- A cornerstone of Donald Trump’s economic and business policies has been deregulation. Throughout his presidency and campaign speeches, he has emphasised that cutting regulations boosts economic growth, encourages innovation, and reduces bureaucratic burdens on businesses.

- The new Elon Musk-led Department of Government Efficiency (DOGE) has made headlines in its efforts to scale back the US federal workforce. However, this is only part of the battle, with the new administration keen to rein in regulatory mission creep.

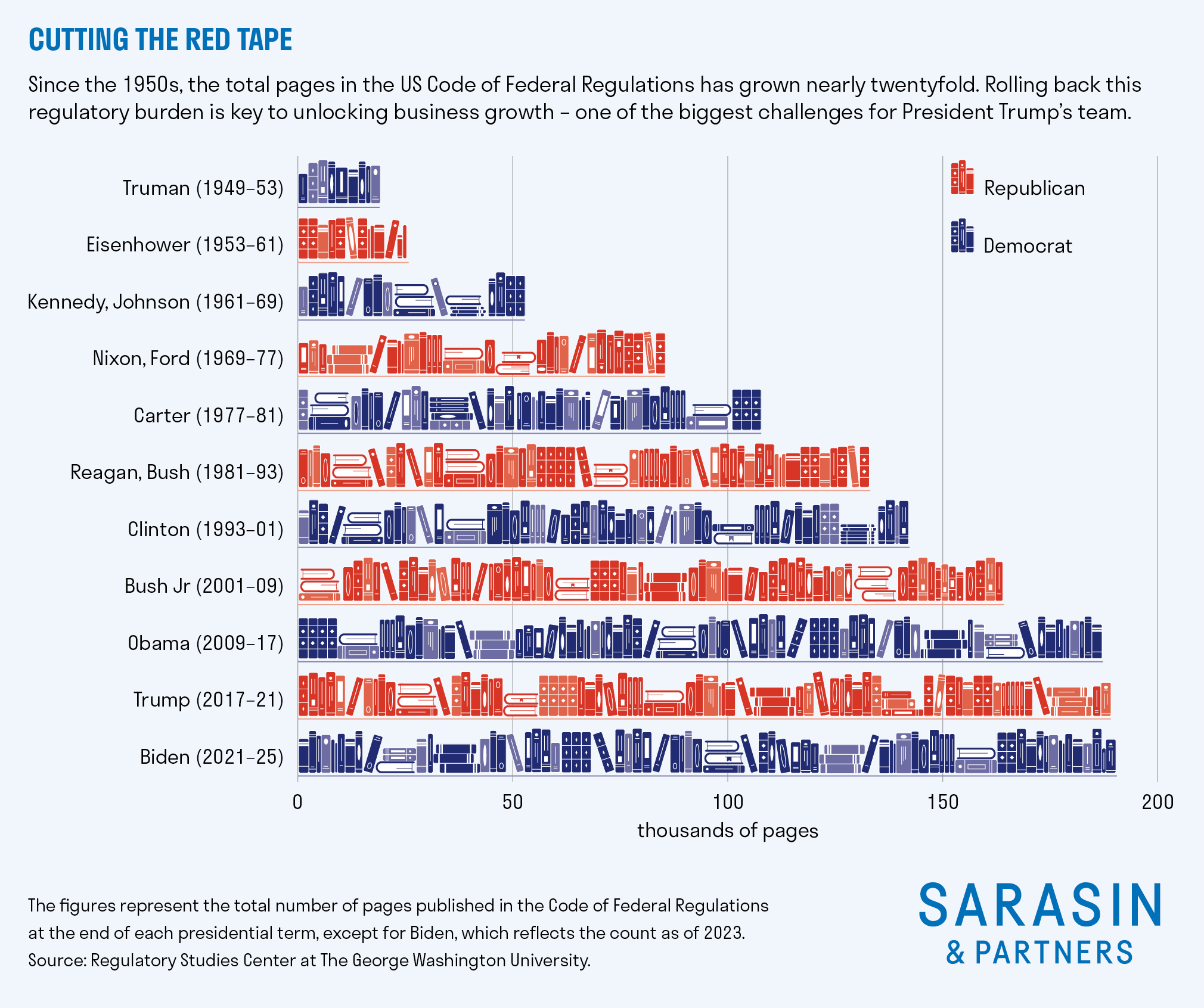

- One way to look at the scale of the task ahead is total pages in the US Code of Federal Regulations, which has grown markedly over the decades to nearly 200,000 today. The Trump administration clearly has a big task on its hands to bring this number down.

What does this all mean for markets? Make sure you watch the latest Six Minute Strategy video from our Chief Market Strategist, Guy Monson, who reports from his recent on-the-ground visit to Washington D.C.

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].