Firstly, what is an ISA?

ISAs (Individual Savings Accounts) were introduced by the UK government in 1999 to encourage people to save. In the tax year of 2020/2021, you can save up to £20,000 tax-free in the form of cash, investments or both.

How do they work?

There are different kinds of ISAs, but what they all have in common is that they provide tax relief. This can be on the interest earned from cash or on the returns from your investments (stocks, bonds and other financial instruments).

Different ISAs are suitable for different kinds of savers.

For example, you may make higher returns from a stocks & shares ISA, but you could also lose money. If you’re not comfortable with the value of your savings potentially going down, a cash ISA might be best for you.

But it doesn't have to be a choice of one or the other - cash or investments.

You don't have to put all your eggs in one basket

It is possible to put money in different kinds of ISAs. There are, however, some rules.

For example:

- You can't invest in more than one ISA of the same type. That means you can have one stocks & shares ISA and one cash ISA, but you can’t have two stocks & shares ISAs.

- Your limit is £20,000 across all of the ISAs you hold – you can’t use multiple ISAs to invest more than this.

How can I exit my ISA?

You can take your money out of an ISA at any time. Additionally, if you don’t close the account and you’re invested in a flexible ISA, you can put your money back in.

But, if you remove all of your money and close your account, you can’t open another ISA of the same kind until the next tax year – you can close your cash ISA and open a stock & shares ISA, but you can’t open another cash ISA. All the tax-free interest you made before withdrawal will remain tax-free.

If you’re unhappy with the terms or performance of your ISA, you can also transfer your savings from one to another.

In this instance, you could transfer from one cash ISA to another cash ISA, as you’re not closing your account.

Be careful when withdrawing and transferring ISA savings, as companies have different rules and charges. Make sure you read the terms and conditions before you sign up.

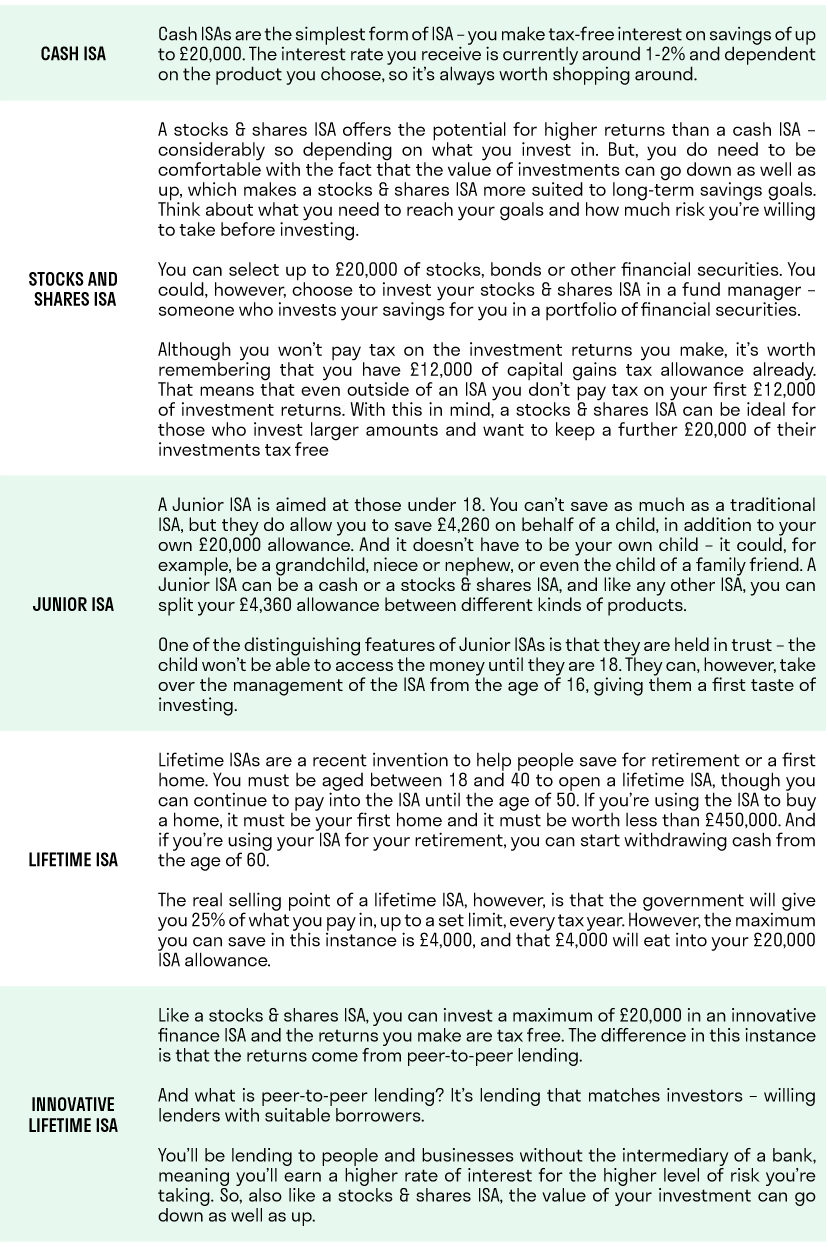

Now, let's look at the different kinds of ISAs savers can use.