As a thematic global investor, we do not directly target exposure to regional stock markets in our concentrated equity portfolios.

Our investment ideas are sourced from our five mega themes (digitalisation, automation, ageing, evolving consumption and climate change) and it is these themes that lead us to investment opportunities, rather than the location of a company’s listing.

However, given China’s economy is one of the two largest in the world and is growing more quickly than that of the US, it will likely become an increasingly important region for prospecting new thematic investments. So how do we access Chinese growth?

Direct investment can be challenging

There are three principal ways to invest directly in Chinese companies: A-shares, listed on exchange in China, H-shares, listed on the Hong Kong stock exchange, and ADRs (American Depository Receipts), listed on an international exchange.

The A-share market affords access to a broader range of companies but comes with some challenges. A-shares are only quoted in RMB and there are a variety of government restrictions on foreign ownership, for example, when selling, there is a limit on repatriation of funds to overseas countries and there is a hard 30% limit on international ownership. Additionally, institutional stakeholder ownership in China is relatively low and retail investors represent a substantial segment of share ownership, which can lead to high valuations and volatility in popular stocks. Where a Chinese company best fits the outcome of our thematic analysis we would typically purchase H-shares quoted in HK$ (which is pegged to the US dollar) or via ADRs quoted in USD on New York stock exchanges.

Whether investing via A- or H-shares, there are important and often significant stewardship factors to consider. Many of the largest Chinese companies are world-class organisations, with excellent communication with foreign investors. However, others do not publish sufficiently comprehensive information or offer ready access for due diligence. Whilst we have in-house Mandarin-speaking analytical and legal experts, it is often a challenge to build sufficient confidence in some Chinese businesses to make an investment.

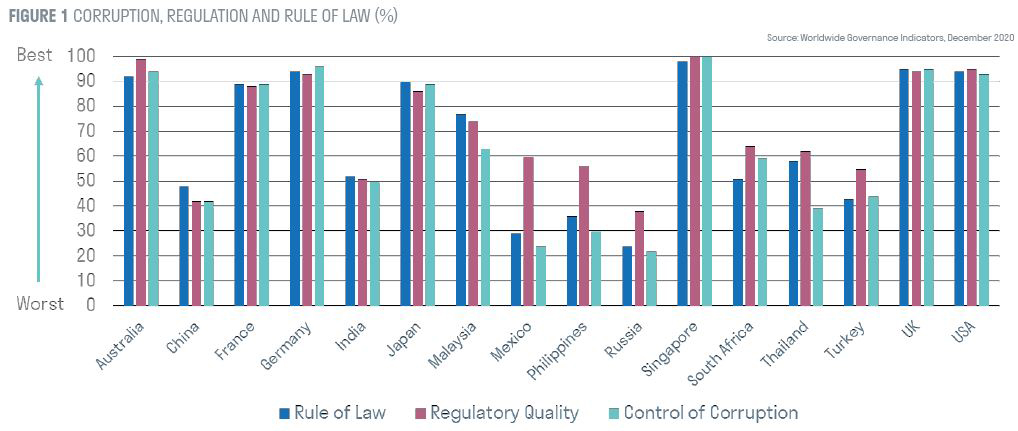

This is particularly the case when it comes to corporate governance and understanding the role of the state. There are some state-owned-enterprises where it is clear that minority shareholders may be a secondary priority to state interests. But there are also businesses where the role of the state and the prospects for shareholders are less clear-cut. Regulatory frameworks in China are currently some of the weakest globally and despite a purge on corruption China still falls well short of other emerging markets in this area (see figure 1). Additional concerns about social factors, such as working conditions and human rights, as well as some damaging environmental factors, explain why the number of Chinese stocks passing the tests in our investment process is currently limited.

Why multinationals may offer the best access to Chinese growth

A second approach to harnessing Chinese growth in our thematic process would be via multinational corporations headquartered outside of China. In the majority of cases, we prefer the stewardship credentials of companies listed in the US or Europe. Furthermore, optimal exposure to our mega themes is not always best represented by a Chinese company. There are many examples in all five of our themes where an international company has a superior product, brand, service or distribution strategy. These company-specific attributes can deliver greater leverage to a theme, and it is often the case that Chinese growth is an important contributor to the investment thesis. Sectors that are particularly rich in opportunities like this include luxury goods, precision industrial tools and healthcare, to name but three.

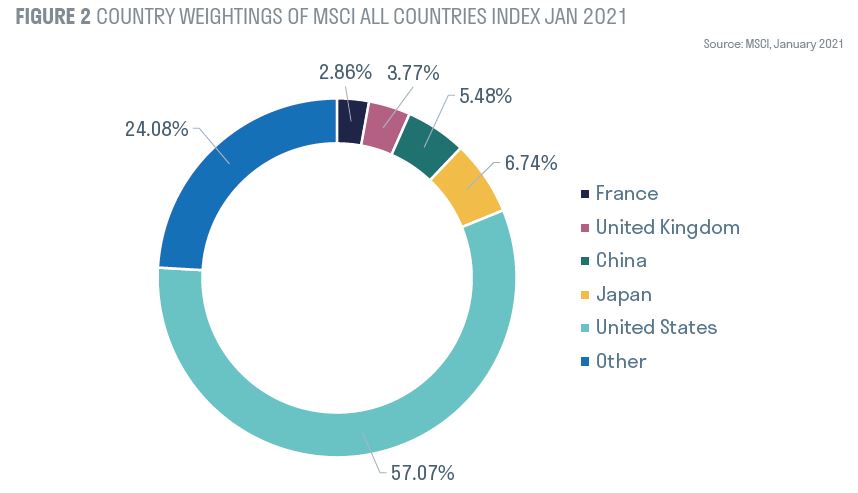

Whilst the development of the Chinese economy provides a tailwind to our themes, it is worth reminding ourselves that despite China’s higher GDP growth rates over the past decade, the level of delivered earnings growth from domestic Chinese companies – an important driver of stock returns – has rarely surpassed the rate of earnings growth in other regional markets. Additionally, China still only represents 5.5% of MSCI All Countries, our main comparator benchmark, with the top ten Chinese companies representing over half that weighting. Indeed, the collective emerging market component of MSCI All Countries peaked at 14% in 2010 and currently sits at just above 12%. In many ways this reaffirms why at Sarasin we do not directly target investment in countries or regions, but anchor on the multi-decade growth opportunities afforded by our themes.

Our current portfolio has a number of stocks which benefit from exposure to China. In a less than 50-stock concentrated portfolio, over one third derive a greater than 15% of their revenue stream from China. Equally, all our five themes have stocks where Chinese expansion is integral to the investment thesis.

A common approach to investment in China and most emerging markets is to target commodities. Glancing at your Sarasin portfolio holdings will indicate that we do not adopt that approach for several reasons. Firstly, copper demand is increasingly driven by the electrification of the global economy and not by the rate of infrastructure investment in China. Equally, direct investment in miners, energy and trading groups is challenged by ESG hurdles and does not originate out of our mega themes – none can demonstrate above GDP revenue growth stretching out to 2030 and beyond. Sarasin’s exposure to China is through companies that are pioneering investment services and providing best-in-class productivity in machining, electrification and technology. We believe these companies could plausibly still be the leaders in their fields in China a decade from now.

Shifting global dynamics – a cause for concern?

We do expect the range of attractive thematic opportunities in China to expand over the next five years and we are conscious of the long-term shift in global dynamics. The geopolitical decoupling of China from US-dominated economic, technology, and currency systems implies that China is likely to need to be considered as more of a standalone investment opportunity for an unconstrained global investor. Investing in China via developed market companies could be compromised as US and European governments force companies to choose West versus China (as with Huawei). The Chinese government could actively seek to reduce access to its domestic markets for international companies and investors, and these opportunities and risks all need to be weighed in our future investment decisions.

With those issues at the forefront of our minds, our Digitalisation theme has screened several potential opportunities in China. In the semiconductor industry, the downfall of Huawei and the distinct possibility of being put in the US’s Entity List at any time have driven Chinese companies to increasingly source from local suppliers. Companies such as MediaTek and Alchip Technologies are potential beneficiaries. In the arena of software, recent surveys of Chinese Chief Technology Officers are indicating they expect to be procuring more software from local vendors in the future. Companies such as Kingdee International and Yonyou Network Technology will likely take share from Oracle and SAP in the enterprise resource planning systems. In e-commerce, where China was the pioneer, we continue to see new business models evolving to challenge the established players. Weimob and Youzan are disrupters that assist merchants operate a director-to-consumer model. Kuaishou Technologies has introduced a new media format – short-form video and live streaming – that can be monetised via advertising and e-commerce.

The opportunity set for direct investment in China is wide but demands scrupulous due diligence and a keen attention to our ownership commitments. Where it is the outcome of our thematic process, we will seek exposure to Chinese growth through companies that provide the best balance between risk and reward. Although digitalisation is currently the clearest beneficiary, we will continue to explore how structural changes to the Chinese economy could support long-term growth within each of our themes.