How would you describe the investment philosophy behind the Sarasin Global Higher Dividend fund?

Our philosophy is based around income that is built to LAST, meaning income that will be generated over the Long term; it incorporates Active portfolio construction, Stewardship principles and follows a Thematic stock-picking method. We believe that dividends should grow in real terms and not compromise the growth prospects of an overall business. Any company in which we choose to invest should be prudently managed, have sustainable goals, thematic tailwinds and a growing dividend stream.

Tell me more about the team behind the fund’s process…

Our investment process is supported by a team of 19 experienced equity and stewardship analysts and fund managers who work alongside our economists and strategists. We constantly bring new and interesting ideas to the table, whilst also challenging each other on existing positions. For example, we regularly review all of the companies on our buy list and in our portfolios; if a company underperforms we will make sure that the investment rationale has not changed and challenge our initial thinking. The mix of specialist analysts, generalist fund managers and stewardship experts creates a blend of experience and knowledge that can identify high quality companies with visible growth profiles and sustainable and rising income streams.

What have you recently been focusing on within the portfolio?

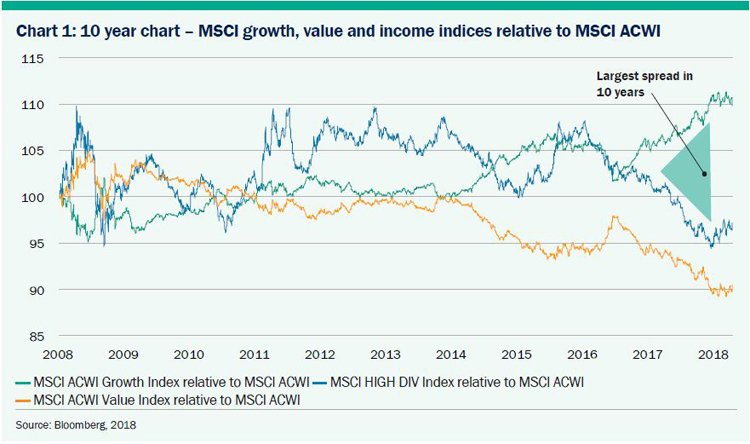

Our focus has been to enhance the portfolio’s thematic credentials whereas our greatest challenge has been the income style’s underperformance when compared to the broader global equity indices. The well-publicised strength of shares in technology-led companies, not least the FAANG stocks (Facebook, Amazon, Apple, Netflix and Google), has left much of the rest of the equity market treading water. We have regarded this as an opportunity, adding to companies on attractive valuations at the same time ensuring their dividend growth will remain robust over the long-term.

For example, we increased our holding in Swiss banking group UBS which is well supported by the demand for wealth services as people grow older, ageing populations being one of our core themes. UBS has a dividend yield of 4.2%, which has grown over 8% a year over the past 5 years (one of the strongest in its industry), has a tier one capital ratio of 13.3% yet its share price has flat-lined this year. We also added to Danish power company Orsted, which has a leading position in offshore wind farm installation, a critical factor in reducing carbon intensity of the energy mix and tackling climate change. The company has a lower income yield at 2.2% but is sustainable and growing at 6-8% pa.

Portfolio characteristics: Sarasin Global Higher Dividend

| Global Higher Dividend | MSCI World | |

| Sales growth | 3.6% | 5.1% |

| Dividend growth 5Y | 13% | 10% |

| Dividend payout ratio | 59% | 39% |

| Return on invested capital | 12.9% | 10.1% |

| Return on assets | 8.8% | 6.9% |

| Market beta | 0.90 | 1.06 |

| Dividend yield | 3.3% | 2.2% |

Source: Style Research, 30 September 2018

Past performance is not a reliable guide to future performance

What differentiates Sarasin Global Higher Dividend from its peers?

The fund has a passion for repeatable and reliable cash flow generation. It targets growing dividend streams that can be supported through all economic climates. This is an absolute mind set which is borne out of fixed income investment, with the differentiated point being the growth and eternal nature of equity income if sourced correctly. Taking few risks with dividend cover, balance sheet structure, emerging market exposure, stewardship and the underlying cash flow generation creates a differentiated portfolio, which lends itself to compounding. This is highlighted by 85% of the portfolio having less than a 75% pay out ratio, the remainder are Real Estate Investment Trusts which by law have to distribute 100%. These pay out ratios look even better when viewed in the context of free cashflow versus net income.

Why is long-term thinking important?

Considering investments over a longer timeframe is crucial because dividend consistency is more important than simply buying shares that offer the highest yields in today’s market. Our clients are long-term investors who require income streams that are high, but at the same time sustainable over time. The fund aims to deliver a dividend income premium of 50% to the global equity index (MSCI World).We therefore focus on businesses with reliable returns and strong free cash flow generation, a sustainable competitive advantage and disciplined capital allocation.

Why is active management important when a number of passive low cost offerings are now available?

Active management is a fundamental part of discovering opportunities that can add significant value for investors, something which maybe missed when simply tracking a passive index. An algorithm does not adapt to global change or demographic shifts, but can only understand momentum and the continuation of historical trends. Active management is also an important factor in achieving diversification. Having a 40 to 60 stock portfolio keeps our ideas concentrated but our income stream diversified. We will always endeavour to be different to an index.

Can you explain more about how stewardship fits into the fund?

Before we commit our clients’ capital to a company, we undertake detailed due diligence that takes a holistic view of its underlying financial performance and its sustainability. We closely monitor investee companies and will engage with management on issues of concern relating to corporate governance, capital structure and strategy. We carefully vote on matters put to shareholders and recognise that poor governance can adversely affect the returns for investors and – equally – that sound stewardship can lead to better returns. When searching for income one can be drawn to invest in a company with a higher headline dividend yield, but all too often in the past we have seen businesses showing higher dividend yields which actually reflect a weakening or poor performance on environmental, social or governance criteria. The higher yield can be a reflection of the higher risk associated with the investment, as you would expect in the bond market. It is very often the case that some things are too good to be true as was the case as with BP, Enron, Parmalat, Capita and Volkswagen.

Can a higher dividend fund be thematic, when it has such a style bias?

Yes, we have a style bias. However, this does not stop us thinking thematically and implementing such ideas throughout the portfolio. We aim to take advantage of global themes, be they the growing demand for healthcare, the emerging markets consumer or decarbonisation and we look to buy solid dependable companies with attractive, consistently strong dividends within those themes. Thematic thinking contrasts markedly with the backward-looking bias of traditional growth or value-oriented investment strategies and market cap-weighted approaches. As a result, it offers an effective ‘hedge’ against fast-changing market dynamics and helps to build long-term conviction in stocks to weather short-term market noise. Sarasin’s Global Higher Dividend strategy has been running for over a decade on these core tenets and will continue to do so for many years to come.