Long-term multi-asset charity portfolios enjoyed yet another strong year in 2021 – particularly those with high allocations to equities.

Equity markets were defiant in the face of COVID-19, but for forecasters the underlying data present a conflicting outlook. This article sets out the backdrop facing charity investment managers and offers some thoughts on positioning portfolios for 2022’s unknowns.

The challenges: high equity valuations, persistent inflation, slowing economic growth and climate change

Unprecedented loose monetary and fiscal policies delivered worldwide throughout the pandemic have propelled equity markets to extreme levels. At the time of writing, just five stocks, Microsoft, Apple, Nvidia, Google and Tesla, account for 8% of the 23% rise in the US market this year, which in itself accounts for the majority of the rise we have seen in the MSCI ACWI.

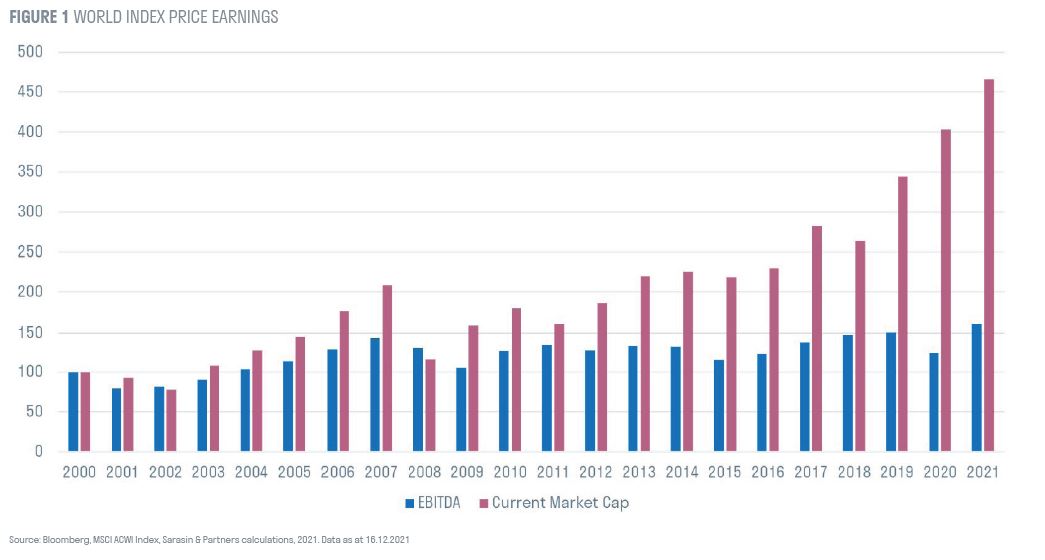

Equity valuations are now on the high side relative to historic values, especially when looking at price-to-earnings (PE) ratios. The bar chart below shows that the price of stocks in the MSCI ACWI, as measured in market cap per share (in red), has been growing since 2008 despite earnings per share (in blue) remaining broadly unchanged. This has pushed up PE ratios, begging the question whether the stock market is overvalued.

And if 2020 was the year of epidemiology, 2021 has been all about inflation. UK inflation has hit its highest level in a decade with UK CPI at 5.1% in November, forcing the Bank of England to raise interest rates to 0.25% on the 16th December for the first time in more than three years.

As we emerged from the pandemic in the summer, we witnessed a strong recovery in demand for goods at a time when rising energy prices and China’s pursuit of a zero-COVID policy led to supply side bottlenecks, causing an inflationary spike that was widely characterised as being ‘transitory’. However, as Federal Reserve Chairman Jerome Powell indicated recently, inflation is showing itself to be more persistent than initially thought. This is likely to dictate a tighter stance to policymaking in the future, although the new virus variant, Omicron, has made this less certain.

After a sharp rebound in global economic growth this year, we expect to see some of the longer-term systemic pressures on growth coming back into play. Demographics continue to shift worldwide, with the ongoing decline in working age populations set to continue. COVID has exacerbated this by triggering a spate of early retirements. Fewer workers means fewer people earning and spending, leading to less money in the system and lower growth. Unless productivity can increase to offset reduced labour, this will prove to be a headwind.

And finally, climate change. In June 2021 the World Economic Forum echoed warnings from Swiss Re Institute that climate change is a systemic risk capable of wiping up to 18% of GDP off the worldwide economy by 2050 if global temperatures were to rise by 3.2⁰C. Swiss Re notes that “no action is not an option… Climate risk affects every society, every company and every individual”. Investing in companies that solve the problems of people and the planet profitably will continue to dominate today’s investment backdrop.

Where to start as we enter 2022?

As always, we need to start with strategy. Is all of the money in the portfolio genuinely long-term, or is there a chance that it might be called upon in the next three to five years? After another year of positive returns, the start of a new year is a good opportunity to double-check that cashflow and asset allocation match the charity’s time horizons.

Given the aforementioned uncertainties, volatility of capital is a likely outcome this year and an early cash withdrawal parked in more secure assets might turn out to be a smart move. Assuming one’s books are in order, we can then turn to tactics.

Prepare for the unexpected

A rising interest rate environment is problematic for bond allocations, and we expect most bonds to deliver next to no real return over an extended period. We have tackled this issue by reducing benchmark allocations and tactically investing even less, such that we hold fewer bonds than at any time over the past 20 years. While one can justify a small allocation to ensure some diversification as a safety net for unexpected events, it feels unlikely that we will be increasing exposure to bonds any time soon.

That said, we continue to find high-quality corporate bonds in the charity space. A number of charity issuers of retail corporate bonds, including Golden Lane Housing, together with other companies (such as Places for People and Orsted) offer superior returns relative to government bonds while also providing exposure to positive societal and environmental impacts.

The real challenge

Given the inflationary backdrop, it will be important to keep our allocation to real assets high. Whilst equity valuations in some parts of the market (principally the technology and consumer discretionary sectors) would suffer disproportionately from higher bond yields, there are a number of more stable areas in the portfolio. These include consumer staples, pharmaceuticals and utilities, which are more lowly rated and have defensive characteristics, including the ability to pass on increased costs to their customers.

A disciplined approach to valuation and a well-diversified selection of sustainable equities with thematic tailwinds should serve long-term charity portfolios well.

Are there alternatives?

Other potential real assets include commercial property, private equity, infrastructure funds and gold, although the latter has proved an unhelpful diversifier in 2021. We will retain our small allocation to commercial property, which continues to help with income generation in portfolios while also benefiting from the post-COVID recovery.

Many listed infrastructure funds provide inflation-linked distributions and operate in growth areas such as renewables, which should be in high demand as the world strives to mitigate and adapt to climate change. Other infrastructure and private equity funds are invested to take advantage of the growth in digitalisation, without paying for lofty valuations.

We are keeping our small gold exposure for the time being, but it is worth noting that the metal’s historic positive correlation with inflation has weakened this year. This may be due to investors choosing to allocate to cryptocurrencies in place of, or in addition to, gold.

Whether this will become a long-term trend remains to be seen, but we do not currently consider crypto to be investable for our clients because of its lack of intrinsic value, questionable environmental impacts and highly volatile and sentiment-driven markets. While digital currencies are clearly assets with a value placed on them – which may well rise against a backdrop of heightened demand and limited supply – we currently see them as falling into in the same category as other collectibles like art, fine wines and classic cars.

What about insurance protection?

Judicious use of option strategies can be another useful diversifier in a multi-asset portfolio, depending on the premiums paid. Even protecting a small portion of the portfolio can prove beneficial when markets wobble. Options can also be used to enhance income and total returns. This is another useful lever for our clients’ portfolios as we have yet to see income from our investments return to 2019 levels.

Whilst on the subject of income, the financial repression of cash and bond yields, which has led to lower yields on virtually all asset classes, means that those willing to embrace a total return approach to withdrawals are likely to be able to build more diversified and better performing portfolios. Now, more than ever, an emphasis on income generation is likely to lead to a more concentrated portfolio, with less attractive growth and defensive attributes. With the yield on the MSCI AC World index hovering around 1.8%, a total return approach allows for an agreed level of real capital gain to be distributed each year, while giving access to both growth-oriented and defensive investment opportunities.

Historically, a total return distribution of 3-5% per annum has been the level at which a multi-asset endowment portfolio has been able to spend, while maintaining its real capital value, after costs. At the time of writing, we are pulling together our Compendium of Investment and long-term forecasts. This will be published at the beginning of March 2022, but it is fair to say that after a decade of above-average returns and high sustainable spending levels, we expect future total return distribution figures to be at the lower end of historic ranges.

To conclude, there is little doubt that 2022 will bring its own challenges, not least because of the uncertainty surrounding the new COVID-19 variant and the relatively high level at which markets ended 2021. Inflationary pressures, tightening monetary policy and continued shocks from COVID, as well as increasing concerns relating to climate change could drive a period of lower returns and higher volatility.

Diversification across asset classes and a disciplined approach to valuations will remain critical, together with a keen eye on sustainability delivered through rigorous environmental, social and governance analysis.