How can asset managers best drive positive action towards a Paris-aligned trajectory? Sarasin & Partners recently spoke at the Economist Sustainability Summit about the role investors play in driving climate action and the power of an integrated approach that encompasses both investing and pressing for change

Net zero: now

Climate change is no longer an issue for future generations, nor an issue that the Asset Management industry can continue to overlook. Its impacts are increasing in scale and severity, this year alone has seen some of the highest temperatures ever recorded, while increasing areas of the globe are simultaneously struggling with drought and heavy rainfall. Without a significant decrease in global emissions, the physical impacts currently being experienced will only escalate.

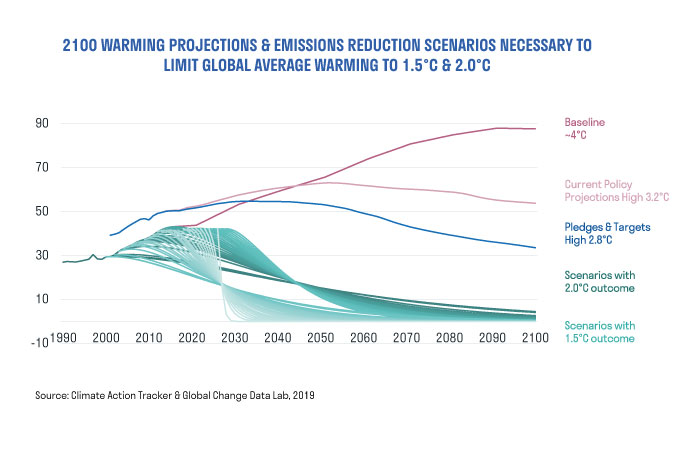

The Paris Agreement represents a commitment to limit the increase in global average temperature to well below 2°C, and aiming for 1.5°C. At current emission rates, global temperature trajectories will clearly exceed these Paris targets.

Accordingly, to deliver on the Paris Agreement aim of making finance flows consistent with a pathway towards low emissions and climate-resilient development, we must both increase climate investment significantly and shift capital away from fossil fuels and other emissions intensive activities.

What does this mean for the investment industry?

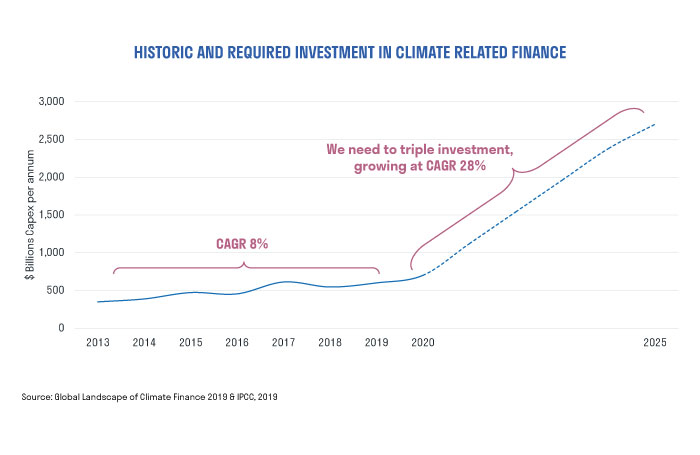

Using data from the Global Landscape of Climate Finance 2019 & the Intergovernmental Panel on Climate Change, we estimate that to achieve net zero, the global economy will need to triple climate-related capital expenditure to in excess of $2.5 trillion a year by 2025. This equates to a compound annual growth rate of some 28% over the next five years. Further, this is not a one-off cost, but an ongoing allocation of capital, directed towards a range of opportunities – renewable energy, smart grids, agriculture and battery storage, to name just a few.

As a thematic investor, we look for the long-term trends that are shaping our world for decades to come. As climate change rises up the agenda, regulations tighten and capital flows shift, those companies that will benefit from the shift represent a significant investment opportunity. This is why climate change is one of our five core themes.

Invest and press – our approach to climate action

Invest – weighing up investment risk and opportunity

When looking at a company’s ability to deliver long-term performance, we seek to identify those that are well positioned as the global economy transitions to net zero. These opportunities can be categorised as those mitigating the impacts of climate change and those focused on delivering adaptation solutions for society and the economy.

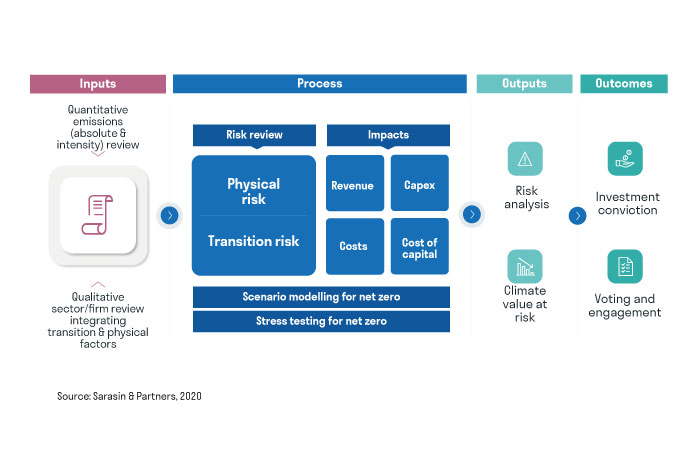

However, we also need to understand which companies and sectors are most likely to suffer from climate-related risks. To do this, we analyse the implications of company-specific net-zero pathways, as well as the risks stemming from the increased physical manifestation of climate change.

In assessing the risks and opportunities to come, we consider a range of quantitative factors, such as a firm’s emissions, and qualitative factors, such as the ease with which sector, or firm specific emissions may be abated. We then apply this understanding of transition and physical risks to our financial forecasts, building a picture of how climate change scenarios could impact revenues, costs, capital expenditure and cost of capital.

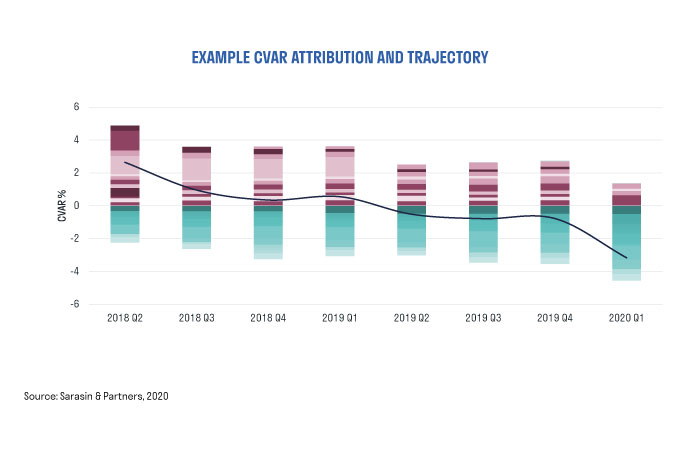

Ultimately, this process enables us to calculate a firm’s climate value at risk (CVAR). This metric is one we have developed to illustrate the economic value at risk from climate change. A numerical measure of risk allows us to easily measure how the climate risk of a portfolio changes over time, as well as compare specific companies and industries. Applying these bottom up company CVARs allows us to generate aggregated portfolio level CVAR - positioning funds to benefit from reduced climate risk and increasing the exposure to companies positioned to deliver mitigation and adaptation solutions. Indeed, over the course of 2020 we have seen a discernible increase in the correlation between our CVAR scores and share price performance. We believe this is indicative of nascent and increasing pricing of climate related risks and opportunities.

Press – driving change through engagement and policy action

While we must take climate factors into account when deploying our clients’ capital, as investors we also play a vital role in pressing companies to deploy their capital towards Paris-aligned activities.

Without such efforts, the necessary shift in capital allocation away from the fossil fuel economy appears unlikely. This is because global fossil fuel related investment still dwarfs renewable spending and while climate-aware investors may be divesting shares in these companies, financing continues to come from elsewhere. Indeed, according to research recently updated by the Rainforest Action Network, since the Paris agreement was signed in 2016 $23.7 trillion in fossil fuel financing has been provided by 35 global banks.

Active ownership thus means addressing the harmful behaviours that are perpetuating carbon emissions by engaging with the companies we own on behalf of our investors. We need all hands on deck to deliver planet stability; and this means getting those pulling the wrong way to change course.

One important, but often overlooked, aspect of corporate behaviour that can create roadblocks to action on climate change is lobbying. Often hidden from view, lobbying by large companies that currently benefit from the fossil fuel economy plays an insidious role in reducing the ability of policy makers to act robustly. Shareholders can play a role in seeking commitments from their companies that they will not undertake any lobbying that runs contrary to the Paris Agreement, and the lobbying they do is disclosed.

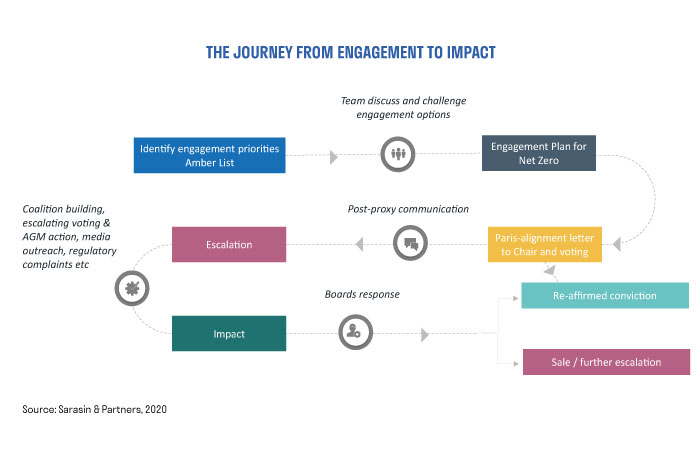

But company engagement is not always easy, and it requires resource. Our Ownership Discipline sets out the detailed steps we take to ensure we are as effective and results oriented as possible –the schematic below summarises the key milestones. Actions include formal letters to the chair of the Board of Directors; aligned voting; building investor coalitions where local rules permit; AGM actions such as file shareholder resolutions; and even speaking out to the media. In certain cases we may even make complaints to the regulator. A long-term engagement can take up to three years, at which point we might decide to divest if the company is not showing signs of change.

Engagement success: BP

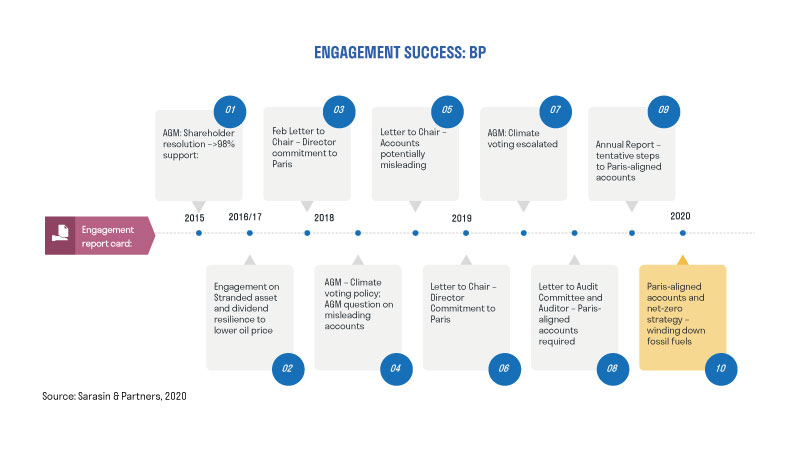

Building a long-term relationship with a company is a crucial element in driving change. Our engagement with BP illustrates the power of a long-term approach. Our goal was for BP to commit to a net zero strategy; and to deliver this we pressed them to publish financial accounts that properly reflected climate risks.

We focused on BP’s accounting because this is a vital lever to drive a Paris-aligned strategy. Accounts that leave out material climate impacts misinform executives, shareholders and creditors and, thus result in misdirected capital. In the case of oil and gas companies like BP, ignoring decarbonisation will make the operations look more profitable than they really are. This would tend to result in more capital reinvested than is compatible with sustainable wealth creation; and also more capital than is consistent with a net zero pathway.

Sarasin & Partners coordinated the engagement with BP’s Audit Committee and its auditor, Deloitte, supported by other investors representing approximately $1 trillion in assets under management. Following a collective letter sent in November 2019, BP responded within months by lowering the long-term oil and gas price assumptions used in its financial statements.

The result was dramatic: an estimated impairment of $13 to 17.5 billion, equivalent to 13% to 17% of 2019 net assets. Alongside its accounting adjustments, BP has also released a stronger net zero strategy, including 10-fold increase in low carbon investment by 2030, together with a plan to cut fossil fuel production by 30%. In our view, this shift in capital was made easier, and arguably feasible, as a result of the accounting adjustments.

The engagement with BP provides a valuable proof point; by aligning financial statements with a 2050 net zero emissions pathway, shifts in capital deployment and strategies will follow. BP has also demonstrated clearly that companies can align their accounting with Paris quickly – no new regulations are needed.

It has also highlighted the critical role that the auditor can play. In this case, Deloitte highlighted in their report to shareholders that BP’s previous commodity assumptions were above what could be consistent with getting onto a net zero pathway. It took only a few weeks for the management team to decide to lower these critical assumptions.

For net zero to be achieved there can be little doubt that the system needs to change. As key actors within finance, asset managers have a responsibility not only to invest in a way that drives positive change, but also to use their voice to press for action on climate change. Both are going to be vital as we confront the climate crisis.

Important Information

This document has been issued by Sarasin & Partners LLP which is a limited liability partnership registered in England and Wales with registered number OC329859 and is authorised and regulated by the UK Financial Conduct Authority and passported under MiFID to provide investment services in the Republic of Ireland. It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and we make no representation or warranty, express or implied, as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Neither Sarasin & Partners LLP nor any other member of the Bank J. Safra Sarasin group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser.

© 2020 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.