Sarasin & Partners is now a member of Ethical AI Collective Impact Coalition (Ethical AI CIC) and a participant in its investor engagement initiative, which has a long-term focus on digital inclusion and a short-term focus on ethical AI.

AI is swiftly becoming embedded in our personal and working lives. While it offers the potential for vast efficiency gains, better decision making and democratised access to beneficial services, it is imperative that organisations work together to ensure that it truly becomes a force for good.

We look forward to collaborating with like-minded organisations at the Ethical AI CIC to define a responsible approach to technology and set out priority actions for investors.

AI increasingly shapes how tech companies store, distribute and protect customer data – and how they promote products. This can lead to undesirable and sometimes unintended social and economic consequences, such as giving priority to preferred users in promoting business content; reinforcing existing gender, race and demographic biases; and the dissemination of violent content.

What is the Ethical AI CIC?

The Ethical AI CIC will be a force multiplier and voice amplifier, enabling members such as Sarasin & Partners to join forces with other organisations in driving positive change. Membership of the Ethical AI CIC also provides members with an ideal opportunity to improve their knowledge of AI issues by taking part in campaigns and workshops with companies that would otherwise be difficult to access.

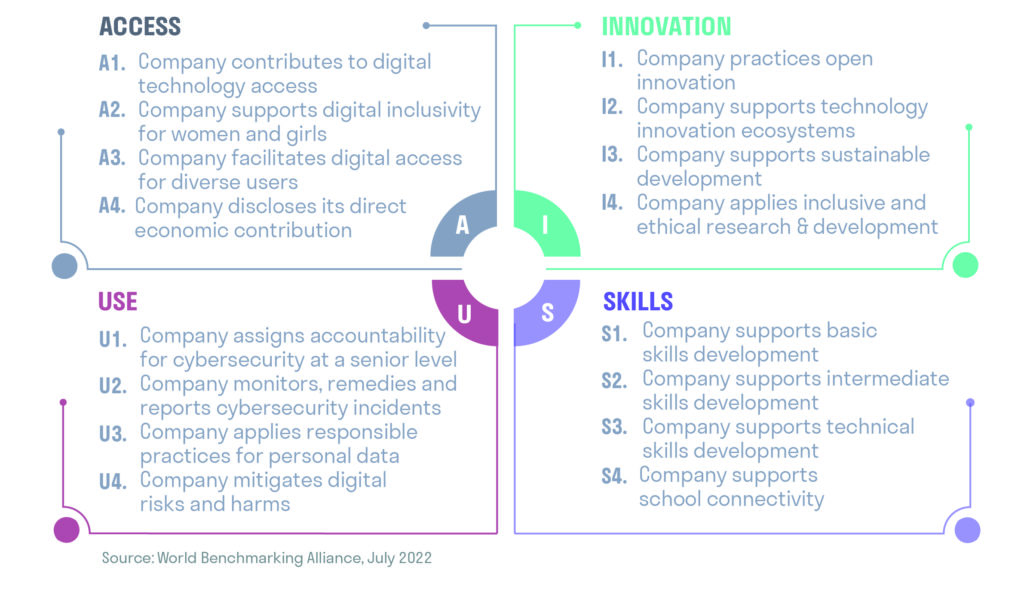

The CIC has been created by the World Benchmarking Alliance (WBA), which will provide analytical support. Engagements will use the results of the WBA’s global Digital Inclusion Benchmark (DIB) of 150 companies, many of which play crucial roles in IT services and software, telecommunications and hardware.

In addition to AI ethics, the DIB criteria cover other key topics that we are keen to apply to Sarasin portfolio holdings under our Responsible Tech workstream, including data privacy, cybersecurity, child protection and the contribution of technology to social and economic value.

Sarasin submission to SEC on proposed rules for climate-related financial disclosures

The US Securities and Exchange Commission recently proposed detailed rules for climate-related disclosures by companies in US markets.

We applaud the SEC’s leadership on this matter.

We welcome the attention given to financial statement disclosures, which we have long argued should play a central role in making investors aware of the true costs of climate change[1]

The failure of financial statements to reflect the real economic consequences of climate change and transition to a 1.5C pathway has increased uncertainty in markets, threatening market efficiency and macro-economic stability. It is time to stop treating potentially irreversible and catastrophic consequences of climate change as non-financial risks.

We hope that where the SEC leads, other regulators will follow.

[1] Sarasin & Partners chairs the Accounting and Audit working group at the Institutional Investor Group on Climate Change (IIGCC); was lead author for IIGCC’s publication “Investor expectations for Paris-aligned accounting” (Nov 2020); and has continued to lead several engagements with publicly listed companies seeking climate-related disclosures in accounting and audit. See our website for more recent public statements on companies and for policy-makers: https://sarasinandpartners.com/stewardship/policy-and-engagement-library/