The Sarasin Tomorrow’s World Multi-Asset Strategy has recently reached its first anniversary. Who is Tomorrow’s World for and why did we launch it?

The pursuit of economic and consumption growth has had devastating environmental impacts – deforestation, pollution and waste, climate change and biodiversity loss, which in turn, compound the inequality the world already experiences.

Conserving our world for future generations will require large shifts in global trends, away from ever-increasing consumption towards sustainable patterns of producing and using goods and services.

If you are an investor, you have two ways of looking at this problem. Firstly, how can I invest in a way that protects my portfolio from the sectors and companies that are most at risk? Looking at investment through this lens is what’s known as single materiality – the impact of climate change as a financial risk. Alternatively, you might ask how can I invest in a way that doesn’t cause harm and that actively contributes to creating a more sustainable world? This second view is a double materiality approach – the impact of an investment on climate change.

The Tomorrow’s World strategy is a way for investors to meet both those needs at the same time. It is a multi-asset strategy that invests in companies and institutions which set out to solve the problems of people and the planet profitably, while avoiding those that cause significant social or environmental harm.

How does it differ from other responsible investment products on the market?

Many of us want to invest responsibly – one need only look at the vast number of ‘sustainable’ strategies on offer.

The problem is that there is as yet no gold standard for assessing the adverse impacts of a company on the world. Regulators have only just begun to require the measurement and publication of carbon emissions and other data, and it will likely take some time before all companies include these in their audited reports. Around 50% of companies publish carbon data, and of that, only about 9% is accurate, according to the Boston Consulting Group.1 We all like to see net-zero pledges but they only mean something if they are backed up by hard data.

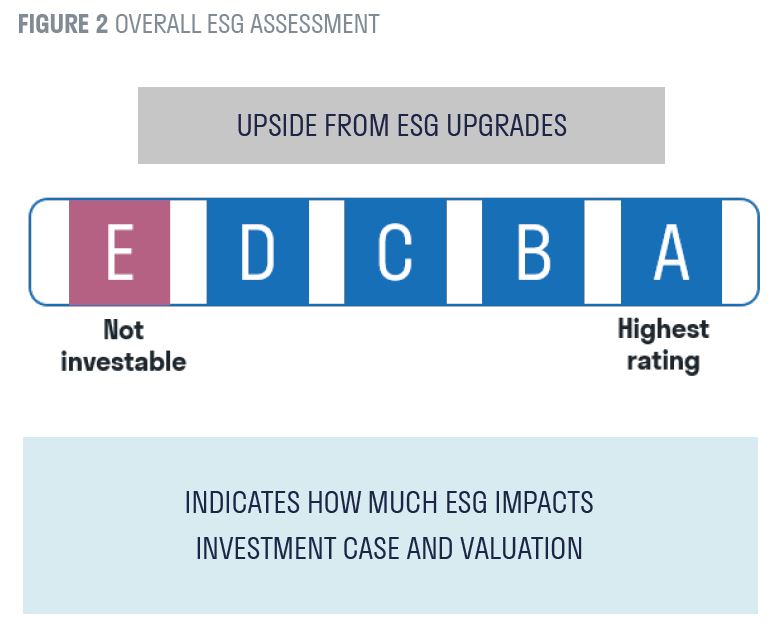

What this means is that adverse impacts need to be measured in other ways, often relying on sources outside the company and making estimates based on detailed knowledge of the company’s production processes. Some investment managers rely on agency-supplied ESG scores, but these scores have become widely discredited due to a lack of analysis and research. There is no substitute for proprietary research conducted by investment managers, and this is where we believe our proprietary analysis sets us apart.

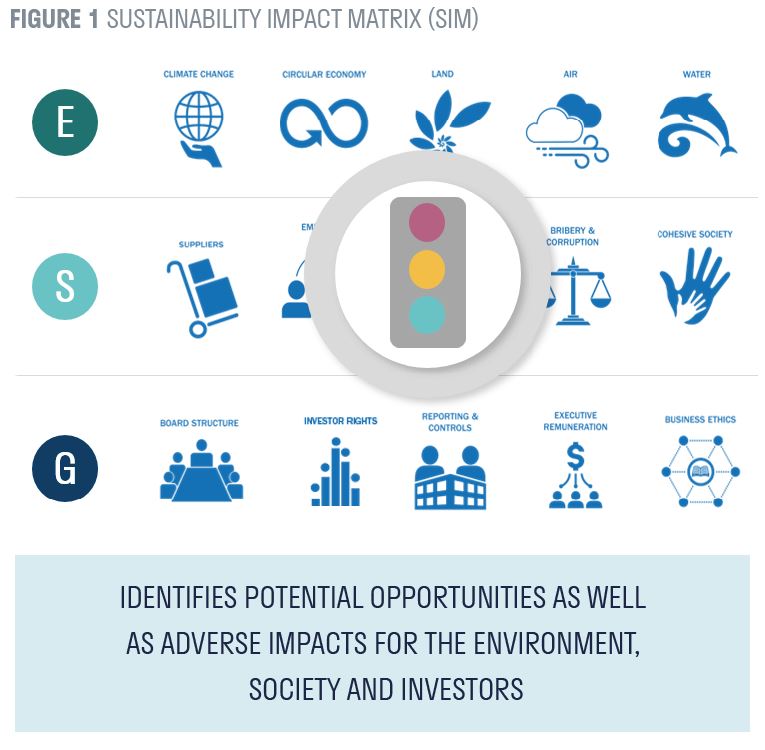

The Tomorrow’s World strategy invests using the best analysis and ideas from Sarasin’s thematic investment process, underpinned by comprehensive in-house ESG analysis, structured through the Sarasin Sustainability Impact Matrix – a system of over 160 detailed questions for each investment – to identify and exclude any company that scores a red traffic light on any of our five environmental or five social factors.

How is the portfolio constructed?

In Tomorrow’s World, consumption of many material things will have to decline, not increase. Businesses hoping to grow their sales and profits by supplying more and more ‘stuff’ may be very disappointed when growth cannot continue. On the other hand, businesses that are dematerialised, providing services, solving problems or improving lives in a non-material way may find that demand rises naturally and their shareholders will prosper.

Tomorrow’s World is a multi-asset solution that provides diversification across asset classes and markets, together with some portfolio protection – in essence, an all-in-one solution for the responsible investor. Stock selection for the Tomorrow’s World strategy is driven by the Sarasin global thematic investment process. To achieve long-term capital growth, we typically invest around 60% of the portfolio in the shares of sustainable businesses around the world. We also maintain a fixed income allocation of around 30%, looking for borrowers which support positive social and environmental development. For further diversification, the remaining 10% is invested in alternatives, including infrastructure, commodities, private equity and cash.

How has the strategy performed since launch?

Tomorrow’s World has met its objectives in the first year, with returns exceeding the sector average. The portfolio does not own investments in the most polluting industries, including oil and gas, mining, transport, fossil-fuel powered utilities, car manufacturers, most consumer goods manufacturers and retailers. With oil and gas prices rising strongly, it is no surprise that the traditional energy sector performed well – but we were rewarded by our focus on companies with sustainable competitive advantages, such as ASML, which manufactures the processors and memory chips found in every electronic device.

Have there been any significant changes to the portfolio since launch?

We launched Tomorrow’s World within a particularly supportive macroeconomic environment, benefitting from record low interest rates. The backdrop is now more challenging and when appropriate, we have bought some hedging in the form of put options on the Nasdaq 100 index, which helps protect the portfolio against interest rate rises. Interest rate rises impact most of the asset classes in the fund, not just bonds. Despite this, our core philosophy has not changed; the portfolio is well diversified, which helps protect it from periods of volatility.

Can you share an example of investments within the strategy?

The development of mRNA vaccines against COVID-19 is just one of the many technological triumphs that marks out the 2020s as the dawn of a new renaissance – like the early 16th century, a period of accelerated innovation and flourishing creativity across science and the humanities. Illumina is one example of a company enabling extraordinary new achievements with its DNA analysis machines. Whilst the pandemic has demonstrated the value of gene sequencing technology to develop therapies and vaccines, track transmission and conduct health surveillance, the breadth of different new applications of DNA science has yet to be fully recognised.

On the fixed income side, social impact bonds allow investors to attribute capital to specific projects and initiatives in a direct way. They also help us to access markets where the issuer doesn’t have publicly listed equity, such as housing associations. One such example is Golden Lane Housing Association, who are a leading provider of supported housing for people with learning disabilities. The proceeds from their bond issue will be used to purchase additional properties for supported living. From an investment perspective we like the credit profile of this issuer, as the vast majority of their revenue is government backed.

In the alternatives portfolio, we hold the Gresham House Energy Storage Fund, which capitalises on the battery storage market. The UK’s increasing reliance on renewable sources of energy means it needs a solution for supply/demand imbalances. Battery storage systems represent a cost-effective way of addressing this issue.

What’s next for the strategy in 2022?

We have recently gained exposure to the European Carbon Market through investment in carbon credits. These are permits that polluting companies need to buy to pay for the cost of their emissions and are becoming increasingly scarce.

We expect the market to tighten over time as 'carbon budget' in Europe is limited, which should push up the price, and cost of emitting. From a broader perspective, we’re finding that an increasing range of client types are interested in investing in Tomorrow’s World, which has led us to consider how we might apply the strategy across different risk/return appetites.

1 Source: New Boston Consulting Group GAMMA survey reveals that only 9% of organisations are able to measure their total greenhouse gas emissions comprehensively.