Three value-adding dividend payers that use R&D to power up profitability and dividend growth.

Eschewing the siren call of businesses that pay high dividends today but lack enduring growth prospects should – in our opinion – be one of the fundamental tenets of equity income investing. A high dividend may look (and feel) good in the short term. But unless it is backed by a healthy and growing business, both dividend and capital investment are liable to evaporate over time.

Suffice to say that we look for companies that are more likely to produce recurring dividends, and also have the potential to increase their profits, provide a growing dividend stream and thus offset or beat inflation. Some companies, however, stand out as true ‘value-adders’ for income investors.

Three of our global equity income favourites – Siemens, Cisco and Merck & Co. – hail from the technology and healthcare sectors. For traditional equity income investors this may be a world away from the dividend stalwarts of consumer staples, commodities and utilities, but it is a logical outcome of our investment approach.

As global thematic investors, we spread our net as widely as possible when looking for potential investments. We are also focused on finding companies that should benefit from long-term trends such as climate change, ageing populations, digitalisation and automation.

A rule of thumb for gauging how much added value a business can deliver is to see whether they stand out in terms of the amount of research and development (R&D) they conduct. After all, the entire purpose of R&D is to develop new products that can be sold at attractive margins – which may also help offset inflation.

Siemens: far more than trains

The most visible part of European industrial giant Siemens’ business is almost certainly its trains, which are helping shift goods and people towards lower-carbon, more environmentally-friendly modes of transport. In fact, Siemens is more like a collection of diverse businesses within one company. These include Siemens Healthineers, a medical devices company focusing on radiology, oncology and MRI scanning.

Siemens is also a global leader in factory and warehouse automation, an area where there is huge potential for growth as companies invest to increase operational efficiency and reduce labour costs.

In addition, Siemens is a leader in creating and developing ‘digital twins’, virtual models of physical objects, such as aircraft engines or bridges. An object being twinned is fitted with sensors that monitor how the object is functioning. Data about aspects such as performance, energy output, vibration, temperature, weather conditions, etc. can then be added to the object’s digital twin. This data can be used to study performance, run simulations and suggest improvements that can be applied to the physical object.

Blending innovative companies for equity income

Like many other industrial companies, Siemens has a somewhat cyclical business. This means that its revenues are generally higher during periods of economic prosperity or expansion and lower when the economy is contracting.

At first sight, this might not appear ideal for investors whose main objective is to receive a steady income. However, Siemens’ cyclical aspects can help equity income investors maintain a tilt towards economic growth, which increases the chances of their investments keeping pace with inflation.

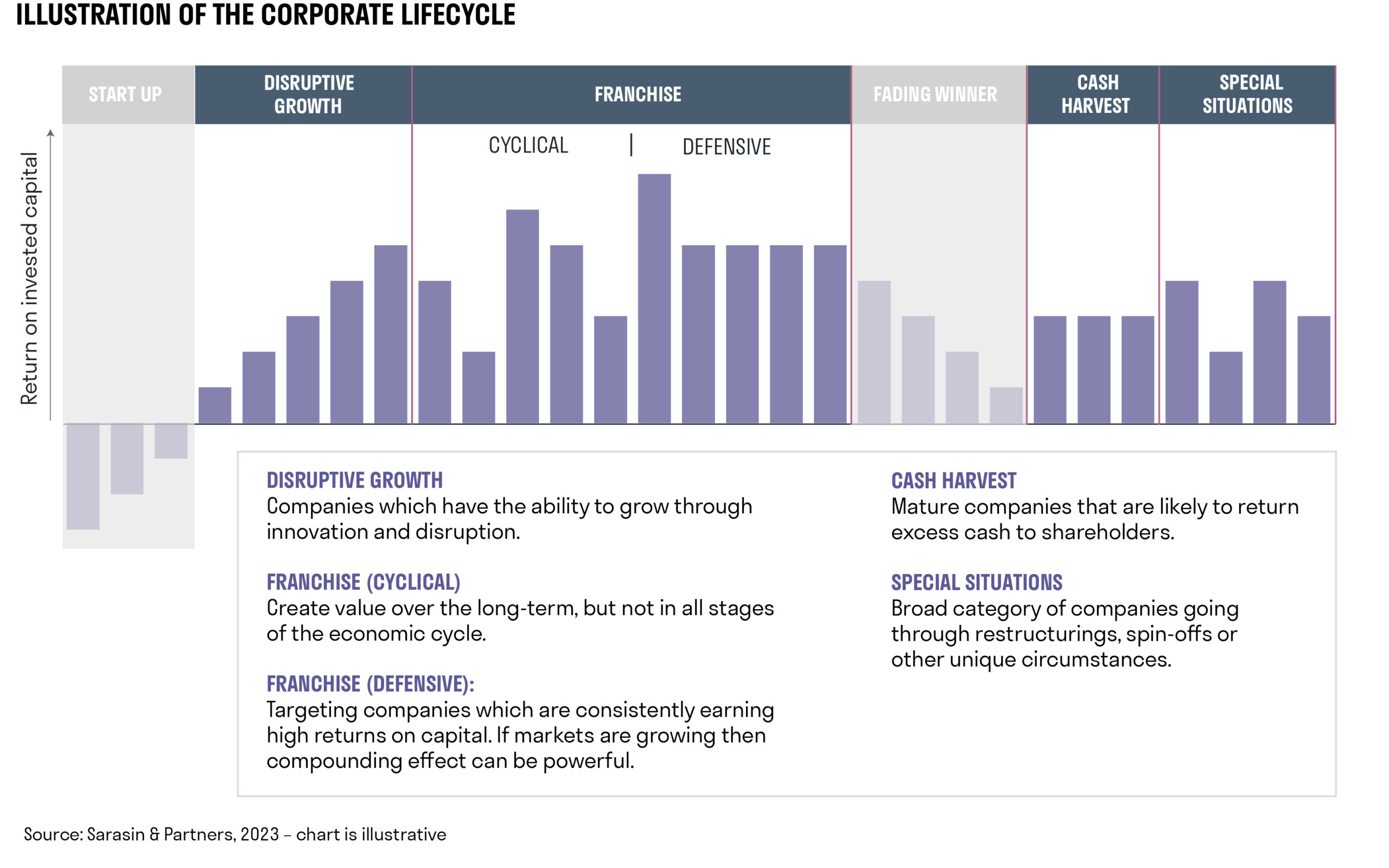

Clearly, a portfolio of cyclical companies is unlikely to provide very smooth returns over time. For this reason, we blend companies such as Siemens with companies that have other strengths (such as being defensive franchises, cash harvesters, or quiet disruptors. Using this approach to building a portfolio we aim to provide steady sources of income and growth across the economic cycle.

Cisco: to the internet and beyond

Cisco is the world’s largest provider of network equipment, supplying the devices needed to build and maintain the internet. It also provides cloud data management and cybersecurity services and therefore, like Siemens, gives investors access to a diverse set of businesses within one company.

Cisco’s dividend of approximately 3% is underpinned by its strong free cash flow generation. The company has committed to return more than 50% of its free cash flow to shareholders via dividends and share buybacks, a pledge that it has honoured since it began paying dividends in 2011.[1]

As active owners, we are engaging with Cisco on issues around remuneration levels, as well as the long tenure of its auditors and some board members.

Merck: improving cancer treatment

US pharmaceutical giant Merck & Co., owns Keytruda, one of the world’s most effective cancer drugs. We believe that Keytruda will help provide Merck with many more years of growth, particularly as cancer treatments move towards combination therapies. Rather than relying on one or two drugs, these layer a series of different drugs with the aim of providing better and more targeted treatment.

An unusual and compelling feature of Keytruda is that it is not a chemotherapy or radiation therapy, neither of which distinguish between healthy cells and cancer cells. Rather, it works with the body’s immune system to focus on attacking and shrinking cancer cells – a process referred to as ‘supercharging’ the immune system.

Merck also has a significant pet pharmaceuticals business that is often overlooked but contributes 10% to revenues.[1] This segment of the company focuses on understanding how the health of humans, animals and the environment are interconnected. For example, Merck is at the forefront of understanding and managing the risks of diseases being transferred between animals and humans, and the threat of antimicrobial resistance.

Research pays dividends

Together, these companies spend $26 billion each year on research and development, which equates to 14% of their sales.[1] This helps them maintain their competitive edge, which ultimately allows profits to grow and compound over time. It also makes these companies more likely to be attractive long-term holdings.

All three companies also have sensible payout ratios. Their managers are not in the business of returning cash to shareholders at the expense of being able to invest properly in future growth and profitability. This prudent approach leaves room for dividends to grow rather than fluctuate or provide investors with a feast-or-famine stream of payments. Over the past five years, Merck has delivered 8% compound annual growth in dividends, while Siemens has achieved 3% and Cisco 5.5%.[1]

AI: the next phase in R&D?

Since the launch of Chat GPT last year, generative artificial intelligence (AI) has attracted a great deal of attention among investors, and may have created a mini-bubble in a handful of large technology companies.

At the moment the most immediate way to gain exposure to AI as a global equity income investor is through semiconductor chip manufacturing and design in companies like Broadcom and Taiwan Semiconductor Manufacturing Company (TSMC). Over the longer term, AI is likely to be applied across multiple industries to enhance everything from production and logistics to sales, marketing and customer service.

We see potential for AI to turbocharge R&D, for example by speeding up drug discovery, digital twin simulations or making use of historic data and patents in previously unthought-of ways.

We will take a close interest in understanding which companies are able to deploy AI in their businesses. This can help improve efficiency and gain an edge over competitors in developing new and compelling products to market.

[1] Bloomberg, 23.04.2023

Important information

If you are a private investor, you should not act or rely on this document but you should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP which is a limited liability partnership registered in England and Wales with registered number OC329859 and is authorised and regulated by the UK Financial Conduct Authority. It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and we make no representation or warranty, express or implied, as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser.

© 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.

Please contact [email protected].