Climate change is one of the most complex issues facing society today, spanning scientific, economic, societal and political aspects, as well as incorporating moral and ethical questions.

Given climate change’s global nature and multifaceted impacts, our investment approach must be correspondingly multidimensional. Therefore, we aim to take account of both global and regional economic and physical impacts, considering as to how climate change might disrupt existing business models and provide new investment opportunities.

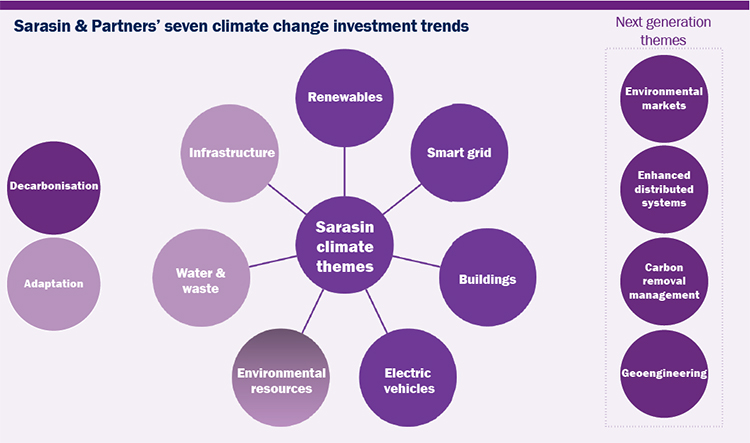

As a result of this process, we have identified seven investable long-term trends within climate change that can be segmented into two principal elements:

- Decarbonisation

- Adaptation

Decarbonisation involves identifying industries and companies exposed to the reduction of fossil fuel usage and associated release of greenhouse gases into the atmosphere. This is achieved either by reducing the source of greenhouse gas emissions, or enhancing the “sinks” (such as the oceans, forests and soil) that accumulate and store them.

Adaptation involves identifying industries and companies who must adjust to the physical impacts of climate change. Here the goal is to reduce vulnerability to the harmful effects of climate change, such as sea-level encroachment, more extreme weather events, or food insecurity.

Beyond these core trends, we have also identified four additional mitigation trends that could form the next generation of investment opportunities as these markets develop. These trends are: environmental markets such as carbon or water rights trading; enhanced power distributed systems; carbon removal management; and geoengineering.

The extent to which each of these trends present company specific investment opportunities is predicated on a range of factors that we incorporate into our analysis. These factors include the speed of various technological developments, limitations to consumer adoption rates, global political endeavours to incentivise decarbonisation and ultimately valuations. We also take insights from our other four mega-themes: digitalisation, automation, ageing and emerging consumers.

Given the magnitude and breadth of the transformation that climate change both implies and demands of our economic system, a significant component of our climate work is to apply an active filter to companies outside of these trends.

As such, we consider how climate change might alter the prevailing risk and return profiles of all industries and companies analysed, specifically through interrogating the physical, transition and liability risks faced.

If we are to meet the goals set out by the Paris Climate Agreement, the global economy needs to be transformed. This transition will simultaneously disrupt existing industries, while presenting innovative investment opportunities, trends we believe can be best anticipated through a thematic approach to analysis.