Key points:

- The market reaction to President Trump’s tariffs was extreme with sharp immediate falls across equity indices, while bonds rallied as recession fears have risen.

- With high cash positions, significant gold holdings, and equity and bond portfolios skewed heavily toward quality, Sarasin portfolios are well positioned to weather a possible US recession.

- Market volatility can create attractive valuations, though investors must tread with caution in such uncertain times.

President Trump has long extolled the virtues of tariffs. Until the first week of April, however, investors had largely been flying blind. The announcement in the White House Rose Garden of sweeping “reciprocal” tariffs has now brought clarity, of a sort. The rates and scope applied, to friend and foe alike, are more aggressive than even the most hawkish commentators had anticipated.

Financial markets reacted swiftly, with sharp equity declines, led ironically, by US indices. The S&P 500 had fallen 14% year-to-date at the time of writing (7 April) while the technology heavy Nasdaq was down 19%[i]. European and Chinese equity indices saw smaller declines, but with volatility sharply higher. Bonds rallied as recession fears have risen, the dollar is weaker, while gold emerged again as the best-performing major asset class.

Our strategy response

We have worried about the tariff agenda and spent much of this year reducing risk across portfolios. We cut equity exposure from overweight to neutral in March, and further to underweight at the beginning of April. We also reduced our exposure to corporate bonds and continued our zero exposure to high yield debt. Across our equity portfolios we have been raising ‘quality’ for some months – this means adding to companies with typically lower leverage, higher return on equity, and with stable year-on-year earnings growth. Where appropriate we have also added to defensive dividend strategies. We also hold gold positions across all our balanced mandates.

As ever, in the face of sharp market declines, it is tempting to wish one had acted sooner or more drastically. Yet with high cash positions, significant gold holdings, and equity and bond portfolios skewed heavily toward quality, we believe our portfolios are well positioned to weather a possible US recession. Importantly, they continue to maintain exposure to companies at the heart of the AI revolution, alongside our long-term grouping of themes under Demographic Change and Future Security. These drivers of structural growth should underpin earnings despite the market correction – and are now available at more attractive valuations.

America’s tariff walls rise again

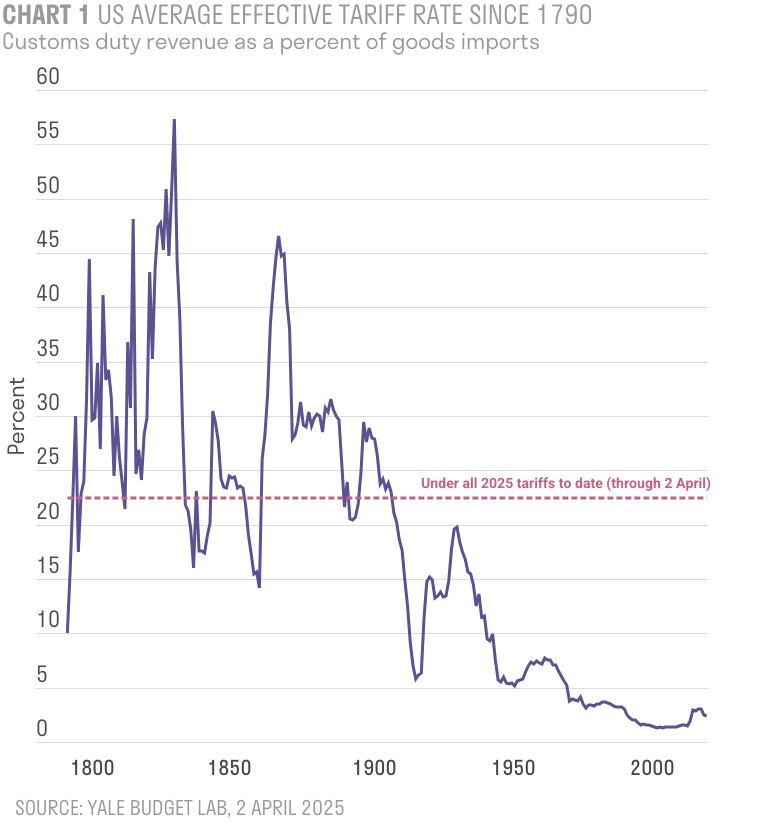

America’s tariff walls have not stood so high in more than a century. A year ago, the US had a trade-weighted average tariff of just 2.2%. Today, tariffs hover between 22% and 24%[i] – exceeding even the protectionist peaks of the 1930s and the infamous Smoot-Hawley tariffs[ii]. Although Smoot-Hawley lifted rates on dutiable goods to 59%, overall duties on total imports amounted to a lesser 20%.

As investors digest this extraordinary policy shift, four key questions arise. First, have tariffs now reached their peak, or will further escalation follow? Second, can the collapse in US business and consumer confidence be contained, or does it herald an inevitable recession? Third, how will the Federal Reserve respond to the inflationary pressures unleashed by rising trade barriers, given that core inflation remains uncomfortably high? And fourth – and perhaps most consequentially – can America’s vaunted system of political checks and balances restrain the executive branch, or must investors now permanently raise the risk premium they place on US assets?

Have we passed ‘Peak Tariff’?

In the near term, it is in everyone’s interest to strike bilateral agreements with President Trump and reverse at least some of his tariff hikes. On closer inspection the Administration’s tariff calculations, appear almost frivolous and largely devoid of serious economic analysis. That suggests they are intended at least partly as negotiating tactics to achieve other goals.

Yet for America’s trading partners, there are reasons for caution. The experience of Mexico and Canada is instructive. Despite agreeing a revised deal in Trump’s first term – the United States-Mexico-Canada Agreement (USMCA), successor to the North American Free Trade Agreement (NAFTA) – the White House is once again pressing for renegotiation. In this world, no settlement appears final. Agreements seem to mark not the end of negotiation, but merely the opening of a new stage in a longer contest.

If that is the lesson others draw, it may encourage a different strategy: to inflict more immediate economic pain on the US to strengthen their bargaining position. This already appears to be Canadian Prime Minister Mark Carney’s approach, and may explain China’s rapid retaliatory measures.

Will deferred business decisions and precautionary saving trigger recession?

Survey data suggests the US economy is slowing, although it still retains momentum, as we saw from recent robust payroll figures[i]. Assessing the true underlying trend will be difficult. Tariffs are already distorting imports and inventory data: consumers have rushed to buy goods, such as cars, ahead of anticipated price rises in April, a pattern likely to play out across a range of imports. It will probably be the third quarter before clean data emerge.

Nonetheless, the start of the second quarter of the year has clearly marked a change. Tariff-related uncertainty is starting to freeze business decisions. Even if negotiations succeed in rolling back some of the new tariffs, the process will be slow. Dealing with trade barriers on this scale will consume management time across corporate America, much as Brexit did in Britain, to the detriment of long-term productivity.

Meanwhile, deportations and immigration crackdowns suggest that even the modest 0.25% increase in population growth we had pencilled for 2025 may prove too optimistic[ii]. This will reduce both the supply of low-wage workers and the demand for goods and services. More generally consumers are likely to start building precautionary savings and cutting back on spending, while higher inflation will eat into real wages.

But there are offsets that can still support US and global growth

Around the same time as Trump’s tariff announcements, there was also some more growth friendly news. In a surprise announcement, eight OPEC+ countries led by Saudi Arabia, announced an increase in output of 411,000 barrels per day[iii]. Oil prices fell sharply in response, and this will be welcome news for the White House (with President Trump always a keen believer in low US energy prices).

Meanwhile bond yields fell sharply, in the face of the equity market sell-off. This should provide some relief to homeowners and other borrowers. Finally, the dollar has continued to weaken (the dollar index having fallen 5% year-to-date to 7 April), which tends to reduce the pressure on funding and liquidity conditions globally.

Putting this altogether we expect US GDP growth in Q2 and Q3 of around 0.5% to minus 0.5%[iv]. If there is escalation, retaliation or even disorderly currency flows then we could get a more meaningful drawdown. Conversely, the US economy had a lot of momentum so it might take some more time for the actual impacts to show up in the data. For the present we see the US just skirting recession – it would not take much though, to turn growth negative.

The Federal Reserve’s dilemma?

Chairman Jerome Powell was clear in his comments on the administration’s tariff proposals[v]. The new tariffs, he said, were “significantly larger than expected” and are likely to “raise inflation in coming quarters.” He has also backed away from his earlier characterisation of tariff-induced inflation as transitory, acknowledging that “while tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent.”

In response, we have raised our US inflation forecast for 2025, with headline CPI now expected at 3.6%, up from 3.1%[vi]. This reflects an anticipated rise in core goods prices, a fall in energy costs, and a renewed uptick in food prices. Even this may prove conservative, given the scale of tariffs announced, though in a weakening economy, companies are likely to absorb at least some of the price shock.

How the Federal Reserve balances rising inflationary pressures against a slowdown in business and consumer confidence will be critical. Powell stated that the economy remains “in a good place,” suggesting that a dramatic policy shift is unlikely for now. We continue to expect three rate cuts this year. However, if the demand shock deepens, these cuts could be accelerated. The months ahead will not be easy for the Federal Reserve – and a running commentary from the White House seems assured.

The erosion of checks and balances

The lack of an effective check on Trump’s policies is our greatest concern. The US has historically thrived on a robust system of checks and balances – a system that now seems to be more fragile than we thought. The Democratic opposition has largely remained passive, Congress has surrendered much of its agency, and many law firms, facing existential threats, are reluctant to challenge even the most extreme policies.

Ultimately, the responsibility may fall to voters in the midterms. Yet here too there are obstacles. A recent executive order requires proof of citizenship to vote[vii] – potentially rendering a driver’s licence insufficient. If popular discontent rises, particularly as voters see their 401(k) pension pots fall, there may yet be a response.

The absence of effective challenge, however, risks delaying any course correction. Investors must therefore consider whether a permanently higher risk premium on US assets is now required to reflect today’s extraordinary policy uncertainty.

Policy summary

Larry Summers, the former US Treasury Secretary under Bill Clinton, reminded investors that the immediate post-tariff announcement market decline was the fourth-largest two-day fall since the Second World War [viii]. The others were the 1987 crash, the 2008 financial crisis, and the Covid-19 pandemic. In retrospect, all proved to be long-term buying opportunities for global equities, though the timelines for recovery varied considerably.

Today, the opportunity is again clear. Some of the fastest-growing companies ever seen, built around a remarkable AI-led revolution, are now generating probably the most prodigious cashflows in market history. At the time of writing, they are currently trading 20–30% below their peaks from a month previous[ix]. Meanwhile investors can also take comfort from falling bond yields, a weaker dollar, and a surprise collapse in oil prices – all factors that typically support US and global growth.

The worry, however, remains political risk in the Trump White House. The President inherited an economy in good shape and a public that placed trade low on its list of priorities. As the Economist recently noted, the “political constituency for new tariffs was extremely small” – yet the administration acted with extraordinary scale. Yes, value is starting to appear across markets but until we can gauge what the risk premium on US assets should be under a Trump White House, we must continue to move with care.

[i] Bloomberg

[ii] Yale Budget Lab: https://budgetlab.yale.edu/research/where-we-stand-fiscal-economic-and-distributional-effects-all-us-tariffs-enacted-2025-through-april

[iii] https://www.senate.gov/artandhistory/history/minute/Senate_Passes_Smoot_Hawley_Tariff.htm

[iv] US Bureau of Labor Statistics: https://www.bls.gov/news.release/empsit.nr0.htm

[v] Sarasin & Partners forecasts

[vi] https://www.reuters.com/business/energy/saudi-arabia-cuts-oil-prices-asia-four-month-low-2025-04-06

[vii] Sarasin & Partners forecasts

[viii] https://www.federalreserve.gov/newsevents/speech/powell20250404a.htm

[ix] Sarasin & Partners forecasts

[x] https://www.whitehouse.gov/presidential-actions/2025/03/preserving-and-protecting-the-integrity-of-american-elections/

[xi] https://bloomingbit.io/en/feed/news/86131

[xii] Bloomberg

Important information

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].