The reopening of China’s economy in January was a stroke of good luck for investors, coming just as US economic growth expectations began to weaken. As a result, the economic backdrop appeared more resilient than investors had feared. Equity markets have performed reasonably well during the first four months of the year, despite the collapse of several US regional banks.

Looking ahead, it would be unwise to rely on luck alone. China’s reopening has not – or not yet – delivered the levels of global GDP growth that markets had hoped for. At the same time, higher interest rates are still working their way through the financial system and will continue to take their toll on consumers and businesses. The challenges for the remainder of 2023 are clear: if central banks ease too soon, they will fail to contain core inflation, but tighten too much and they risk a deeper recession and potentially more financial failures. At the same time, the tightening of financial conditions caused by the collapse of several US banks brings another hard to predict factor into play.

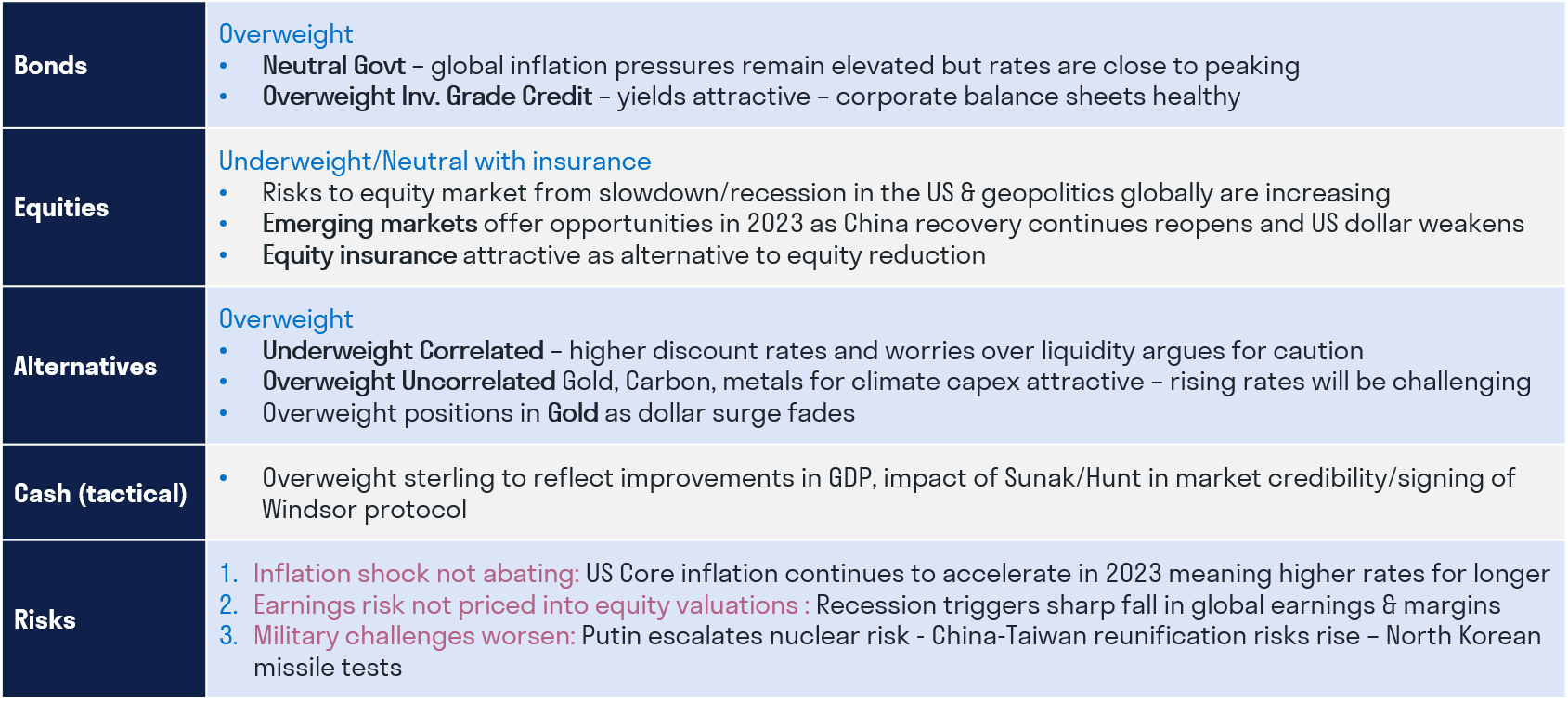

In this environment, stocks appear slightly expensive compared to where we expect company earnings to head over the coming months. We have therefore taken profits on some holdings and boosted our portfolios’ defences by:

- Adding to higher-quality corporate bonds

- Reducing exposure to cyclical equities

- Diversifying alternatives holdings

- Applying portfolio protections, where permitted.

Equities – underweight or neutral with portfolio insurance

Economies are proving resilient to higher interest rates and central banks will be forced to maintain tight monetary policies for a while yet in the fight against inflation. However, PMI indices show that US growth is slowing[1], suggesting a shallow recession in the second half of 2023. Furthermore, the recent collapses among US regional banks will further tighten credit conditions and reduce corporate profitability, accelerating the trajectory towards recession.

We have reviewed our equity holdings to identify companies whose borrowings could prove problematic and also minimise exposure to sectors that are historically vulnerable to rate rises, such as utilities and commercial real estate. The result is a less cyclical equity portfolio with defensive additions to healthcare under our Ageing theme and consumer staples in our Evolving Consumption theme.

A particular challenge remains our holdings of European industrial companies such as Air Liquide, a world-leader in the production of hydrogen. We remain positive about the opportunity for long-term climate-related expenditure, but we are concerned that slower growth in the short term may constrain earnings. We have therefore trimmed a number of holdings.

One area where we do see good value is in emerging markets. These are likely to continue to benefit from the reopening of China and any weakening in the US dollar, which would reduce the amount paid by emerging market countries for oil and debt payments. We have relatively few direct holdings in emerging markets but have implemented wider exposure to potential growth in this area from companies quoted on developed market exchanges.

As profit expectations fall amidst heightened geopolitical risk, there will likely be better opportunities ahead to buy equities. The outlook for corporate profitability is currently weak, but company earnings will recover and probably at a faster pace than they fall in a recession. A more defensive approach to theme and industry allocation is warranted, but equities are still the best asset class to access growth and produce attractive long-term real returns. We remain vigilant for opportunities to add to equity exposure.

Bonds - overweight

Building on our portfolio adjustments earlier in the year, we have increased overall exposure to bonds. With interest rates potentially close to peaking, we have a balanced, neutral approach to government bonds pending a clearer view of the peak. However, corporate balance sheets are in good health, underpinning corporate bonds, which now offer attractive yields.

We particularly favour higher-quality corporate bonds, with a focus on areas where monetary support can materially lower risk, such as bank bonds issued by strong global franchises. The support offered to US banks by the US Federal Reserve (Fed) is very generous, enabling them to pledge treasuries, agency debt and mortgage-backed securities as collateral to the Fed. These assets will be valued at par, which should mean that banks will not need to sell securities quickly in times of stress. This is highly supportive of bank debt and adds to global liquidity.

Alternatives - overweight

As part of bolstering our portfolios’ resilience, we increased diversification among our alternatives and reviewed holdings to identify hidden leverage and financing risk, especially in more complex infrastructure funds and green energy generators.

We retain an overall overweight to alternatives but with an underweight to correlated alternatives, which are vulnerable to further rate rises and lower liquidity. Indeed, other more traditional defensive assets, such as gilts, may represent better return potential and liquidity for the level of risk involved.

We are overweight uncorrelated alternatives, including trading strategies such as market neutral approaches and carbon credits, which will be increasingly in demand as a result of the transition to a lower-carbon economy. A number of our portfolios also hold gold, which should benefit from any further declines in the US dollar.

Currencies and cash

We see opportunities to enhance returns in currency markets and particularly in sterling, which tends to regain ground slowly after political crises. Examples of this were the 1992 exchange rate mechanism (ERM) crisis, the 2008 Global Financial Crisis and the Brexit referendum in 2016. Sterling reached another low during the short-lived Truss government in 2022 and is recovering once again. We anticipate that there is more to come as the Sunak government restores the UK’s credibility with the signing of the Windsor Accord and the adoption of deliverable mid-term policy targets. Risks remain, including the need to address rancorous public pay disputes, but there is evidence that global investors are returning to UK assets.

We continue to hold some cash in reserve, reflecting our view that we have not yet seen the full effects of interest rates in the economy. We prefer to err on the side of caution and keep a store of cash available to invest when we feel prices (particularly equity prices) are more compelling.

Portfolio insurance

Where our mandates permit, we will continue to use portfolio insurance to hedge equity positions. The recent decline in market volatility has made this a more cost-efficient option for reducing equity risk.

A time for patience

Markets are passing through the most erratic phase of the bear market, with hopes of a soft landing in conflict with the near-inevitability of an earnings recession. The rapid increases in US interest rates are beginning to take effect, with businesses and consumers facing tighter conditions and the possibility of more failures in the banking sector. Geopolitical risk is at a high point. Russia has intensified its nuclear threats, and the success of the Ukraine’s 2023 offensive is by no means guaranteed. Meanwhile, increasingly erratic behaviour from North Korea and deteriorating Sino-US relations give significant cause for concern.

Yet the world is not short of good long-term investment opportunities. Alongside our defensive positioning, we continue to invest in higher-quality companies that benefit from our long-term themes of Climate Change, Digitalisation, Automation, Evolving Consumption and Ageing Populations. As economic momentum and sentiment trough, and inflation recedes, there will be excellent opportunities to be brave and add risk, and particularly when monetary policy is finally eased. In the meantime, risk-reward is skewed negative: this is still a time for patience.

Policy summary: Cautiously adding to risk through Corporate Bonds & Emerging Market Equities

[1] Source: Macrobond, May 2023

Important information

If you are a private investor, you should not act or rely on this document but you should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP which is a limited liability partnership registered in England and Wales with registered number OC329859 and is authorised and regulated by the UK Financial Conduct Authority. It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and we make no representation or warranty, express or implied, as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser.

© 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.