The financial crisis has left policymaking crippled. Fiscal policy is hamstrung as bloated debt to GDP levels leave little room for manoeuvre. In the US, debt levels are 80% of GDP and rising fast as the costs of President Trump’s tax cuts accumulate.

Monetary policy is also exhausted and running on empty; negative interest rates blanket Europe and Japan. The US Federal Reserve, encountering heightened market volatility at the end of 2018, conducted an abrupt reversal of its programme to unwind its balance sheet. It is true that amongst developed economies the Federal Reserve has the greatest scope to cut interest rates. Nevertheless, with policy rates at 2.25% - 2.5%, it is clear that even the US economy’s interest rate buffer will be insufficient in the event of a meaningful downturn.

At the same time, scars from the financial crisis still run deep through the economy. Despite aggressive incentives in the form of lower taxes and sharply lower interest rates, businesses remain reluctant to invest. Perhaps the inevitable transition of the world economy into an asset light growth model resulting from the digital revolution has permanently diminished the demand for long life structures and equipment. Weak investment has also led to stagnant productivity and real wages, widening income inequality. Additionally, wealth inequality has dramatically increased as easy money indiscriminately lifted all asset prices.

A new idea: Modern Monetary Theory

These stark realities are forcing policymakers to make hazardous choices. Many are embracing a dangerous new idea called Modern Monetary Theory (MMT). So, what exactly is it?

At its very core, MMT postulates that if a country borrows in its own currency – as the US, UK and Japan currently do - it should be able to run very large deficits without leading to an increase in interest rates. Debt constraints are not as tight as currently believed or perceived. It therefore follows that, when demand is weak, fiscal policy should be loosened aggressively.

MMT’s strongest advocate has been Stephanie Kelton, Bernie Sanders’ economic advisor during his 2016 Presidential campaign. Her ideas are now being embraced by the wide swathe of the candidates vying for the nomination of the Democratic Party for the 2020 Presidential election. MMT is gaining in popularity as it provides the most expedient solution to fund the expensive signature policies being proposed by the Democratic field, from Medicare for all to the Green New Deal.

How does MMT work?

How is this possible? Does it not turn conventional wisdom on its head? Let’s first consider the claims made by MMT. At its core, MMT proponents believe that when central banks print money and hand it over to governments to spend, reserves in the banking system rise ultimately putting downward pressure on interest rates. How so?

Let’s take this step by step as the mechanics behind MMT can be quite confusing.

Let’s assume that the government decides to spend money not funded through the sale of bonds or higher taxes but by the central bank printing money (creating deposits). The first thing that happens is that the government’s account at the central bank is debited while its accounts at commercial banks are credited. This influx of deposits into the banking system is partially converted into required or excess reserves. In a normal world, the government would pay for this spending by raising taxes or issuing bonds and the reserves would be mopped up. However, as the government decides to leave the increase in spending unfunded, the newly created reserves end up putting downward pressure on interest rates. This is because the banking system is keen to lend out the excess reserves in the interbank market at Federal Fund rate. This excess liquidity drives down interest rates, until they hit the floor set by the central bank – which is the interest on excess reserves. So, it follows that when governments spend money created by central banks, interest rates actually go down. MMT advocates therefore believe that government should finance spending by creating excessive reserves.

Is it really that simple?

All of this leads us to ask a number of questions. Have economists been advocating excessive prudence? Have we really been holding back much needed investment in infrastructure, health and education to the detriment of social and economic welfare?

Unfortunately, it is not that simple. As with most things in economics, there is no such thing as a free lunch. Yes, it is true that if a government were to decide to spend money printed by the central bank, interest rates would first decline because of the presence of excess liquidity. However, interest rates will stay low only as long as inflation expectations remain anchored. Instead, if households and businesses across the country start to believe that government spending will crowd out the private sector, inflation and inflation expectations will rise. MMT advocates gloss over the secondary impacts from unfunded – or monetary financing - government spending. Instead, they argue that if the economy overheats, then taxes could be increased to cool the economy. This would reduce the reserves and liquidity in the banking system and raise interest rates.

Are there any risks with MMT?

The real risk from MMT arises from ‘fiscal dominance’ – a scenario where monetary policy is rendered impotent. Inflation becomes subservient to growth objectives. Moreover, throughout history, there is not a single example of a nation exhibiting prudence after embarking on monetary finance for government spending. Unfunded government spending has always had disastrous consequences – from Weimar Germany to Zimbabwe.

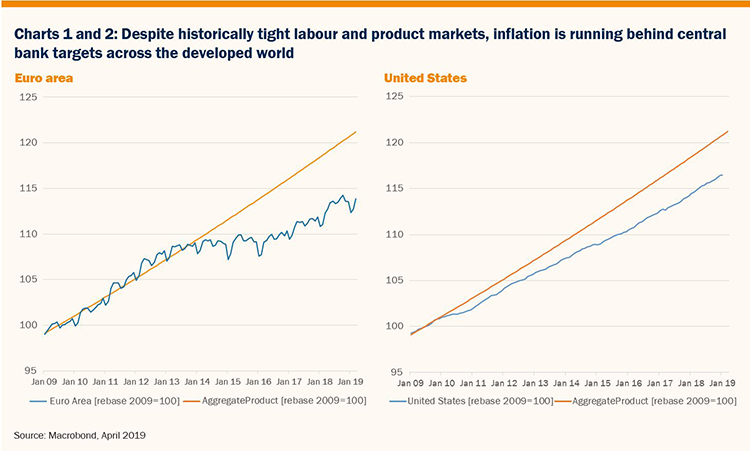

Today’s politicians are being emboldened by inflation’s quiescence. Long-term shifts in technology and demographics along with clear inflation targets have played a major role in driving inflation down. Charts 1 and 2 show that despite historically tight labour and product markets, inflation is running behind central bank targets across the developed world. Were policy makers to sacrifice the hard-won stability in inflation expectations at the altar of monetary finance, the risks would be grave. Central banks would become political puppets, inflation risks would rise and ultimately growth would suffer. Surely, there are better and sustainable ways to finance government spending? Let us hope that prudence wins the day.