Labour’s budget will expand public spending and taxes significantly for a second straight year. It is a missed opportunity for more substantial reform. Many of the targeted measures – higher taxes on pensions, dividends and savings – disincentivise investment and run counter to the government’s long-term objective of raising productivity and growth. Instead of rationalising a welfare state that expanded substantially during a health emergency, it marginally expands it. At a very high level, a growing public sector footprint will draw resources away from the more productive private sector.

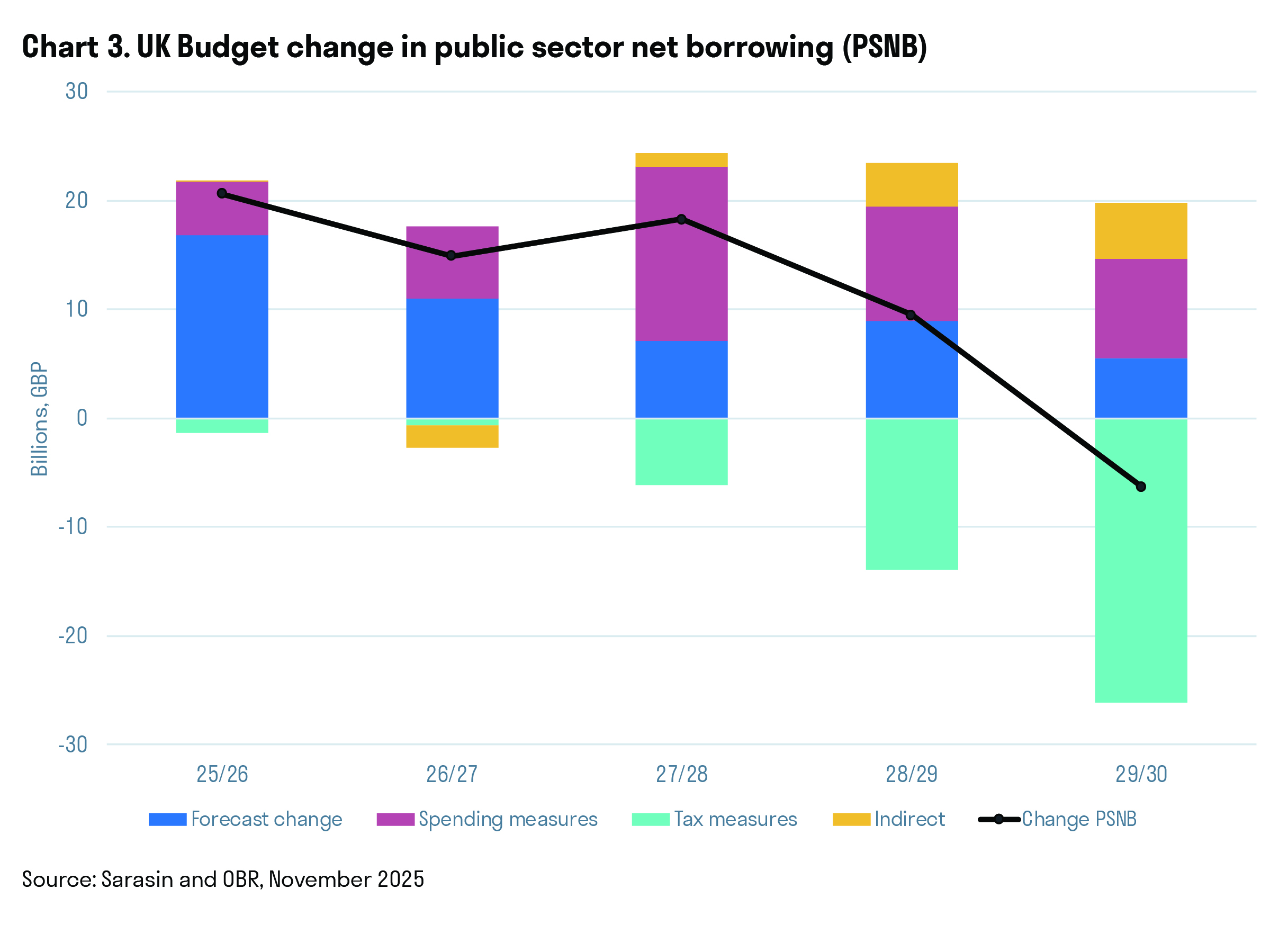

While the last two Budgets have delivered modest changes in net borrowing, they are built upon a sizeable increase in the government’s tax take. The tax increases in the last two budgets rank among the three largest since the OBR was introduced in 2010. Revenue relative to GDP will rise to around all-time highs of over 42 per cent in 2030, with the biggest single contributor being the freeze to income tax thresholds in later years.

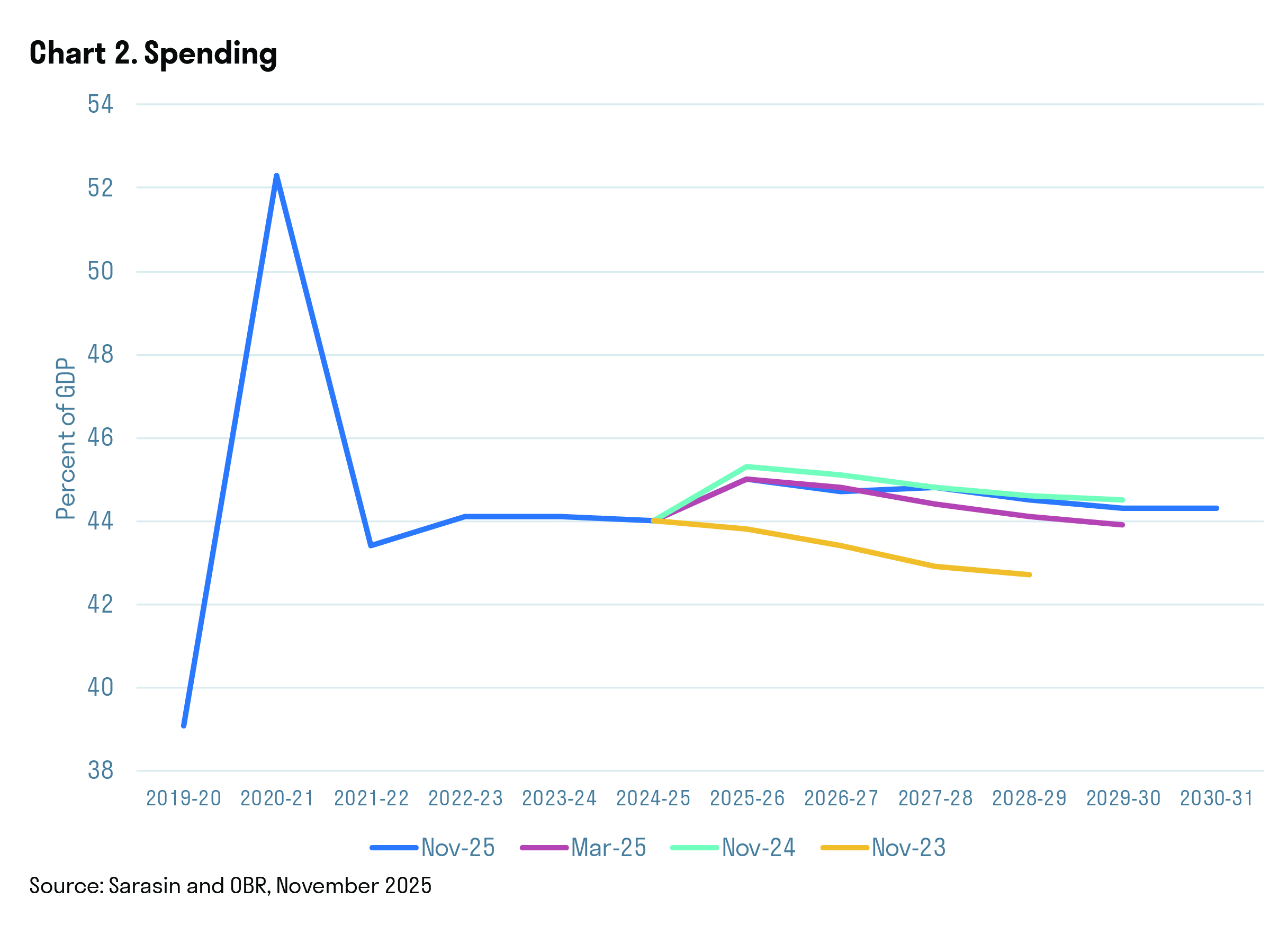

Spending is also rising sharply, reflecting both higher costs from existing policies and new commitments. It is expected to remain 5 percentage points above pre-COVID levels five years from now. Spending overruns of the past two years raise serious doubts about the Government’s promise to slow spending in coming years. They reflect the uncomfortable reality that government programs, once introduced, are incredibly difficult to roll back.

Higher public sector net borrowing in the short term is expected to see debt-to-GDP rise relative to today, despite the Government meeting its fiscal rules. The final-year buffer has increased to £22 billion, providing some additional headroom.

New Budget policies on net deliver a small fiscal expansion over the near term and delay fiscal consolidation. Credibility in the fiscal rules would have been enhanced had more of the tightening been brought forward, especially given inflation is currently above target and the Bank of England can offset any effect on growth if required.

More ambitious supply-side reforms that boost productivity, improve flexibility and dynamism in an economy that has suffered sizeable supply shocks from Brexit and the Pandemic should be prioritised to balance the books in a sustainable way.

Important information

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].