Getting specific – how we assess climate risk and opportunity

Climate change was never far away from the headlines in 2020. On one hand, lockdowns meant total CO2 emissions were the lowest for nearly a decade while we also saw a wave of net-zero initiatives announced from countries such as China and Japan. At the same time, the realities of climate change became more severe and more frequent – with records suggesting it was the hottest year ever recorded. This exposed fire prone areas such California and Australia to record breaking fires and even places like Greenland and the Siberian tundra experienced increased fires.

As such, what is clear, is that without a significant reduction in emissions we are far from on course to achieve the Paris Agreement goals of limiting the increase in global average temperature to well below 2°C. The agreement also calls for making finance flows consistent with a pathway towards low emissions and climate-resilient development, which will see climate-related investment increase and shift capital away from fossil fuels and other emission-intensive sectors.

Net zero - not a nice to have

As climate change rises up the agenda, regulations tighten and capital flows shift, those companies that will benefit from the shift represent a significant investment opportunity.

In a decarbonising world, a net-zero business model is not a nice to have, it’s essential for remaining viable. Carbon taxes, investor scrutiny, regulation and more conscious consumption are just a few examples of the increasing pressures businesses face in a net-zero world.

Our research suggests that climate change risks and opportunities are increasingly being reflected in capital market asset pricing, with climate risks weighing on companies’ valuations, but there is still further to go. By integrating these considerations into our investment process and actions, we are positioning our funds for a net-zero environment.

Recognising that the greatest impact will come with scale, we were signatories of the initiative – which unites 30 asset managers, representing over $9 trillion of assets, with a commitment to work with clients to achieve the goal of net zero greenhouse gas emissions by 2050 or sooner.

Climate risk or opportunity?

Climate-aligned investing comes in many forms; while some managers might exclude entire sectors or screen out companies based on their carbon footprints, we think it’s important to take a more holistic approach – considering both quantitative factors such as emissions but also qualitative aspects like the ease with which sector, or firm specific emissions may be reduced.

It may seem easy to applaud or discount entire sectors in a net-zero environment, out with oil majors and in with renewable energy, but the reality is that climate risks and opportunities are inherently idiosyncratic. This is why we approach it on a case by case basis.

In understanding whether climate change presents a risk or opportunity we seek to answer a few questions:

- Does climate change present a risk to a company’s business model?

- How easily will the sector and the company transition to net zero?

- Is the business more or less viable in a net-zero environment?

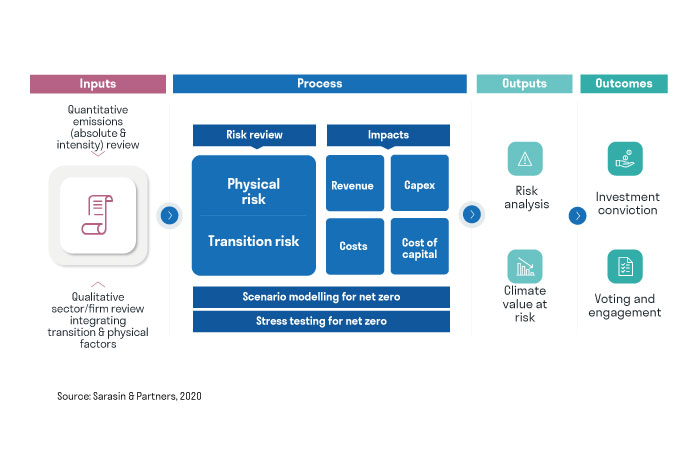

The inputs

Our process starts by taking quantitative factors, such as a firm’s emissions footprint (across Scopes 1 -3), and considering not only the absolute volume, but also the intensity or how significant they are relative to financial metrics. We also consider more qualitative factors including the ease with which sector- or firm-specific emissions may be reduced. For example, whether regulation is supportive and if the company has a viable net-zero strategy in place.

Transition risk

Here we are seeking to understand how quickly a sector and firm is, or can decarbonise and what that means for the company.

We consider Paris-aligned emission scenarios and draw on third-party projections on policy pathways, like those provided by the International Energy Agency, to help us understand how decarbonisation will impact different sectors. By mapping a company against these scenarios, we build an understanding of how different decarbonising scenarios will impact the business. High emitting companies, without a viable net zero pathway, carry more transition risk.

It’s also important to look beyond headline emissions. A company could have low emissions but still be materially exposed to a value chain that is highly emissions intensive and thus risked. Conversely, a company may be exposed to "green revenues" (e.g. renewable power value chain, or zero carbon transport solutions) that may jump in significance in deep decarbonisation scenarios.

Physical risk

For physical risks, we consider the footprint of the company's activities – both direct locations and where the value chain is located – to understand broader geographical exposure. We then plot these footprints against high climate change scenarios such as sea level rise, water stress, heat stress.

Climate impacts

With a good understanding of transition and physical climate risks, we analyse how climate scenarios may impact a company’s financials.

We focus on four key areas:

- Revenue – how exposed are revenues to a climate change scenarios? For example, an oil producer likely faces a high risk to revenues (on diminishing consumption volumes and uncertain pricing outlooks) whereas a renewable energy generator will likely not.

- Cost – how might a business’s cost profile change? High emissions intensity means a business is likely to be adversely affected if carbon prices were to rise – pushing up its cost of production.

- Capital Expenditure - does the firm have to deploy more capital to make the transition? A high requirement for capital expenditure puts increased pressure on a firms cashflows and while such a scenario does not necessarily undermine the investment case, it does need to be viewed in the context of those businesses where additional capital requirements are low.

- Cost of capital - is the market already reflecting climate risks in cost of capital, through a higher or lower required return? If the market is already taking this into account there’s likely less risk from a re-rating downwards.

Outputs

Climate risk

This is a summary risk score to cover a firm’s overall climate risk, considering the transition, physical and financial aspects.

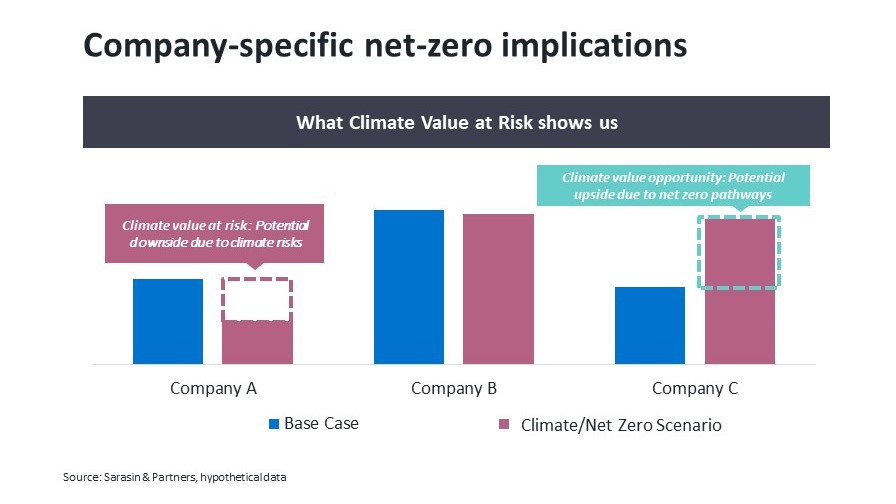

Climate value at risk (CVAR)

Here we incorporate Paris-aligned, or high physical climate change scenarios, into our valuation models to understand whether a business is more or less valuable in these environments.

Some of the factors we consider include: the impact of higher carbon prices; physical impacts for property, plant and equipment; changes in demand and/or pricing of commodities, goods and services; impairments / stranded assets; change in CAPEX requirements; and regulatory impacts for demand or supply (e.g. licenses).

A significant drop in valuation would indicate such scenarios present a significant threat to the business and in turn any invested capital. A positive CVAR however, indicates the business could become more valuable in these scenarios. There will be various drivers but they could include higher revenues generated by a renewable energy provider, or those working to make companies more energy efficient.

While climate risk is increasingly being priced in, there are many instances where it’s not and that creates the case for an investment opportunity.

Putting analysis into action

With an understanding of how at risk a business is from climate change and how that might impact valuation, we focus further analysis and investment decisions on those businesses that represent investment opportunities in a decarbonising world.

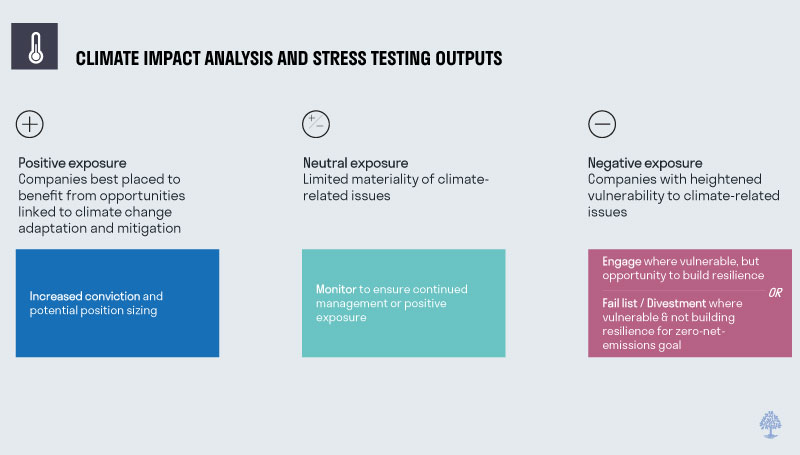

We place global equities into three categories: those with positive exposure to climate change, those with neutral exposure, and those with negative exposure – the companies most vulnerable.

While positive climate exposure acts as one indictor to start or increase a position size, we do not consider all negative exposures to mean divest or avoid. Some of the most vulnerable companies may present an opportunity for engagement and cooperating with firms to build resilience.