Since the beginning of the 20th century, farmers have embraced a variety of methods to improve yields and raise productivity. These have ranged from using tractors and implements to displace labour, to the ‘Green Revolution’ where new seed traits have improved yields and farmers have increased fertiliser and pesticide application on row crops.

However, the human species now faces a major new challenge: feeding an additional 67 million mouths per annum to 2050, in a sustainable way. Food production, according to UN estimates, consequently needs to increase by over 70%. Environmental issues such as soil quality, climate change, land and water scarcity, and fertiliser run-off (where fertiliser is washed into rivers) make this objective tougher to fulfil.

We are reaching a limit to what can be achieved using existing non-technological methods. Most industry observers acknowledge considerable inefficiency in the production of food. There are several ways to improve efficiency across the food chain, but at Sarasin & Partners we believe technology is likely to be the most disruptive and powerful route to greater agricultural output from the existing land.

A confluence of technologies applied to agriculture

This new set of activities has the overarching name ‘agtech’ (agricultural technology) and encompasses a wide variety of innovations. Agtech is the interplay between farm inputs, life sciences, robotics, and data analytics. The idea behind bringing these areas together began in Silicon Valley several years ago, when the productivity potential for agriculture became apparent. For example, agriculture input giant Monsanto estimates 40% of farmland is over-fertilised. In addition, fertiliser application rates tend to be uniform across a field. By finding an approach that can more precisely apply fertiliser to an individual crop we can achieve multiple goals: 1) reduce a farmer’s costs; 2) lower the risk of ‘run-off’; and 3) boost yields through targeted application.

In fact, variable rate application (VRA) fertiliser approaches were proposed as far back as the 1980s, through use of radar-based GPS units on tractors. Unfortunately, it was not economically viable and adoption remained low. In recent years, though, we have seen rapid advances in technology capability, and cheaper and ubiquitous hardware and equipment. Software for weather modelling, precise sensors mounted on tractors, and drones to map soil composition across fields are all examples of technology combined in a modern VRA system.

The concept behind precision fertiliser application and monitoring is replicable to other farming tasks. Adjacent markets such as precision spraying, precision planting, and precision irrigation are growing rapidly – all have similar multiple benefits to the farmer and the environment. During the summer of 2017 John Deere & Company, a leading global farm equipment manufacturer, acquired Blue River Technology, a venture capital backed start-up, for $305 million. One of Blue River’s advanced products is a ‘See & Spray’ implement that uses cameras to intelligently distinguish between weeds and crops, and a robotic nozzle to achieve accurate spraying of herbicide on to weeds without contaminating the crop. The power behind this is the data analytics that comes back from the machine, which then learns and improves for future sprays. We think Deere understand the importance and role technology will play in future farming methods, and consider this a smart acquisition.

What could a farm of the future look like?

Picture the scene – a farm worker based in a centralised office with a series of monitors and screens relaying information about weather, soil, equipment utilisation, and raw input levels. At the press of a few buttons the employee launches an autonomous drone to carry out a survey or mapping of a field, calculates the optimum choice of seed and fertiliser combination to vary within the field, automatically loads the inputs on a tractor, and uses GPS and autosteer to set the tractor off on its journey in a field. All without even leaving the office! This might sound incredibly futuristic and perhaps not likely to occur within the next few years, but in the long-term this could have a dramatic impact on how society produces its food.

AGCO, another leading global farm equipment manufacturer, has taken this even further by researching into a prototype tractor concept consisting of a mothership and a ‘swarm’ of smaller lightweight battery-powered robotic tractors that carry out individual tasks in a field simultaneously. Known as Project Xaver, the idea is to increase safety, reduce energy and heat loss, improve efficiency and reliability, and lower soil compaction – deemed a major risk to long-term agricultural output. Again, this is far from becoming a commercial product, but it demonstrates how large corporates are thinking about all sorts of technology to make agriculture more efficient.

Agtech is a core theme at the heart of Sarasin’s Food & Agriculture Opportunities strategy

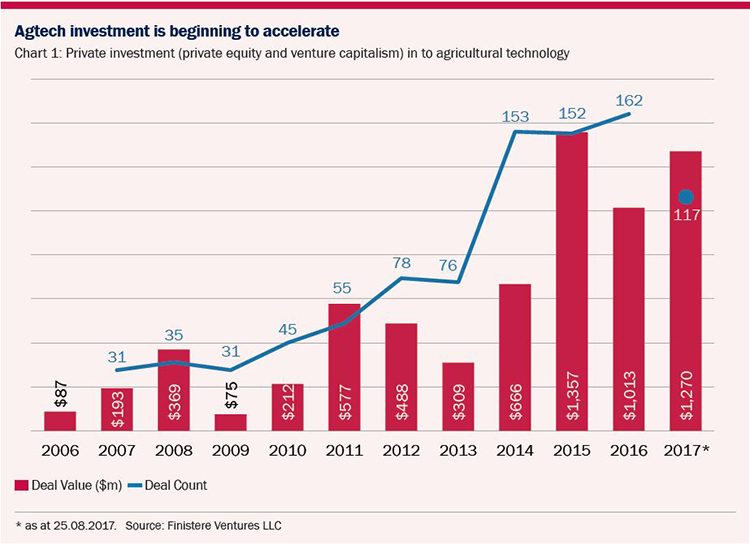

The production of food needs to increase dramatically with an ever-growing number of constraints placed on the average farmer. Chart 1 illustrates how early-stage investment capital from private equity and venture funds has begun to accelerate. We predict this will continue to grow in size, and our interactions with large corporates involved in all parts of the agriculture value chain suggests they also see the opportunity for innovation and disruption.

As with many advances made in the past, there will be some companies facing headwinds, for example, a sustained reduction in the application of farm inputs such as pesticide or fertiliser is a key risk to agricultural chemical companies. But for many other companies across the food chain, new technology offers huge opportunities. Our job as long-term stewards of our clients’ funds is to navigate our way through the technological changes underway, ensuring an appropriate portfolio response which takes advantage of the agtech theme.