Why Thematic

In an increasingly dynamic and complex world, how can you invest for the long term?

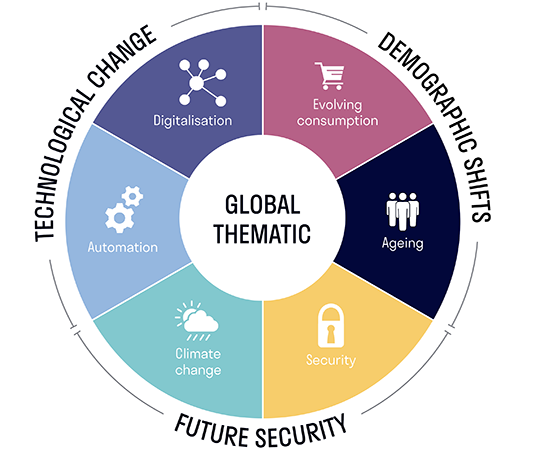

Guided by the structural forces that drive global change, our thematic investment approach helps us find the most compelling long-term opportunities. We believe there are six key themes that will play the most significant role in shaping our futures. Thinking thematically narrows our investment universe to companies that benefit from these themes.

Our stewardship work and our thematic investment philosophy draw on each other. We invest in long-term trends that have the power to improve societal welfare. Because we want to invest in ways that drive positive change, ESG (environmental, social and governance) analysis is embedded within our investment process.

Our six themes are grouped into three pairs, reflecting their shared characteristics.

Technological Change covers the innovation driving enhanced economic productivity; Demographic Shifts addresses population dynamics and evolving spending habits; Future Security represents some of the big societal challenges facing us all. In practice, all six themes are interconnected; in the global economy, it is the complex and continuous interactions between technology, demographics, and governance that drives financial markets over the long term.

Ageing

Today, 9% of people are aged 65 and over. By 2050, 17% of the world’s population will be over 65. The world’s older population continues to grow, spurred by improving life expectancy and a lower fertility rate. How we work, pay tax and save will change, and patterns of consumption will shift, bringing opportunities in financial services and healthcare.

Climate change

Climate change will lead to profound upheaval and its impact is underestimated by society and investment markets alike. Our lives will be shaped both by how well we can reduce the adverse effects of climate change and by the extent to which we can adapt to what we cannot mitigate. In endeavouring to meet these challenges, a broad range of investment opportunities will emerge, from renewable energy and electric vehicles to smart buildings and agriculture.

Automation

The combination of shrinking labour forces in most advanced economies, falling technology costs and artificial intelligence means that automation will sweep across all industries. While automation is already an established presence in automotive manufacturing and food and drink processes, most sectors of the economy are at an early stage of adoption. Digital networks will enable the collection, storage and analysis of data to enhance the benefits of automation.

Evolving consumption

The way we consume is changing – a trend that has been accelerated by the impact of COVID-19. Consumers are becoming increasingly interested in fitness, health and wellness, and spending money on experiences and travel is becoming more of a priority. Standards of living in emerging markets will converge with those in developed markets. Younger generations are entering the workforce and becoming influential consumers with different priorities to earlier generations. Entertainment preferences are shifting towards smartphones and on-demand video.

Digitalisation

The world is rapidly shifting from analogue to digital. The pandemic forced great numbers of people to contain themselves within their homes, leading to transformation in how we work, entertain ourselves, shop and socialise. We are connected in a way we have never been before, and this hyperconnectivity is redefining the way we interact with technology. Processing power is growing exponentially, paving the way for increasingly complex computing. The rise of digital content, transactions, advertising and data offer significant opportunity.

Security

We believe we are living through a profound shift in the geopolitical landscape. At its heart is the growing strain from increased global population, economic growth, and resource consumption, which exacerbates issues such as climate change, resource scarcity, and geopolitical instability – challenges too complex for any one nation to manage alone. Yet with no consensus on the ideal political or economic system, nor a sufficiently shared global identity, there is currently no realistic pathway to a single unified solution. As such, financial decisions made by organisations and individuals worldwide are more frequently driven by security concerns rather than purely economic or efficiency driven motivations.