Following intensive engagement with NextEra Energy - one of our largest carbon footprint investments - we were delighted when the company committed in June to achieving ‘Real Zero’ carbon emissions by 2045. This covers the vast bulk of emissions resulting from their direct energy generation and distribution (Scope 1 and 2).

NextEra is the USA’s leading supplier of renewable energy, but has lagged its peers for some time in terms its commitments to decarbonisation.

This public net-zero commitment places NextEra firmly in the vanguard of US utilities in terms of decarbonisation ambitions, which is where we believe it should be.

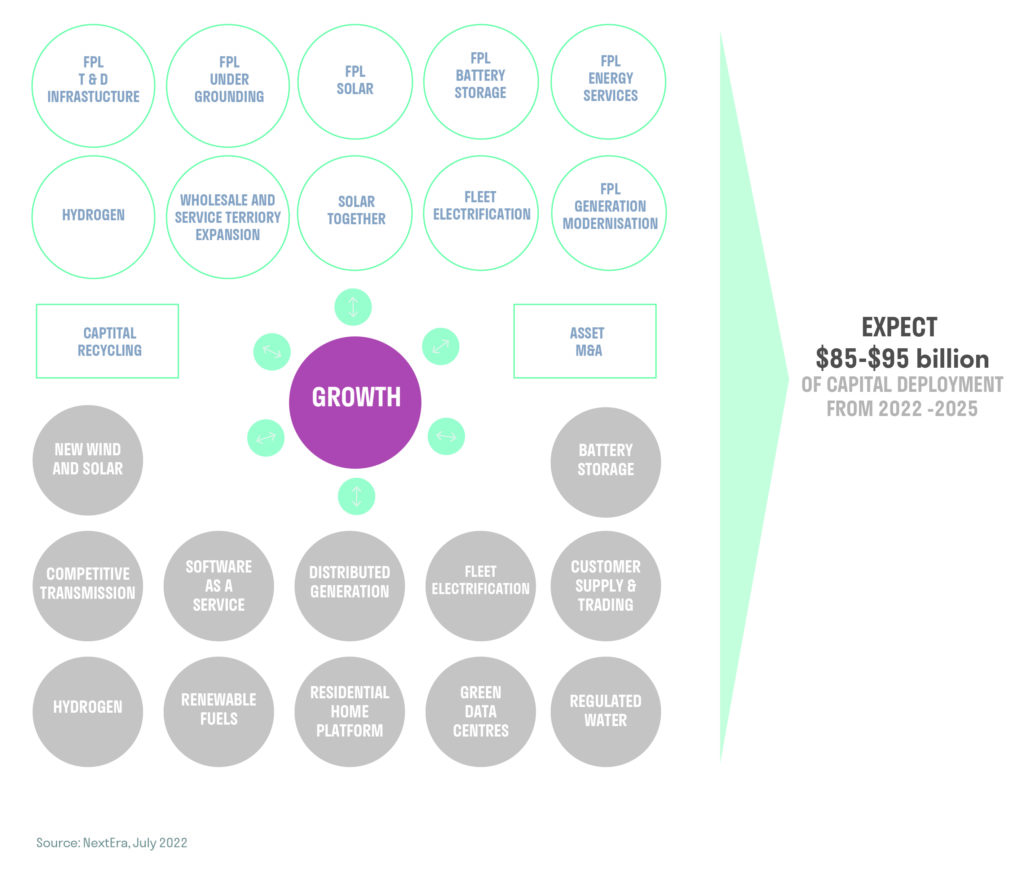

The commitment is supported by a clear strategic plan to decarbonise while growing its market share through multiple market opportunities (see below). That the plan is rooted in strong economic drivers makes it both powerful and credible.

Why is NextEra’s commitment important?

NextEra’s announcement marks a key moment in our engagement with them, which started in 2018. Since then, NextEra has stepped up its investment, R&D and disclosures linked to its role in the energy transition.

Sarasin has worked as co-lead of the CA100+ investor engagement effort alongside CalPERs, the largest US pension fund. Most recently, we escalated engagement by co-filing a shareholder resolution (which was subsequently withdrawn) and pre-declaring our votes against the lead director and chair to press for action.

Companies exposed to Russia

We continue to engage with companies that have exposure to Russia. In early April, we published a statement emphasising our concerns about Russia’s invasion of Ukraine and voicing support for companies that choose to terminate or suspend operations in Russia.

At the same time, we provided a risk assessment of our portfolios’ exposure to Russia in terms of their underlying companies’ revenue and EBITDA. Lastly, we outlined our plans to engage with companies regarding their exposure to Russia, particularly in relation to human rights. We have focused on companies with material societal footprints in Russia, such as significant market share, large assets or a large workforce.

Why do we engage with these companies?

In engaging with companies that announced they were leaving Russia, we discussed their proposed course of action, the implications for workers and suppliers and who would take control of their Russian assets. Our discussions with companies that chose to continue operations in Russia focused on their rationale for staying and the potential for reputational damage.

We grouped companies into three categories according to the decisiveness of their response.

Group I includes companies that pulled back swiftly from business activities in Russia, such as Amazon Web Services, Apple, Microsoft, Meta, Alphabet, Mastercard, Paypal and Disney. Most of these companies helped relocate Russia-based employees to non-Russian operations. Equinor terminated investments into Russia and exited its Russian joint ventures by late May. Schneider Electric stopped imports to Russia and sold its Russian assets to local management in late June.

Group II includes companies whose actions were decisive, but hampered by their entrenchment in Russia. HSBC can only reduce its exposure at the speed of its clients’ withdrawals and is committed supporting 200 Russia-based employees. Deere & Co. and OTIS stopped sales to Russia but cannot terminate servicing agreements. ENEL part-owns a Russian generating company which it decided to sell prior to the commencement of hostilities but has yet to do so.

Group III includes companies that were slow or indecisive. Marriott closed its Moscow office and paused future hotel development in Russia before belatedly announcing – in early June - its suspension of all Russian operations for economic reasons. EssilorLuxxotica announced it would restrict its Russian operations to medical vision care services, but has not provided specific details. Colgate, Unilever, Givaudan, and IFF did not withdraw from Russia on the grounds that their products are ‘essentials’, although Russia has domestic food and hygiene products sectors.

Our engagement in this area may not prove impactful, but it is a test of corporate policies relating to human rights, democracy and the rule of law. Companies that declare their support for Ukraine, make donations to the Ukrainian people and take decisive action to discontinue operations that support the Russian state will be less vulnerable to reputational risk.

More Progress at Alstom

In 2021, we commenced engagement with Alstom on a range of issues, including internal controls (particularly around Alstom’s acquisition of Bombardier), net-zero commitments, executive remuneration and board composition. The calls have been broadly constructive, with the company agreeing to consider the issues raised.

In our latest call with the Lead Independent Director we gained reassurance regarding stability of the board, progress of the Bombardier integration and attention to internal controls.

We were also notified of their progress in addressing our remuneration concerns. Improvements include introduction of a clawback mechanism and significantly increased shareholding guidelines, albeit still below our guidelines.[1] One other remaining area of weakness is the lack of a post-departure shareholding requirement.

We are pleased to see the progress Alstom is making but continue to press for full implementation of our requirements, which seek to ensure alignment of executive pay with long-term shareholder interests.

[1] For the interests of a company CEO to be well aligned with the interests of shareholders, our policy assumes they should own a material amount of the company’s stock. We believe that for all companies outside of the US this level should be 400% of a CEO’s annual base salary. For companies in the US, a higher level of 600% is appropriate in order to reflect the substantially lower level of US CEOs’ base salaries relative to their non-US counterparts.