Model portfolio manager Ben Gilbert takes us through six charts that explain why 2022 was a particularly difficult year for financial markets, but why a long-term mindset is key for thematic investors.

Read on to find out:

- How global equities and fixed income performed against key world events last year

- Why interest rates matter

- What's next for global markets

As John F. Kennedy famously said, "Change is the law of life and those who look only to the past or present are certain to miss the future."

Whilst it has been a highly unusual and painful time for investors, it is important to remember that markets have been through turbulent periods before and, given time, tend to recover from drawdowns.

Attempting to time markets in the short-term and capitulating at the moment of ‘peak fear’ also tends to damage long-term returns significantly as investors miss out on the recovery.

Volatility is undoubtedly unwelcome and can indeed be scary, but is a fact of investing in financial markets. If investors are able to remain invested through periods of volatility and resist the urge to sell at the moment of maximum fear, we believe this should, in time, reward patient investors.

The period since the COVID-19 pandemic has been extremely challenging for financial markets. This is particularly true of 2022 and especially valid for Sterling-based (£GBP) clients in the UK.

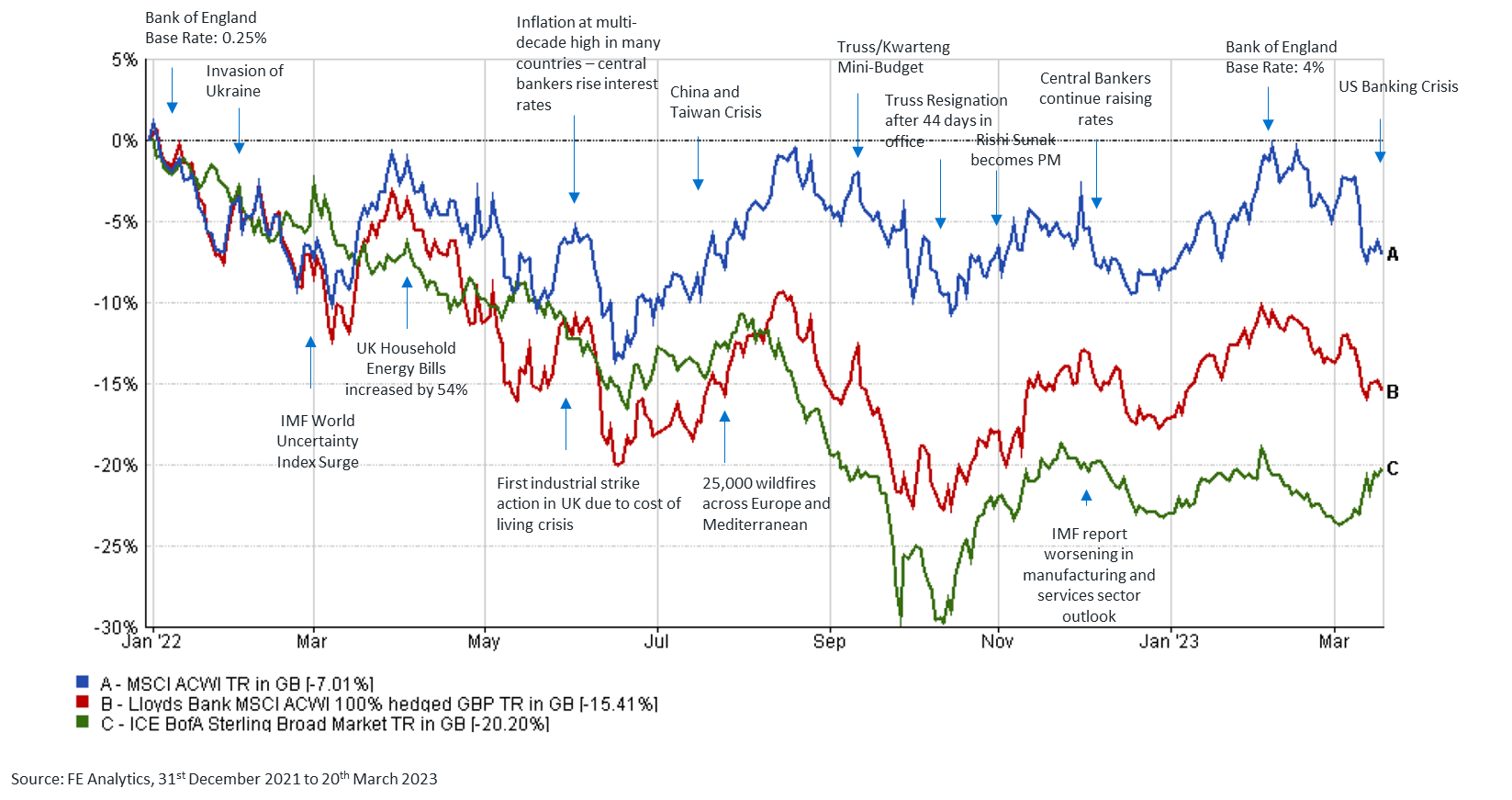

In a little over a year, we have seen Russia invading Ukraine, record interest rate rises, a cost-of-living crisis, a trio of UK Prime Ministers and the second largest banking collapse in US history. The chart below illustrates some of the shocks that have impacted investment markets, the UK and Sterling in the short term.

Performance of Global Equities, Global Equities (GBP hedged), and UK Fixed Income 2022-to-date against key events

What was so difficult about 2022?

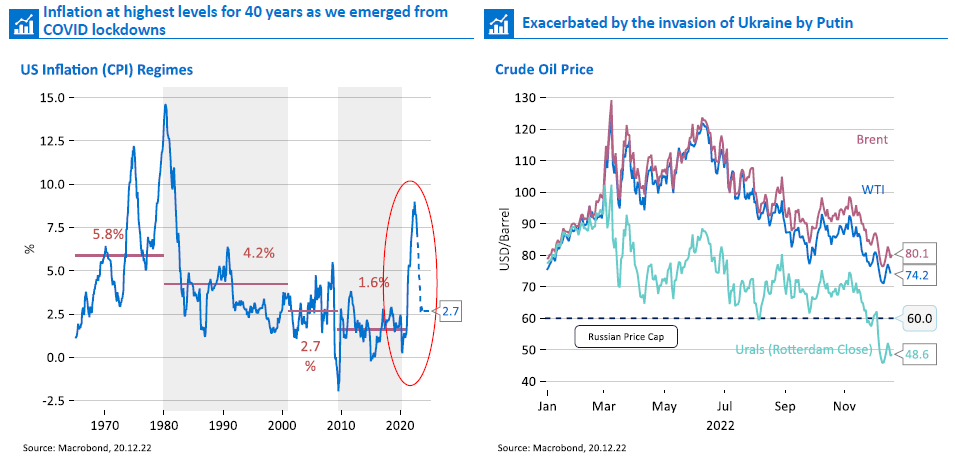

2022 was an extraordinary year for financial markets. As the global economy emerged from the COVID-19 pandemic, inflation rose to its highest level in 40 years.

This started at the end of 2021 and beginning of 2022 as inefficiencies in global supply chains started to filter into input costs. This was one of the effects caused by companies repeatedly shutting down and re-opening factories during lockdown.

A burgeoning inflation problem was then dramatically exacerbated when Russia invaded Ukraine. This caused oil and gas prices to spike, which in turn led to further increases in the prices of many basics (please see below, with oil as one example).

Subsequently, global central banks increased interest rates rapidly when compared with market expectations. In the UK alone, we have gone from interest rates of 0.25% in January 2022 to 4% at the time of writing.

Why do interest rates matter?

One impact of rapidly raising interest rates is that bonds and equities (which tend to make up the majority of a risk-rated investment portfolio) tend to fall sharply in the short term. Financial analysts ‘discount’ future cash flows (in basic terms, your share of profits from owning shares in a company) at a rate which is closely related to central bank base rates.

When these central bank rates are low, company valuations are high. Conversely, when this rate is high, valuations are lower. This is because it sets a higher hurdle to justify the risk you are taking on by lending out your money (a bond) or owning a company (an equity).

Interest rates tend to move in cycles and don’t remain static. Over time, history shows that much of the valuation adjustment owing to interest rate changes will be less important than the fundamental strengths of the businesses you are investing in. For example, portfolios generally saw a sharp recovery from October 2022 to the end of January 2023 as the market got more optimistic that rates would come down.

In due course, the important driver of returns ought to be the cash flows attributable to you as the owner of an investment portfolio. However, in the short term, these valuation adjustments and the irrational exuberance or pessimism of markets can be very concerning. Some solace for investors can be sought in the fact that, counterintuitively, it tends to be a better time to invest when rates are high, valuations have just fallen and investors are fearful (as they are at the moment).

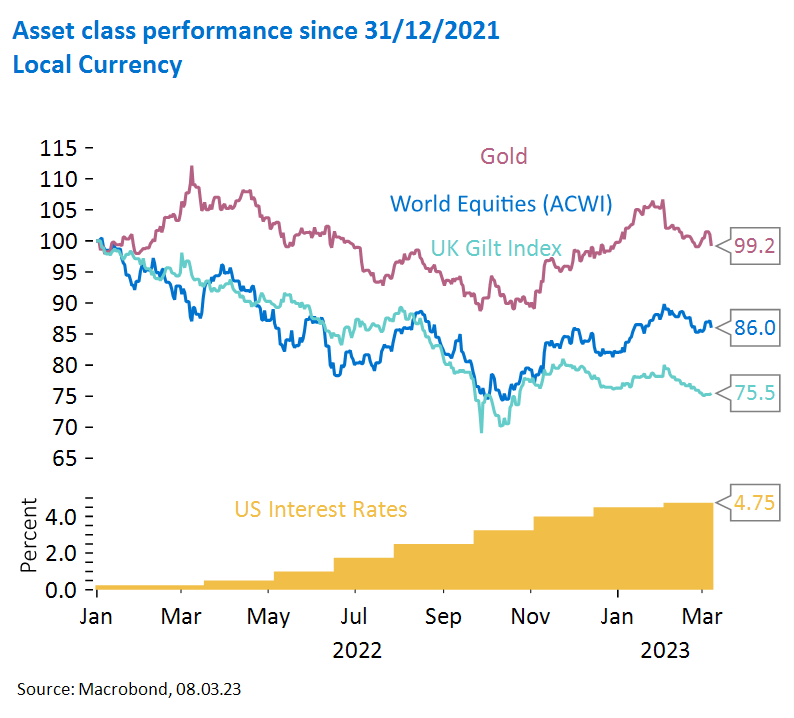

2022 didn't provide many hiding places

When financial markets are volatile, bonds - and government bonds – in particular, tend to provide protection for balanced investors. However, in the highly unusual circumstances of 2022, both bonds and equities fell at the same time. In fact, virtually all asset classes fell in 2022 as interest rates rose (see below). This meant that there were very few places for investors to hide. It was particularly painful for more conservative investors, as bonds (which tend to be seen as safe havens) fell even more than equities (which tend to be seen as riskier).

UK investors were dealt the additional blow of the disastrous Kwarteng/Truss budget which caused UK bond yields to spike (and their prices to fall), in addition to Sterling (£GBP) selling off dramatically around the end of September. Below you can see that UK government bonds (gilts) fell approximately 23%, whilst global equities (ACWI) fell 18.5%.

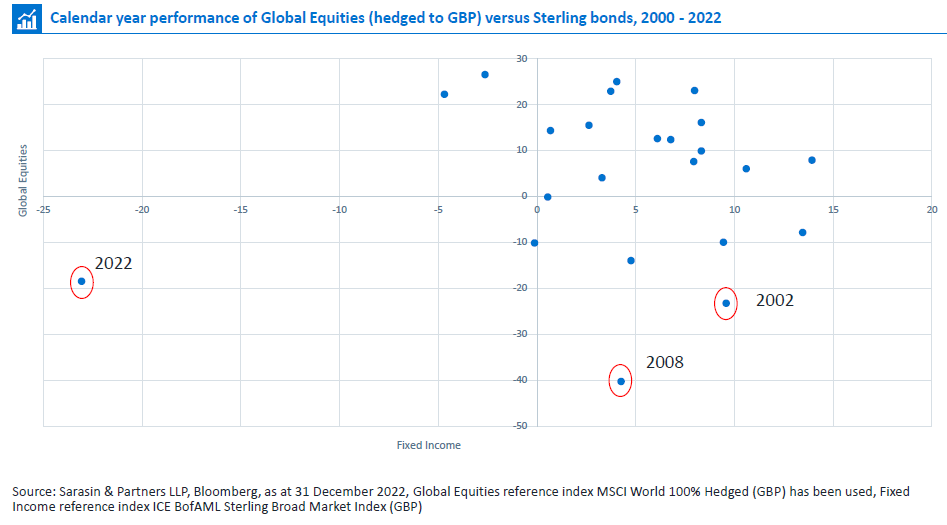

To try and put into perspective just how difficult a year 2022 was, the below chart plots the intersection between bond and equity returns in each calendar year from 2000 to 2022. It is quite evident that 2022 was by far the worst year for equities and bonds combined. In fact, by some measures it was the worst sell-off for bonds in over 100 years.

The 22-year period quoted below includes two very material sell-offs, namely the 2002 dot-com ‘boom and bust’, as well as the 2008 financial crisis. Both are highlighted to give some context for just how extreme the moves in financial markets have been during this period.

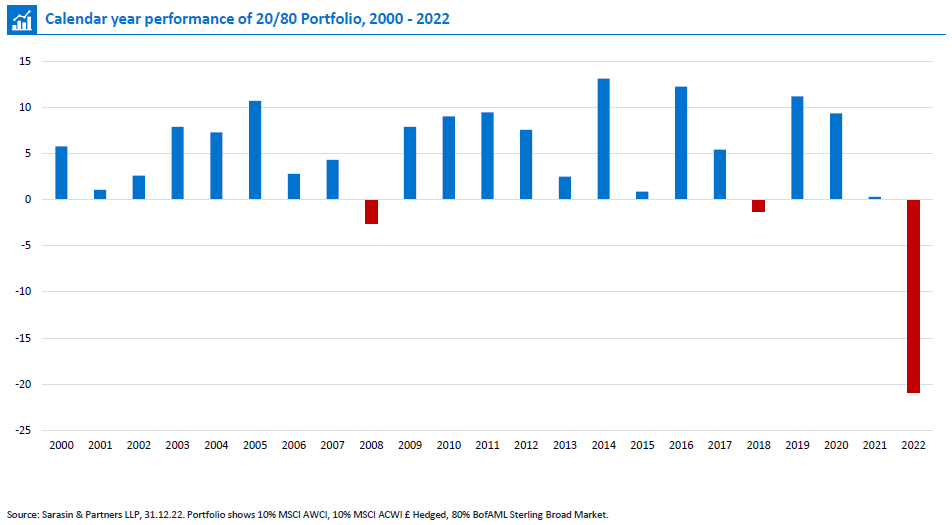

To follow on from this, the chart below depicts the same data but shows discreet annual returns for a typical conservative investor holding 80% in bonds and 20% in equities.

Again, this illustrates just what an extraordinary year 2022 was for more defensively-positioned portfolios.

What next?

Whilst 2022 was an exceptionally difficult year, markets have sold off before and will likely do so again. Given time, investment portfolios ought to recover as the value of the cash flows drive long-term returns.

The last time a combined bond and equity fall of this magnitude occurred was in 1994, when the Fed unexpectedly increased interest rates in the face of inflation shocks. There are some members of our investment team who bore witness to this and will never forget the lessons they learned.

To summarise, investors should not forget the importance of having a long-term investment mindset. At Sarasin & Partners, our global thematic equity process is key.

Whether it’s renewing the world’s energy infrastructure, automating factories, or capturing a new wave of emerging market growth – there are many ways to capture long-term thematic investment opportunities despite the short-term challenges.

Our mega-trends and sub-themes are the key areas of the global economy where we focus our attention, and seek to find durable businesses which will shape and benefit from economies of the future.

You can read more about our investment themes here.

This information is for investment professionals only and should not be relied upon by private investors.

This promotion has been approved by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England & Wales with registered number OC329859 which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

The investments of the Model Portfolios are subject to normal market fluctuations. The value of the investments of the Model Portfolios and the income from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable guide to future returns and may not be repeated.

All details in this document are provided for marketing and information purposes only and should not be misinterpreted as investment advice or taxation advice. This document is not an offer or recommendation to buy or sell shares in any fund. You should not act or rely on this document but should seek independent advice and verification in relation to its contents. Neither Sarasin & Partners LLP nor any other member of Bank J. Safra Sarasin Ltd. accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The views expressed in this document are those of Sarasin & Partners LLP and these are subject to change without notice.

Where the data in this document comes partially from third party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third party data.

Persons domiciled in the USA or US nationals are not permitted to invest in the Model Portfolios. This publication is intended for investors in the United Kingdom.

© 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].