers such as ourselves. Looking beyond the US, there are excellent stock selection opportunities in Europe, Japan or Asia Pacific, where valuations are lower but earnings growth is comparable to the US.

UK-listed companies, including those with a high proportion of global earnings, are particularly cheap relative to their global peers.

LSEG (London Stock Exchange Group), for example, is predominantly a data and indices company with a high proportion of recurring revenue and growth opportunities from generative AI. But when compared to its peers around the world, it is trading at a discount.

If the downside risks to the Chinese economy do not materialise, the upside in companies with exposure to Chinese consumers could be compelling. For example, Asian insurers such as AIA and Prudential are now pricing in no new customer growth – an implausible outlook.

The healthcare sector continues to offer a good number of relative value opportunities in our Ageing theme. High-quality companies such as Thermo Fisher that have faced challenges since the end of the pandemic look set to return to their long-term growth trajectory, and yet are valued at their lowest multiples in the past five years. Meanwhile, 2023 was a remarkable year for anti-obesity drug producers such as Eli Lily, but the disruptive risks these drugs pose to the medical technology industry have been over-estimated. We see attractive opportunities among companies such as Smith & Nephew and Medtronic.

Scope for further upside

In summary, the prospects for equity markets are encouraging. Yes, there is limited upside to profit growth, but lower interest rates would support higher valuations in areas of the market that lagged in 2023.

After 2023’s impressive market gains, we see scope for further upside across a wider range of equities, provided that inflation continues to fall and lower interest rates support higher valuations in the parts of the market that lagged last year.

Any broadening of the market’s focus would benefit companies across our Ageing, Automation and Climate Change themes, and enable them to take up the baton from Digitalisation, which led the way so magnificently in 2023.

[1] Source: Bloomberg, 2 January 2023

[2] Source: Bloomberg, MSCI All Countries World Index (ACWI) as at 31st December 2023

[3] Bernstein Research, December 2023

Important information

This document is intended for retail investors. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

The index data referenced is the property of third-party providers and has been licensed for use by us. Our Third-Party Suppliers accept no liability in connection with its use. See our website for a full copy of the index disclaimers https://sarasinandpartners.com/important-information/.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].