Q&A with Fund Manager Tony Carter

Q: Who is the fund for?

A: The Sarasin Responsible Corporate Bond Fund is suitable for investors who are looking to invest in a diversified portfolio of responsibly screened corporate bonds and other credit instruments. It is designed to deliver returns (net of fees) in excess of the broad sterling credit market while also delivering material positive social impact. The fund has consistently outperformed the benchmark index since inception, whilst steadily maintaining a dividend yield of 3.5-4%. Note, these returns are not guaranteed. We attribute this in part to the high-quality credit we hold in the fund, with an average credit rating of around A-/BBB+.

Q: What is the fund’s philosophy?

A: The Sarasin Responsible Corporate Bond offers an ESG option to investors seeking exposure to the UK non-gilt (credit) bond market. It seeks to reduce investors’ exposure to ESG risks and give them greater exposure to ESG opportunities.

In order to achieve its objectives, the fund takes an active approach both from a “top-down” and “bottom-up” perspective. As a relative return credit fund, corporate credit selection is at the heart of the investment process. In addition to in-depth credit research, the fund uses sector exclusions and an ESG protocol to ensure that investments are appropriate for a responsibility-oriented corporate bond fund. It will exclude/avoid:

- companies operating in certain ‘sin’ sectors (such as those involved in the production or distribution of tobacco, alcohol, armaments, gambling and adult entertainment)

- borrowers with poor environmental and social profiles

- companies which fail to employ acceptable standards of governance from a creditor’s perspective.

Q: Do I have to sacrifice some returns if I want to invest in ethical bonds?

A: Not at all. Whilst some exposed sectors (like tobacco) do offer a decent “ESG risk premium”, most, such as oil majors and autos, do not. On the other hand, some strong ESG sectors (retail charity bonds, certain transport and renewable energy infrastructure issuers) offer much more attractive yields due to other considerations such as liquidity and relative investor unfamiliarity.

Q: So what do you mean by responsible investing – just applying exclusions to “sin sectors”?

A: We do apply negative screens, but that’s only a part of it. It’s an important part though, since it would hopefully allow an investor to avoid treading on ESG “landmines” (e.g. owning BP bonds when the Deepwater Horizon disaster occurred or owning auto bonds when the defeat device scandal blew up in 2010. But ESG integration should present opportunities to generate profits as well as simply avoid losses. One way is by investing in high-impact but niche sectors (such as retail charity bonds). Another is to lend to companies whose dedication to sustainability is rewarded over time by a lower cost of capital (in other words, the equities or bonds you own go up in value) – for example, Orsted, which was thus rewarded as it transitioned from a fossil fuel extractor to one of the world’s largest wind energy producers.

Q: How can you demonstrate that your portfolio delivers genuine impact?

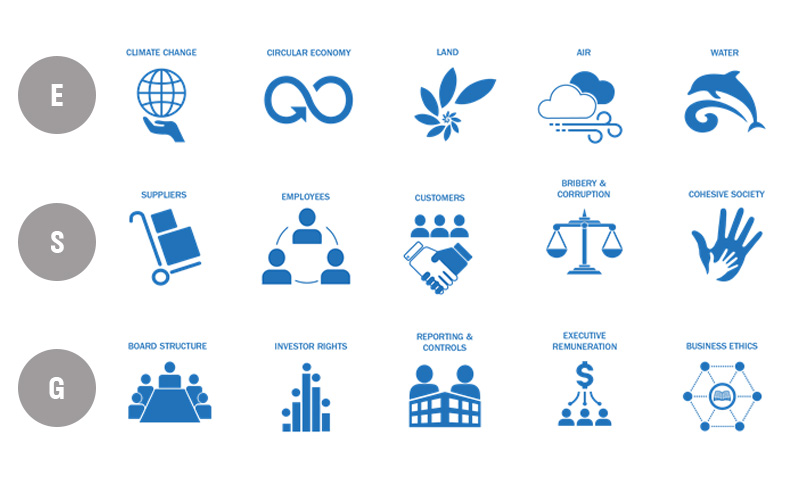

A: As far as is possible we base our ESG scoring on data rather than subjective views. We have a system that draws over 400 data fields from Bloomberg, which we group among the 15 key sub-dimensions on which we measure ESG risk. These ESG factors draw heavily on the United Nations Sustainable Development Goals (SDG), particularly the Environmental and Social dimensions.

This way we are able to give a numerical score to all the main issuers in each industry sector, not only the ones we own but also the ones we don’t, which lets us easily verify that we own the higher-scoring ones.

Additionally, we recently obtained an Impact Rating of A from 3D Investing (Square Mile Research), the only UK credit fund to have done so.

ESG scoring map

IMPORTANT INFORMATION

If you are a private investor, you should not act or rely on this document but should contact your professional adviser.

This promotion has been approved by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England & Wales with registered number OC329859 which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

The investments of the fund are subject to normal market fluctuations. The value of the investments of the fund and the income from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a guide to future returns and may not be repeated.

There is no minimum investment period, though we would recommend that you view your investment as a medium to long term one (i.e. 5 to 10 years). Frequent political and social unrest in Emerging Markets, and the high inflation and interest rates this tends to encourage, may lead to sharp swings in foreign currency markets and stock markets. There is also an inherent risk in the smaller size of many Emerging Markets, especially since this means restricted liquidity. Further risks to bear in mind are restrictions on foreigners making currency transactions or investments. For efficient portfolio management the Fund may invest in derivatives. The value of these investments may fluctuate significantly, but the overall intention of the use of derivative techniques is to reduce volatility of returns. The Fund may also invest in derivatives for investment purposes.

All details in this document are provided for marketing and information purposes only and should not be misinterpreted as investment advice or taxation advice. This document is not an offer or recommendation to buy or sell shares in the fund. You should not act or rely on this document but should seek independent advice and verification in relation to its contents. Neither Sarasin & Partners LLP nor any other member of the Bank J. Safra Sarasin group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The views expressed in this document are those of Sarasin & Partners LLP and these are subject to change without notice.

This document does not explain all the risks involved in investing in the fund and therefore you should ensure that you read the prospectus and the Key Investor Information document which contain further information including the applicable risk warnings. The prospectus, the Key Investor Information document as well as the annual and semi-annual reports are available free of charge from www.sarasinandpartners.com or from Sarasin & Partners LLP, Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, Telephone +44 (0)20 7038 7000, Telefax +44 (0)20 7038 6850. Telephone calls may be recorded.

Where the data in this document comes partially from third party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third party data.

Persons who are domiciled in the USA or are US nationals are not permitted to hold shares in the fund and shares may not be publicly sold, offered or issued to anyone residing in the USA or to US nationals. This publication is intended for investors in the United Kingdom.

© 2021 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].