The global economy proved remarkably resilient in 2023. Can it pull off the same trick in 2024?

As we look back on 2023, the real surprise for investors was not the succession of geopolitical shocks, but rather the extraordinary resilience of the world economy. At the start of 2023 the challenges looked formidable, with war and an energy crisis in Europe, supply chains still disrupted by Covid and deteriorating China-US relations. Come October, investors faced the consequences of the Israel-Hamas war, which could yet widen into a regional conflict.

But economic growth didn’t stall. Indeed, the US actually saw a significant re-acceleration in third-quarter growth. Momentum will now slow as interest rates bite, but the American economy looks set to achieve a rare thing – a soft economic landing. Meanwhile, the UK and Europe will probably not escape recession, but any downturn will be mild.

Disinflation is becoming the norm

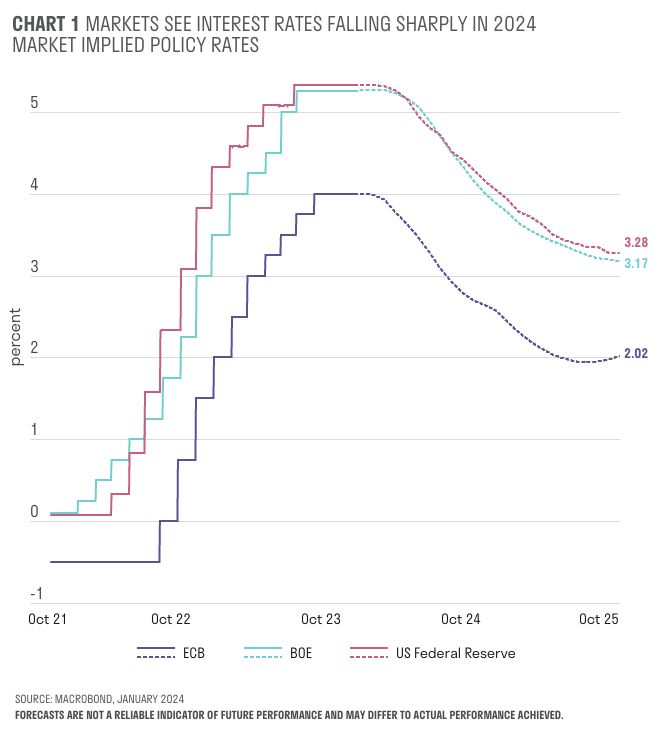

The good news in 2023 was not confined to growth. Consistently weaker inflation data in the US and Europe fed a growing narrative that central bankers will ease monetary policy in 2024. Behind these disinflationary trends lies the healing of post-Covid supply chains, softer capital goods prices (especially from China) and steadily lower energy costs. Against this backdrop we now expect six US rate cuts in 2024, beginning in March, and a further four in 2025.

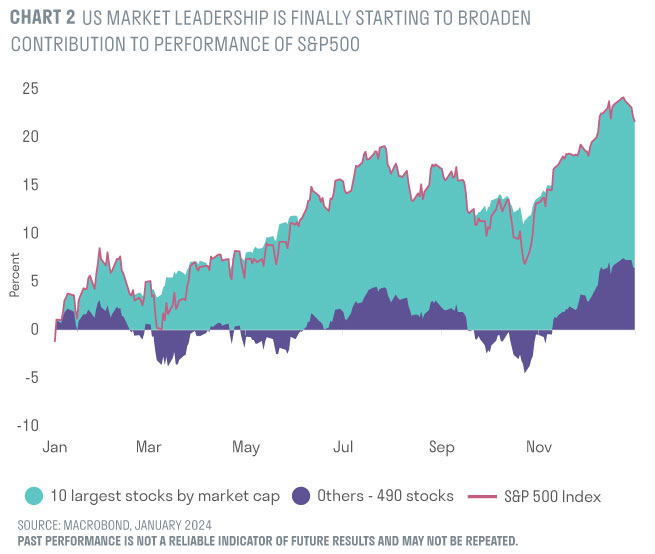

It is this near-Goldilocks scenario, including the real prospect of a soft landing, that fuelled investment gains in 2023. The rally was most evident among super-cap US technology stocks, the so-called ‘Magnificent Seven’. These accounted for a staggering two-thirds of the rise in the S&P 500 last year, reflecting optimism about the break-neck pace of development and deployment of artificial intelligence (AI).

We were too cautious

We were, in retrospect, too cautious – modestly underweighting equities and holding precautionary positions in cash for much of 2023. Against a background of relentlessly rising interest rates, we were particularly wary of equity valuations. And while we held a number of the ‘Magnificent Seven’ AI winners, we did not hold them in the quantities needed to match the technology component of the index.

As headline inflation started to fall over the summer and with a growing confidence that the peak in interest rates had likely passed, we started adding first to corporate bond exposure and then to equities. By the fourth quarter we also saw the beginning of a widening in equity market leadership, with global equities now rallying alongside US shares. Taken together, this proved to be a more supportive environment for our investment style and asset positioning.

Beyond equities, our bond holdings performed well and we added to credit and extended duration over the summer as UK corporate yields soared above 6%. [1]

We also added modestly to our holdings of infrastructure and to renewables funds, where discounts to net asset value had fallen to levels last seen in the darkest days of the 2008-9 Great Financial Crisis. Both moves were well timed, as bond yields fell back sharply in the last quarter of 2023 and discounts started to narrow.

Beware geopolitics

Looking ahead, the geopolitical risks today seem even more daunting than they did a year ago. Of greatest immediate concern is potential escalation in the Israel-Hamas war, which now reaches the Red Sea and Israel’s border with Lebanon. So far, the absence of a wider regional conflict has allowed energy prices to fall, with none of the strategic reductions in supply (outside of regular OPEC+ meetings) that marked earlier Arab-Israeli conflicts. We believe this crisis can still be contained: there is little evidence that Iran wants to escalate the conflict or that the larger Arab states want to use oil to ‘punish’ the West. Human suffering on both sides remains intense and that must be policymakers’ priority.

Meanwhile the stalemate in Ukraine looks set to remain, albeit with horrific attacks on civilian infrastructure. We believe that ways will be found to deliver the aid to Ukraine that is currently stalled in the US and EU. Any diplomatic route towards a settlement in 2024 would likely help market sentiment. Meanwhile, with Europe having largely severed its links to Russian energy, Russia’s ability to put pressure on the West is greatly reduced.

Is there value in Chinese equities?

Talks between the presidents of the world’s two largest economies took place in San Francisco last November, marking what could be the first steps towards thawing Sino-US relations. The wins were modest – high-level military communications were restored and fentanyl supplies restricted – but the dialogue alone was important.

From an investor’s perspective, the question is whether talks are enough to stem the outflow of capital from Chinese markets in the face of an extraordinarily hostile and bi-partisan US Congress. Chinese equity markets were the stand-out underperformers of 2023: while the S&P 500 is now 24% higher than it was three years ago, the MSCI China is 50% lower.[2]

Following our analysts’ visits to China and Hong Kong last year, we remain defensive. Before committing funds to the region we would like to gauge China’s reaction to Taiwan’s national elections, which are due to be held on 13 January. We would also like to see evidence that residential property prices are starting to bottom, together with convincing moves by the Chinese government in support of foreign inward investment. Xi’s outreach to US executives on his Californian visit was a step forward, but China’s abrupt new regulations for gaming companies in late December were a step back.

A super, super-election year

More than 70 countries will hold elections in 2024, with more than two billion voters heading to the polls, from the United States and Mexico to India and South Africa.[3]

The UK may also see a general election, but with little to choose between Conservative and Labour economic policies, investment risk should be low.

The headline-grabber remains the November 2024 US elections, in which control of the House of Representatives, the Senate and the presidency could all change – a rare instance of Republicans and Democrats battling for all three levers of elected power in Washington.

Recent polls show Donald Trump consistently ahead of President Biden, despite ever-mounting legal challenges, but early presidential polls are notoriously unreliable. It is also worth remembering that Trump’s last presidency was rewarding for equity investors. It saw the S&P 500 rise by more than 50% – a figure substantially above the average for presidencies since the 1980s.[4] The investment risks posed by the US election could be meaningful, particularly if Trump’s universal tariffs are enacted, but it’s probably too early to assess the impact on markets.

A broadening of market leadership?

2023 was a difficult year for active investors. The lion’s share of equity returns came from a handful of stocks, in what was probably the most extreme concentration of returns since the 1960s.

It was a particularly challenging year for our multi-thematic managers, who were essentially operating in a market focused on just one theme – AI. Other high-growth themes were largely ignored by the market, including robotics, climate transition, smart buildings, electrification and medical diagnostics. In short, real value is building up across our investment themes, such that if market returns do broaden, our clients’ portfolios should be well positioned.

Where else might this widening of returns be felt? After a dull 2023, the opportunities in global equity income look promising, with global dividend growth now expected to be in excess of 8% in 2024, well ahead of inflation. Valuations too are attractive with the MSCI World High Dividend index offering a yield close to 4% and a forward price/earnings multiple of just 11.[5]

Investment policy implications

The prospect of lower inflation and resilient economic growth were powerful drivers of investment markets in the final quarter of 2023. Our clients benefited from the upswing, which delivered strong absolute returns across portfolios.

Market leadership will likely broaden in 2024 - indeed we have already seen tentative signs of this over recent weeks. In turn, this should allow other investment themes offering long-term growth at reasonable valuations to shine as the year progresses. In particular, in a climate of falling interest rates later in the year, the opportunities for equity income mandates with strong dividend growth should also return.

Against this backdrop, our multi-thematic investment process, and our focus on long-term income growth, look well positioned for market conditions in the year ahead.

[1] All data in this article sourced from Macrobond, as at 3 January 2024, unless stated otherwise.

[2] Macrobond, 3 January 2023

[3] The Economist: 2024 is the biggest election year in history, 13 November 2023

[4] Reuters, December 2023

[5] FactSet, 3 January 2024

Important information

This document is intended for retail investors. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].