As we digest this quarter’s economic data, it is clear that a strong, vaccine-driven recovery is now unfolding around the world.

It is US-led but global in scale, synchronised across regions and fuelled by generous monetary and fiscal policies, operating hand in hand. As with so much in this economic cycle, the recovery is developing at speed; one big fiscal package following on from another, alongside a series of new commitments to climate and infrastructure spending.

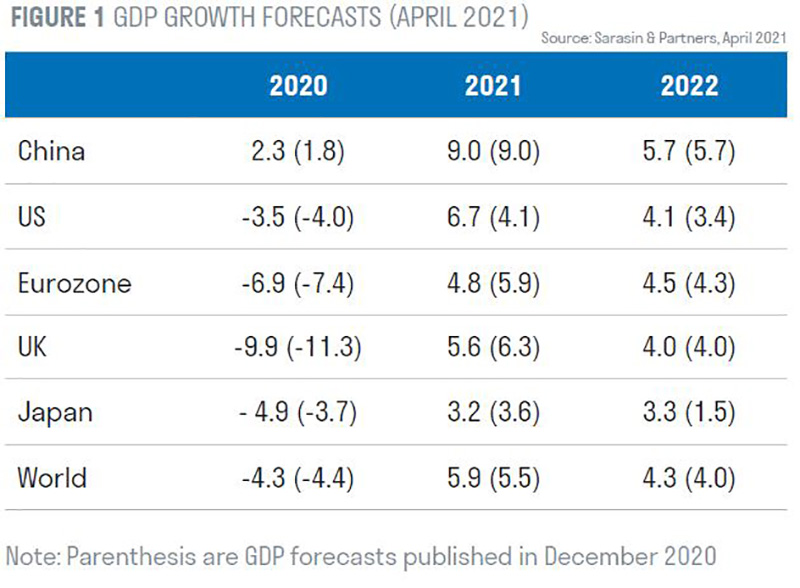

Consumers too are part of the story – with record levels of savings accumulated during lockdown, they are primed to spend as economies reopen. The Chinese economy, in particular, continues to accelerate. Already 6.5% larger than it was a year ago (after an extraordinary feat of virus control), China is seeing record demand for its exports, particularly electronics and PPE equipment for the work-from-home global economy. Put these together and we see world growth accelerating to almost 6% in 2021 (figure 1) – the strongest pace since 1973.

A sustainable economic recovery is not guaranteed of course – to be certain of that we will need to see the roll-out of vaccines in the developed world replicated across the developing world. As we saw in Europe last month, fair distribution is logistically and politically challenging, especially as many of the vaccines will need repurposing for new variants. Our scientific advisors say this is possible though, and we estimate that some form of herd immunity will be present in the US by July 2021, in the UK in August and in Europe by the end of the third quarter. Against this backdrop, the US economy should make good all its COVID losses by Q2 2021 in a robust, V-shaped recovery, wholly different from the slow climb back and austerity programmes seen after the 2008-9 Global Financial Crisis. The UK, which saw a far deeper recession, as well as processing the additional shock from leaving the EU, will likely recover to pre-COVID level by late 2022.

A recovery of this magnitude doesn’t come without challenges

But there are challenges – accelerating global demand is heaping pressure on already fragile supply chains. Producers are struggling with shipping and port delays while manufacturing surveys across the world show longer delivery times and rising prices. In some cases, particularly within semiconductors and some petrochemicals, outright shortages are developing. Against this backdrop, we expect firms to pass higher input prices onto customers, and combined with last year’s low base effects, we see US inflation accelerating to breach 3% by mid-year and average 2.6% in 2021. At present these price effects should be transitory, as there is substantial slack still in labour markets – in the medium term though the question of whether the post-COVID economy merits structurally higher inflation will remain hotly debated.

Herein lies the challenge for investors. As we saw last year, financial markets have a habit of diverging from the real economy in the latter stages of a downturn – typically rallying well before the trough of the economy. In 2020 the magnitude of these effects was extraordinary, as central banks undertook the most generous programme of monetary support ever seen. Fast forward to 2021 and bond yields are already flashing amber warnings even before the recovery has truly begun. In one sense this is entirely natural – today’s big upgrades to growth forecasts certainly merit equally big rises in bond yields. However, even after recent moves, real yields offer little compensation for increasing inflation risks around the world. More worryingly perhaps, bond markets are still in the thrall of massive central bank purchases – any policy error, or indeed a simple miscommunication, as in 2013, could precipitate a disorderly correction. This leaves us cautious.

Equities can still perform but volatility will likely rise

We are more sanguine about our equity positions. First, an economic recovery of this magnitude will deliver a very substantial boost to earnings and dividends; with President Biden’s American Rescue Plan not yet spent and ratification of the European Recovery Programme still waiting on signatures from member countries, much of the uplift is yet to come. Second, part of the impact on equities of higher bond yields has already been seen, with a dramatic rotation from growth to value and a shift in market leadership from the US to other global markets (where valuations are typically lower). Finally, even after recent moves equity valuations are not in bubble territory (even if there are a few signs of froth) – dividend yields are still at attractive levels versus bonds and last year’s dividend cuts will soon be replaced by substantial rises in 2021-2. This environment supports our long-term themes, which are well placed for the post-COVID economy, but investors should still be ready for higher volatility as bond yields trend higher.

What this means for investment policy

So, what does this mean for investment policy and asset allocation in 2021?

- We are moving further underweight government bonds. We see little inflation protection at current yields and an asymmetric distribution of risks when central banks finally move to taper their purchases (2022 is the date we expect the Federal Reserve to begin). Corporate bond spreads are also tight, and offer only limited protection if yields trend higher – however, many UK issuers do offer meaningful social impact benefits. We own issuers exposed to social housing, critical infrastructure, university finance and to charities themselves. We are underweight corporate bonds but less so than for government issues.

- We still retain a clear overweight to equities, seeing opportunities in less glamorous sections of the market that traditionally perform ‘mid-cycle.’ These include healthcare, foods, insurance, utilities and even real estate, especially where they enjoy tailwinds from our investment themes. In particular a reset in the valuation of clean technology and renewable energy companies would present a welcome opportunity to add to our climate change theme, which we still see as the defining issue of the next decade. One new challenge for our analysts will be rising corporate tax rates around the world, as governments move, albeit slowly, to address deficits. This will place a premium on careful, fundamental research.

- Across our alternative holdings we continue to have a bias toward infrastructure (especially clean energy) and listed private equity. We are now also adding to uncorrelated alternatives, including to our positions in gold, after making reductions in the last year. We see gold supported by very high deficit spending in every economy, central banks that will deliberately overshoot inflation targets and still more than US$14 trillion1 in negative yielding bonds globally. After recent price volatility and a scepticism about security of title, we are unconvinced about allocating funds to bitcoin or crypto alternatives.

- We are generally underweight cash worldwide given very low real yields and deliberate repression of interest rates. We do not have any material currency views at this point as interest rates are still close to zero in all major markets and expansionary economic policies are broadly aligned. We do though continue to hedge a portion of foreign currency exposures back to sterling, as we continue to expect international fund flows to return to the UK as Brexit uncertainties fade and the UK vaccine roll-out continues to impress.

As we look at today’s economic renaissance we must give thanks not only to the creators of our remarkable vaccines but also to the voters of the state of Georgia – they gave President Biden those two extra Senate seats that have allowed today’s giant fiscal programmes to be enacted. Together these have allowed a most exceptional recovery to unfold, and with it hope for the lower paid, the workforces of the developing world and the many minority groups that have been disproportionally hurt by this downturn.