Partner, Head of Stewardship

Natasha Landell-Mills, CFA

Partner, Head of Stewardship

Natasha oversees the firm's stewardship activities. Specific areas of work include steering the integration of environmental, social and governance (ESG) matters into the investment process, managing voting and engagement, and leading outreach on several policy and market-related matters.

Enjoying this article?

Sign up to receive our commentary on the latest trends, straight to your inbox, every week.

When there’s still so much to achieve, it can sometimes be hard to see progress. Looking back on 2020 is particularly tough given the hardship and disruption imposed by the coronavirus pandemic.

But it offers us the opportunity to report on what difference your capital is making through our stewardship activities. That is, how we are helping to catalyse positive change in your companies and the broader market place, nudging wherever we can towards a more sustainable world, and thereby protecting and enhancing your capital.

ESG INTEGRATION STRENGTHENED

Our environmental, social and governance (ESG) analysis has taken a big step forward in 2020. With more resource deployed into improving our understanding of ESG value drivers, we have gained deeper insights into your companies. We have rolled out an enhanced ESG matrix, invested in increased ESG data gathering, and built ESG inputs into company valuation models.

CLIMATE STRESS TESTING - BUILDING PORTFOLIOS RESILIENT TO DECARBONISATION

An innovation we expanded in 2020 is our climate stress testing work. This involves bottom-up analysis of how your companies will be impacted by the world shifting onto a net zero carbon growth pathway. We evaluate which government policies are most likely to curb fossil fuel-based activities in a particular sector, and what this will mean for specific companies. Based on this analysis we have exited all of our oil and gas holdings, including Shell, BP and Total.

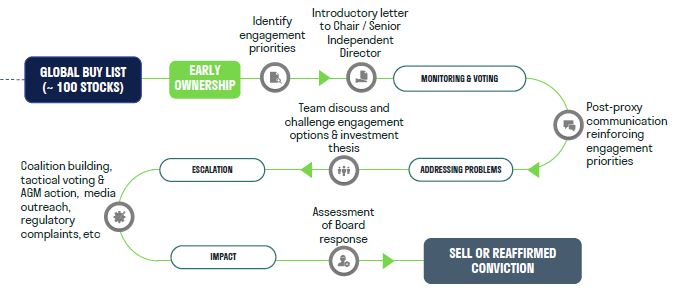

FIGURE 1: SCHEMATIC OF SARASIN & PARTNERS’ OWNERSHIP DISCIPLINE

TAKING OWNERSHIP SERIOUSLY

Understanding ESG value drivers helps us invest better. It also provides the foundation for impactful engagements with companies. When we understand the inner workings of businesses, then we know when things aren’t going smoothly. We bring an outsider’s perspective, with an appreciation of broader stakeholder expectations for companies and their contribution to society.

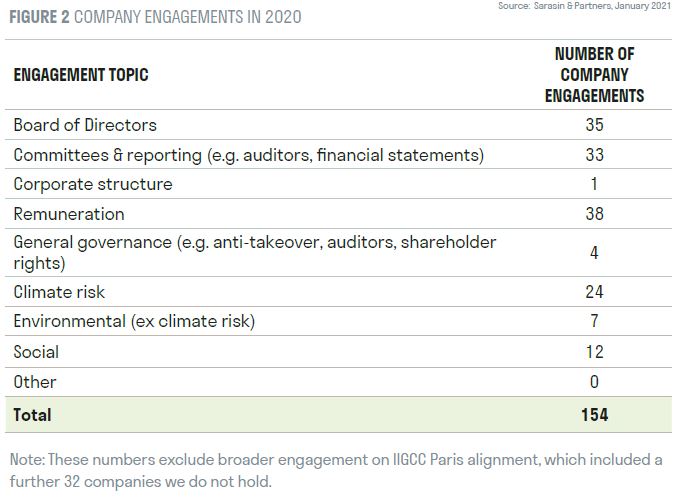

In 2020, we engaged with 80 of your companies on a range of matters (as shown in the figure 2) from board structure and diversity, to auditor independence, to climate resilience, or treatment of staff during the coronavirus lockdowns.

We have voted at about 700 company meetings. As detailed in our Ownership Discipline above, we vote against management where shareholder interests are at risk. We voted against management or abstained at least once in 480 meetings held. The most frequent areas of dissent included non-independent directors, excessive or mis-aligned remuneration and auditor reappointment due to concerns over independence.

Most of our engagements are bilateral, but we also collaborate in broader initiatives, for example the Climate Action 100+ initiative, ICCR Coronavirus Initiative, Ellen MacArthur’s Global Commitment on the Circular Economy, and ShareAction’s Workforce Disclosure Initiative. We also lead our own collective engagements as we seek to escalate a concern.

FIGURE 2: COMPANY ENGAGEMENTS IN 2020

MAKING OWNERSHIP MATTER

Paris-aligned financial statements at Shell, BP and Total

In 2020 we ratcheted up our effort to press fossil-fuel-dependent companies for Paris-aligned accounts: accounts that reflect the world moving onto a net zero pathway by 2050. Targeting BP, Shell and Total, we coordinated investor letters representing USD1 trillion in assets to the Audit Committee Chairs and lead audit partners. The impact was clear: all three companies’ 2020 financial statements adjusted critical accounting assumptions for Paris, multi-billion-dollar impairments followed, and accelerated transition strategies were published.

Barclays becomes first European Bank to incorporate net zero ambition into its articles of association

Working alongside ShareAction, UK pension schemes and other investors, we co-filed a Shareholder Resolution at Barclays’ 2020 AGM, calling for net zero commitment. In response, management filed its own Resolution for a Net Zero Ambition, covering all financing activities. This gained over 99% shareholder support. Attention is now turning to other banks.

Managing coronavirus responsibly

In 2020, we mapped your companies’ exposure to mismanagement of key stakeholders during the pandemic. One company where we identified concerns was Associated British Foods. Specifically, we were not comfortable with Primark’s initial decision not to pay for outstanding garment orders and non-payment of landlords. We sought discussions with the Finance Director, and were pleased to see the company reverse its stance on paying suppliers and set up a wage fund for garment workers.

RIPPLE EFFECT - PARIS-ALIGNED ACCOUNTS DRIVE PARIS-ALIGNED BEHAVIOUR

Sometimes our company engagements lock onto a broader market failure. This has been the case with our work on the need for Paris-aligned accounts. Companies are widely ignoring decarbonisation when they make critical accounting assumptions – which means their numbers may mis-represent their true economic health. The result: too much capital going into harmful fossil fuel activities.

Our company engagements with BP, Shell and Total have provided a platform to send a clear message to all companies, auditors and regulators. In partnership with IIGCC, we published “Investor Expectations for Paris-aligned Accounts”, which was sent to 36 European-listed companies in the energy, materials and transportation sectors with the support of over $9 trillion in assets. We have made a submission to the Climate Change Committee, seen widespread press coverage, and presented at conferences.

WHAT WILL BE IMPORTANT IN 2021

First, climate change. We will be more focused than ever on the investment opportunities and risks the accelerating energy transition brings. We will be working hard to ensure that your companies act on the climate imperative. Above all, in the run up to the next international negotiations on climate change in November, we will further amplify the centrality of Paris-aligned accounting and audit.

Second on our list will be maintaining our focus on promoting robustly independent audits to deliver accounts that underpin long-term stewardship. We have had considerable traction over the past few years raising awareness on the importance of accounting for the manner in which capital is deployed and thus long-term economic growth. Above all, shareholders need to start holding auditors and Audit Committees to account.

A third priority for 2021 will be setting a vision for a responsible technology sector. Scrutiny is beginning to translate into action, whether over anti-competitive behaviour, questionable tax structures, inadequate content management or privacy controls. An unresponsive tech sector will raise risks to capital. Investors have been relatively silent on these trends; this needs to change. We will identify and pursue material threats.

A fourth priority will be pressing companies to develop a more sophisticated approach to their ‘social supply chain’. Alongside our ongoing COVID monitoring effort, we will expand our scrutiny of how companies are ensuring fair treatment of staff and suppliers, and – above all – providing better disclosure on the human capital embedded in their businesses.

While we will need to remain flexible to respond to events as they unfold, our purpose remains clear: to grow and protect your capital in a way that benefits society, not at its expense.