Charitable organisations utilise a range of strategies to fund their projects and ensure they have a lasting impact. Among these, the charity endowment represents a core source of financial stability, insulating charities from more volatile and inconsistent sources of funding, such as legacies and donations, particularly during periods of economic stress.

Charities must decide the right balance between using their resources to address the urgent issues of today, and investing for the future to ensure they are equipped to meet the inevitable challenges of tomorrow.

Charity endowments through time

Charitable endowments have a rich history, tracing back to ancient civilizations where the concepts of charity and philanthropy were deeply embedded in societal and religious values. The earliest forms of charitable giving often involved temples and religious institutions receiving donations of land, money, or goods to support their activities. The endowment of monasteries with land allowed them to become self-sustaining, providing food, shelter, and education to the poor. Over time, the structures and strategies of endowments evolved, influenced by cultural, economic and legal developments.

Today, endowments are used in various sectors, including arts and culture, higher education and public policy, as institutions seek to establish financial stability and support their missions more sustainably. Emerging economies are increasingly establishing their own endowments to support local causes and institutions, reflecting a growing recognition of the importance of sustainable charitable funding.

Spend or invest?

Many charity trustees are challenged to think about how much of their capital should be spent in the near term or invested for the long term through an endowment. In fact, the most frequent mandate put to us by existing and prospective charity clients is ‘to provide a stream of income for the beneficiaries of today, whilst growing the value and spending power of the capital ahead of inflation for the beneficiaries of tomorrow.’

In finding the right balance, charities often consider:

- Mission and goals: Charities need to align their financial strategies with their mission and long-term goals. Organisations that exist to tackle specific issues that have a known, finite lifespan may find that it is right to prioritise near-term spending. Those that seek to make structural change, however, often find that their work spans decades, and so they may lean towards investing for the future and building an endowment.

- Donor intentions: Understanding donor preferences and intentions is crucial. Some may be more inclined to support an endowment for its longevity and to leave a lasting legacy, knowing their contributions will support a cause for generations. In some cases, there may even be an inter-generational desire to support a specific end. Other donors, by contrast, may want to see their contributions make an immediate impact.

- Impact on fundraising: A robust endowment can attract larger donations, as it demonstrates financial stability and a commitment to long-term sustainability. An endowment that can show it is having an impact and is aligned with the values of the charity will typically not struggle to raise donations. In some instances, it can make fundraising more challenging as certain funders will require greater comfort and clarification as to why additional support is required over and above a substantial investment reserve.

- Financial health: A stable charity with sufficient operational funding may opt for an endowment to secure future growth, whereas a charity with immediate funding needs, or one running a sizeable planned deficit budget, might not have that luxury.

- Stability and flexibility: A long-term endowment offers charities a source of protection should other funding sources be challenged. For instance, many charities that depend on retail activity saw their income decline during the COVID-19 pandemic. However, some had a robust endowment supplemented with dedicated short-term investment reserves, which they were able to draw on during their time of need. The stability of this financial cushion allows for more strategic long-term planning and programme development.

How much impact can an endowment generate?

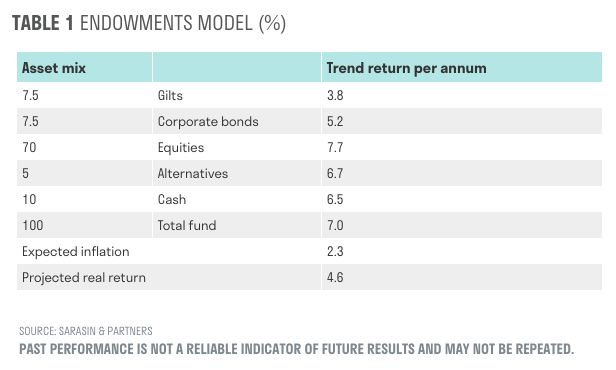

While endowments can vary widely in their composition. We outline below our core Endowments Strategy, which is illustrative of how many charities invest their long-term assets, together with the projected returns over the next 5-7 years:

We expanded on the future returns that multi-asset charity investors could expect in a previous House Report article.

The above table suggests that a charity investor may spend roughly 4.5% of the portfolio per annum, while still maintaining the real capital value of the endowment. In practice, charities typically take a slightly more conservative approach and have a withdrawal rate of closer to 3.5 – 4.0%.

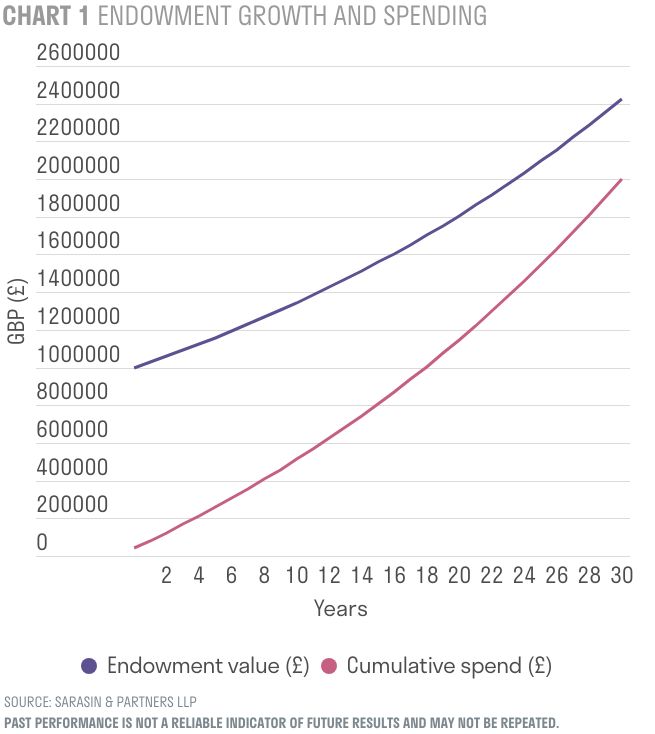

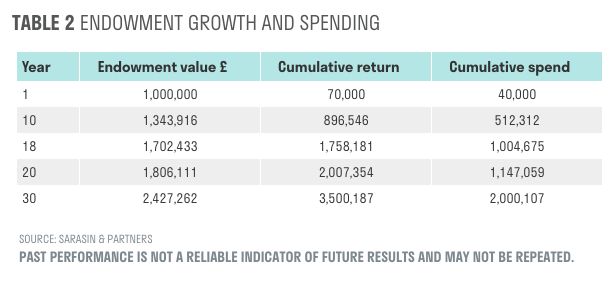

By way of example, if a charity invested £1 million as an endowment today and spent 4% per annum, they would be able to fund over £1 million of cumulative charitable spending in 18 years, while also growing the original donation to £1.7 million.

This is illustrated in chart 1.

While we would also need to assess the impact of inflation in a real-world example, the amount of charitable funding that can be achieved over time can far exceed the value of immediate spending, given the compounding effect of investment returns.

However, this is not a ‘one-size-fits-all’ solution. Some charities may prefer to have a higher spending rate to support more urgent causes, while others will prefer to spend cautiously and maintain a larger safety buffer in case of a crisis.

Conclusion

The history of charitable endowments is a testament to humanity’s enduring commitment to philanthropy and social betterment, and they have evolved to become a cornerstone of long-term sustainable charitable work.

As financial strategies and societal needs continue to evolve, endowments will likely remain a vital tool to ensure the longevity and effectiveness of charitable organisations worldwide. This will be especially true if we acknowledge that some causes will require support for many decades, perhaps even centuries, to come.

When we work with charities to determine the appropriate investment strategy for them, cashflow analysis is a crucial element. In addition, understanding how differing investment solutions might perform over various timeframes, can help trustees decide upon the best course of action their charity and its beneficiaries. Much of the analysis that informs these conversations can be found in our Compendium of Investment, but please contact us if you wish to discuss your charity’s unique circumstances.

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].