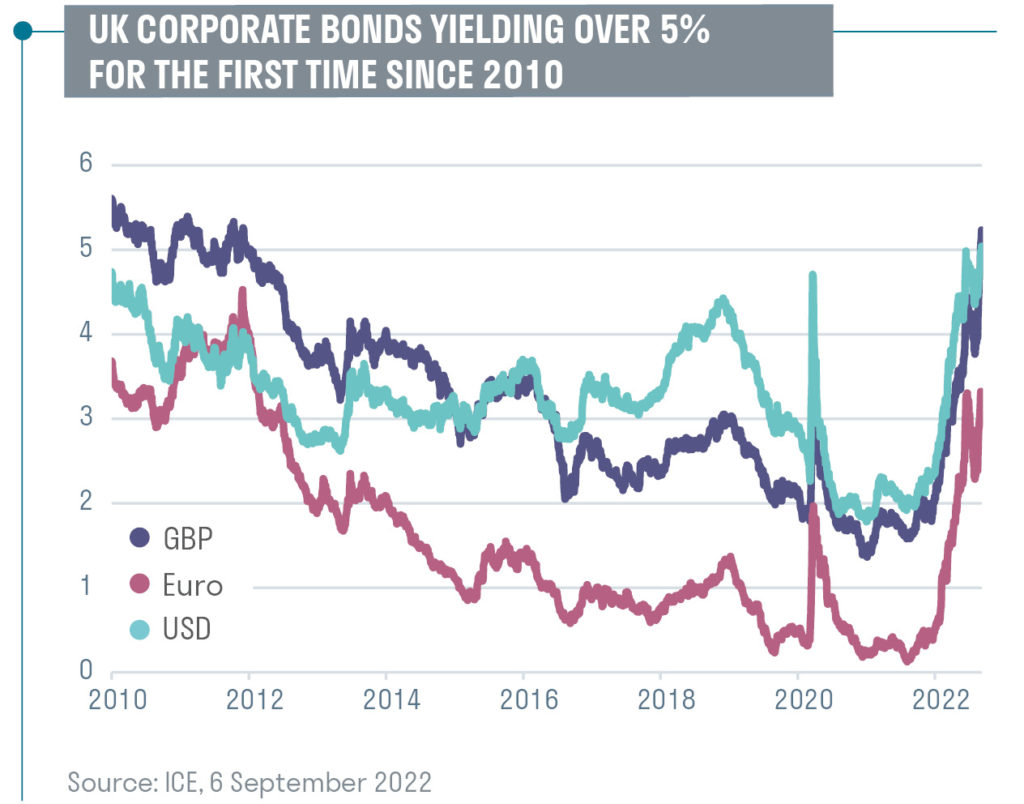

There is more pain to come for sterling bonds, but attractive opportunities will arise as markets reprice.

The summer months have provided some respite for credit and equity markets, which have rallied throughout July and August. During the past year, sterling corporate credit spreads have experienced a roller-coaster ride, doubling from ~100bps to ~200bps before tightening back 20bps or so over the summer.

Now, conditions are deteriorating once again. Spreads are widening, following a surge in government bond yields as fears of stagflation grow. All eyes are firmly fixed on central banks, and just how swiftly and aggressively they will act to bring inflation to heel.

Inflation continues to defy forecasts

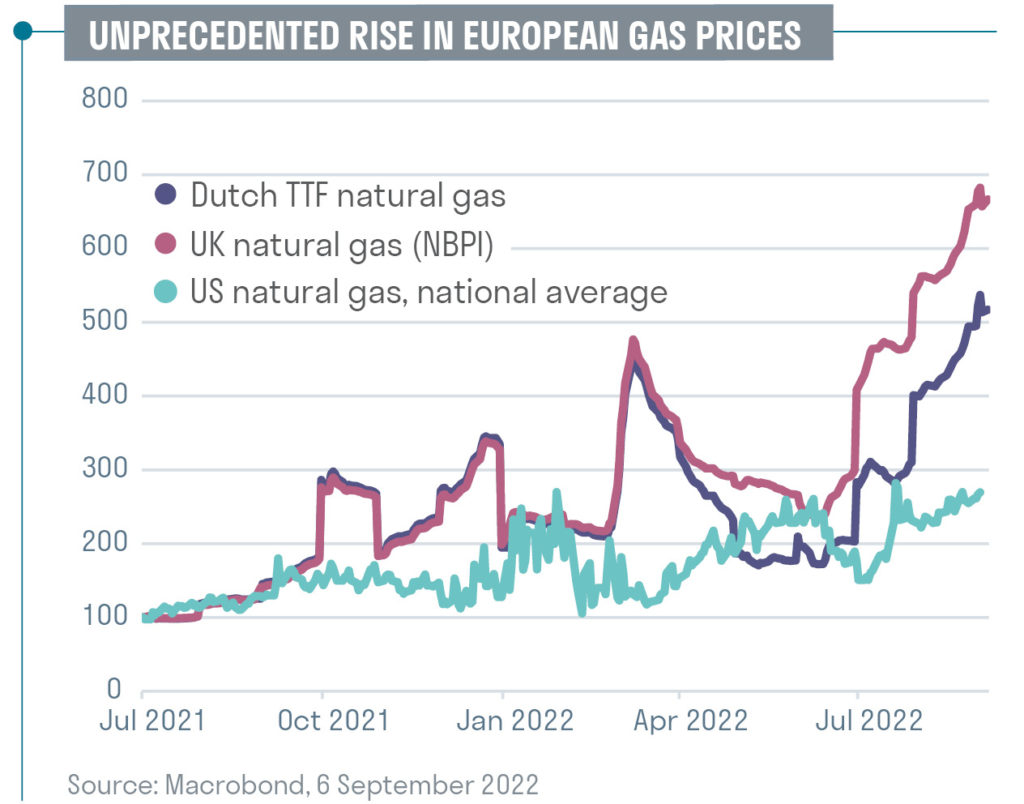

With inflation data continuing to beat forecasts, expectations for increases in rate hikes have leapt in recent weeks, particularly in the UK and Europe. UK inflation hit 10.1% in July, the highest annual rate of CPI growth since 1982. Some analysts now expect UK inflation to peak above the 13%-plus predicted by the Bank of England, with Citi forecasting UK inflation at 18.6% in early 2023.

The key driver behind the UK’s inflation spike is soaring gas prices, but it is by no means the only culprit. During recent months price increases have become more broadly-based. Core inflation, which excludes energy and food prices, rose to 6.2% in July, with 75% of the items tracked by CPI showing price increases of more than 4%.

At the same time, economic activity indicators have weakened - with the notable exception of labour market data, which remains robust. July data showed UK manufacturing PMI figures had declined by more than 6 points to 46, suggesting that activity will be weak in the coming months (although the services measure has so far held up better). Meanwhile, the GfK consumer confidence survey measure has fallen to an all-time low of -44, and UK government borrowing is higher than expected.

Difficult choices

This unpalatable mix of high inflation and strong labour markets puts pressure on the Bank of England (BoE) to raise interest rates in order to prevent inflation from becoming entrenched, particularly in the form of higher wage expectations. The BoE faces an uncomfortable choice between fighting inflation and keeping interest rates at moderate levels to support economic growth. The markets expect the BoE to raise rates to more than 4% by mid-2023, while the US Fed Funds rate is projected to reach 3.75-4% and the ECB rate 2%.

If, as we expect, the UK government adopts a robust fiscal response to the cost-of-living crisis, it could take some of the relentless flattening pressure off the UK yield curve. Under this scenario, measures such as gas subsidies designed to relieve inflationary pressures would take pressure off the BoE to hike short-term rates by as much as is currently expected. At the same time, it would push long-term rates higher because more long-term gilts must be issued to fund the stimulus.

A second scenario is that the UK government applies moderate or no fiscal responses, which would put pressure on the BoE to raise rates further and more quickly in order to tackle inflation. This could result in an even more inverted yield curve (short-term rates higher than longer-term rates) in the coming months. Inflationary pressures would ease eventually, but only at the cost of a deeper recession. If this second scenario begins to look more likely, we can expect the market to swiftly reprice bond yields lower, particularly short-term bonds, thus causing the curve to steepen. In this scenario, curve steepening is unlikely to occur until into 2023, when the BoE’s rate-hiking is close to completion and the true depth of the recession is clearer.

The BoE continues to unload its bonds

In addition to raising interest rates, the Bank is also putting upward pressure on yields by reducing bond holdings accumulated during quantitative easing. Its gilt holdings are being sold back into the market or allowed to mature at a rate of around £80bn per annum (£40bn from maturing gilt holdings, £40bn from active gilt sales).

The Bank is also a significant holder of sterling corporate bonds, which it acquired during the pandemic under the Corporate Bond Purchase Scheme - the first time that its quantitative easing programme had extended to corporate bonds. The BoE aims to completely unwind these holdings, which have a par value of £14.5bn, by 2024. Given that £1.5bn of these bonds will run off between now and early 2024, we can expect a run-rate of corporate bond sales from its portfolio of around £200m par value per week between now and early 2024. We expect this to put some downward pressure on credit markets at the margin, but it may also create some attractive investment opportunities.

A time for active, selective bond management

Given our bearish view, we are keeping our exposure to high-beta sectors such as banks’ and insurers’ subordinated bonds to a minimum. Instead, we are focusing on defensive areas that are far more likely to weather rate increases, recession and rising defaults.

These tend to be lower-risk, high-quality credits issued by bodies such as agencies and supranationals, and names in non-cyclical sectors that benefit from strong, inelastic demand and/or government backing, such as universities, housing associations and key infrastructure projects. In building our defensive positioning, we are also aided by the integrated ESG analysis that we apply during our research, where we tend to find that better ESG profiles go hand-in-hand with robust business models.

This approach has led us to names such as Golden Lane Housing Association, where 98% of rents are government-backed, and the University of Manchester, which boasts more students and applicants than any other UK university. We also have exposure to key infrastructure providers such as Greater Gabbard (offshore wind transmission assets connecting Greater Gabbard offshore wind farm to the National Grid) and Bazalgette, which will design, build, commission and maintain the Thames Tideway Tunnel to replace a Victorian-era sewage system.

We fully acknowledge that these are tough times for bond investors. However, we also believe that this is when an active management approach, with a focus on high-quality names, thorough research and careful selection can prove its mettle.

Ultimately, bond yields are likely to settle at a higher level than has prevailed over much of the past decade, providing a more attractive return profile for long-term investors.