Midway into 2022, hopes for a year of diminished uncertainty and geopolitical tension remain misplaced.

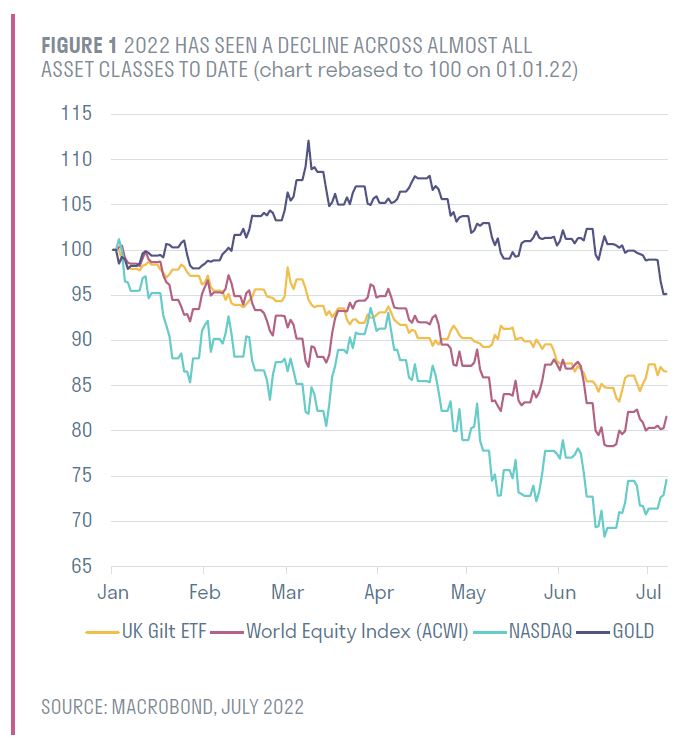

A poor outlook for growth, rising interest rates and stubbornly high inflation have seen global equity markets drop precipitously while bonds, historically one of the key diversifiers to equities, have suffered their greatest downturn in decades. Investors reliant on the conventional playbook – equities for growth and bonds for diversification – have found themselves wrongfooted.

As we have written before, we do not think this necessarily sounds the death-knell of the traditional 60:40 style mandate, but it does suggest that investors seeking diversification and attractive real returns may wish to look beyond equities and bonds. Interest in alternative asset classes has been growing for some time, and is now even more pronounced as investors reckon with an extremely challenging macroeconomic outlook.

The wrong kind of inflation

While a moderate level of inflation is desirable for economic growth, high inflation impacts investors primarily through its ability to erode returns. UK inflation is currently at a 40-year high of 9.1%. If inflation were to continue to run close to 9%, a portfolio returning 6% would actually have achieved a negative return of -3%, after adjusting for inflation. The many investors who have recently increased their cash holdings will also suffer, as high inflation rapidly erodes the real value of cash. Inflation-linked bonds can offer some protection against inflation, but these benefits can be offset by the impact of rising interest rates.

Alternative investments are often thought of as having the ability to mitigate inflation, with both gold and property frequently cited as examples of assets that can hold or even increase their value as inflation rises. However, the alternatives universe is broad – and getting broader. It is important to remember that alternatives are not just one asset class but instead a collection of different asset classes, all of which are ‘alternatives’ to equities and bonds.

At the highest level, we categorise alternative investments into correlated and uncorrelated assets. Correlated assets – such as private markets exposure, including renewables, property, infrastructure, or private debt or equity – are those, whose performance is likely to be influenced by volatility within the equity and bond markets. Uncorrelated assets, such as hedge funds or selected/certain commodities are likely to perform in a way that is unlike either equities or bonds, and may even be negatively correlated with those assets.

Investors seeking to add alternative sources of returns and diversification to their portfolio – as well as protection from inflation – need to understand the varying characteristics of alternative assets on offer. With the potential for attractive returns comes the inevitable risk trade-off. Alternatives have distinct risks and investors need to assess whether the asset they are considering fits within their overall risk appetite. Alternatives offer different levels of liquidity and may therefore be difficult to sell quickly. Some may also be more volatile than equities or bonds – at the furthest end of the spectrum the recent ‘crypto crash’ provides ample evidence of this.

Finding the sweet spot

Within our alternatives allocations at Sarasin, we have identified three areas we think have the potential for positive real returns, a good level of income, and diversification, without exposing investors to unnecessary risks or overpaying.

- Infrastructure investments

Infrastructure – defined as the physical structures

necessary for society and the economy – has become an increasingly popular investment. Investors can choose to

gain access to either economic infrastructure, such as transport or utilities, or social infrastructure, such as

schools or hospitals. Infrastructure investments typically exhibit stable and predictable cashflows and generally, provide inflation-linked distributions.

Energy storage is a key infrastructure that will help the UK to decarbonise as more renewable energies come on to the grid. We hold the Gresham House Energy Storage Fund PLC (GRID), which capitalises on the opportunities in the battery storage market. The UK’s increasing reliance on renewable sources of energy means it needs a solution for supply/demand imbalances. Battery storage systems represent a cost-effective way of addressing this issue. The trust has performed strongly, as a beneficiary of high power price volatility and strong operational performance. GRID

continues to be the market leader for battery storage

in the UK, with around a 30% market share.

While a moderate level of inflation is desirable for economic growth, high inflation impacts investors primarily through its ability to erode returns.

- REITS

Probably the best-known alternative asset, property offers some inflation protection – as both rental income and property values tend to increase with inflation – along with steady income. We gain exposure to property through real estate income trusts (REITS), which are companies that manage a portfolio of income-producing properties, from which they pay out dividends to shareholders. Investing in REITS allows investors to access the potential benefits of property without sacrificing too much liquidity, as REITs can be bought and sold far more easily than the underlying properties themselves.

We invest in Home REIT PLC (HOME), a REIT that manages a diversified portfolio of homeless accommodation assets let to registered charities, housing associations and other regulated organisations that receive housing benefit or comparable funding from local or central government, on very long-term and index-linked leases. As the homeless population in the UK has risen, there is a critical shortage of affordable, high-quality accommodation for homeless people. Local authorities have a duty to house the homeless but the severe shortage of fit-for-purpose accommodation has meant councils have been forced to house people in B&Bs or guesthouses, which can be significantly more expensive than the properties HOME lets.

- Hedge funds

There are many different kinds of hedge funds offering different risk/return profiles, and carefully selected hedge funds can be an invaluable part of a well-diversified portfolio. Today’s more volatile market conditions are particularly well suited to many hedge fund strategies, providing greater opportunities for them to deliver attractive returns.

The ability to generate positive returns even when equity or bond markets are falling makes hedge funds a particularly attractive proposition for investors right now – provided they can identify the right strategy at the right time.

Our holding in Neuberger Berman Uncorrelated Strategies Fund provides exposure to a basket of different hedge fund strategies, all of which aim to generate returns that are uncorrelated to equity and fixed income markets. The hedge funds themselves also have a low level of correlation with each other, which reduces the overall risk of the fund and gives it the ability to withstand different market environments. We like how diversified the fund is, thanks to Neuberger Berman’s rigorous fund selection process, as well as its performance-based fee structure, meaning investors don’t pay for returns they don’t get – both features that buck the ‘expensive and risky’ hedge fund stereotype.

When constructing multi-asset portfolios, Sarasin looks to understand the risks associated with the combination of assets so that we can make an informed judgement on whether the expected return offers suitable compensation for the risks being taken. Alternatives may offer the potential for positive real returns and diversification in a high-inflation environment, but investors need to understand the characteristics of the alternatives they are considering – and ensure that their investment process seeks out high-quality, diversified holdings based on fundamental research rather than overly opportunistic, speculative investments.