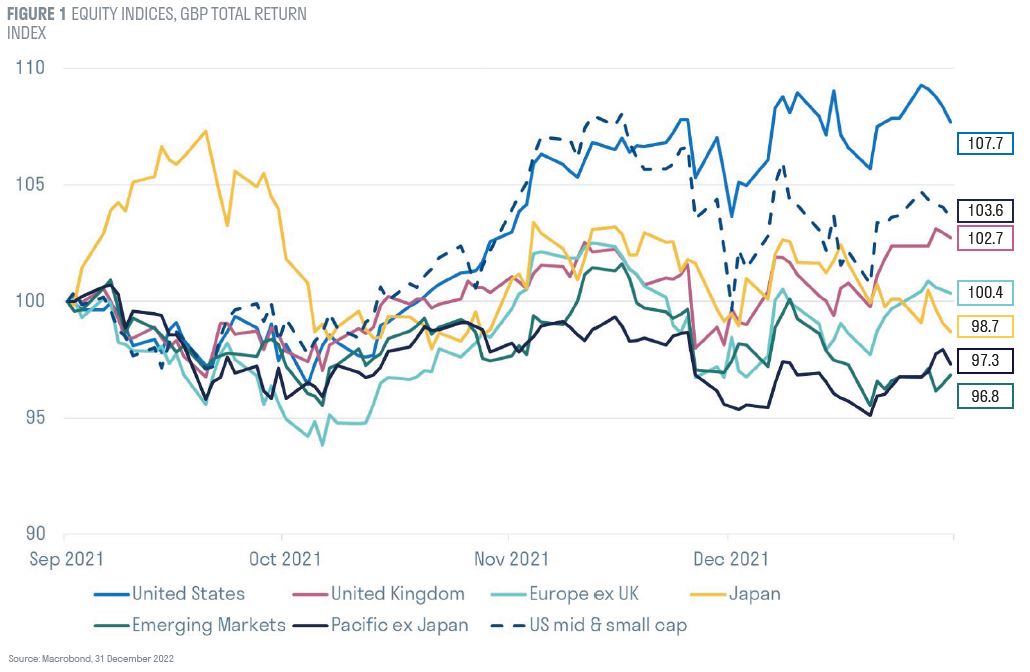

2021 saw the recovery in equity markets continue apace. Investors flooded into equities, and were rewarded with impressive returns - especially in the US market, which made 68 all-time highs in 2021.1

However, below the headline market return there are unsettling signs of rising volatility and narrowing breadth that suggest a flatter and more volatile year ahead. The cause is not the Omicron COVID variant, but weaker fundamentals and ebbing liquidity

Equity markets have been supported by impressive corporate earnings momentum, negative real interest rates, and emergency levels of policy stimulus. The strength of these forces is beginning to wane. Inflationary pressure continues to build, and the Fed is bringing to an end a period of super easy financial conditions. By mid-2022, the US central bank will have completed its QE taper and begun raising interest rates

Through 2021, corporate profit expectations were increased by 20% in Europe and the US in 2021. Unfortunately, the impetus from positive earnings momentum is waning. Margins tend only to fall in a recession, but expectations are for record current levels of profitability to increase again in 2022. High input costs and rising wage pressures seem likely to constrain margin progression. In combination with higher corporate taxes, there is now scope for earnings to disappoint.

The big are getting bigger

Meanwhile, investors have continued to pour money into equities, with the last 12 months seeing inflows of $1tn.2 While speculation over the direction of US monetary policy has checked momentum in the broader global equity market, the largest US stocks have continued to enjoy a high proportion of flows. For every dollar that flows into Nasdaq, 48 cents go into six large cap tech stocks. For every dollar that flows into the S&P500, 25 cents go into the very same stocks.

High retail participation in markets, using trading apps such as Robinhood, has ‘gamified’ popular stocks since March 2020. Spurred on by Reddit influencers, new investors have enjoyed early success in markets led by the extreme performance of momentum strategies.

The market cap of Tesla rose by $390bn in 2021 and of Nvidia by $410bn,3 creating real performance pain for any benchmarked investors that have not owned these companies. There is no doubt that both of these businesses have leading and disruptive positions in rapidly growing industries. It is noteworthy, however, that they have an aggregate market valuation of nearly $2tn but combined sales of just $71bn and profits of $12bn this year.4

Tesla stock has dominated the options market. On some days Tesla’s options trading activity is five times the rest of the S&P 500 combined.5 Enthusiasm for the EV theme led two second half 2021 IPOs, Lucid and Rivian, to market caps of $62bn and $93bn respectively. Lucid did not deliver any cars in 2021, Rivan delivered 382 of the c. 71,000 ordered.6

Speculation is rife in other risky assets. The price of Bitcoin rose by 59% in 2021, despite a 31% fall from its high. Decentraland, a metaverse currency, rose almost 600% in the wake of Facebook renaming its holding company to ‘Meta’. Non-fungible tokens (NFTs) of CryptoPunk digital images are transferred from one computer to another for as much as $10m each.

A warning from the past

In isolation there may be a rationale for each of these examples of apparent excess. In combination they have all the hallmarks of hubris. According to Bank of America, 1 in 4 of the 1999 vintage of IPOs went on to be successful companies. However, the immediate aftermath of the bubble was destructive. 75% of companies that IPO’d in 1999 were near worthless, but the market was pricing them all as winners. This is the consequence of excess liquidity combined with a good story.

Cheap money is also spilling over into the real economy. According to CoreLogic, US home prices nationwide, including distressed sales, increased year over year by 18% to September 2021. The combination of higher house prices and higher stock prices has produced a surge in household wealth.

Rapid increases in house prices have proved an Achilles heel for economies in the past; the Fed will not want to repeat the mistakes of the GFC and has an important oversight role in financial prudence.

An end to the excess?

There are signs that the excess in the US equity market is giving way. Nearly half of the Nasdaq stocks are now trading below their 100-day moving average. Breadth is declining and the number of S&P 500 stocks trading at 52-week lows is rising rapidly. S&P valuation dispersion is at its widest since the late 1990s. Equity volatility is catching up with the pickup we have seen in bond market volatility since September.

The US equity market now looks vulnerable to any reversal of flows, as breadth is narrowing. We have already seen mini bubbles collapse in meme stocks, SPACs, and clean tech this year.

Apple is now valued at 29x 2022 earnings and Microsoft at 35x. Higher prices imply higher risk, except in a momentum market. These valuations may be defensible with the 10-year real interest rate at a multi-decade low. But should financial conditions tighten for any reason, the valuation support for markets would be removed. History suggests that when the Fed starts tightening, real yields rise.

How can equity investors avoid valuation risk?

Fortunately, opportunities remain within the market for stock pickers. A broadening out of the market is healthy. Bullish sentiment is giving way to pessimism.

As COVID-19 becomes endemic we will see medical procedures and cross border travel recover. This will benefit thematic portfolio holdings in healthcare, payments, retail and experiences.

Earnings and price momentum strategies have been particularly successful in 2021. Stocks in defensive sectors such as consumer staples, growth utilities and specialist REITs have been left behind and offer valuation upside. Finally, a market seeking simple stories has shunned the more complex restructuring opportunities in the last 18 months. We see significant value in the special situation investments in our portfolios.

It is not an overstatement to say COVID-19 has changed the way we live and work and will prove a huge catalyst for innovation and creativity. The reality of the metaverse, or ‘Web3.0’ is still five or more years away, even if it does have the potential to be hugely disruptive. In time it will provide opportunities in new companies, and we are actively exploring those today.

Lower valuations can benefit thematic investors

The hype cycle has a familiar pattern: excess and mania leads to a backlash, adjusted expectations and lower prices. A reset of valuations in a polarised market provides terrific entry points into new, exciting thematic investments. Our thematic approach leads us to companies that are at the point of commercial application rather than hype, across a broad set of themes.

For example, a consequence of current supply constraints and a shortage of labour is the desire for companies to strengthen their supply chains. Surveys of corporates and order books show a rising propensity for capital expenditure. This will particularly benefit the stocks in our automation theme, and industrial software companies in particular.

It will not be enough to tackle climate change via adaption and reduced emissions from fossil fuels alone. A period of huge invention and investment is ahead of us. Progress at COP26 demonstrated that the private sector will be a critical provider of financing for new technologies to reduce and ultimately remove greenhouse gases.

Investors have become conditioned to QE, financial repression, and US technology stocks as the answer to all their needs. Policy is now shifting from the virtual world of Wall Street to the real world of Main Street. For equity portfolio managers, it is the time to diversify away from the larger US growers and accept more benchmark risk.

The polarisation of the global equity market masks the risk that lies below the surface for asset allocators. Negative real rates, earnings progression and washed out sentiment limit the absolute downside. However, a period of lower equity returns and higher volatility is ahead. Fortunately, this reality will bring rewards for stock pickers in a wider array of themes, countries and stocks.

1Bloomberg, 31.12.21

2Goldman Sachs, 31.12.21

3Bloomberg, 31.12.21

4Bloomberg, 31.12.21

5Goldman Sachs, 31.12.21

6Reuters, 31.12.21