As emission regulations tighten, investment opportunities in the auto industry are somewhat limited.

Gas-guzzling cars are on the way out. As the health implications of poor air quality and the contribution of transport to climate change become more prominent in the public conscience, regulations are being tightened accordingly.

As long-term investors, we are strongly supportive of the transformation to lower emission transport. Our challenge is to ensure we understand the scale and speed of the change, so we can invest wisely. Critically, the question we need to answer is whether current car manufacturers can deliver sustainable returns to shareholders amidst the disruption from emissions tightening and electrification.

In answering the question, we must be mindful of other disruptive forces on the horizon, such as autonomous driving, connectivity and shared mobility. Finally, the auto market is considered to be at ‘peak cycle’ demand levels in the US and Europe and that Chinese volume growth is waning, presenting near term pressures on profits that may make heavy investment in new technology challenging.

The stresses in the industry became headline news in 2015, when VW was found to be routinely cheating on its emission tests to meet tightening rules designed to protect air quality. To date VW has paid out some €27.4 billion, while other car manufacturers have faced similar allegations and the European Commission concluded that cheating was widespread.

After this we undertook a deep dive of the emission cheating scandals and took the view that the auto industry would struggle to deliver increasing shareholder value as it grappled with tightening regulations for emissions and that the risks of material liabilities and impairments was pronounced. Indeed, since 2015 many global car company share prices have failed to deliver returns for shareholders, weighed down by these and other concerns.

Here we revisit the situation, considering how the industry is facing the interwoven challenges of emissions legislation and electrification, and critically what it means for our approach to investing in the sector.

Emissions: So many acronyms! NEDC to WLTP and RDE

All around the world, governments are tightening rules on Nitrogen Oxide (NOX), Sulphur Oxide and Carbon emissions in the transport sector. The driver for these regulations is twofold. First, governments (and the public) are waking up to the need to address worsening air quality that has harmful health implications and thus real economic costs. Second, cars are major contributors to global greenhouse gas emissions, which must be brought down to combat climate change. Accordingly, car manufacturers’ dependence on the internal combustion engine is not sustainable.

In the European Union, regulators have strengthened laboratory emission tests, replacing the New European Driving Cycle (NEDC), with the Worldwide Harmonised Light Vehicle Test

Procedure (WLTP) for all new cars registered after 1 September 2018. From 1 September 2019, WLTP will also be supplemented by another test, the Real Driving Emissions (RDE) test, which will (as the name suggests) measure a car’s emission performance in real life driving situations.

WLTP is conducted in a laboratory, as was the case with the NEDC, but with more realistic driving conditions. The test is 10 minutes longer (30 rather than 20), twice the distance (14 miles rather than 7), half the time at a standstill (13% of the test vs. 23.7%), higher average speed (29mph vs. 21mph) and a more realistic test temperature (14oC vs. 20-30oC range).

This toughening in test regime means the car industry will need to spend more to bring down emissions. Diesel cars sold after September 2018 have to meet RDE test levels. Early testing data from Emission Analytics, an independent tester of real-world emissions data, suggests that these cars are having real-world driving NOX emissions that are generally below regulatory limits. As such, bringing down air pollution due to NOX emissions by diesel cars is possible, but costly.

Notwithstanding the costly fallout from the VW cheating scandal, the prospects of higher costs have, according to the European Commission’s Joint Research Centre, also led to questionable efforts by car companies to inflate their WLTP test results to make it easier to hit the 2025 and 2030 targets. This presents a risk of future possible fines or litigation.

To make matters more demanding for car manufacturers, the more material challenge will be addressing CO2 targets, especially as the EU’s 2025 and 2030 carbon emissions targets could yet be strengthened. While the European Commission proposed CO2 reduction targets of 15% and 30% last year, the European Parliament recently backed a more ambitious target of 20% by 2025 and 45% by 2030. While boosting fuel efficiency is the principal (conventional) methodology for reducing CO2 emissions, it remains technologically challenging and expensive to do so.

Diesel faces a bigger problem?

Apart from the potential cost of retrofitting diesel cars to reduce NOX emissions, manufacturers and owners of diesel vehicles have one more thing to worry about, whether diesel cars will be allowed to drive in certain parts of cities at all.

In recent years, non-governmental organisations such as ClientEarth have been taking European governments to court when they fail to tackle air pollution as required under the EU’s Ambient Air Quality Directive. These legal actions have already resulted in bans on diesel vehicles in certain areas and/or at certain times in a range of European cities.

For example, in February 2017, Germany’s highest national court ruled that cities were required to put in place diesel restrictions to protect people’s health, a decision stemming from ClientEarth’s legal action against a German state. ClientEarth has subsequently launched lawsuits against 11 German cities to implement diesel bans, while similar legal actions have also been seen in Belgium, Italy, France and the UK.

This trend towards bans on combustion engine vehicles is not limited to Europe. Elsewhere, Mexico City and a range of Indian cities are also waking up to the urgent need to address poor air quality in densely populated areas through restricting access to internal combustion vehicles.

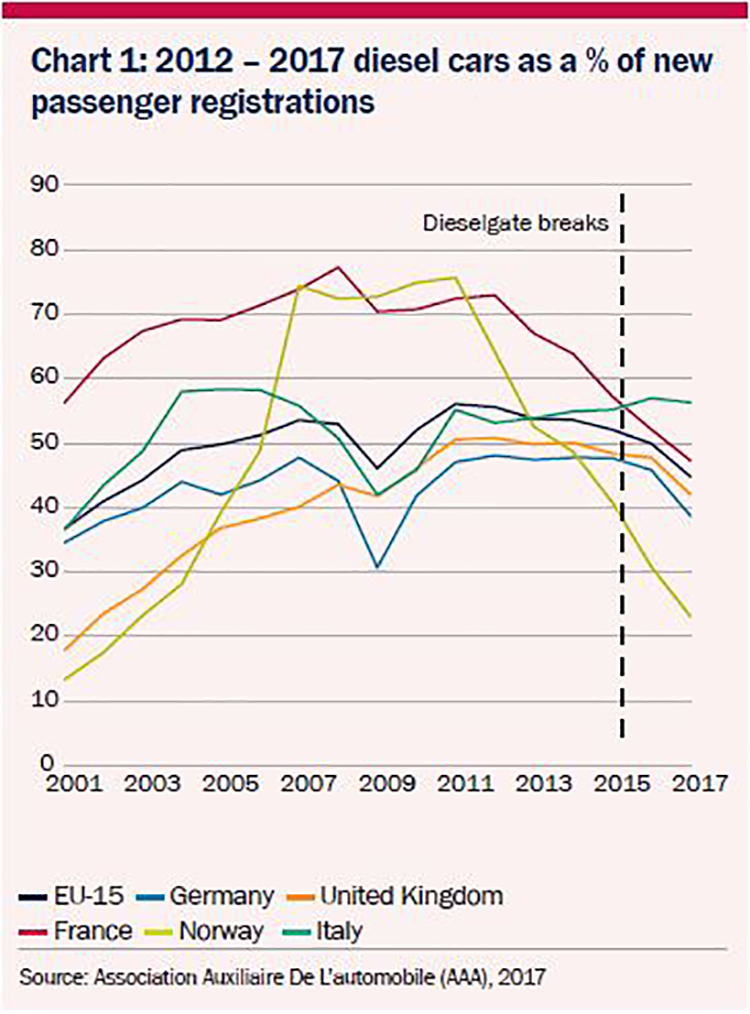

These developments and the prospect of further bans are clearly translating into negative consumer attitudes to diesel purchases. This is shown in the chart below which illustrates new passenger registrations of diesel vehicles have been declining precipitously in Europe, driven principally by UK and German consumers.

Electrification – A tale of two manufacturing approaches

Ultimately, the only sustainable solution for car companies is to switch to electric vehicles, though in time other low emission technologies may also become commercially viable. However, the electrification of the drivetrain presents a similarly profound challenge for the automotive industry.

Not only do car manufacturers have to design new electrified models but they must face the challenge of adapting their extensive manufacturing facilities to ensure profitability.

Car companies appear to be taking two distinct approaches to this adaptation requirement. The first, as championed by BMW and Jaguar, is the “one platform serves all”. Under this method, a single platform is used to build internal combustion engine, hybrid and pure electric versions of a given model.

This ‘flexible architecture’ minimises the initial capital outlay, and allows for product flexibility, a significant factor given the known unknown that the electric vehicle (EV) adoption curve presents over forthcoming years. As such, flexible production lines can run at enhanced utilisation rates, regardless of whether end demand is for electric, hybrid, or ICE vehicles.

The second method, which will be employed by the world’s largest carmaker Volkswagen, is the MEB (Modularer Elektrobaukasten) platform. This type of bespoke/native EV architecture is also used by Tesla, the world’s largest pure-play EV manufacturer, at its US production line.

This modular approach to automotive manufacturing recognises that EVs and ICE vehicles have fundamentally different vehicle architecture and thus starts the manufacturing process with a battery pack between the wheels, before building the car up from the base.

In adopting this approach, bespoke manufacturing lines are able to design and manufacture EVs with several advantages. Not only do these native lines already deliver cars with higher ranges but they have far more interior space for passengers. Further, as the EV manufacturing learning curve develops, it is likely that the economic efficiency of bespoke lines improves. This combined with lower battery costs is set to materially reduce the production cost of EVs.

Of course the downside with the native manufacturing line approach is that it requires expensive upfront investment, though likely to diminish over time, and it affords no flexibility in propulsion system delivery. As such, if EV adoption is slower than anticipated, these lines could remain idle before demand (eventually) picks up.

A rock and a hard place

Notwithstanding a widespread recognition of the transformation required, it is difficult to avoid the simple conclusion that car companies find themselves between a rock and a hard place. On the one hand they face ever tightening emission rules and bans on internal combustion engines in larger cities. On the other hand, the prospect of further capital investments to build EV capacity.

The leadership will need to be both bold and cautious in navigating this uncertain future, keeping an eye all the time on potential disruption from new entrants (including disruptors such as Tesla, Dyson and the plethora of Chinese EV manufacturers that continue to emerge) that are not weighed down by legacy assets.

Given these challenges, automotive industry valuations remain very low. As shown in the chart below, European OEMs are trading at an average P/E of 6.5x, beneath the 10 year average of 10.9x and at a widening discount to the MSCI Europe Index, currently trading at 14.4x.

Do these low valuations represent an opportunity to find value in an increasing unloved sector, or should we be wary, given the materiality of the challenges that could simultaneously continue to dampen sentiment and constrain free cash flow generation?

As thematic investors, our analysis continues to point towards a challenging operating environment for the traditional automotive sector. However, disruption will lead to changes in the structure of the industry and our research points to new and emerging opportunities from both digitalisation and climate change. So while the ride is likely to be bumpy, we continue to look for hidden value across the industry chain.