We get to know our companies comprehensively. When it comes to climate change, we use a proprietary, forward-looking approach to weighing individual companies’ prospects as the world warms.

Active investment managers spend a lot of time assessing the outlook for individual companies. But when it comes to estimating how climate change might improve or seriously impair a company’s prospects, it is often assumed that homogenous assumptions can be applied across the board.

For example, an estimated price for carbon emissions in 2030 might be applied to all companies being analysed, regardless of their plans to reduce carbon emissions, their competitive position, or whether such a carbon price is likely to apply in the jurisdiction where they operate.

Similarly, companies’ carbon footprints are often used as a guide to climate risk exposure, but these can only tell us about emissions today. They are not helpful in assessing what a company’s emissions might look like in five, or ten years’ time.

The reality is that climate change will affect individual companies in a much more nuanced way. This is partly because its effects will differ across the globe. The picture becomes increasingly complicated when we consider individual companies’ plans for decarbonisation, likely government policy responses in different regions, societal preferences and access to technology that can help alleviate the effects of a warmer world.

Faced with this, some investors consider climate impacts too complex and intangible for meaningful analysis. We beg to differ. To our mind, it calls for two key attributes of sound active management: professional judgement and investment experience.

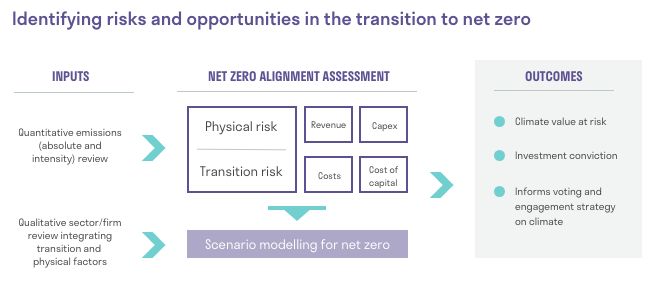

The key to making sense of how climate change affects individual companies lies in gaining insight on company-specific climate data and then quantifying our findings before incorporating them into traditional financial analysis. We do not expect to achieve perfect predictions, but our findings can help in two important ways – avoiding major risks and uncovering misunderstood investment opportunities.

Staying focused on the big picture

With global tensions growing and question marks hanging over the economy, it is natural for investors to focus on what they believe to be near-term risks, at the expense of addressing what are perceived to be longer-term risks. However, climate change is already happening around us; the markets’ failure to recognise this has the potential to wreak damage on all economic activity and on our quality of life.

Climate change will affect how all companies do business, not just the carbon-intensive companies that most readily spring to mind. For investors, understanding how climate change might affect their portfolios should therefore be of paramount importance.

Sarasin’s Climate Value at Risk

This where Sarasin’s Climate Value at Risk (CVaR) methodology comes in. Estimating value at risk (VaR) is a long-standing technique that investment managers use to examine and quantify potential threats to an investment thesis. Although it has the word ‘risk’ in its title, value at risk analysis can also help flag up promising opportunities. CVaR takes the concepts used in VaR and applies them to the complexities of climate change.

CVaR in action: Hydro One

Hydro One Ltd is a Canadian electric transmission company that enables renewable and low-carbon energy projects to be connected to the power grid.

Our CVaR analysis showed that a 1.5°C temperature outcome could be beneficial for the company’s equity value, with the CVaR analysis indicating a potential 27% upside in fair value versus a business-as-usual scenario.

In terms of physical risks, Hydro One’s significant fixed asset base could be vulnerable to fire and flood risk as global temperatures rise. However, the company is well insured, making a cashflow shock due to replacing damaged assets unlikely.

Hydro One could benefit substantially from the transition to a lower-carbon economy. If there is an acceleration in renewables projects, the transmission system would need to grow. This would enlarge the company’s asset base on which to derive a return.

In essence, CVaR is a forward-looking fundamental analysis and modelling exercise, based on a scenario in which the increase in global temperatures is limited to 1.5°C above pre-industrial norms. By quantifying a company’s exposure to accelerating decarbonisation and physical risks, CVaR helps us gauge possible valuation impacts.

CVaR builds on traditional financial analysis techniques, such as discounted cashflow analysis, that investment managers often use to estimate how much they should pay for a stock today. Some of the information we use in CVaR is publicly available, such as the Taskforce on Climate-Related Financial Disclosures (TCFD) that some companies are required to provide, which includes an assessment of the risks and opportunities they face.

We are also able to draw on information that is not as widely available, such as insights from our ongoing engagements with companies into their plans for transitioning towards a lower-carbon economy.

In turn, our CVaR results feed back into our engagements with companies. Companies that CVaR reveals as being at risk from climate change could still take steps to address these risks. This is exactly what we encourage when we engage with companies that have climate-induced risks but have the opportunity to ameliorate, if not capitalise, upon an ability to move towards a net-zero aligned path.

Misunderstood risks and opportunities

As one might expect, most oil and gas companies subjected to CVaR analysis do not come out well. Once the impacts of higher carbon prices, the growth of renewables and declining use of fossil fuels are taken into account, we can expect lower volumes, margins and revenue, as well as increases in the cost of capital.

But climate risks are not always where you expect. Our work on banks, for instance, has pointed to potentially material risks to capital from loan books overly exposed to carbon-intensive sectors. Banks are essentially a derivative of the global economy, so they internalise the risks of their borrowers. By analysing banks’ lending practices, we are able to get a better idea of this risk exposure and incorporate it into our CVaR analysis.

Some companies may also be substantially underpriced when it comes to climate change. For example, future demand for copper, lithium and rare earths – all crucial to the energy transition – appears be underestimated. This plays to the strengths of mining companies such as Lynas Rare Earths. Likewise, Air Liquide, a global leader in the production of hydrogen, is well-placed to benefit from the decarbonisation of industry and travel.

Consultancies such as Tetra Tech, that advise on systems and infrastructure needed for adapting to climate change, may also be deeply under-appreciated. Similarly, firms such as Quanta Services, which provides the skilled labour needed for building smart electrical grids and renewable power networks, have pronounced and positive exposure to decarbonisation.

Be prepared

Climate change presents major risks but also significant investment opportunities, some of which are deeply misunderstood by the equity and bond markets. We cannot say exactly when the risks will become realities, but climate change is progressing faster than many expect.

We are also likely to experience tipping points – events such as the collapse of ice sheets – that will accelerate climate change. The speed at which climate change is happening and the likelihood of tipping points make financial and economic models based on backward-looking climate data increasingly irrelevant[1].

The acknowledgement at COP28 that decarbonisation will require a transition away from fossil fuels shows that governments are finally waking up to the dangers of climate change. We can expect increasingly strong policy responses as governments scramble to introduce decarbonisation regulations. When this happens, the markets’ focus will likely rapidly switch towards identifying which companies will be compromised by climate change and which will benefit.

We believe that investors should be well prepared ahead of these events; and should play their part as responsible shareholders in driving corporate action to mitigate it. Thorough company-level research into who is prepared for decarbonisation is not just about minimising risk – it is also about the potential to identify rewarding investment opportunities.

[1] The Emperor’s New Climate Scenarios, The Institute and Faculty of Actuaries and University of Exeter, July 2023

Important information

This document is intended for retail investors. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected]