‘Diabesity’ drugs have dominated headlines in recent months. The first of these was launched to little fanfare in the midst of the Covid pandemic in 2021, but as early adopters – often celebrities – showcased the seemingly miraculous results from these drugs, the world sat up and took notice.

The scientific community came on board in summer 2023 after results from the first rigorous, large-scale trial (Novo Nordisk’s*[1] SELECT trial[2]) confirmed the weight-loss effects of glucagon-like peptides (GLPs) – with far-reaching ramifications.

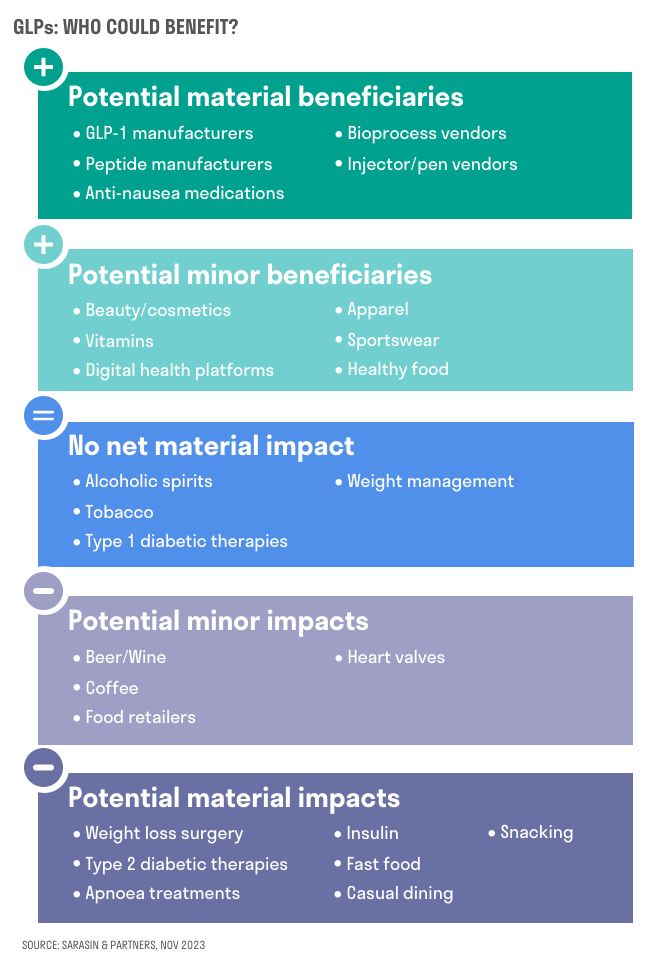

Bearing the brunt are healthcare companies focused on conditions associated with being overweight or obese – principally diabetes and heart conditions. Also in the firing line were companies linked to joint replacements, dialysis, sleep apnoea relief, weight management products, food retailing, alcohol, fast food, snacking, casual dining and even coffee.[3] Sarasin’s thematic global equity portfolios have little exposure to consumer services that could be most affected, such as fast food and casual dining.

In our view, the market down-draught caused by GLPs has created good buying opportunities among healthcare companies that have been marked down unfairly. However, we also think that the potential market for GLP drugs may have been greatly under-estimated.

The skinny on GLPs

After many years of work and numerous dead ends, two pharmaceutical giants – Eli Lilly* (held under our Ageing themes) and Novo Nordisk – can now offer two GLP medicines for weight loss and the treatment of associated co-morbidities, such as diabetes and heart disease.

Glucagon-like peptides (GLPs) are hormones, signalling molecules that the body uses to control blood sugar levels. They are part of the endocrine signalling system, which regulates the central nervous system and can suppress appetite.

The ability of GLPs to affect bodyweight and blood sugar levels was first confirmed in the 1980s, but it took many years to make them suitable for injection. GLPs have been in commercial use in treating diabetes since 2005, providing researchers with a long track record of their effects.

Unlike most weight-loss treatments, GLP drugs act on the body’s own regulation system to reduce appetite, essentially signalling to the brain that the person is ‘full’. They are intended to be used in conjunction with lifestyle changes, usually increased exercise and improved diet, without which treatment is less likely to lead to longer-term health benefits. GLPs are not without side effects, which include nausea, gastrointestinal issues and loss of muscle mass.

As well as having the potential to reduce the incidence of heart disease and diabetes, GLPs could be beneficial in the treatment of chronic kidney disease, hypertension, some cancers and osteoarthritis. This would not only be extremely beneficial for society – it could also significantly reduce healthcare costs for individuals, governments and insurance companies.

How big could the GLP market get?

Demand for these drugs has surprised even long-term watchers of the pharmaceuticals sector. Just six months after the launch of Wegovy (a higher-dose version of Novo Nordisk’s GLP drug Ozempic), 1% of the Danish population were taking it, according to the CEO of Novo Nordisk.[4]

So far, the focus has been on how GLPs might be used to treat obesity-related conditions, their long-term safety record, and also the drugs’ reception among US insurance companies and physicians. The US healthcare market is the largest in the world: what happens there can determine the success or failure of new drugs. To date, most US insurers will only pay for GLP use for weight-related conditions – not for weight loss alone.

Seen through this lens, we believe that the global market for GLPs as prescription-only drugs is likely to reach $75 billion by 2027 and perhaps $100 billion by 2030. This estimate, however, does not fully take account of potential new indications, such as liver and Alzheimer’s disease, as well as the potentially even higher use of GLPs as a consumer weight-loss product.

Enthusiasm for Wegovy among Danes suggests strong potential demand in other western developed countries, but also in areas of the Middle East and in China, where obesity rates are high in urban areas. Prices for GLPs are already falling, making them more accessible to a wider market. The potential market for GLPs may therefore still be underestimated by investors, even after the strong share price rises of producers such as Eli Lilly in 2023.[5]

Arguing the case for the prosecution, it is conceivable that current enthusiasm wanes if consumers tire of GLPs’ non-negligible side effects. A recent study suggests that two-thirds of GLP users stop taking them within 12 months,[6] while a clinical trial[7] found that people who stopped taking GLPs regained much of the weight they had lost within a year.

More user-friendly GLP products would be highly desirable, and this is one of the objectives of intensifying research into them. However, the same intense research in pursuit of the holy grail of GLPs could also result in a highly competitive market with undifferentiated products. Were this to happen, prices could fall dramatically in the absence of a significant increase in demand.

The problem with obesity

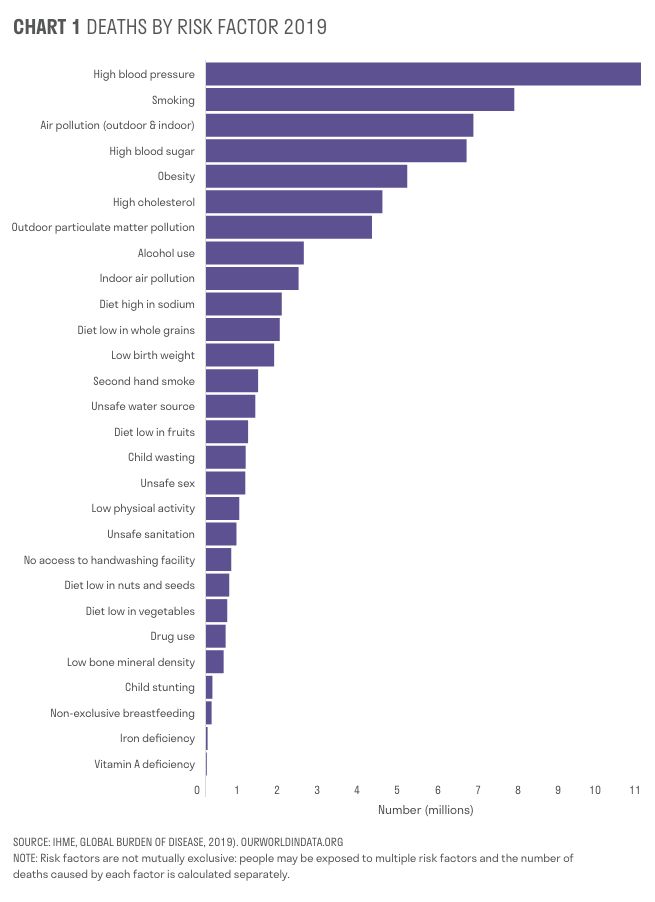

Approximately 5 million deaths a year are attributable to obesity[8]

Big killers, such as high blood pressure (see chart 1), are strongly linked to excessive weight[9]

Between 1999 and 2020, US obesity prevalence increased from 30.5% to 41.9%[10]

The estimated annual medical cost of obesity in the US was nearly $173 billion in 2019[11]

Globally, about 13% of adults are obese and 39% are overweight[12]

Winners and losers

In response to the markets’ knee-jerk reaction to GLPs, we have taken time to assess the likely winners, and also which companies may have been unfairly marked down in the scramble to reduce the perceived risks posed by GLPs. The market reaction has been overdone in some cases, but investors in healthcare will still need to put some thought into which companies they choose to be exposed to during the next few years.

Eli Lilly and Novo Nordisk are likely to dominate the market for GLPs thanks to the quality of their current products and established pipelines of GLP innovations. In pharmaceuticals, drugs that are best-in-class tend to dominate market share, and Eli Lilly currently has the best-in-class GLP therapy. Other clear beneficiaries are companies such as Thermo Fisher* that supply products used to make and deliver GLPs.

But this is a very nascent market in areas outside type 2 diabetes. Other companies are developing GLP-related therapies, including Pfizer, Amgen*, Roche, Boehringer Ingelheim and Sciwind Biosciences, as well as smaller biotech businesses such as Carmot Therapeutics (recently bought by Roche*). Next-tier GLP challengers such as Amgen and Roche could surprise, and there is also potential for more radical GLP innovation to upset the current market leaders’ apple cart.

Elsewhere, suppliers of diabetes treatments, including Medtronic*, may have been oversold. For example, GLPs are not a treatment for type 1 diabetes, and many type 2 diabetics may be reluctant to abandon familiar insulin delivery systems and glucose monitors. GLPs can also work in tandem with existing therapies, for example by being co-prescribed with glucose monitors.

Likewise, GLP use may increase the number of people for whom medical procedures such as joint replacements and heart valves are viable options. This would benefit our investments in Smith & Nephew* (joints) and Edwards Life Sciences* (heart valves), both of which were caught in the recent market downdraught.

Looking at the very long term, it should be borne in mind that, while a thinner population can enjoy better health for longer, they will inevitably require other kinds of medical treatment as they age. Fewer cases of diabetes, heart disease and hypertension suggest more demand for cancer and Alzheimer’s treatment and care.

‘Diabesity’ drugs are a major breakthrough that could significantly improve both the quantity and quality of life across the world. This is likely to shift patterns of healthcare and consumption – decreasing demand in some areas and postponing it in others. However, the biggest thematic driver of healthcare demand will not change: the steady but seismic ageing of western demographics.

[1] Macrobond, November 2023. Sarasin portfolio holdings mentioned in this article are marked *

[2] Published in August 2023

[3] Macrobond, December 2023

[4] CNN, Ozempic and Wegovy maker ‘just scratching the surface’ in meeting demand for weight loss drugs, CEO says, 5 September 2023

[5] Bloomberg, November 2023

[6] Early- and later-stage persistence with antiobesity medications: A retrospective cohort study, published in Obesity, December 2023

[7] Weill Cornell Medicine, SURMOUNT-4 study, December 2023

[8] Institute for Health Metrics and Evaluation (IHME), Global Burden of Disease, 2019

[9] Centers for Disease Control and Prevention, December 2023

[10] Centers for Disease Control and Prevention, December 2023

[11] Centers for Disease Control and Prevention, December 2023

[12] World Health Organization, 2016

Important information

This document is intended for retail investors. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].