What can multi-asset investors expect to achieve?

In the last few years, investors have been confronted with one of the most aggressive bouts of inflation seen in decades. The effects of this were amplified by the falls seen in both equity and bond markets in 2022. While there has been a strong recovery in portfolio values over the last year, questions still remain as to what the future holds.

To answer some of these questions, we believe it is important to consider:

- The past – how have portfolios historically behaved in these market environments? What lessons can be drawn from these patterns?

- The future – what do we expect to drive returns going forward? What is different about the next decade?

- Your portfolio – what are the implications of our forecasts for asset allocation?

The findings we will describe are sourced from our Compendium of Investment.[1] For over 25 years, we have produced this document with the aim of sharing our long-term outlook for the asset classes we include in our clients’ portfolios. These projections are the basis of how we establish long-term investment strategies.

History favours the patient

To build a clear understanding of the past, we have sourced the longest available history of investment markets. With the support of our data providers, we have produced a long-term multi-asset portfolio track record, the Endowment Model, an investment strategy used by our charity clients. Our analysis traces all the way back to 1900, reminding us of the many periods of growth, collapse and recovery that an investor would have experienced in the last 124 years.

Given the surge in inflation experienced during 2021-23, we have specifically reviewed how our multi-asset approach has performed following periods when inflation outpaced the absolute return, resulting in negative real returns. The results make for heartening reading, showing a general trend of rebounds in performance.

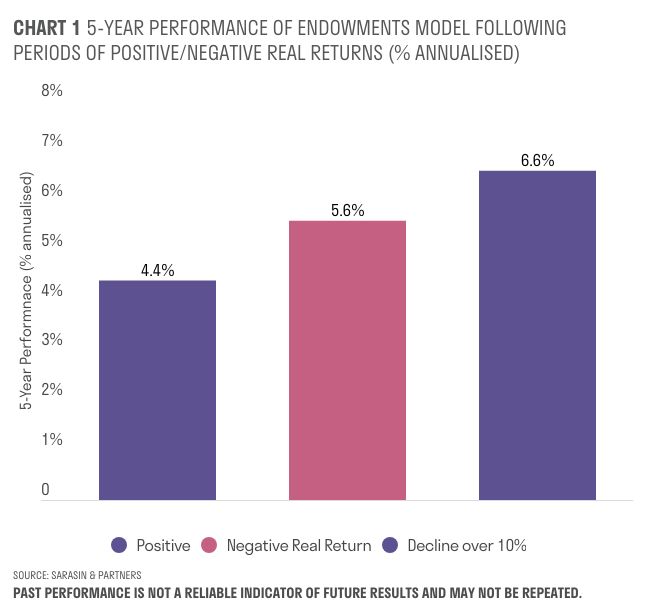

We found that, following a period of negative real returns, investors in the Endowment Model experienced average real returns of 5.6% per annum over the next five years. However, particularly sharp losses – where real returns have declined by more than 10% in any one year – have typically been followed by even stronger real returns of 6.6% per annum over the next five years.

The chart below shows the average five-year performance of the Endowment Model after a period of positive real returns, negative real returns and a sharp decline in real returns of -10% or more.

Perhaps the key insight from our analysis is that the worst decision for many investors would have been to sell in the depths of a market decline and then miss out on the recovery. If history serves as a guide, investors in multi-asset strategies are likely to experience a rebound in returns, as has already been seen in 2023 and in the first quarter of this year.

The fundamentals that drive projected returns

While the past offers helpful lessons, the key driver of our market projections is the prevailing economic environment and how we expect it to shape investment markets.

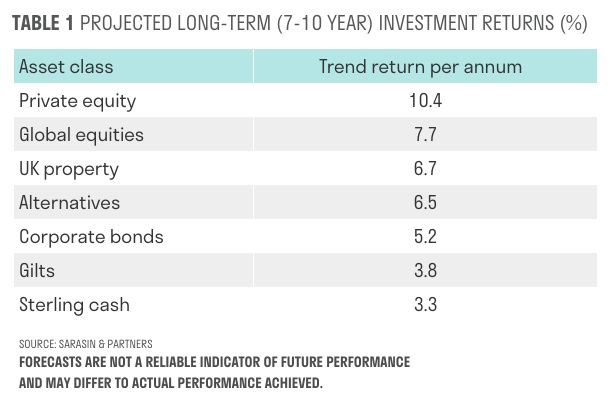

Over the long-term, returns from equities are driven by the rate at which capital is returned to shareholders (via dividends and buybacks), which is ultimately a function of earnings and economic growth. Over the near term, we expect gross domestic product (GDP) to grow a little quicker as inflation begins to recede, and interest rates are lowered. Growth is likely to decline gradually thereafter, as the working-age population grows at a slower rate. This, together with a range of other factors detailed in the Compendium of Investment, sets the tone for 7-10 year expected investment returns.

These returns are lower than the historical average since 1900, as UK equities and gilts have typically generated 9.0% per annum and 5.0% per annum, respectively.

However, we are also expecting inflation to be lower – an average 2.3% per annum, while the average since 1900 has been 3.8%. This is positive for investors’ spending power.

Our projected return for global equities, the primary engine of growth for our clients’ portfolios, is 7.7%. Once we account for the expected level of UK inflation, this translates into a real return of 5.3%, which is slightly higher than the long-term average of 5.0%.

Having experienced over a decade of low bond yields, the projected return from gilts is now 3.8% which equates to a return of 1.5% after inflation. Real returns from corporate bonds appear more encouraging at 2.9% per annum.

What are the implications for today’s portfolios?

To help understand the impacts of our forecasts on both medium-term and long-term portfolios, we have used the following:

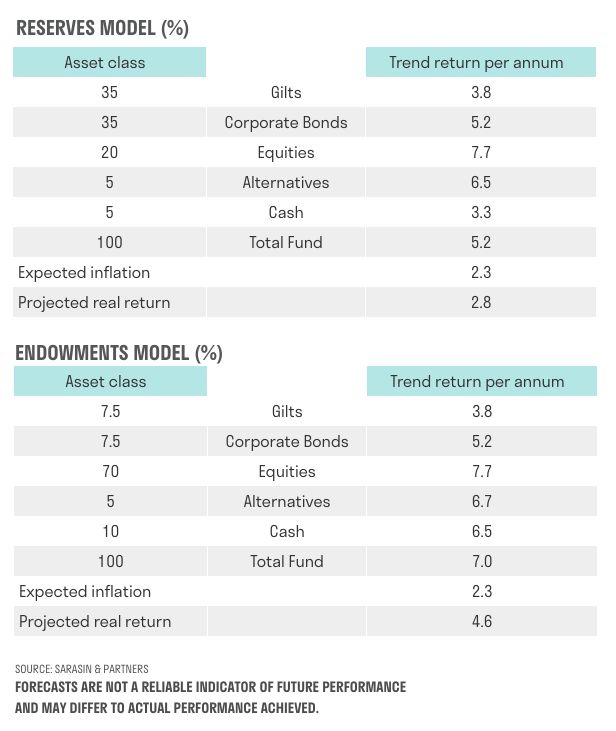

- Reserves Model – medium-term time horizon (2-4 years). Predominantly invested in UK gilts and corporate bonds, with the balance allocated to equities and alternatives.

- Endowment Model – long-term time horizon (5+ years). Predominantly invested in equities, with the balance allocated to bonds, alternatives and property.

Given the more conservative asset allocation and the expectation of bonds generating a lower return than equities, our Reserves Model is projected to earn a return of 5.2% per annum, or 2.8% after inflation. This is materially higher than one might have expected from such a portfolio a few years ago, largely because higher interest rates have boosted potential returns from bonds.

The Endowment Model, which has a higher exposure to equities, is forecasted to generate a return of 7.0% per annum, or 4.6% after inflation. Interestingly, this is in line with the long-run real returns generated since 1900 of 4.4%.

The higher projected return available from equities may tempt investors towards the Endowment Model. However, it is crucial to understand your time horizon and that equities are typically more volatile than bonds. Such a portfolio may therefore not be appropriate for investors with a short-term time horizon.

What could materially change our outlook?

Forecasting the global economy 10 years from here is complex, as is assessing the implications for multi-asset investment returns. Many things could change, but two particularly merit our attention. These are the rapid advances we are witnessing in technology and the transition to net zero, both of which could have major implications for productivity.

Unlike slow-burning demographic trends, the effect of technology on productivity growth is harder to predict. Technological change can be sporadic, rapid and disruptive – as well as a significant investment opportunity.

Two of its biggest drivers are economic necessity (for example due to scarcity of labour, energy, resources or capital) and major threats (such as pandemics, conflict and climate change). These are already very evident in today’s world.

Real improvement comes when a technological breakthrough not only allows an economy to overcome increases in costs, but also achieve higher production levels than before the cost pressure occurred.

The rapid development of generative artificial intelligence (AI) may prove to be an example of this. And despite adding to inflationary pressures and social and political strife, climate change and the transition to net zero economies could be another.

Summary

Our view of the current economic and market environment suggests healthy returns for multi-asset investors. With a projected real return of 4.6% per annum from the Endowment Model, investors can ensure that they are able to adequately plan current spending requirements, while preserving the real capital value and longer-term needs.

If the historic trend of outperformance following periods of weak real returns does repeat itself, then investors may benefit even further.

[1] All data in this article sourced from The Compendium of Investment, 2024 edition, Sarasin & Partners.

Every two years we update the data in the Sarasin Compendium of Investment and set out our projections for returns from core asset classes over the next 7-10 years.

The returns we cite here and in the Compendium are the average annual returns that investors could achieve over the next 7-10 years, rather than in any single year.

Our projections are also base-case ‘index’ returns. Active investment management could add or detract from them, and the effect of investment management fees and other costs must also be taken into account.

The new macroeconomic regime means a mixed outlook for global economic growth and investment returns, but lower inflation and robust performance from equities and bonds could stand multi-asset investors in good stead.

Important information

This document is intended for retail investors. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect of any such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct. indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected]