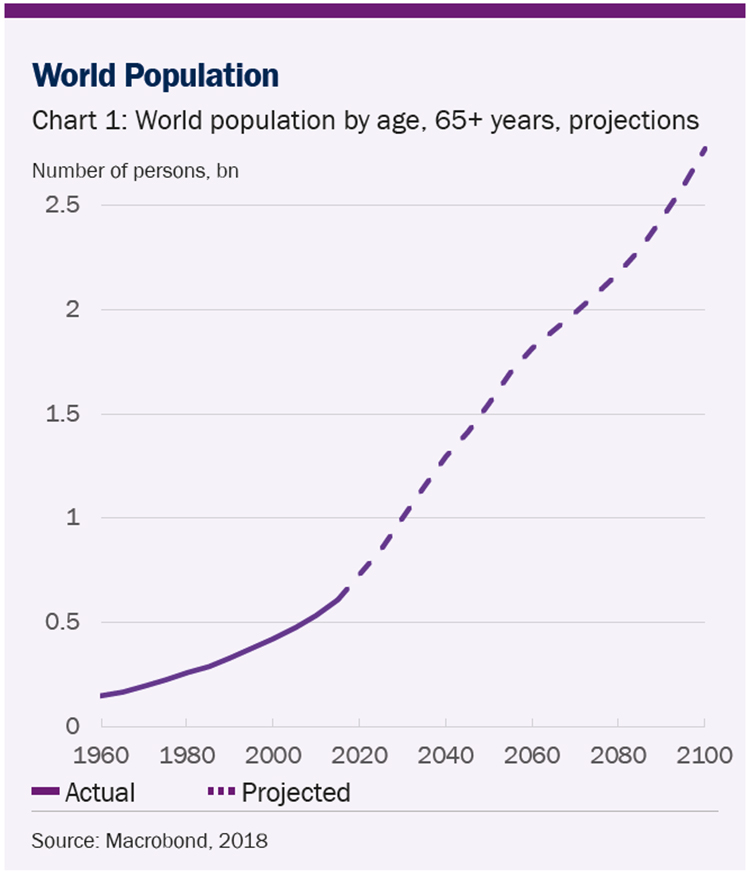

The ageing of populations is an inevitable issue with profound and inescapable effects on societies around the world. Furthermore, these implications have far-reaching consequences which feed into our other investment themes.

The global effects of ageing are altering many industries, ranging from cosmetics to companion animals, from changing consumption habits to tectonic shifts in savings, and even to changes in investment risk appetite. However, at the centre of this change in demographics - being both a cause and effect - is the improvement of healthcare over the decades, which has been the main orchestrater of longer average lifespans. In particular, a recent trip to two continents revealed two very different healthcare markets with long-term thematic investment implications.

A tale of two countries

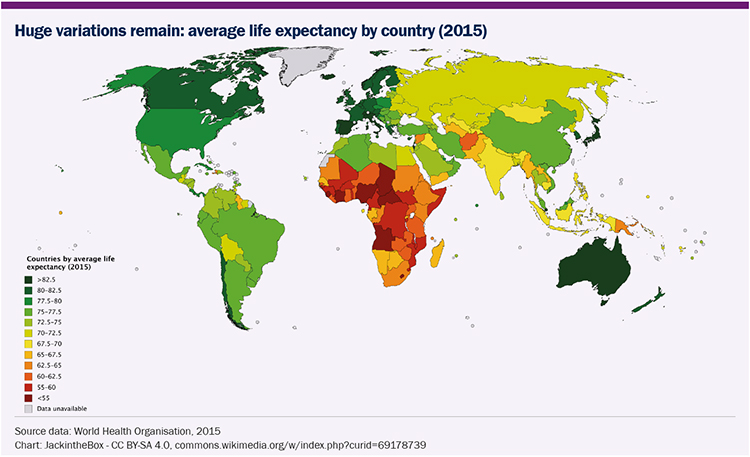

There exist two healthcare systems on opposite sides of the planet, with startling differences which extend beyond just geography. Both are OECD countries with ageing populations; however, the characteristics of each are very different. In the first country, GDP is high at $59,000 per head. At the recent election, politicians argued how to cut a healthcare budget that at 18% of GDP has run out of control, patients have witnessed a doubling of annual out of pocket expenses from $700 in 2008 to nearly $1600 currently, yet have a life expectancy of 79 years. The other country has only $50,000 per head, at the recent elections politicians argued how best to increase healthcare spending more and starting at a level of only 10% of GDP, yet patients have a life expectancy of 83 years – one of the highest in the world. The two countries are the US and Australia, respectively and each offer differing investment opportunities which relate to the ageing theme.

A supportive backdrop down under

If the two healthcare markets are disparate, so too are the investment implications. In Australia, the market is well-funded with positive health outcomes and a stable outlook. Such a strong set of characteristics is partly because of the strength of its economy, with no recession since June 1991. This highly benign home environment has created perfect incubation conditions for a number of great healthcare companies. The most obvious and well established with over 100 years of trading is Commonwealth Serum Laboratories (CSL), the pre-eminent blood plasma collector and processor in which Sarasin & Partners has owned shares since 2005. There is still plenty of growth ahead, as the company produces more highly innovative medicines from blood plasma – for example, to help organ transplants work more effectively or to cure tragic Graft versus Host Disease (GvHD), an autoimmune condition for bone marrow transplant patients. Exciting, too, is that Immunoglobulin, a key product from CSL, has shown faint benefits in slowing or stopping Alzheimer’s disease.

This prosperous domestic market has also helped other impressive companies thrive. Another example, which is owned in a number of our portfolios is Sonic Healthcare, one of the world’s leading laboratory testing companies. It operates in a market dominated by scale where diagnostic testing represents only around 3% of healthcare spend, but the output from tests has an influence over roughly 75% of healthcare activity. Other healthcare companies originating in Australia include Cochlear (developing implants for profound deafness), as well as earlier stage companies such as Nanosonics (hospital infection control and decontamination) and Mesoblast (stem cell therapies).

Opportunities in the US differ

In the US, the effects of ageing on the healthcare system are markedly different. There is now strong bipartisan support to try to tackle the inefficiencies across the healthcare system which have caused runaway spending and relatively poor health outcomes overall. For the wealthy the US healthcare system has one of the best outcomes, but extreme poverty reveals a lack of healthcare on a vast scale throughout the country. In the recent midterm US elections, both Republican and Democrat politicians wanted to enact a root and branch change of the healthcare system. However, the radically differing view as to how to execute a plan has created stalemate, perpetuating the status quo.

Against this backdrop there are three areas where progress is being made. Firstly, innovation is becoming increasingly important, which is aptly timed to coincide with a potential leap forward in using more sophisticated immune oncology as well as gene and cell therapy. The second area of progress is the reduction of perverse incentives that historically have rewarded the healthcare system based on what was done to the patient rather than what was done for the patient. The last area of progress is attempting to reduce price gouging, not only with unwarranted drug prices but more importantly reducing inefficiencies in distribution and other so-called ‘middlemen’ in the system. There are also certain aspects of the healthcare industry that are already accepted, such as the necessity of a profitable healthcare industry, not only for tax purposes but also to reinvest into further innovation in the industry.

One particularly innovative American pharmaceutical company with products related to ageing is Pfizer. It manufactures leading drugs for rheumatoid arthritis, as well as a vaccine for hospital acquired pneumonia which is coupled with a highly interesting non-opioid painkiller (Tanezumab) for osteoarthritic pain. This works so well that when tested, older patients were too free of pain, resulting in increased activity that meant far greater wear and tear to hips and knees. Amgen is another highly innovative company that refines its pipeline using the genetic information and medical records from a subset of the Icelandic population to scan for promising drugs which could accelerate their development and innovation.

Opportunities closer to home

Whatever the financial state of individual national healthcare systems, medical innovation has always been critical. A little closer to home in the UK is a highly innovative company at the vanguard of the next leap forward in medical innovation – Syncona - which we are looking to hold more widely within our portfolios. Syncona works closely with both the Wellcome Trust and Cancer Research UK and has a wide array of early to established biotech businesses using transformational cell and gene therapies.

Looking to the future

As we have seen in Australia and the US, even if regional differences in healthcare markets exist there will be governments and companies all over the world that are constantly developing new drugs and methods that prolong the ageing process. Innovation is likely to remain critical and is likely to accelerate with the genomic revolution, and whether we like it or not, ageing is something which investors cannot afford to ignore.