On all fronts

The geopolitical consequences of Russia’s invasion of Ukraine are accelerating deglobalisation and a drive for energy independence in Europe. The effects will be felt in financial markets for decades to come.

Russia’s war in Ukraine is not sufficient reason to sell equities, but the energy crisis it has triggered adds to the inflationary spike created by fiscal and monetary responses to the pandemic.

Central banks are scrambling to tighten monetary policy, just as economic momentum wanes and profit expectations are beginning to fall.

Long COVID

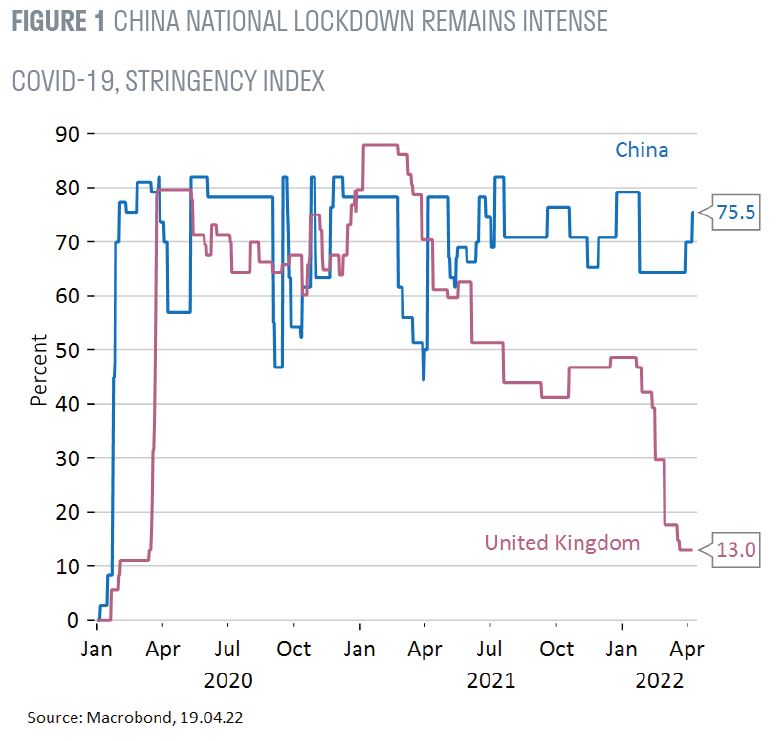

The pandemic damaged global supply chains, raised logistics costs, reduced inventories and investment, and brought structural changes to labour markets. This constrained supply just as demand boomed in response to emergency monetary policies and fiscal relief which, according to Bank of America, has totalled $30tn. Post-pandemic life is returning to normal in Europe and the US but not in China, where reliance on containment rather than immunisation kept coronavirus at bay until the emergence of the highly transmissible Omicron mutation, which threatens to overwhelm China’s healthcare system. China’s restrictions will remain in place, slowing recovery in supply chains, keeping prices elevated and acting as a drag on global growth expectations.

Post-pandemic life is returning to normal in Europe and the US but not in China, where reliance on containment rather than immunisation kept coronavirus at bay until the emergence of the highly transmissible Omicron mutation, which threatens to overwhelm China’s healthcare system. China’s restrictions will remain in place, slowing recovery in supply chains, keeping prices elevated and acting as a drag on global growth expectations.

Commodities tighten

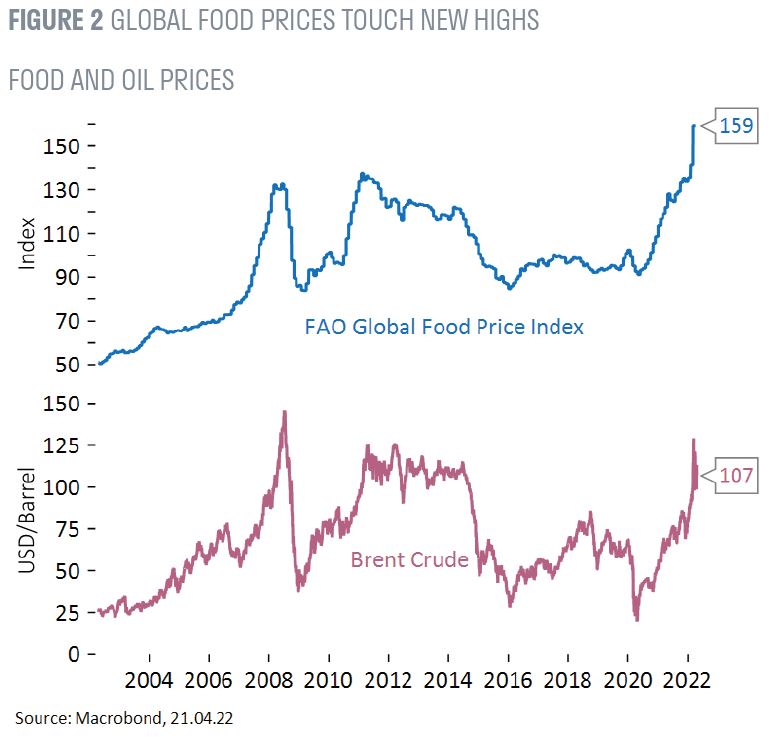

Commodity markets have tightened significantly from their pandemic lows. By autumn 2021 the oil price exceeded $80 a barrel, more than double the 2020 low. Natural gas prices spiked in Europe in the second half of 2021, while products such as lumber experienced dramatic price increases.

The Ukraine war and sanctions imposed on Russia could turn tight commodity markets into a 1970s-style energy crisis. Russia was exporting 8m barrels of oil a day (c.10% of global production) and supplied 35% of Europe’s natural gas, while Ukraine is an important source of wheat, corn and fertiliser, and an important route for Europe’s gas supplies. Until supply chains, commodity flows and demand adjust, prices will remain high and feed into inflation, squeezing consumers’ spending power. Ultimately, the duration of the war in Ukraine and the nature of the peace settlement will determine how much economic damage is done. However, oil prices are unlikely to recede whilst Putin is in the Kremlin.

Ultimately, the duration of the war in Ukraine and the nature of the peace settlement will determine how much economic damage is done. However, oil prices are unlikely to recede whilst Putin is in the Kremlin.

Fighting inflation

Economic growth is slowing, but remains above trend for now. Ongoing supply constraints and high commodity prices mean that inflation will not recede quickly, even if there is a ceasefire in Ukraine. In the US and Europe there are reasonable scenarios under which CPI could peak at 10% in the first half of 2022. Meanwhile, central bank policy is still highly stimulative.

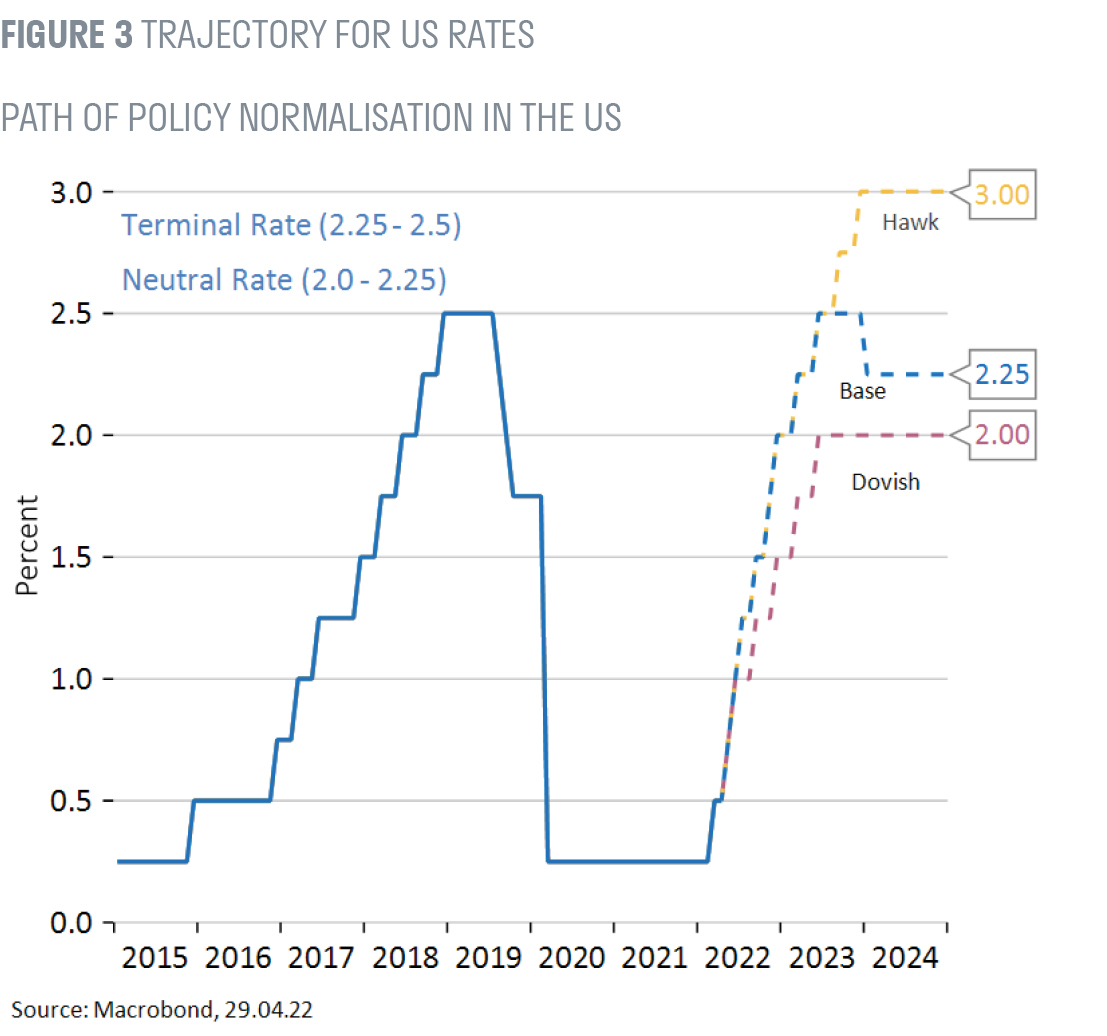

An important central bank tool for reducing yields and stabilising markets during the pandemic was to issue and buy bonds (quantitative easing). The effect of unwinding these purchases is highly uncertain. In 2018 the Fed was forced by market turbulence to rein back its quantitative tightening programme, and we should expect more dislocations this time around. The Fed’s fourth cycle of interest rate rises in 27 years is in full swing, and could be in place for at least 18 months. In the past 70 years, the first 9 months of a rate hiking cycle has not dampened growth and equities have performed well in the early stages of all but one of those 13 rate cycles. This would normally be encouraging, but the current cycle is moving at warp speed and is unlike previous cycles. Tighter monetary policy will do little to improve supply chains and fiscal policy may actually work against monetary policy as governments are forced to spend on defence, humanitarian support and energy independence. Furthermore, the fact that central banks have proved to be poor economic forecasters puts their credibility at risk and suggests that the risk of policy error is high.

The Fed’s fourth cycle of interest rate rises in 27 years is in full swing, and could be in place for at least 18 months. In the past 70 years, the first 9 months of a rate hiking cycle has not dampened growth and equities have performed well in the early stages of all but one of those 13 rate cycles. This would normally be encouraging, but the current cycle is moving at warp speed and is unlike previous cycles. Tighter monetary policy will do little to improve supply chains and fiscal policy may actually work against monetary policy as governments are forced to spend on defence, humanitarian support and energy independence. Furthermore, the fact that central banks have proved to be poor economic forecasters puts their credibility at risk and suggests that the risk of policy error is high.

Signs of recession

Leading indicators suggest that demand is still strong. Consumers accumulated vast savings during the pandemic, employment is high and the banking system is well capitalised. In absolute terms, interest rates are extremely low, while energy costs as a percentage of US consumer income are well below historic highs.

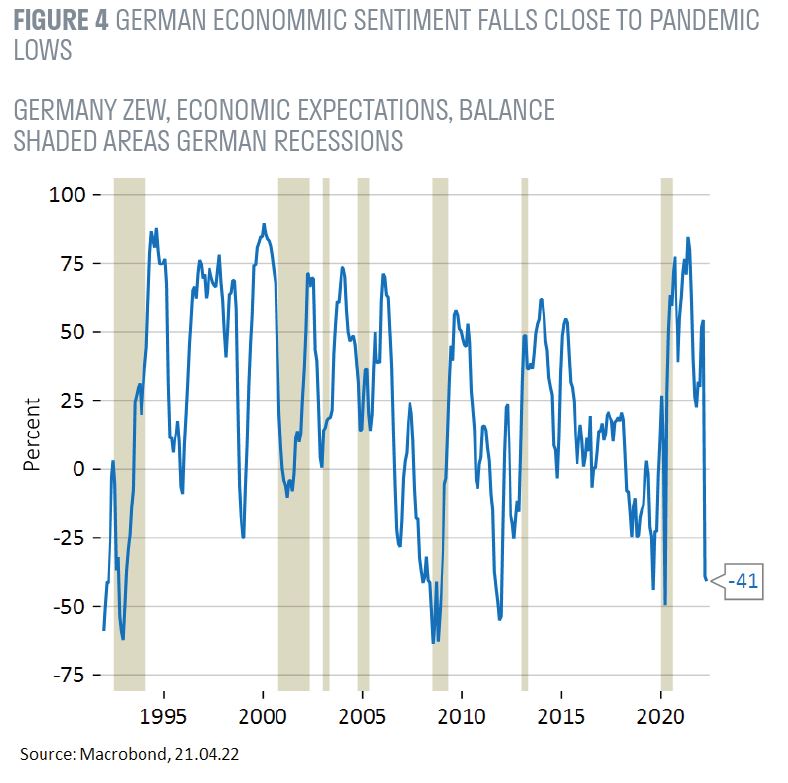

The next recession is by no means imminent, but confidence measures are declining. In addition, the historic correlation between high oil prices recessions should also give pause for thought. If monetary policy cannot solve supply chain issues, tighter policy will have to work against demand and asset prices to ensure that inflation expectations remain anchored.

Lower-income consumers face an enormous cost of living squeeze due to negative real wage growth; it is natural that consumer confidence is collapsing. Europe faces greater uncertainty than the US, given its proximity to the war in Ukraine and reliance on Russian gas, but emerging markets are also hostages to commodity price volatility, along with currency volatility. China, meanwhile, faces its own challenges in the form of a deflating property bubble and the rapid imposition of new government policies.

Perhaps of greatest concern for the market is that the yield curve (2-year minus 10-year yields) briefly inverted in early April for the first time since 2019. A persistent inverted yield curve typically heralds a recession in the subsequent 12-18 months, and investors are keeping a weather eye on lead indicators for further signs of trouble. Equity markets tend to discount forward by as much as 12 months, but in the current environment investors may be inclined to pre-emptively price in a recession before it is proven. We have already seen substantial rotation from cyclicals into defensives within markets.

Unrealistic profit expectations

Corporate profits rarely decline outside of a recession. Revenue growth is supported by inflation, at least whilst the economy grows and companies have pricing power, but the surge in earnings growth in 2021 sets a high bar. Profit margins have expanded to all-time highs and there is a presumption of further progress in 2022. Despite this, bottom-up expectations for earnings growth in 2022 are c.8% – including c.3% from energy sector earnings growth. Companies are being cautious in their guidance for the coming year. In aggregate, earnings momentum is no longer positive and PMIs suggest that earnings growth expectations could turn negative by the end of 2022. Most top-down estimates for earnings are lower than bottom-up estimates, with Goldman Sachs forecasting just 2% S&P500 earnings growth ex-oil for 2022. Weakening economic activity would likely feed through quickly into lower profit expectations and undermine valuation support for equities.

Companies are being cautious in their guidance for the coming year. In aggregate, earnings momentum is no longer positive and PMIs suggest that earnings growth expectations could turn negative by the end of 2022. Most top-down estimates for earnings are lower than bottom-up estimates, with Goldman Sachs forecasting just 2% S&P500 earnings growth ex-oil for 2022. Weakening economic activity would likely feed through quickly into lower profit expectations and undermine valuation support for equities.

Assault on sentiment

Equity market valuations have improved markedly, particularly outside of the US, with the MSCI ACWI Index currently trading at 15.7x, on a blend of 2022 and 2023 forecast earnings. European and emerging markets are at reasonably attractive multiples of 13x and 12x respectively, but the S&P 500’s 19x PE multiple (80th percentile in its 30-year history) is a cause for concern.

Derating has corrected the most speculative corners of the US market and valuations of the four largest stocks, Apple (25x), Microsoft (29x), Amazon (43x), Alphabet (21x) have been resilient. These are exceptional companies, with high free cashflow margins and good growth prospects. They are consensually viewed as attractive in almost all market environments, other than a sharp rise in real rates.

For the US market to trade closer to global averages, the market would need to reassess the premium these companies deserve. I believe that a sell-off in these companies could occur in a final capitulation of equity markets.

Market sentiment is depressed by the wholesale change in interest rates expectations, high commodity prices and geopolitical uncertainty. Hedge fund leverage has decreased dramatically, as it did in March 2020 and December 2018, while S&P 500 put volumes now exceed call volumes and intraday volatility is high. Retail investor losses in the US are estimated at around 20% year to date. On the upside, the extent to which sentiment has fallen suggests that the market could respond well to improving news flow, at least in the short term.

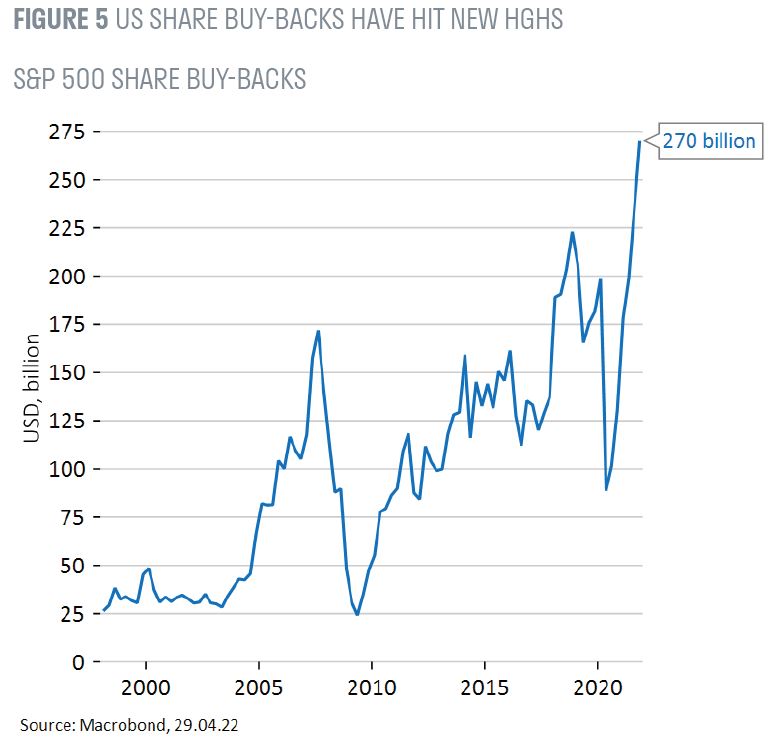

Despite market nerves, flows into global equities continue to be impressive. According to Goldman Sachs, year-to-date 2022 global equity inflows are annualising at $880bn. This is on track for the second largest year on record after $913bn in 2021. The exception is Europe, where strong inflows reversed following Putin’s invasion. European equity investors are screening stocks for Russian exposure, but US investors are nervous about having any European exposure. Strong company balance sheets also remain a support for the market; year-to-date US share buybacks are $270bn – on track to set a new record.

Strong company balance sheets also remain a support for the market; year-to-date US share buybacks are $270bn – on track to set a new record.

Cold War II

China’s increasing closeness to Russia is cementing a new Cold War era of global power competition that increases the risk of future misjudgements. It seems unlikely that Ukraine will be an isolated clash of ideologies, raising the question of how determined or capable NATO would be to intervene simultaneously in Eastern Europe, the Middle East and Asia.

For capital markets, a continuation of fiscal largesse is inevitable because governments will need to fund the cost of defence rearmament, energy independence, resettlement of refugees and reconstruction in Ukraine.

Longer-term, we may all suffer the consequences of a fractured world; the fight against climate change will be significantly harder to win in a world lacking geopolitical cohesion.

Thematic opportunities

We should be realistic about the potential for index-level returns from equities over the coming years, but there are clear pockets of thematic opportunity.

The need for resilient supply chains was made plain by COVID-19 and accelerated by the war in Ukraine. This will spur investment in automation, robotics and industrial software. The threat of cyber-attack is ever present, and investment in cyber security will also grow.

Tackling climate change will demand vast levels of investment, as will the need for energy independence from Russian. Companies associated with renewable power, smart grids, and energy efficiency will all benefit.

In the aftermath of the pandemic, consumers fortunate enough to have savings and sufficient discretionary income will prioritise experiences and health. Travel has barely recovered and there is enormous pent-up demand, which will benefit companies in the leisure industry, particularly those that appeal to mid- and higher-end consumers.

Defensive portfolio construction

A key element of our approach to constructing portfolios is a focus on stock-specific opportunities in thematic industries that offer attractive returns and growth. The emphasis today is on companies with pricing power and the ability to weather turbulent economic conditions.

Against this backdrop, healthcare (particularly medical technology) is increasingly attractive. Our research suggests that pent-up demand for surgical procedures should support acceleration of profits growth, despite a slowdown in the broader economy. Our analysis indicates that valuations do not yet reflect the cyclical recovery and long-term defensive growth these companies offer.

The onset of Cold War II raises challenges for multi-national corporations, which must prioritise where to deploy capital in a divided world. Companies may be forced to choose between western and Chinese consumers, and operations in China may need to be run for the domestic Chinese market rather than export. Companies that do not have to straddle the US-China divide appear safer options and could attract valuation premia.

Conclusion

COVID-19 remains a formidable foe in China, where economic policies designed to combat the pandemic led to a demand and supply shock, creating an inflationary boom not seen since the 1970s and against which central banks must now battle.

We have entered a second Cold War era that raises geopolitical risks and urges energy independence. Commodity shortages and high prices challenge governments and consumers just when the urgent need to fight climate change demands global cooperation, action and investment.

In the short term, the war in Ukraine raises the probability of a recession in the next 18 months and equity markets are naturally attempting to discount that risk. Higher volatility and lower profit expectations will limit returns from equities, and the growth versus inflation trade-off has deteriorated. Despite the 11% correction in global equity markets since their November 2021 highs (MSCI ACWI to 22 April 2022), their relative attraction has not increased.

Important information

If you are a private investor, you should not act or rely on this document but should contact your professional adviser.

This document has been approved by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England & Wales with registered number OC329859 which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Neither Sarasin & Partners LLP nor any other member of the Bank J. Safra Sarasin group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser.

© 2022 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].