As the Magnificent Seven ride on, we remain cautious towards equities - but opportunities for stock pickers are improving.

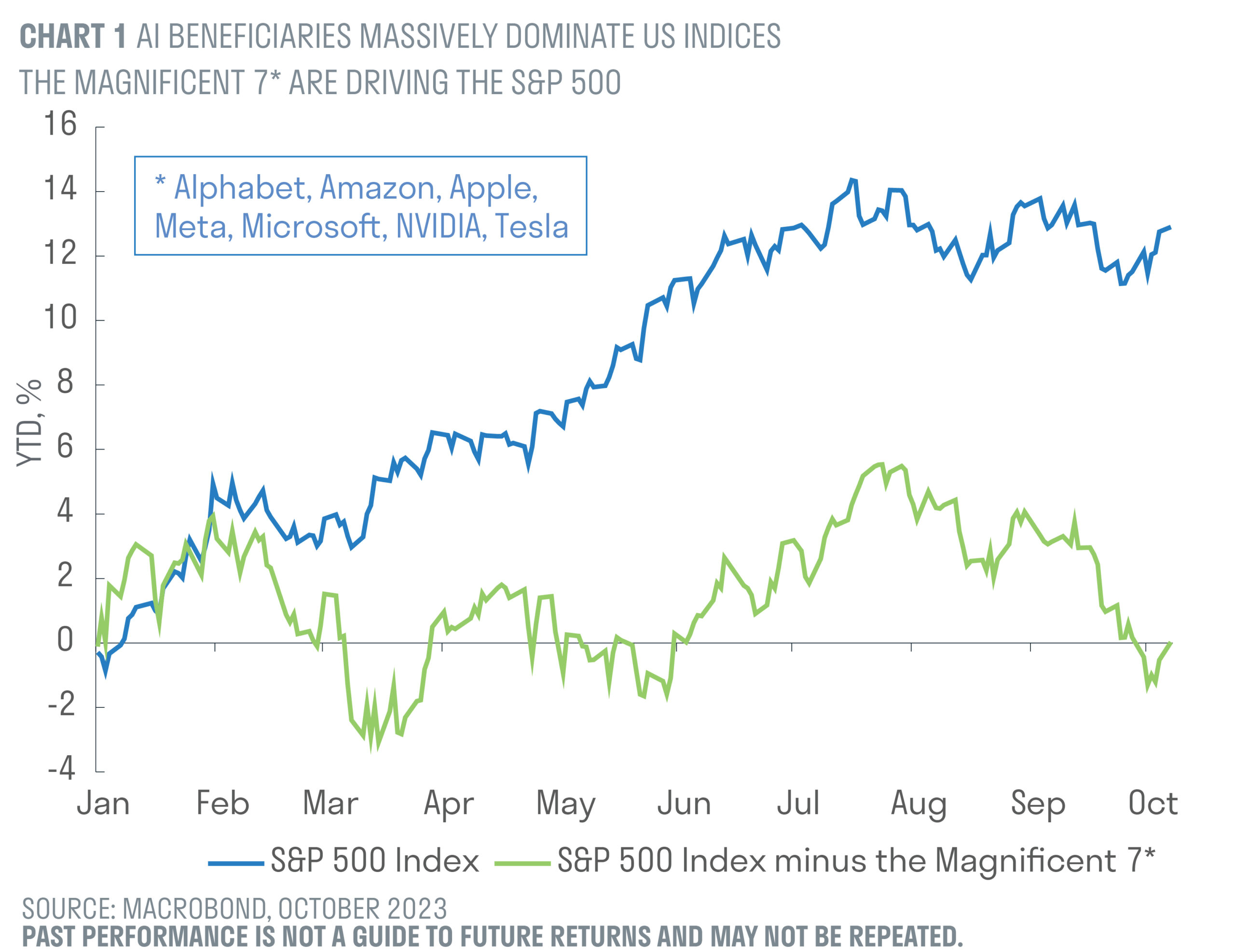

The overriding feature of equity markets continues to be the apparently unstoppable rise of a narrow group of US technology companies dubbed the ‘Magnificent Seven’. These US tech giants have fundamental support from high cashflow margins, strong balance sheets and thematic growth, augmented by the exciting potential of generative artificial intelligence.

In the past three months their relative earnings revisions have improved, underwriting investor confidence in their ability to deliver much higher medium-term earnings growth than the rest of the equity market. However, the valuation of these stocks has expanded dramatically, despite the grind higher in US 10-year government bond yields to 4.8% from around 3.5% at the turn of the year, and real interest rates exceeding 2%.[1]

According to Bank of America, the price/earnings (P/E) ratio of the ‘Magnificent Seven’ is 31x, while the P/E for the remainder of the index (“The S&P 493”) is 16x and 13x for international equities (All Countries World Index - ACWI ex-USA).

The Magnificent Seven now make up nearly 30% of the S&P500 index and have contributed almost 65% of the index’s returns for the year to date. Any expectations for future equity markets returns must consider expectations for the earnings and multiples of these companies, which in reality are less homogenous than much of the AI commentary that surrounds them. This was also true in the internet craze of the late 1990s, but it did not prevent an exuberant asset bubble from forming.

It cannot be ruled out that the Magnificent Seven could double in price from current levels, given their current aggregate valuation is half that of the leading stocks in 1999. However, it is important to remember that the bursting of the internet bubble in March 2000 defined the path of global equity markets for the subsequent 2.5 years and resulted in a 40% peak-to-trough decline in the S&P500. Managing the rise and fall of an equity market bubble can be a defining period for an active investor.

America soars, China languishes

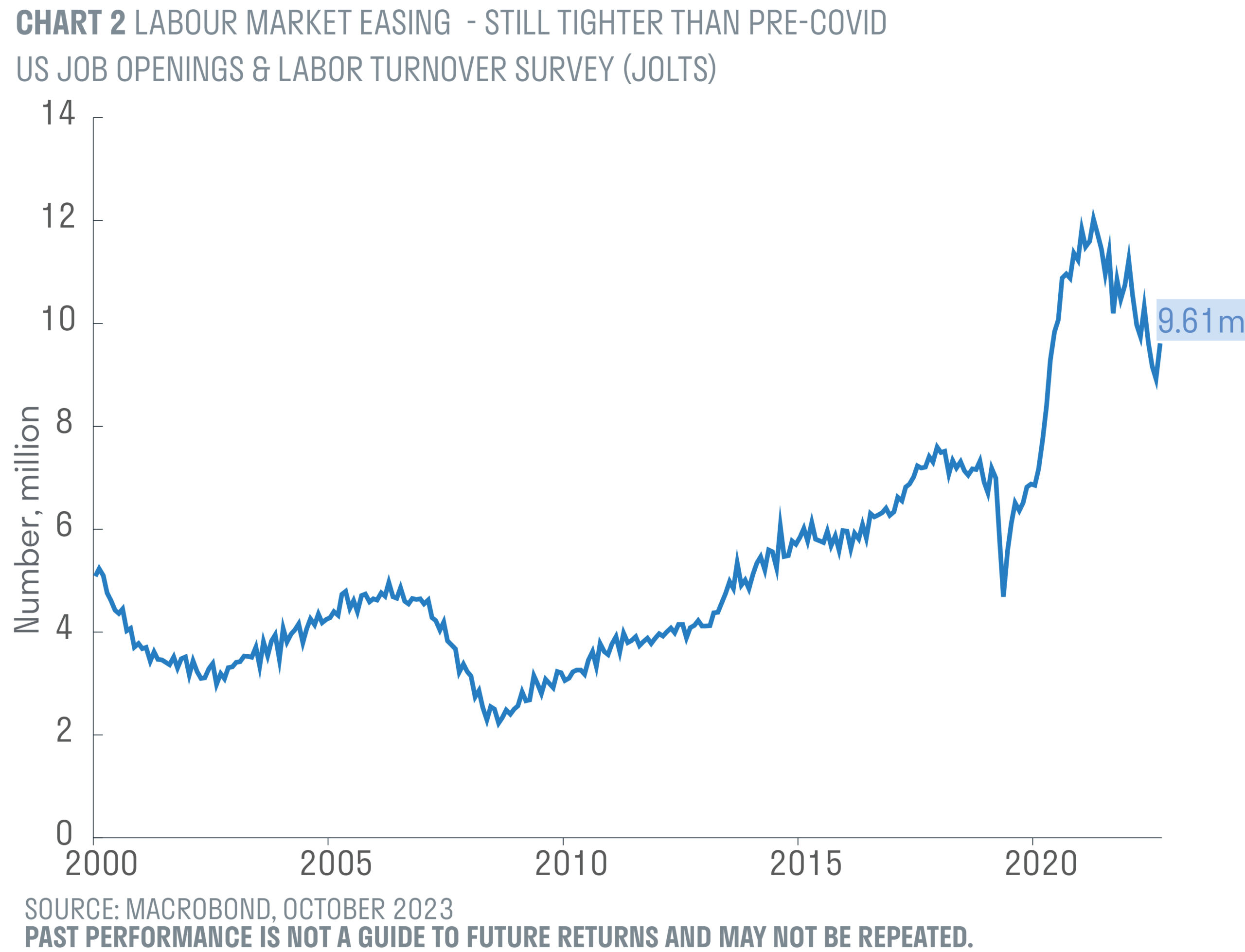

The US economy continues to be resilient to the most aggressive interest rate cycle in 40 years. So far, employment and consumer spending are holding up well as inflation falls. Nominal wage growth remains strong and fixed-rate mortgages have insulated US consumers from much of the impact of higher interest rates. As a result, market sentiment has shifted from fears of a recession to expectations of below trend, but positive economic growth.

The Fed has made it plain that interest rates will stay high until inflation is clearly returning to target. For this to happen, the confidence of the wealthiest households to continue spending on services must fall amid a weakening employment market. In the short term the US economy seems likely to hit an autumn air pocket with auto worker strikes, a potential government shutdown, higher oil prices and student loan repayments weighing on growth.

It remains to be seen whether this brings down the curtain on the roaring 2020s. If it does not, interest rates will continue to rise until activity slows and the jobs market weakens more decisively.

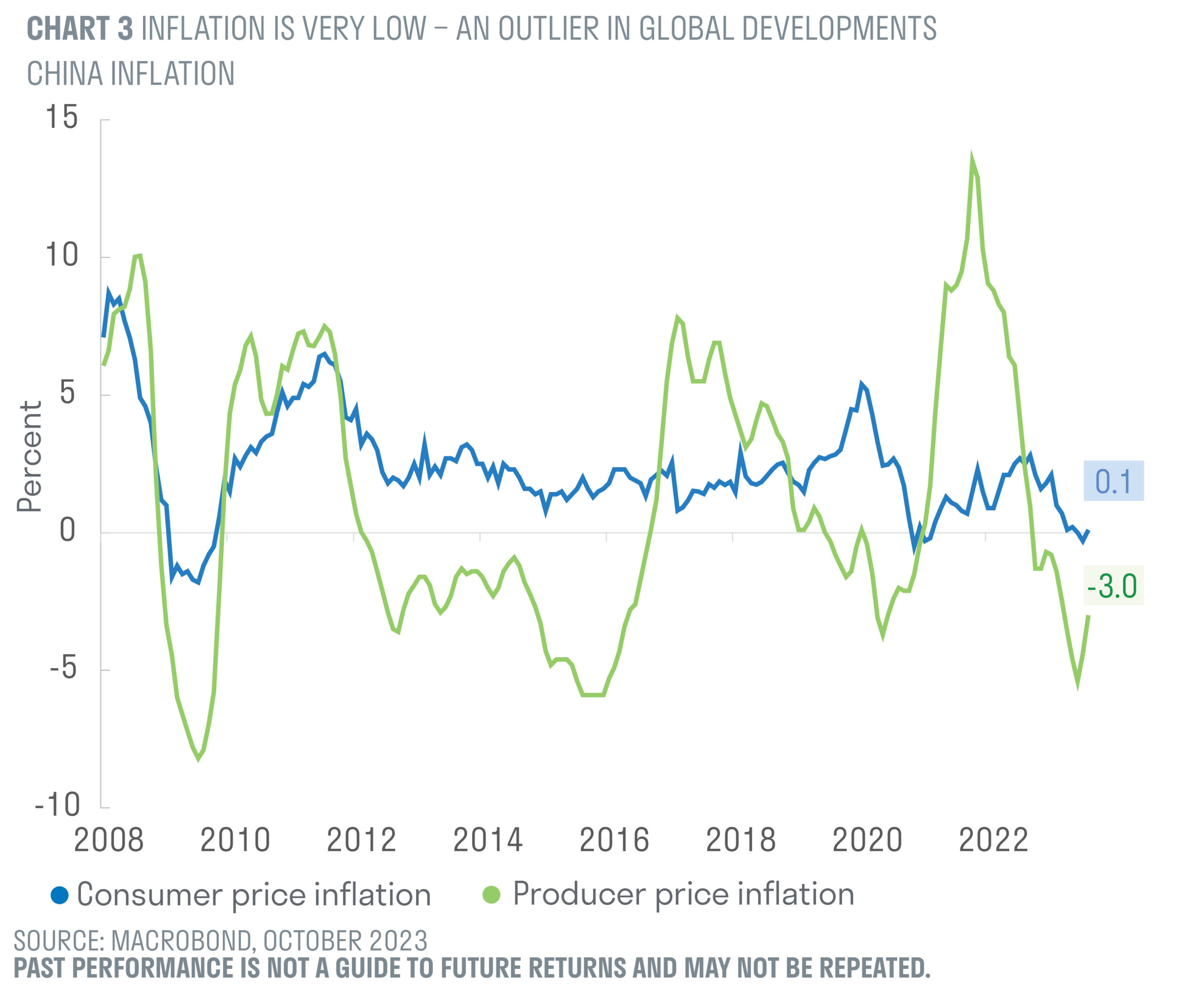

Sentiment towards China is the polar opposite of the optimism surrounding the US. China faces structural challenges from an ageing population, its property bubble and unsustainably high levels of local government debt. There are fears that an ideological Xi dictatorship will allow the economic ‘Japanification’ of China, rendering it ‘un-investable’.

The Chinese government is, of course, well aware of what happened in Japan in the 1990s and is gradually easing policy. The Xi government is reluctant to provide public bailouts, in part for ideological reasons, but also from concern that cash handouts would either be saved or lead to inflation. However, restrictive measures on housing purchases are being eased steadily and interest rates cut. What is badly needed is a recovery in private company and consumer sentiment and further measures to support this are likely.

Over the longer term, it is also likely the Beijing government will restructure local government debt and offer support to the economy via increased investment in key industries such as renewable energy. It remains to be seen if such a package of incremental measures and structural reform can return the Chinese economy to its 5%+ growth target. Ultimately, Xi’s goal is to sustain the Communist Party of China’s grip on power and he will not risk a deflationary bust that could threaten his vision.

China’s economic data is turning more positive and exports appear to be stabilising. If it becomes evident that the Chinese economy is in the process of bottoming, as mainland Chinese investors now expect, extreme negative sentiment towards China could well turn rapidly.

China is a small component of a global index such as MSCI ACWI. However, there are strong economic linkages between China and the rest of Asia, with Europe, and via demand for commodities. Developed market stocks with high exposure to China have performed particularly poorly in recent months. Should China be seen as investable once more, valuations are low enough to produce some significant share price moves.

Hedge and diversify

Equity investors face a slew of risks, including extreme concentration of equity returns, potential for a new technology bubble, rapidly tightening monetary policy in the US and the urgent need for reflation in China.

In this environment, constructing an all-weather portfolio that can prosper in a range of potential outcomes is challenging. Hedging out rising geopolitical risk is particularly difficult when US consumers rely on Chinese exports and Chinese companies are dependent on Taiwanese semiconductors.

Short-term interest rates and longer-term bond yields are now reaching levels that tighten financial conditions rapidly and begin to constrain economic growth. Our central expectation is for growth to slow to a crawl in the coming months and be accompanied by a modest increase in US unemployment.

There is a risk that markets react more negatively to such a ‘growth scare’ and begin to discount a weakening economy. Hard landings generally begin with a soft landing: history suggests equity performance after the last rate hike depends on the subsequent performance of the economy. Markets rise when recession is avoided, but drop substantially when aggressive tightening results in a downturn. We therefore continue to emphasise quality companies with defensive earnings in our portfolios.

Such attributes have not been rewarded by an equity market repositioning from recessionary fears at the end of 2022. Higher bond yields have favoured industrial, energy and financial companies whilst utilities, staples and healthcare have produced negative returns.

Broadly, the Magnificent Seven are likely to be fairly resilient to economic weakness, with the possible exception of their advertising revenues. We will retain our valuation discipline here, recognising the risk of a momentum bubble.

Pockets of thematic value

Despite our caution on the valuation of the US equity market and the outlook for corporate profitability in a period of deflation, the environment for stock pickers is improving.

The healthcare sector is offering an unusual number of relative value opportunities, with high-quality companies such as Thermo Fisher and Medtronic valued at their lowest multiples in five years or more. Considerable value is on offer among UK-listed companies, which are particularly cheap relative to their global peers, and many have a high proportion of global earnings.

London Stock Exchange Group is predominantly a data and indices company with a high proportion of recurring revenue, but trades at a discount to peers around the world. Meanwhile, Reckitt Benckiser has a strong set of brands in attractive health and hygiene categories but is far cheaper than US-listed competitors such as Procter & Gamble.

If the downside risks to the Chinese economy do not materialise, the upside in companies with exposure to the Chinese consumer is compelling. Asian insurers such as AIA and Prudential are currently pricing in no new customer growth. As the Chinese consumer begins to travel internationally, the prospects for Samsonite (luggage) and Shiseido (skin products) are strong. And if international investors return to the Chinese equity market, companies such as Tencent are likely to enjoy considerable upside.

Long-term, active investors should embrace periods of economic weakness, lower equity prices and market inefficiencies. Meanwhile exciting new themes in generative AI, healthcare innovation, climate change solutions and automation are creating investment opportunities in the winners of the future.

[1] All data in this article sourced from Bloomberg and Macrobond as at 30.09.2023, unless stated otherwise.

Important information

If you are a private investor, you should not act or rely on this document but should contact your professional adviser.

This document has been approved by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England & Wales with registered number OC329859 which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser.

© 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.