For informative purposes only. Private markets investments are highrisk investments. Investors should seek appropriate advice before considering any investment into private markets.

Key points:

- A shifting global landscape is creating new investment opportunities in key sectors such as technology and AI, industrial and business services, and healthcare and tech integration.

- There are several ways for investors to access private markets, with investment trusts being among the most popular.

- Private equity growth has been driven by a combination of fewer public companies, lower volatility, access to attractive differentiated investment themes, and strong historical performance.

Following the events of 2025’s first quarter, and particularly President Trump's 2 April 'Liberation Day' announcements, it feels like we can safely say we find ourselves in a new era of global disruption and change.

With the World Uncertainty Index [1] already approaching January 2020 levels, we are navigating through extreme tariff rhetoric and volatile ‘seesawing’ on trade policy, a significant reset of the US’s relationship with Europe, and growing concerns around Western economic confidence and growth. But that is just one side of the ledger; counterbalancing all this is a widely accepted view that artificial intelligence (AI), and its rapid impact on business efficiency and opening up of new ways of doing business, is likely to herald a long-term productivity boom that could be as consequential as the Industrial Revolution and the invention of the World Wide Web.

We see private markets as being in the vanguard of this wave of innovation and technological change, presenting exciting opportunities for investors. With private markets valuations remaining stable, robust deal activity levels and product innovation, this is a space worth exploring.

Understanding private markets

Following on from Alastair Baker’s introduction to the sector in the Q4 2024 edition, it’s worth recapping how private markets work and how they can be accessed. Private markets are made up of a variety of asset classes, including private equity, private debt, real estate, and more. We see these markets as akin to a spice market of old – rich with diverse and interesting opportunities. Just as traders would find a variety of flavours, investors in private markets can access different types of assets not always readily available in public markets. This diversity offers investors the chance to ‘season’ their portfolios according to their risk appetite and return objectives. It allows for customised

strategies that match an investor’s clearly defined investment goals, sitting in portfolios alongside traditional asset classes.

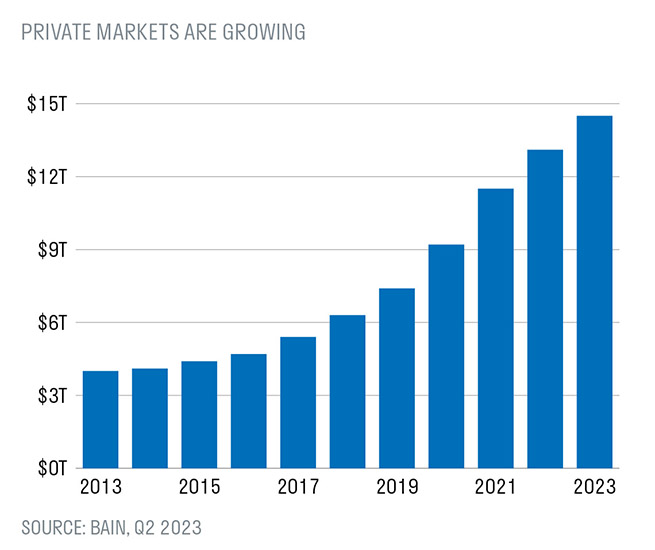

Private markets have undergone significant growth in recent years. Total assets under management (AUM) in private markets have more than tripled, climbing from $4trn in 2013 to nearly $15trn in 2023 [2]. To put this into perspective, in 2023, the total size of global public equity markets was approximately $115trn, meaning private markets are

about 13% of the size of public markets [3]. This expansion has been driven by multiple factors, including the increasing demand from institutional investors such as pension funds and endowments. These investors are attracted by a number of opportunities e.g. private credit for its high-yield opportunities, the stability of contractual returns offered by infrastructure assets and the potential for good profits generated by the active ownership model employed by private equity firms.

Key growth drivers in private equity

The largest asset class within private markets is private equity, which itself takes several forms, ranging from buyout to venture investing, and we highlight below four key drivers behind the growth of private equity:

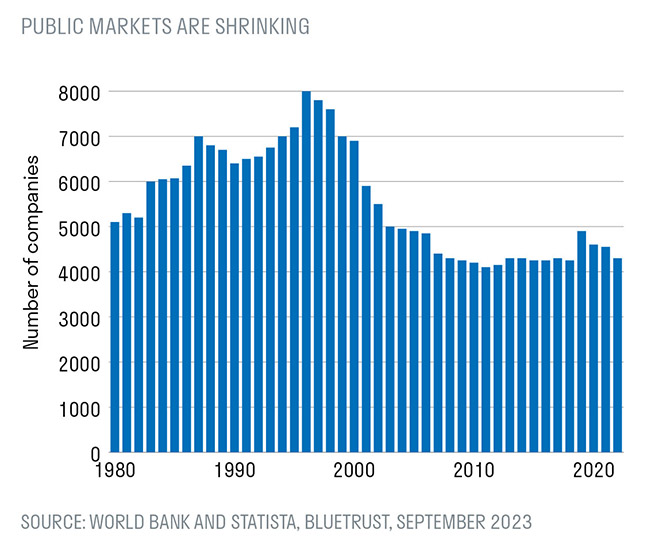

1. Shrinking number of listed companies

The number of publicly listed companies, especially in the US, has been shrinking. Fewer high growth companies are opting to go public and instead are choosing to stay in the private realm, a phenomenon we call ‘private for longer’. They are financing their growth from the private equity and debt markets, while others are delisting and being taken private. This shrinking pool of public companies is not only contributing to the increasing concentration of public equity markets but also means that private equity firms are increasingly investing into high-growth companies at this phase of value creation – an opportunity set for investors that is now less readily available in public equity markets.

2. Lower volatility

Private markets exhibit less price volatility than public markets. Public markets are subject to rapid information flow, constant commentary and emotional reactions, often resulting in large price fluctuations – something that has been very apparent through this year's first quarter. In contrast, private markets, with their less frequent quarterly valuations and focus on long-term value creation, offer a more stable investing journey. While this doesn't mean there is less underlying risk, the smoothed valuation evolution can provide investors with a source of pricing stability in their portfolios. However, this does come at the cost of private investments being illiquid for extended periods.

3. Access to unique investment themes and talent

One area where private equity targets rapidly growing companies is in specialist sectors such as fintech and AI. These themes represent part of what will inevitably be the future of business and technology, and private equity investors are increasingly focused on these areas. Additionally, private equity firms often bring in turnaround CEOs with proven track records to revitalise established businesses and use their capital markets expertise to optimise capital structures and maximise returns for investors. This combination of attractive investment themes and high-quality talent and expertise has helped private equity to generate value over the long term.

4. Strong historical performance

One reason private equity has attracted capital is its strong historical performance both on an absolute basis and relative to public equity markets. For example, the aggregated growth of the Net Asset Values (NAVs) of UK listed global private equity investment companies shows a return of 15.4% [4] per annum over the last decade – outperforming the MSCI AC World Index by 2.7% per annum [5]. While this past performance clearly shows the ability for private equity to outperform traditional public market investments, it does of course come with several caveats and there is no guarantee that this will be repeated over the next decade.

Emerging sectors for future growth

Looking ahead, we see several key sectors that have the potential to drive substantial future returns in portfolios. With the global landscape changing rapidly, major geopolitical events already underway, technological advancements, and demographic shifts creating new investment opportunities, here are some sectors to watch:

1. Technology and AI

The AI revolution is transforming industries across the globe. With global AI investment widely believed to already be at the $200bn [6] level, the potential for growth in this sector remains significant. Private equity firms are increasingly backing companies in AI and related fields. For example, Anthropic, an AI research company, is backed by private equity and is known for its work on large language models similar to OpenAI's ChatGPT. As such the continued advancements in AI present a transformative opportunity for private equity investors.

2. Industrial and business services

The industrial and business services sector offers stable, recurring revenues and significant consolidation opportunities. Private equity firms are investing in companies like Service Logic, a HVAC (heating, ventilation and air conditioning) provider, which is utilising cuttingedge technology to improve data entry by field engineers. Such innovations are driving efficiency and growth in an otherwise traditional sector, making it an attractive target for investment.

3. Healthcare and tech integration

Healthcare is a sector ripe for disruption, and technology integration is key to its transformation. One standout example is One Medical, a tech-enabled primary healthcare organisation that was previously backed by leading private equity manager Carlyle and later acquired by Amazon. With the healthcare industry facing increasing costs, the integration of technology to streamline service delivery presents a significant growth opportunity for investors.

Accessing private equity

Given the long-term and illiquid nature of private equity investments, many investors are unfamiliar with how to access this asset class. There are several potential routes, each offering varying levels of risk, liquidity, and return potential. Some of these routes include:

1. Listed investment companies

One of the most convenient ways to access private equity is through listed investment companies, more commonly referred to as investment trusts. These companies typically invest in a diversified portfolios of private equity investments and are traded on public exchanges. This structure offers a degree of liquidity and diversification, but comes with the risk that the shares may trade at a discount to the underlying NAV. While this can be advantageous when buying shares, it can be a serious disadvantage when selling and the discount has widened.

2. Semi-liquid private equity funds (evergreen funds)

A new route that has developed over the last two to three years is through semi-liquid private equity funds, also known as evergreen funds. These funds provide periodic windows for investors to redeem their investments, offering partial liquidity while still providing exposure to private equity. Some investors have concern over the possibility of redemption gating in the future and the potential for returns to be reduced by the need to hold cash to provide liquidity, and this is something to be aware of.

3. Traditional illiquid strategies

For more knowledgeable investors, traditional illiquid strategies like limited partnership funds offer direct access to private company investments. These funds typically require higher minimum investment amounts and can create operational challenges when incorporated into traditional listed equity portfolios. However, they do provide a longterm, illiquid investment that can be well suited to investors seeking significant capital growth over extended periods.

Attractive opportunities for suitable investors

Private equity offers attractive opportunities for growth, portfolio diversification, and long-term value creation. Despite the challenges of today’s world, private equity has continued to grow at an impressive rate, driven by a combination of fewer public companies, lower volatility, access to attractive differentiated investment themes, and strong historical performance.

[1] The World Uncertainty Index is a measure that tracks uncertainty

across the globe by text mining the country reports of the

Economist Intelligence Unit

[2] Bain 2024 Global Private Equity Report, March 2024

[3] Various sources, Sarasin Bread Street research

[4] Source, Numis, GBP, total return basis, as at 15/2/2025

[5] ibid

[6] 2023 Goldman Sachs research forecasting $200bn by 2025

This document is intended for retail investors in South Africa only. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations.Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement.

The index data referenced is the property of third-party providers and has been licensed for use by us. Our Third-Party Suppliers accept no liability in connection with its use. See our website for a full copy of the index disclaimers https:// sarasinandpartners.com/important-information/.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].