Investors tend to have a preference for investing in their home country – and UK investors are no different. UK investors traditionally skew their portfolios to UK equities.

However, when investing in equity markets, investors need to consider which markets, regions and sectors they wish to be exposed to – and avoid behavioural biases that can have a negative impact on both returns and portfolio diversification. We tend to connect familiarity with low risk – just think of the phrase ‘better the devil you know’. However, in the world of investing, this is known as having a home bias, and more importantly, often doesn’t hold true – investing internationally can open up a greater opportunity set and also improve portfolio diversification, reducing risk.

Why invest globally?

1. Home bias can lead to investors being overexposed to certain sectors while underexposed to others

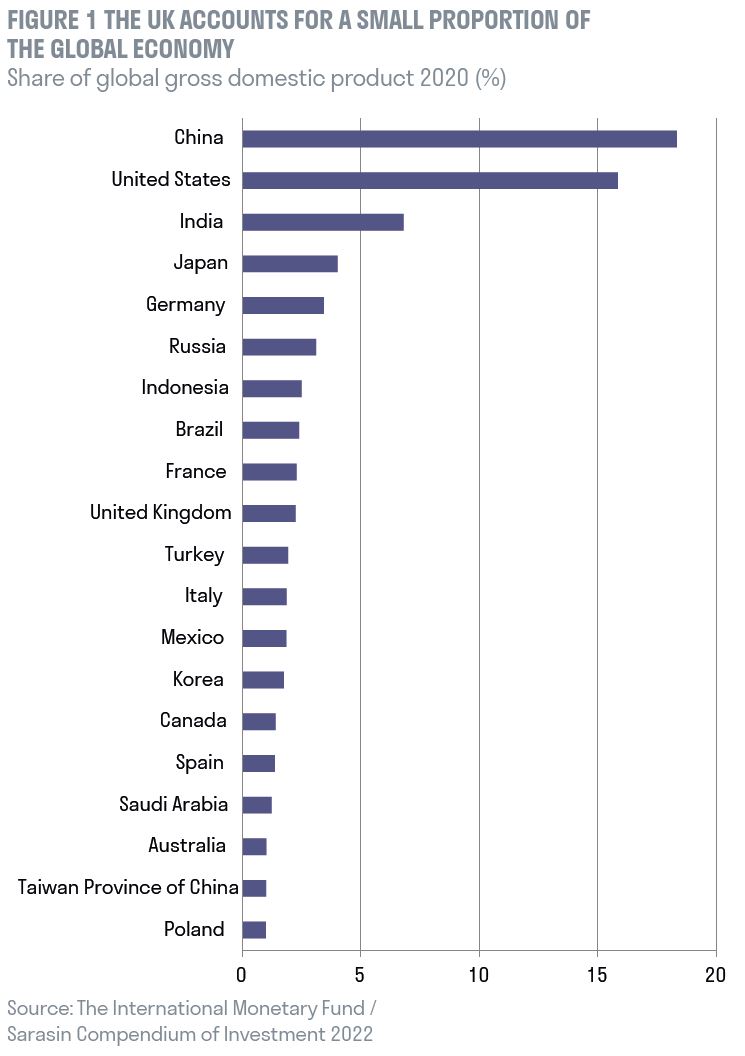

The UK is a developed economy and one of the financial capitals of the world, but put in a global context, it looks much smaller, only accounting for 2.2% of the global economy.1 The UK stock market represents just 3.6% of the MSCI All Countries World Index.2 A UK investor with a heavy bias towards UK assets would have a far greater percentage of their portfolio linked to the UK stock market. So why is this a problem?

As stock markets develop over time, they naturally come to reflect the industry strengths of the national economy, often resulting in certain industries being under or overrepresented, as figure 2 shows. An investor with a UK bias will be more exposed to banks and energy companies while being under-exposed to others such as information technology. This not only limits the portfolio’s potential for returns, but means that any decline in overweight sectors will disproportionately weigh on the portfolio’s performance.

Furthermore, certain sectors, such as banking, mining and oil and gas - are more cyclical - sensitive to the business cycle - than others. The UK stock market is heavily exposed to these sectors,

meaning that it is likely to experience more volatility.

2. Home bias can have a negative effect on income from dividends

As mentioned, the UK equity market is relatively concentrated in certain sectors, particularly oil and gas and financials. UK dividend income is relatively concentrated, with a small number of companies responsible for the majority of UK dividend income. This means that any portfolio that is overly reliant on an income stream from UK equities is not appropriately diversified, and risks being exposed to dividend cuts.

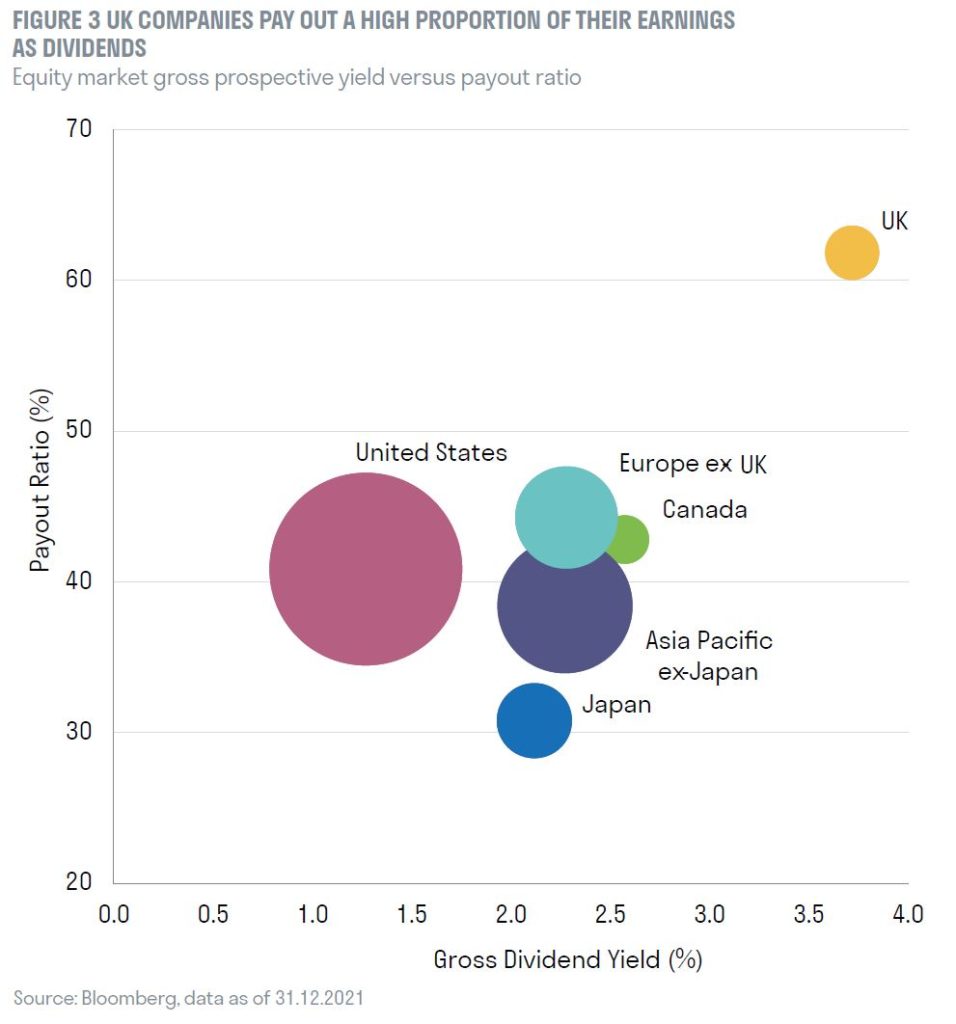

Furthermore, as figure 3 demonstrates, the UK market is currently providing the highest income for investors but it is also paying out the greatest proportion of earnings. Firstly, this means that

other markets have a greater potential to increase the amount of earnings they pay out as dividends. Secondly, the higher payout ratio means that UK companies are not reinvesting in their

businesses as much as their global counterparts, which could mean that UK companies have a lower rate of earnings growth in the future. A higher payout ratio also implies a higher level of risk, as the company has a reduced capacity to pay out dividends in the event of lower profits.

3. Companies are increasingly international

Companies are becoming increasingly global, often generating more earnings outside the country they are primarily listed in. A greater number of companies are choosing to list in countries far away from where they were founded. As a result, investors are often choosing to invest in companies they judge to be superior in their field, or the beneficiaries of enduring global economic themes, rather than restricting themselves to those headquartered in a particular region.

A distinctive, global approach to investing

At Sarasin & Partners, we believe that investors can best achieve long-term returns by ignoring geographical borders. Our process is truly global – we seek to buy companies with attractive risk/reward characteristics regardless of where they are listed. We typically invest in multinational corporations with worldwide customers.

Our investment process is built on three key pillars:

Thematic: we identify themes that are shaping the investment landscape. We look broadly and horizontally across industry sectors and geographies,

combining both macro and micro factors, searching for sustainable change.

Stewardship: we take a responsible ownership approach to investing – we believe this delivers better risk-adjusted returns. Environmental, Social

and Governance analysis is fully integrated into our investment process and approach to fundamental analysis. We invest in businesses for the long term and aim to keep portfolio turnover low.

Active: we invest in companies where the long-term economic profits are not reflected in their market valuations. Our thematic approach gives us insights into the long-term potential of companies and we identify mispricing via fundamental analysis.

An important consideration when investing outside of your home market is currency exposure. Most investors have liabilities denominated in their home currency. As a result, any investment in international equity markets will mean that there is a potential mismatch between the currency of the investor’s assets (the portfolio) and their liabilities (the currency in which they spend).

Many UK investors believe that by skewing their portfolios to UK equities they are matching sterling liabilities. In fact, the largest UK companies derive a high proportion of their earnings from overseas.3 In our view, a more effective way of mitigating this risk while gaining exposure to international equity markets is through a low-cost and robust currency hedging policy.

We believe that our global, thematic approach to investment – with sustainability at its core – delivers better outcomes for clients over the long term.

1 Source: International Monetary Fund, 2020

2 Source: MSCI, 2020

3 Dividend Dashboard, AJ Bell, Q1 2022