Awareness of the urgent need for clean energy has been turbo-charged by a scramble for energy security. Sarasin’s new High-Carbon Transition sub-theme seeks out leaders in dirty industries who are cleaning up their act to deliver the carbon emission cuts the world needs to get onto a 1.5°C temperature pathway. By leveraging Sarasin’s active ownership expertise, through this theme we seek to deliver both maximum impact from carbon reductions alongside superior financial returns from being on the right side of the transition. This, for us, is what securing tomorrow is all about.

One lasting impact of the invasion of Ukraine is that it has turbo-charged the shift towards clean energy. Ensuring domestic energy security at affordable prices is now paramount for many countries, and wind, solar and hydrogen will be an important part of making this happen. This in turn is adding to the pressure on high-carbon industries to change what they produce and how they produce it.

In response to the challenge ahead of us and the rapidly falling costs of clean energy, many investors are turning to low-carbon companies. These companies are important actors within the energy transition and offer attractive long-term return prospects; we too invest in companies such as wind turbine maker Orsted and heat pump manufacturer Daikin through our Climate Change mega-theme.

Investing in low-carbon stocks is only one part of the picture

It’s no good investing in windmills, if steel mills which supply them don’t decarbonise, for instance.

The most difficult part of the energy transition – and what underpins our ability to reach a 1.5°C temperature pathway – is the need to transform high-carbon, hard-to-abate sectors. This requires engaged and supportive shareholders with the ability and willingness to challenge and reject unsustainable corporate strategies.

It is these companies we are targeting in our new high-carbon transition investment sub-theme.

Investing in the transition

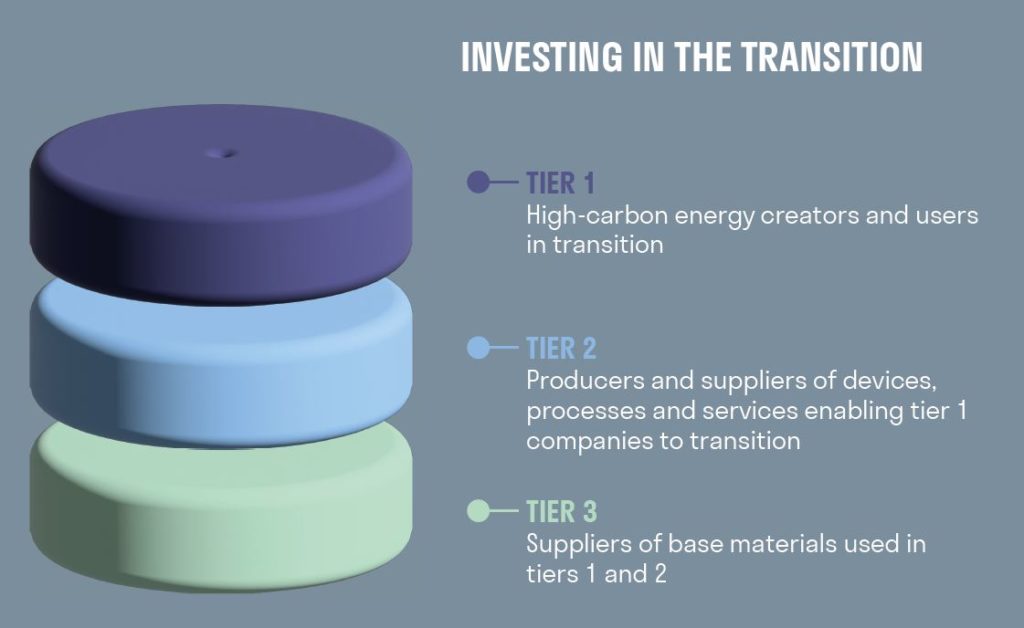

Our process begins with the identification of high-carbon companies that can create value through transformation. We look for opportunities in three broad categories:

Tier 1 includes names such as Equinor, an energy company whose gas production will be increasingly in demand as a relatively clean interim energy source. Looking longer term, Equinor’s ambition – and that of the Norwegian government which holds a large stake in the company – is for the company to become a preeminent operator of offshore wind and carbon capture facilities as it moves towards a net zero business model.

Helping companies such as Equinor make the transition to cleaner and more responsible business practices are an array of tier 2 companies such as Aker, a carbon capture provider and Fluor, a specialist in renewable fuels, hydrogen production and energy storage. Further along the supply-chain are companies such as Flowserve, Ingersoll Rand and Alfa Laval that supply precision pumps, heat exchangers and other components for the carbon transition.

In tier 3 we have suppliers of the vital materials without which transition will not be possible. Rio Tinto is a household name whose copper and aluminium will be in high demand as energy use switches from fossil to renewable. Less well-known is France’s Air Liquide, which supplies industrial gases and is a world leader in developing large scale green hydrogen – a low-carbon store of energy made using renewable power.

Other examples include building materials (particularly concrete) producer CRH, one of the largest carbon emitters on our buy list, but with an ambition to be sector-leading in carbon reduction. As the world adapt to climate change, we will need more cement. This needs to be low carbon.

For each and every potential investment, we undertake bottom-up analysis of fundamentals, including an assessment of upside potential from a 1.5°C transition using our proprietary Climate Value at Risk methodology.

This leads us to companies offering attractive value enhancement opportunities associated with a net zero transition.

Engage for change

The opportunity for low-carbon businesses to thrive in hard-to-abate sectors is clear. The challenge is delivery.

There are often a range of technological, economic, legal, policy or social barriers to change. Our role as supportive and engaged shareholders, therefore, becomes critical to delivering the long-term returns.

Sarasin’s long experience with active ownership is key in this sub-theme. Success requires careful analysis relating to the key asks put to Boards, a strong understanding of the governance arrangements, thoughtful voting to ensure director accountability (see Box on our Net Zero Voting policy) and a willingness to be public.

Sarasin votes for net zero alignment to underpin long-term value creation

A key element of a successful engagement strategy is clear and robust voting. We have integrated climate governance into our voting policy since 2018, and in September this year, we published the latest update as a standalone document.

Active ownership delivers results

Our track record shows that we can deliver impacts through our engagement. Take the leading US power company, NextEra. Despite having the largest renewables capacity, it is one of our largest carbon footprint companies due to its extensive gas generation and distribution network, primarily focused in Florida. Until this year, it lagged its peers in terms of its commitments to decarbonise.

Following intensive engagement as co-lead of the CA100+ investor initiative, we were delighted when the company committed in June to a ‘Real Zero’ carbon emissions target by 2045. This covers the vast bulk of emissions resulting from its energy generation and distribution.

We have carried out other successful engagements, across a range of sectors, such as with Shell, BP and Total on climate accounting and audit, with HSBC on financing of fossil-fuel-intensive activities and Weyerhaeuser, one the world’s largest timberlands management companies.

Our policy outreach to the audit industry has also gained considerable traction with investors globally, with a rising number of auditor reports providing commentary on how climate risks are being integrated into their audit processes.

Divestment won’t get us to net zero

It would be easy for Sarasin, like other asset managers, to decarbonise our clients’ portfolios by selling shares in hard-to-abate sectors. But we do not believe this would help decarbonise the global economy. Shares will pass to less concerned shareholders. Moreover, by walking away from these companies, we risk turning our backs on transformation opportunities that offer attractive long-term returns.

Instead of focusing our gaze on a relatively narrow green opportunity set today, we are investing and engaging across all sectors to deliver a more sustainable future tomorrow. Our new high-carbon transition sub-theme complements other climate sub-themes to enable this holistic approach. This is not only right for the planet; we believe it will deliver more sustainable financial rewards for our clients .

1 For example, In March 2022 the EU announced its REPowerEU plan to scale up renewables infrastructure rapidly and quadruple current 2030 targets for green hydrogen. The EU aims to become independent of Russian fossil fuels “well before 2030”. https://www.independent.co.uk/climate-change/news/eu-russia-oil-gas-ukraine-war-b2031117.html

2 This approach is in keeping with our Net Zero Asset Managers commitment. Please see our NZAM Action Plan here.

Important Information

This document has been issued by Sarasin & Partners LLP which is a limited liability partnership registered in England and Wales with registered number OC329859 and is authorised and regulated by the UK Financial Conduct Authority. It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and we make no representation or warranty, express or implied, as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Neither Sarasin & Partners LLP nor any other member of the Bank J. Safra Sarasin group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser.

© 2022 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.