Constructing an investment portfolio that can both withstand and take advantage of market movements is key to producing attractive returns, so understanding the drivers of performance across all asset classes is vital.

Using a broad range of securities helps managers to deploy as many of these performance drivers as possible – and, we think, those labelled 'alternative' are critical to this mission.

Alternatives sit outside regular listed equity, high-quality corporate and government debt, while offering a wide spectrum of possibility. As a portfolio of assets, their job, as the name also suggests, is to move in the alternative direction to the regular assets in a portfolio, to offset or at least limit drawdowns or losses.

They should 'zig' when the rest of the portfolio 'zags'.

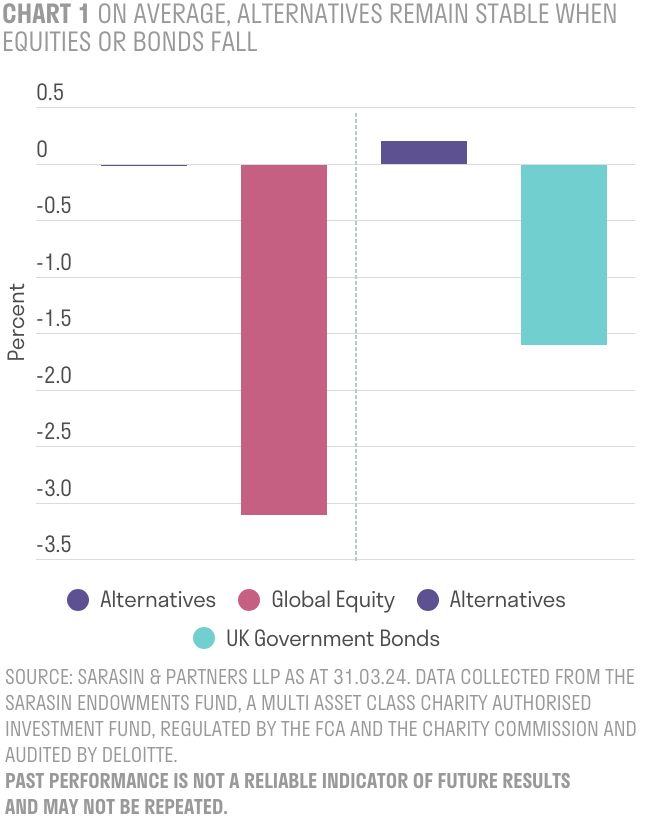

Yet, over the past year, some of the securities that typically make up a portfolio of alternatives have and moved to a greater extent in the same direction as the other assets in the portfolio. Chart 1 shows the average monthly performance of our endowment funds’ alternative portfolio. The months when equity markets fell are shown on the left-hand side, while the months when UK government bond markets fell can be seen on the right-hand side. Clearly evident is the stabilising effect alternatives have on the portfolio during these difficult periods for other assets.

Alternatives also need to earn an attractive return over the long term to warrant a place in a portfolio. Chart 2 shows how the long-term consistent returns from the alternative allocation in our endowments portfolio make them an attractive asset to own over the medium term.

So, what happened?

Alternatives, as a label, covers a broad collection of assets. To help us manage them we group them into two distinct categories: correlated and uncorrelated.

Those falling under the correlated banner give us exposure to unique assets that offer compelling returns but, at their core, are often likely to move in a similar way to traditional asset classes.

We further divide this correlated section into alternative income, which is likely to move in line with regular bonds, and alternative equity, which is likely to move with listed equities.

Within our alternative income portfolio is our direct infrastructure allocation, which offers three important properties:long-term, high-quality cash flows from assets such as schools, hospitals and toll roads;low credit risk, as many of the contracts are underwritten by local authorities or government;terms often have a built-in upward inflation adjustment which helps maintain the real value of the dividend payment from these investments.

Over the past year, the assets in this part of the alternative income portfolio have faced the most challenges, which have taken the form of a combination of external macro factors. High and persistent inflation around the world, but also specifically in the UK, meant the interest rates intended to cool this measure stayed higher for longer.

Initially, as inflation accelerated in 2021 and 2022, assets in our direct infrastructure portfolio performed well, as cash flow increased quickly as it was adjusted upwards in line with the rate of rising prices.

Yet, as time passed, these elevated rates pulled down the value of fixed income assets, which made infrastructure assets less attractive, reducing their value.

Happily, economic conditions are back to relative stability and these assets are now performing closer to our expectations. While moving in a similar way to corporate bonds – which have a place in our regular non-alternative portfolio – they offer very compelling dividend yields in the region of 6.5% - 7.5%, which is around one to two percentage points more.

Infrastructure holdings are also trading at discounts of 20% to the value of their underlying assets, which leads us to expect better future returns in this area.

On the other side of this correlated allocation, private equity also faced challenges in 2022, but made a recovery in line with broader listed markets through 2023 and the start of 2024.

The other side of our alternatives portfolio contains assets that we label as uncorrelated. These provide a return source that moves to its own beat and helps stabilise the portfolio in volatile and unexpected market conditions.

Over the past year, this part of the portfolio held up strongly, partially thanks to our decision to make a meaningful allocation to gold. This decision was driven by our thematic work that showed mounting geopolitical risk and rising government deficits were likely to drive up the gold price as it remains the ultimate store of value.

What happens to alternatives now?

Alternatives have a compelling long-term history of differentiated returns. The recent period has been disappointing, but our assessment shows that valuation have now corrected to reasonable levels and the macroeconomic backdrop has improved. We have seen evidence that this may be beginning to bear out this quarter.

During the equity and bond market wobble in April this year, we saw alternatives hold their ground. Alternatives have produced what we consider to be respectable positive returns that are ahead on bonds and not far behind equities.

After an unusually difficult period we may be seeing signs of improvement, which should renew investors’ faith in alternatives.

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].