At Sarasin & Partners we have long pioneered a global, thematic approach to investing. This thematic philosophy is encapsulated in our view that markets underappreciate the impact of structural trends. Here, we explain how that approach works.

Structural trends are long-term forces that shape behaviours, societies, industries, and even financial markets. They arise from innovations in technology, demographic shifts, changing consumer priorities, or global challenges like climate change and shifting geopolitical dynamics.

For example, longer life expectancies impact labour markets and healthcare spending, but also lead to different choices around education, urbanisation, family formation, and a range of associated spending decisions. Another example is the continued progress in the technology underpinning computer chips. Moore’s Law has continued to deliver exponential improvements in the performance and cost of the basic building blocks of modern computers, leading to the rise of smartphones, e-commerce, cloud computing, and more recently breakthroughs in AI.

At Sarasin, we call these material, enduring trends 'themes'. We believe markets underappreciate the persistence of these themes, which gives rise to attractive investment opportunities.

Why themes are overlooked

Despite their transformative power, structural trends or themes are consistently underestimated by financial markets. According to efficient market theory, prices should reflect all available information, reacting only to unexpected developments. However, behavioural and institutional factors mean markets often fail to price in these themes for years, or even decades.

Institutional pressures: Short-termism in asset management

The structure of the asset management industry inherently incentivises short-termism. Professional managers are agents acting on behalf of clients, their principals, who typically evaluate performance on quarterly or annual timescales. This focus on short-term results leads managers to prioritise identifying short-term market inefficiencies or attempting to outperform peers by predicting near-term company performance, rather than focusing on longer-term opportunities. These pressures are reinforced by the quarterly earnings cycle, where corporate reporting often aligns with investors’ near-term priorities, further obscuring the visibility of enduring themes in financial markets. This well-studied phenomenon is called the principal-agent problem, defined as a ‘conflict in priorities between the owner of an asset and the person to whom control of the asset has been delegated’[1].

Conventional investment wisdom also plays a role. Traditional approaches emphasise a narrow focus on fundamental analysis of individual companies, often assuming that themes will 'cancel out' over time. As a result, many investors concentrate on short-term forecasts while conservatively assuming that growth and profitability will steadily decline over longer periods, when in fact the empirical evidence suggests that this is not the case[2].

Behavioural challenges: Cognitive biases in decision making

Behavioural science reveals that cognitive biases often prevent investors from recognising and acting on themes. For example:

Anchoring bias: Investors may rely too heavily on historical averages, leading to slow adaptation to new trends.

Confirmation bias: Investors often overweight evidence supporting their existing beliefs while dismissing contradictory information.

Substitution bias: Confronted with complex questions about long-term trends, investors may simplify their analysis, focusing instead on shorter-term, more tangible opportunities.

These biases encourage a collective focus on short-term market drivers, leaving enduring themes under-researched and undervalued.

Structural trends in action: Thematic investing

At Sarasin & Partners, thematic investing involves understanding long-term structural trends and counteracting the inherent biases toward short-termism. As an independent partnership, our structure aligns our time horizon with that of our clients, enabling us to take a truly long-term perspective. This alignment allows us to focus on delivering sustainable value over decades, rather than succumbing to the pressures of quarterly or annual performance targets.

We also structure our internal philosophy and processes explicitly to recognise and mitigate the incentives, conventional wisdom, and behavioural biases that drive short-termism. By embedding a disciplined focus on themes into every stage of our investment process, we ensure that our approach consistently reflects long-term opportunities. This philosophy is not limited to one aspect of investing but is deeply integrated across our research, asset allocation, and security selection processes. Below, we outline two key areas where this thematic approach adds value:

- Equity selection: A deep understanding of the major global themes is required to accurately estimate the true intrinsic value of companies, and forms the core of our thematic equity research process. For example, major technology companies like Amazon, Apple, and Microsoft were long recognised as profitable and growing, but few investors accurately gauged the strength and persistence of the digitalisation tailwinds driving their success. As these themes played out, the companies’ share prices rose in line with their underappreciated growth.

- Active asset allocation: Thematic research also enhances asset allocation decisions by providing insights into the themes influencing economic variables like inflation, interest rates, and GDP growth. These are important drivers of long-term asset class performance.

A dynamic approach to themes

It’s important to note that themes and their under-appreciation do not last forever. Economies and societies have self-correcting mechanisms, and the conditions fostering transformative trends eventually change. Similarly, companies benefiting from structural growth will face competitive pressures that limit returns over time.

Markets also tend to overcorrect, often moving from underestimating themes to overvaluing them just as they begin to reverse. As a result, thematic portfolios should not be purely 'buy and hold' with minimal turnover. An active investment approach, that continually reassesses market expectations and adjusts portfolios accordingly, is critical for sustained long-term success.

At Sarasin & Partners, we are committed to identifying and capitalising on enduring themes to deliver long-term value to our clients. By integrating thematic research into all aspects of investing, we strive to mitigate biases, uncover opportunities, and address risks that could impact client outcomes. Alongside our focus on responsible investment, this thematic approach is central to our mission of securing tomorrow.

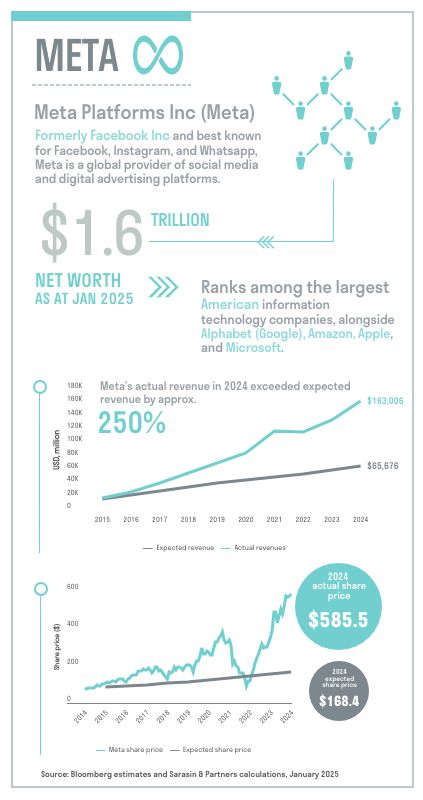

Case study: Meta, December 2014

In December 2014, Meta - which at that time traded as Facebook - traded on over 40x expected earnings, and was generally considered a relatively expensive, high-growth stock.

Its strong market position underpinned confidence that Meta would continue to benefit from its core tailwind or theme – the growth in digital advertising as marketing spend continued to steadily shift online from offline. However, it was priced for a steady fade in growth down from above 30% in the upcoming two years, to 10% annual growth over the longer-term.

In reality, revenue growth averaged exactly 30% over the subsequent decade as the thematic tailwind from digital advertising proved very durable, and the company successfully maintained a strong market position. As a result, while the valuation multiple faded from c.40x earnings to closer to 20x, the share price increased by 700% over the decade, significantly outperforming both the expectations of investors and wider stock market indices.

[1] https://www.investopedia.com/terms/p/principal-agent-problem.asp

[2] https://www.unpri.org/download?ac=4215 , UNPRI 2017

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].