In 2013, Mark Zuckerberg, the CEO of Facebook, popularised the mantra ‘move fast and break things’ to describe how technology innovators bring about change. He argued that companies must move at breakneck speed to disrupt the status quo. Accuracy and accountability follow later. In short order, other technology companies followed Facebook’s lead and disruptive businesses have since flourished.

Recently, politicians have also started to embrace this disruptive philosophy. Newly formed parties – from the Five Star movement in Italy to Alternative fur Deutschland (AfD) in Germany – have ostensibly challenged accepted political beliefs and enjoyed stunning success at the ballot box. Incumbents, facing a ‘stand-still and perish’ threat, have followed suit. As politicians of all hues cast aside accepted truths, the centre ground of politics is rapidly vanishing. Politics, everywhere, is lurching rightwards and leftwards.

The new breed of disruptive politicians has little interest in anchoring policies on the opinions of experts. Instead, there is a growing disregard for institutions and their knowledge banks. In such an environment, policies can become unmoored from the liberal, market-driven principles on which much of post-war prosperity has been based.

Why are politicians jettisoning conventional thinking?

For much of the past 70 years, the global economy experienced strong growth as favourable demographics amplified strong productivity trends. With many of the world’s citizens enjoying decades of sustained increases in living standards, a strong global consensus in support of unfettered open markets as the best way to cement progress in rich and poor countries emerged.

The financial crisis of 2008 and its economic scars, however, have profoundly shaken this belief; not only was the global recession deep, but the recovery since has been disappointing at every turn. Furthermore, demographic trends are now on the wane and productivity growth is disappointing across the board. There is little confidence that the global economy will once again attain pre-crisis levels of growth.

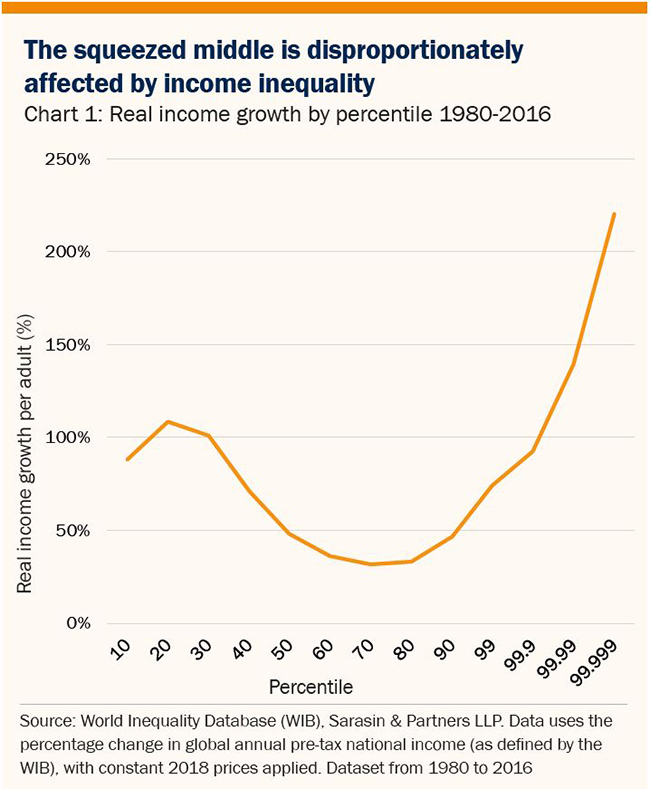

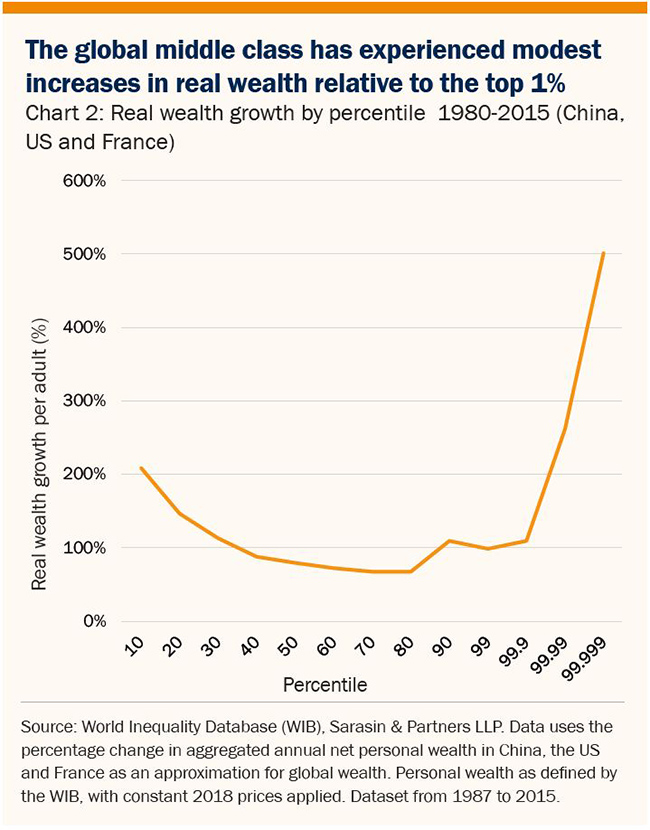

Waning growth is exposing the dark underbelly of capitalism: increasing income and wealth inequality. Chart 1 plots real income growth for the period from 1980 to 2016 for different income groups. This chart is called the elephant curve of global inequality; the trunk of the elephant captures the strong income growth of the top 1%. It also shows a ‘squeezed middle’ – the global middle class that has experienced very modest increases in real incomes during the past 30 years. This is a demographic segment that is disproportionately represented by the bottom 90% of the population in the US and Western Europe. The broad trend in global wealth is no different. Chart 2 shows a global1 middle class that has experienced relatively modest increases in real wealth relative to the top 1%. This stagnation in real income and wealth is feeding a growing discontent with conventional policies and has opened up the political status quo for disruption.

The Next Big Thing in policy-making

Across the world, politicians are pitching plans to restore distributional equity. Policies like Medicare for All, People’s Quantitative Easing, Modern Monetary Theory (MMT), and Universal Basic Income all seek to address the democratic need for greater income and wealth equality. That the slowdown in growth is taking place at the same time as risks from climate change are emerging is also forcing politicians to confront the intergenerational inequity associated with a warming planet. Policies like the Green New Deal, championed by the Democrats in the US, are attempts to steer the economy towards a more sustainable path in response to the growing demand from younger generations.

A fiscal embrace…

The new breed of disruptive politicians are targeting the vast swathes of the population that have fared relatively poorly. They are calling for a more muscular fiscal agenda that includes increases in spending on health, infrastructure, defence, climate and education. In the US and UK, calls for greater spending are being accompanied by proposals for lower taxes. This new fiscal agenda will lead to a deterioration in public finances: fiscal multipliers – the growth impulse from additional government spending – are typically low when economies have limited spare capacity. This is because when labour markets are tight, increased government spending will likely crowd out private enterprise. At this stage of the economic cycle, increased fiscal spending is unlikely to usher in a growth tide that lifts all boats.

While increased spending on infrastructure and education can deepen an economy’s capital stock and raise productivity, sustained increases in productivity (known as total factor productivity) need much more. They require the right ecosystem for driving and rewarding innovation – aspects typically outside the sphere of influence of government budgets. In his 1994 paper, ‘The myth of Asia’s Miracle’, Paul Krugman famously criticised the East Asian growth model of the 1990s – driven mostly by capital deepening – as unsustainable. The ensuing financial crisis in 1997 serves as a cautionary tale. Governments also have a poor record in effectively deploying their budgets. As a result, there are strong grounds to believe that the coming fiscal expansion will likely raise debt and deficit levels while having a very modest impact on productivity and growth.

…brings the risk of fiscal dominance

Since the financial crisis, monetary policy has been the dominant policy lever. Central banks have taken aggressive and unorthodox measures to reflate the economy. Now, more than ten years later, there is a growing consensus that not only is the toolkit much diminished but also additional monetary policy easing will likely have limited impact on the economy. Instead, there is a gathering consensus that fiscal policy will need to start playing a much more active role. Accompanying this shift is a rethink about debt thresholds – the appropriate level of debt an economy can sustain without compromising growth and inflation. There is a tacit acceptance that debt-to-GDP levels can approach 100% without damaging the economy.

Even though higher debt thresholds create fiscal space, a more muscular fiscal agenda will need monetary policy to remain accommodative – to contain the interest burden associated with rising debt levels. Low interest rates along with quantitative easing will be essential to anchor current and future interest rates. Over time, there is a risk of fiscal dominance – where monetary policy not only contains the government’s interest burden but also explicitly starts to fund inefficient government spending. Policies such as the previously mentioned MMT and People’s Quantitative Easing, and purported plans to convert existing government debt into Zero Coupon Perpetual bonds (essentially turning them into cash) are harbingers of an impending collaboration between monetary and fiscal policy.

In sum, politicians are now being empowered to disrupt the status quo. In the coming years, we expect a steady expansion of fiscal policy aimed at addressing the inequities built-up in society. With it, public debt and deficit levels are set to rise. Even so, monetary policy will remain accommodative and the era of low interest rates will remain with us. Unorthodox monetary policies will be essential to enable the coming fiscal expansion. These policies might provide a temporary boost to growth, but ultimately longer-term challenges – such as those around demographics and productivity – are likely to prevail. The world is slowing and a heterodox marriage of monetary and fiscal policy is unlikely to become a long-term salve. Furthermore, there is a very material risk that this becomes an unequal marriage – with a subservient monetary policy leading to a deterioration in confidence and inflation expectations and lower growth further still. Over the long term, any economic resurgence will very much depend upon the next wave of disruptive innovation from technological companies. Politicians will do well to heed the advice of another technology disrupter – Google – and ‘Do No Evil’.

1 Net personal wealth in China, the US and France as an approximation for global wealth