The financial industry may not attract the feverish speculation that characterises technology companies or healthcare start-ups. But those who disregard change in the financial industry are failing to appreciate its dynamism. The financial industry is undergoing radical change, thanks to inexorable trends which are recreating the way consumers interact with money, corporates deal with their finances and governments regulate the financial services landscape.

This fundamental reshaping of the financial industry is putting financial actors into two camps: the disruptors and the disrupted. The disruptors are creating new business models with superior economics, which will translate into better equity returns and greater benefits to consumers. Meanwhile, the disrupted are bound to disappear from the industry’s landscape. They will lose market share, see their returns erode, be tied in endless restructuring and most significantly, destroy shareholder value.

In this new battle for dominance, how can companies secure tomorrow? And who are the disruptors? Five themes – ageing, digitalisation, automation, an evolving consumer and climate change – are redefining the way financial services are produced and consumed, as well as creating opportunity for companies able to spot trends in advance.

How the five themes are creating opportunities for financial disruptors

Ageing

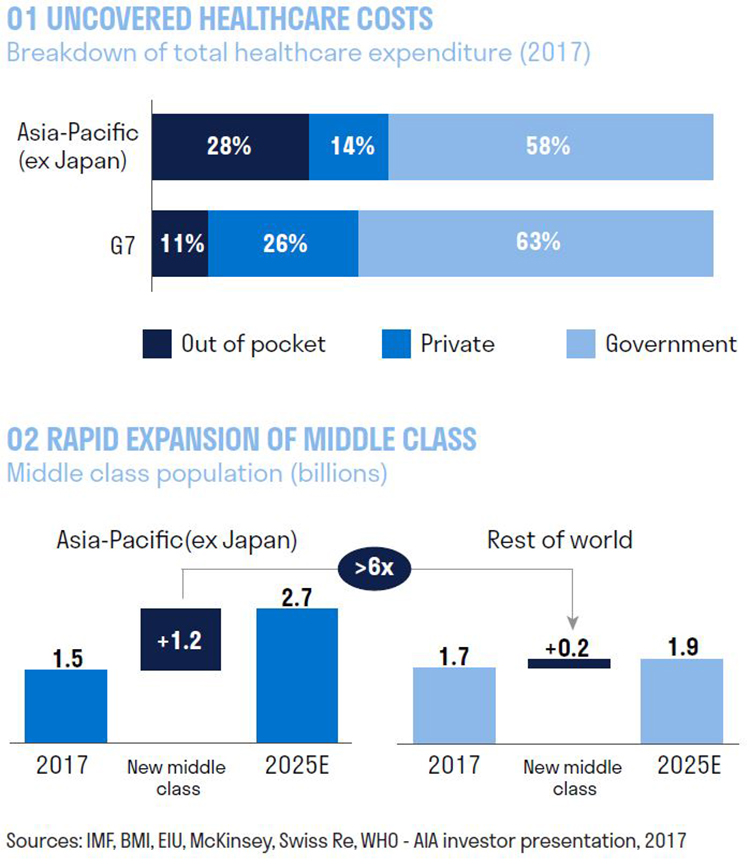

The consistent increase in the average age of the global population drives demand for mortality and morbidity insurance, especially in emerging markets. This structural demographic change has just started and should accelerate in the decades to come. Insurers, such as AIA in Asia, are addressing this growing market. In developed markets, consumers are demanding new ways of saving and investing efficiently. For example, BlackRock provides ETF products, which allow investors to cost-effectively save and invest.

Digitalisation

Digitalisation is revolutionising financial services in three ways. Firstly, it enables a vast increase in the volume of electronic payments carried out by corporates and consumers. Mastercard benefits from this trend by providing the infrastructure through which these payments flow. Secondly, digitalisation is changing the way banks work, allowing for widespread growth in online and mobile banking, which together with the reduction of bank branches, should last until the end of this decade in most banking systems. This allows companies like Jack Henry & Associates to flourish. Jack Henry supplies core banking systems to small and medium sized financial institutions, giving them the opportunity to build their digital banking offerings. Finally, digitalisation allows firms to reach the consumer more effectively and collect customer data, leading to products that are better designed and priced. Admiral, the UK motor insurer, has clearly benefited here. Its data-gathering activities in price comparison websites allow not only more efficient distribution, but also a better pricing of risk.

Automation

Automation creates more efficient markets and a leaner cost structure for companies. Electronic markets work better, since they connect more buyers and sellers, have access to larger asset volumes and generate lower transaction costs. A beneficiary here is the London Stock Exchange, the largest global swaps clearer. Firms like Moody’s, the global rating agency, that standardise investment assets, also contribute to market efficiency. Measuring credit risk in a standardised manner allows for more transparent trading in debt instruments. Only a fraction of global investment assets are standardised and traded in formalised markets, therefore we expect these companies to be decades away from mature growth.

Evolving consumer

Who consumers are, how they consume and what they consume is changing. Consumers in emerging markets are driving the need for increased financial inclusion. This creates lending opportunities for banks, especially within their digital franchises. HDFC in India is a good example of a digitally focused bank which benefits from an expanded middle class. As per capita incomes growth, we expect the addressable market for HDFC to continue growing strongly well into the next decade. Meanwhile, as wealth levels expand across the world, the need for financial protection also increases. Providers of pension protection, health and mortality insurance can take advantage of this trend. UK Prudential has been one of the main beneficiaries of this change through its life and health insurance franchise in Asia.

Climate change

Climate change will also reshape the financial industry through this century. A more uncertain climate will lead to more infrastructure investment, creating a market for specialised infrastructure asset managers. Partners Group is one of the key players in infrastructure investment. Moreover, property insurance will become increasingly important, as risks will be both more severe and statistically unpredictable. We believe this opens an opportunity for risk redistribution players, such as Hannover Re.

Investing at the forefront of finance

Financial disruptors tend to be different from those in other industries. Innovators often face uncertain demand, negative cash production, and a complex competitive landscape. Here, in contrast, most financial disruptors enjoy not only growing revenues, but also deep competitive moats, downward sloping cost curves and increasing margins. In contrast with many other industries, financial disruptors cover their cost of capital and increase their returns over time.

We have been invested in quality financial disruptors over the last few years, allowing us to harvest attractive returns to our customers. Investments such as Moody’s. LSE, Mastercard, Prudential and AIA have been the cornerstone of our portfolios.

We believe investing in financial disruptors can be an attractive investment opportunity. The space offers investments that have both unique secular growth opportunities and robust business economics, allowing for material returns to equity holders without the risks associated with nascent technologies and unproven business models.