2023 is proving to be a dizzying year. A multitude of events has buffeted markets: a sharp collapse in European gas prices followed by the rapid reopening of China’s economy; resilient US growth and stubborn inflation requiring sustained increases in interest rates and central bank asset sales, or quantitative tightening; shocking bank failures necessitating the very opposite – aggressive central bank liquidity injections; and most recently, unforeseen cuts to oil supply from a Saudi-led OPEC coalition. Investing is beginning to resemble multiverse-jumping – alternative realities all possible all at once!

Making sense of the multiverse

Today, uncertainty about the trajectory of the economy has risen materially because short-term cyclical pressures are colliding with long-term structural shifts. This is possibly creating one of the most challenging economic backdrops since the Global Financial Crisis.

In particular, the post-Covid economy is proving to be the inverse of the post-GFC economy which was ruled by insufficient demand and low and inertial inflation. Long-term shifts like geopolitics, demographics and the energy transition, have intensified. Economic outcomes are being driven by the the security, scarcity and agility of supply. Great Power Politics is cleaving the world apart, demographic shifts are increasing labour scarcity and the energy transition is creating winners, losers and a more expensive market for carbon.

At the same time, the post-Covid economy is having to reckon with meaningfully strong cyclical pressures. Aggressive fiscal and monetary stimulus collided with discombobulated supply chains, scrambling supply and demand like never before. Inflation responded by racing higher and signalling to markets that supply needed to keep pace. Over the past year, these signals have worked and supply shortages have started to ease, most notably in the market for goods. Labour markets, however, have remained tight as the US economy continues to create jobs far in excess of the growth of new workers. As a result, service sector inflation remains resilient.

It is this intermingling of cyclical pressures with longer-term shifts that is creating a highly complex environment where a multitude of outcomes is still possible. To navigate this landscape, it is best to disentangle and understand the cyclical pressure points.

A slow dance to recession

For over a year, the US Federal Reserve (Fed) has been raising rates in an aggressive bid to bring demand in sync with supply. As the Fed tightened, other global central banks had little choice but to follow suit. The result has been a synchronised tightening in financial conditions.

Notwithstanding a concerted tightening in monetary policy, global growth has remined surprisingly resilient. In particular, the US economy has shown relatively low sensitivity to increases in short-term interest rates. Strong household balance sheets, long maturity of mortgage debt (typically 15 to 30 years) and the ‘terming out’ of corporate debt as businesses took advantage of the era of ultra-low rates have kept demand resilient even as rates marched higher.

Low sensitivity to interest rates was always going to be the Fed’s Achilles heel because its key policy tool is less effective at restraining demand in a timely manner. It also increases the possibility that monetary policy lags have lengthened, increasing the uncertainty over the level at which interest rates become restrictive.

With every step up in interest rates, the risk that something within the financial system breaks has only grown more plausible. A decade of ultra-low interest rates was also likely to have led to investor complacency and mispricing of long-term risk.

During the course of last year, as rates continued to march higher, there has been gathering evidence that risks were building up within the financial system. The implosion of the crypto industry following the collapse of a leading exchange, FTX, was the first casualty. Liz Truss’s ill-fated budget was another. Last month’s collapse of Silicon Valley Bank, Signature Bank and Credit Suisse are the most dramatic casualties of the central bankers’ quest for price stability. Given their pole position in the heart of the financial system, central bankers had little choice but to move decisively and aggressively.

In the US, regulators not only guaranteed all deposits (including uninsured) of the banks in receivership, but they also launched a new temporary lending programme that allows banks to borrow from the Federal Reserve using the par value of treasury bonds as collateral. Given the large unrealised losses across the banking system associated with treasury bond holdings, such a programme will likely be helpful in arresting the near-term financial panic. However, such a move is also highly controversial as it implicitly removes the downside risks from holding bonds.

Central banking, till now, has always followed Bagehot’s dictum: Lend freely, at a penalty rate against good collateral. The latest Fed programme goes above and beyond this. By lending at par value, the Fed has removed not only the interest rate risk, but also market discipline associated with holding treasury bonds.

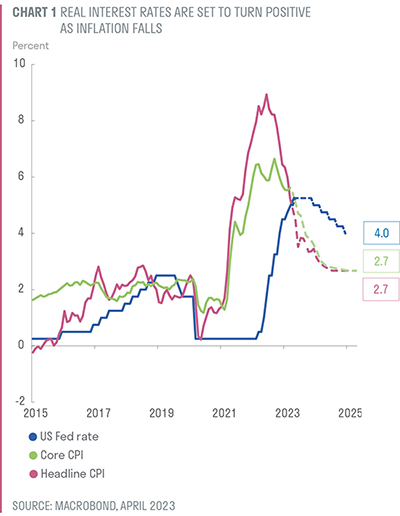

Even so, financial conditions are likely to continue tightening and tip the economy into a recession for two main reasons. First, as inflation continues to head lower, real interest rates will mechanically move higher. By the second half of the year, real interest rates are likely to be between 1-2% – a level that typically leads to a significant slowdown in demand.

Real interest rates are set to turn positive as inflation falls

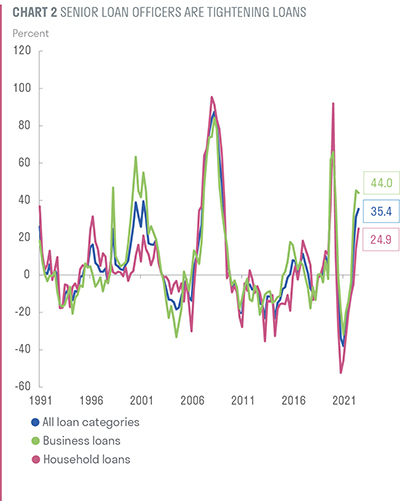

Second, banks are likely to pull back from lending in response to higher funding costs (as deposits continue migrating to money market mutual funds in search of higher returns) and more prudent balance sheet management (in response to rising delinquencies and defaults).

Senior loan officers are tightening loans

This is likely to be particularly true for regional banks, which play an outsized role in providing roughly 40% of all loans to the US economy and approximately 70% of loans to the commercial real estate market.

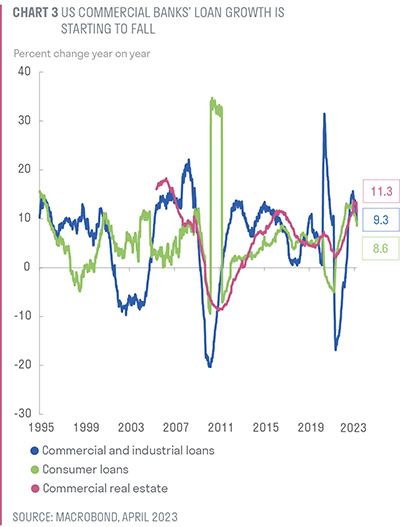

US commercial banks’ loan growth is starting to fall

Foggy bottom

Central banks may have arrested a fast-moving financial panic, but are unlikely to do much to avert the slow-moving credit crunch that is now well underway. To a large extent, this is a credit crunch of their own making. With an eye to longer-term structural shifts, they are unlikely to turn back on their goal of right-sizing demand to match the supply potential of the economy.

As we look to the end of 2023, there continues to be a wide range of positive and negative potential outcomes. On the downside, negative momentum in the economy could lead to a more intense credit crunch. Inflation could also remain resilient – mark-ups continue to surprise on the upside as global businesses seem to be successfully pursuing price over volume strategies. On the upside, the downward momentum in prices could intensify, providing a much-needed reprieve for central banks. A cut in US interest rates could lead to a huge sigh of relief across the world and breathe fresh life into financial markets.

With such a wide array of outcomes still plausible, investors should be prepared for continued turbulence in the coming months. Multiverse-jumping and shape-shifting are likely to be with us for just a while longer as we ride out the current cycle. Against this backdrop, we believe in assuming a lower risk appetite until we have clarity on how deep any credit crunch turns out to be. We prefer credit exposure over equities, and favour more liquid alternatives that hedge against extreme outcomes, in particular gold, and commodities that are critical to the decarbonisation agenda.

Important information

If you are a private investor, you should not act or rely on this document but should contact your professional adviser.

This document has been approved by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England & Wales with registered number OC329859 which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect of any such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct. indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Neither Sarasin & Partners LLP nor any other member of the Bank J. Safra Sarasin group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser. © 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact [email protected].