At its core, real estate investing is about understanding how people use space and interact with other people in that space. The lockdowns that have reshaped our lives have had a significant impact on the way we live and work. For a real estate investor, understanding these changes is crucial. Should real estate investors change their investment strategy in a post-COVID world, and if so, how?

The pandemic’s impact on real estate will depend on the extent to which it alters the nature of human interaction. Will people feel less inclined to shop in busy malls, go to cinemas or eat out in restaurants? Will employees feel uncomfortable in offices and want to work from home indefinitely? Will online shopping continue to thrive?

These are important and challenging questions to answer. They require the ability to foresee both potential behavioural changes and the evolution of the pandemic itself.

Listed real estate suffered a significant hit

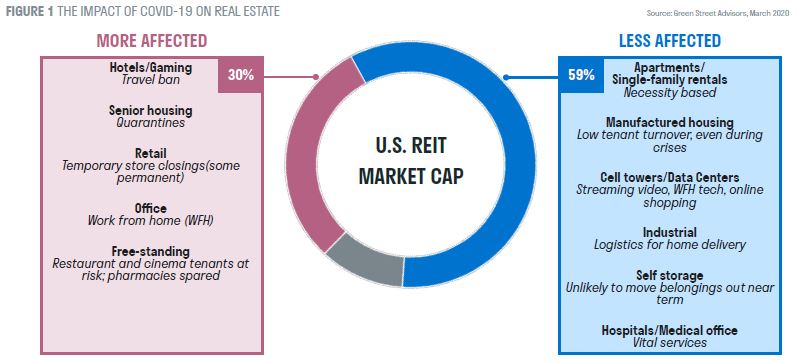

Not all real estate sectors were equally affected by the pandemic, but the sector as whole was badly hit and fell by approximately 20%1 over the year to date, underperforming the general equity market. Initial concerns over financial leverage mushroomed into fears over the sustainability of cash flows – and therefore dividend payments. While the current macroeconomic backdrop remains weak, focus is likely to eventually return to the environment of low growth, low returns and low or even negative rates we face. How will real estate fare if ‘lower for longer’ shifts to ‘lower forever’?

For structurally supported sectors, real estate's income profile should continue to look attractive. The initial worry that all tenants would stop paying their rent, jeopardising real estate companies’ ability to pay dividends, proved to be unjustified for most real estate sub-sectors. With the exception of retail and the hotel sectors (about 12% of the universe), most tenants paid their rent.

In Western markets, retail real estate was already challenged by e-commerce, a structural, thematic shift, which reduces the need for bricks and mortar shopping venues. It has also been accelerated by COVID, with a new dependency on online shopping likely to translate into a habit for many. E-commerce is clearly a drag on real estate as it reduces retailer demand for physical stores. We had already been avoiding most retail REITS for this reason. However, COVID also threatens to unseat our preference for high-footfall, experiential shopping centres, due to an increased need for social distancing measures and a reluctance to visit crowded locations. A post-COVID world might lead us to focus more on open-air shopping centres, regional shopping venues focused on non-discretionary products, or those that attract a younger, more COVID-resilient crowd.

Although retail real estate was hardest hit by structural changes and by the impact of COVID, it is perhaps too easy – and unwise – to disregard the sector altogether. We should remember that although online retail is on the up, most sales are still done in bricks and mortar shops. While the face of retail has definitely changed and that change has not yet finished, some retail landlords will emerge stronger.

Are the days of the office over?

There is much speculation about how the lockdown-accelerated trend of working from home will alter corporates' long-term real estate strategies. Working from home is a trend that is here to stay, and many companies have already announced changes2. Countries where workers suffer longer commute times but enjoy larger homes, such as the US, may see a more marked impact.

However, the office is far from dead. There are a number of factors that will likely limit the impact on office floorspace demand, particularly for prime markets. Workspaces may need to decrease density in order to allow for increased social distancing. Secondly, hot desking is now less appealing and may even become regulated against. Thirdly, companies have long engaged in providing quality spaces to attract and retain talent, and any cost saving that does arise may be channelled towards a better, and likely, greener, office in a more appealing location. Finally, the need for in-person collaboration is unlikely to disappear. This is an area where we feel our real estate strategy is well positioned, as most listed office real estate companies own modern and sustainable buildings in prime locations.

A boon for industrial real estate and data centres

While retail real estate has suffered, industrial real estate has seen something of a tailwind. The same e-commerce trends that threaten the retail sector, and which COVID-19 has intensified, are likely to benefit logistics. One thing that the pandemic has taught us is that most countries were very dependent on Chinese production of goods, such as PPE. Retailers of items such as car parts and mobile phone parts also found themselves unable to serve customers due to lack of supply and no production coming in from China, and lost revenue. A lesson from the pandemic is likely to be that higher inventory levels ensure resilient supply chains. Sectors such as food and beverage, electronics/appliances and healthcare have particularly lean supply chains at present.

The accelerated adoption of e-commerce should also require greater supply chain investment. Several industries, such as food and beverage, are still in the early phases of e-commerce adoption, and during the heights of the pandemic, grocers saw an increase in sales. Not all this growth is necessarily permanent, but much of it could be as new adopters are now familiar with e-commerce and its convenience benefits. Growth in these categories will reinforce same - and next-day service requirements.

Data centre providers, facilities that house an organisation’s shared IT operations, have been – together with the industrial sector - by far and away the best performing real estate subsector. This does not come as a surprise given the sector's growth profile, coupled with solid balance sheets. Data centres are likely to continue to perform well, as workplaces become more agile, flexible and cloud-based in a post-COVID world.

Our thematic investment approach means we are well positioned to capture the trends that COVID has accelerated. Our preference for liquid, listed real estate companies, and our broad, flexible, global mandate enables us to adjust the portfolio as we identify new trends and themes that impact the world of real estate. Looking ahead, we intend to draw even more heavily on our thematic process for idea generation and will position the portfolio to benefit from long-term trends such as the industrial and data centre sectors.

1Source: S&P Developed REIT Index, end of July 2020

2Source: Nikkei Survey, August 2020