Semiconductors, driven by AI’s need for power-hungry GPUs, have seen significant growth, but challenges remain. Sarasin invests in key stocks, while monitoring concerns of a price ‘bubble’.

Semiconductors may not be the first things that come to mind when we think of our tech devices, but they are critical to our modern technologies and are present everywhere. In short, they are the fundamental components - used to convert and amplify electronic signals - that make the chips which power our digital economy today.

Semiconductors are found in our everyday devices, from smartphones, to computers, appliances, cars, planes, and industrial equipment. Every day, we create products that have more and more semiconductor content. It’s no surprise that global semiconductor sales have been growing at 5-7% annually in the past 20 years[1] – they are big business and investors are keen to gain exposure.

Nvidia and the rise of AI

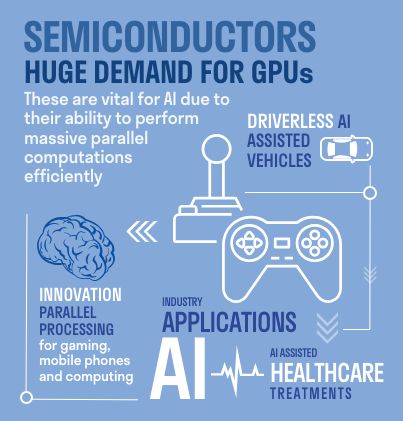

The semiconductor industry has dominated the investment headlines in 2024, and much of the focus has been on one stock in particular, Nvidia. From its formative years in creating graphics cards for gaming and multimedia, the company has grown tremendously to hit a multi-trillion dollar market capitalisation. Today its graphics processing units (GPUs) are used extensively to power the development of artificial intelligence (AI).

As my colleague, Colm Harney, outlined in his article ‘AI: The new industrial revolution’ in the last House Report (Q3 2024), the pace of AI development has surpassed even the most optimistic predictions since the launch of ChatGPT in late 2022. This was a key event in kick-starting a new investment cycle involving big technology companies which currently rely on Nvidia’s chips to build AI models. Nvidia and its suppliers have benefited significantly from this trend - the PHLX Semiconductor index (SOX) has climbed around 25% year-to-date (to 30 September), beating the 20% performance from the S&P 500 in the same period.

The semiconductor industry is known for its pronounced cyclicality; the high-tech foundries needed for production are very expensive and time-consuming to build, but once established can produce huge volumes of computer chips around the clock. This high ratio of upfront to operating costs means that relatively small swings in demand, due to the ebbs and flows of the economic cycle, are often amplified into huge swings in profitability for the semiconductor industry. Understandably, the growth of AI has sparked a record-breaking uplift in profits for the industry leader, Nvidia.

In 2025, consensus is expecting Nvidia to earn $160bn from sales to the datacentre market, which is almost 10 times higher than in 2022[2]. This spectacular growth has made it more challenging for investors to forecast the next inflection point in the industry, and so every quarterly result is now closely watched by investors.

We at Sarasin hold a number of semiconductor companies in our portfolios, such as Nvidia, Broadcom, Taiwan Semiconductor Manufacturing Company (TSMC) and ASML, which fit within our key forward-looking theme of Digitalisation.

While individual investment cases differ, a commonality among all of them is the idea that AI will spark the next cycle of investment in semiconductors, particularly as tech companies need to build the hardware before they can make more progress on applications. This trend was the same in the previous technological cycle (e.g. personal computers, internet, mobile and cloud computing).

How are semiconductor companies embracing sustainability?

GPUs are power hungry, and so a huge drain on energy resources. In order to provide more computing power for AI training and inferencing, Nvidia has increased the power consumption with each new generation of its products. This, in turn, has meant significant incremental demand for power generation from the datacentres which house these GPUs.

While the semiconductor industry has a long track record of making chips with more efficiency with each new generation, the sheer amount of power needed by these AI datacentres is definitely something it needs to find a sustainable long-term solution for. This is a key area of concern for the biggest users of semiconductors. For example, Microsoft recently signed a 20-year deal with Constellation Energy to re-open previously decommissioned nuclear reactors at Three Mile Island to supply power to its AI datacentres[3]. Apple meanwhile has shared details of new reusable datacentre air filters; the company has a stated aim of being 100% carbon neutral across its products and supply chain by 2030[4].

What are the risks of investing in an AI future?

Despite the rapid progress in AI development in the past two years, we have still not seen a clear path for all related companies to turn into profitable businesses. Return on investment is front of mind of every investor.

While we have seen promising use cases for AI in areas such as customer service agents and code generation, helping software developers to be more productive, the question remains whether the scale of investment can be justified.

The market will certainly watch the launch of upcoming models such as GPT-5, Llama 4 and Gemini 2 closely, and analyse how much more capable they can be. If these new models fail to deliver an increase in abilities commensurate with the outlay on development and operational costs, then sentiment towards AI investments could cool. However, if the 'scaling laws' hold and these models meet expectations, we expect AI to unleash the next era of computing, with transformative effects on society and the global economy.

We have kept a close eye on the recent volatility in the share prices of semiconductor companies, and concerns about a potential ‘bubble’ in all things related to AI. However, as it stands today, we are happy to hold a basket of stocks that we see as long-term investments that remain well placed to profit from ongoing technological progress.

The future for semiconductors

Semiconductors are becoming more and more vital to our modern technologies. We expect semiconductors’ importance to increase in the future and we will continue to attempt to identify the right investments in the sector for our clients.

We remain cautiously optimistic about developments in AI, though we are keeping a close eye on the profitability of related companies, and valuations within the wider tech sector.

[1] https://www.wsts.org/61/market-statistics

[2] https://visiblealpha.com/blog/nvidia-nvda-earnings-preview-fiscal-q2-2025/

[3] https://energycentral.com/c/ec/microsoft-inks-20-year-power-purchase-agreement-constellation-reopen-tmi-1

[4] https://www.apple.com/environment/pdf/Apple_Environmental_Progress_Report_2024.pdf

This document is intended for retail investors in South Africa only. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations.

Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement.

The index data referenced is the property of third-party providers and has been licensed for use by us. Our Third-Party Suppliers accept no liability in connection with its use. See our website for a full copy of the index disclaimers https:// sarasinandpartners.com/important-information/.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].