As equity markets reach fresh highs, where are the risks for investors and how can we mitigate them when so many defensive assets have been debased by years of easy money?

As world markets inch steadily higher the most common question we are asked by investors is ‘so, what can go wrong?’ It’s easy to understand their concerns – after all, we’ve seen five months of back-to-back gains in stock indices, equity volatility that is plumbing new post-COVID lows and US treasury yields that have fallen below 1.5%, while consumer prices are still rising by 5%1. Markets, it seems, are discounting every piece of good news and more.

Last month’s big worry for example, that the Federal Reserve was ‘behind the curve’ on inflation has, after some deft communications from Chairman Powell, soon been forgotten. Powell managed to bring forward forecasts of US rate rises to 2023 and talk openly about tapering asset purchases later this year, with barely a murmur from either bond or equity markets. Political risks too are perceived to have fallen – President Biden has all but inked a bi-partisan infrastructure deal and quickly brought America’s allies on board at last month’s G7. Even the worryingly infectious new variant of the virus seems now to have had its worst effects mitigated by vaccination. In short, are markets trying to tell us that this is about as good as it gets?

The old problems remain

Yes, the world is a much rosier place than it was six to nine months ago, but underneath the optimism, there is much still to worry about. Industries across the world signal extreme pricing pressures across their supply chains (last month China reported that producer prices going into factories are climbing at a 9% annual rate, the highest in 13 years2). In both the US and UK, we are hearing that labour supply is increasingly sticky, with working parents and retirees particularly reluctant to re-join the regular workforce after COVID -led absences.

This is putting upward pressure on labour rates for new recruits, which could easily spill over into the wider workforce (on a positive note I should add, many of these wage gains are at last accruing to the lowest paid). Meanwhile, political challenges with China continue to rise on a number of fronts. The Biden White House is probably even more hawkish here than Trump’s administration, just as tensions with Taiwan are again rising (a record 28 Chinese fighters entered their airspace in a single day last month). In other words, we have plenty of tools to harvest opportunities – but managing the risks is going to be a lot harder.

So what tools are left to manage the downside?

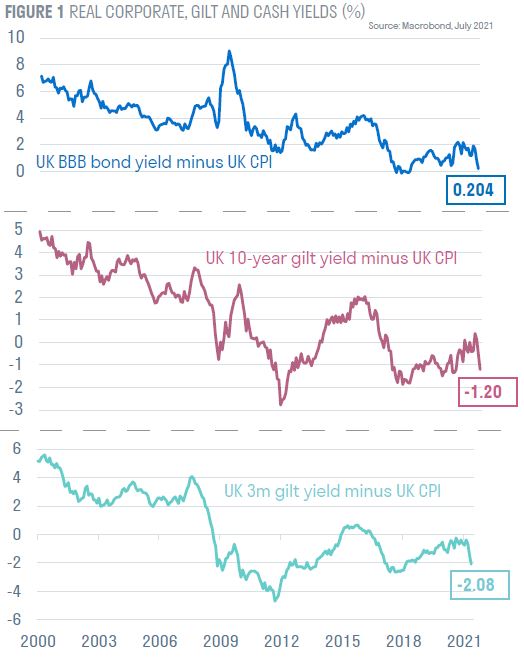

For investors the problem is clear – aggressive financial easing by central banks has effectively debased many of the traditionally defensive assets. Equity valuations, for example, are worryingly high even for ‘value’ stocks, with the MSCI World Value Index already trading at 15 times next year’s earnings and more than twice book value3. Government bonds offer little shelter with real yields deeply negative - UK 10-year gilts have a real yield of minus 1.2%, while even BBB rated corporate sterling debt only just offers a positive real return (figure 1). Meanwhile, there is a dearth of other alternatives; cryptocurrencies offer too many regulatory and ownership hurdles, while gold is potentially attractive but portfolio position sizes are probably limited. Elsewhere, there are many opportunities in private assets but again valuations are sky-high as global private equity houses battle for deals. In short, there are fewer places left to hide as central bank liquidity has now floated most of the boats.

So, let’s look below at the many global opportunities for our portfolio managers today but also at how they can successfully mind our backs if things go wrong:

- Global economic momentum remains strong, so remain overweight equities and infrastructure. We see further upside to our already robust global forecasts led by the US, while the European recovery will continue to accelerate as tourism and travel re-opens. We see some softness in China but this comes off what will still be a very strong recovery year (Chinese GDP is expected to grow by 9%4). More importantly, there seems little appetite to moderate growth going forwards – a deep and inclusive recovery remains the stated priority of most policy makers. Couple this with ambitious new climate investment goals that have already triggered a rolling capital investment boom, and the dash for growth continues. Our asset allocation response is to remain overweight equities, where we see strong upward momentum in earnings and dividends. For similar reasons we favour infrastructure and renewable assets that can give exposure to today’s unprecedented climate ‘retro-fit’ of the energy and industrial complex, much of which has now been mandated for as early as 2030.

- But, how can we mitigate the equity risks? First, keep a quality overlay in equity selection – this has been expensive recently as turnaround stories have surged in recent months. However, the value of good governance and experienced management will become clear as the post-virus economy demands on dramatic changes in strategy and growth. Second, keep in mind that automation and digital innovation (AI, cloud computing and 5G) are evolving at extraordinary speed and are very disruptive. Focus on industrial winners that are also embracing these challenges – Otis, Dassault and Siemens are some recent examples we have purchased. Third, use the power of corporate engagement to push for change – this can allow us on occasion to avoid the expensive market leaders and buy more challenged companies where management is open to change. Indeed, a good engagement team is becoming as necessary as a strong fund management team. Finally, be cautious on regions where the vaccine roll-out is still lagging – this argues for a still measured approach to emerging markets.

- And if today’s inflation risks are not ‘transitory? Global inflation is going to remain well above target for at least the next 12-18 months – supply-chain disruptions, labour shortages and commodity prices being the primary drivers. Our base case though is that consumer prices then fall back to around 2.25-2.50% in the medium term, a level higher than we are used to, but consistent with the political need to run economies ‘hot’ and ensure the recovery is inclusive. But, there is huge uncertainty in these forecasts, not least in the future evolution of the virus, the direction of oil and food prices and the position of President Biden’s huge spending plans post the 2022 mid-term elections. Our view is to probably fear inflation more than deflation given how generous policy is today – with the Federal Reserve and ECB each set to buy more than USD 1 trillion dollars of bonds over the next 12 months, the ongoing financial stimulus remains vast.

- Where are the inflation hedges? First, don’t hold bond exposure where you don’t need to – today’s yields offer little inflation protection with real yields negative and corporate spreads close to all-time lows. Second, dividend-yielding stocks with strong thematic drivers are offering a large yield premium over bonds, and importantly the prospect of strong dividend growth. This is a useful and attractively priced global asset class. Third, if there has to be a major policy re-think by central banks then asset prices could react violently, so consider utilising derivatives. Today’s low equity volatility makes transparent, listed, equity options attractive. Finally, don’t be afraid of running higher than normal cash balances. Even though cash yields are zero (or still negative for much of the world), some opportunistic ‘fire-power’ could yet be useful as we chart our way through a fast changing, but hopefully, post-COVID economy.