Discovering global consumer trends that provide long-term growth

Our evolving consumption theme is a huge and ever-changing source of global investment opportunities. The diversity of change within this area, which represents about 70% or so of global economic activity, is enormous.

When researching this theme, we do not simply stereotype different types of consumers but rather attempt to tease out sub-themes and crosscurrents that could provide ideas for pockets of enduring, secular growth.

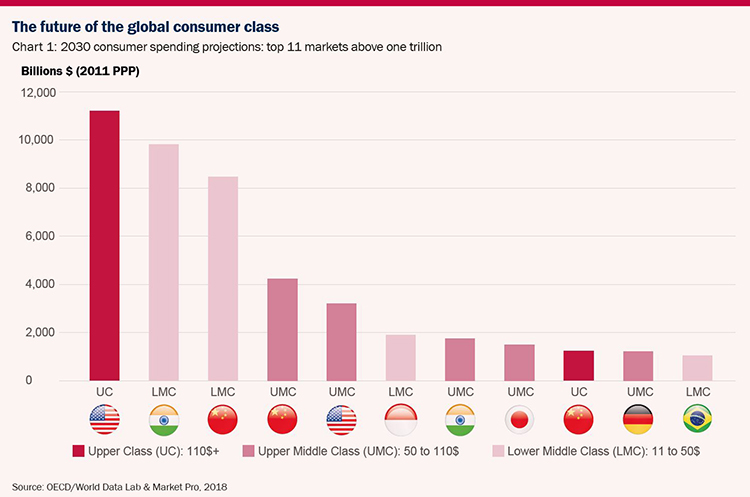

Inevitably, a number of these effects overlap with other themes we look at – for example the democratisation of healthcare within ageing, or a variety of ideas within digitalisation involving music and gaming. We purposely avoid rigid analysis like solely focusing on a particular country and income threshold - for example, the emergence of the Chinese middle classes - as this puts the emphasis on the symptoms rather than the causes. Chart 1 from the OECD illustrates the multitude of different flavours of consumers that by 2030 are likely to spend over $1 trillion for each grouping, but even this is a simplification.

Observing how humans change consumption over time

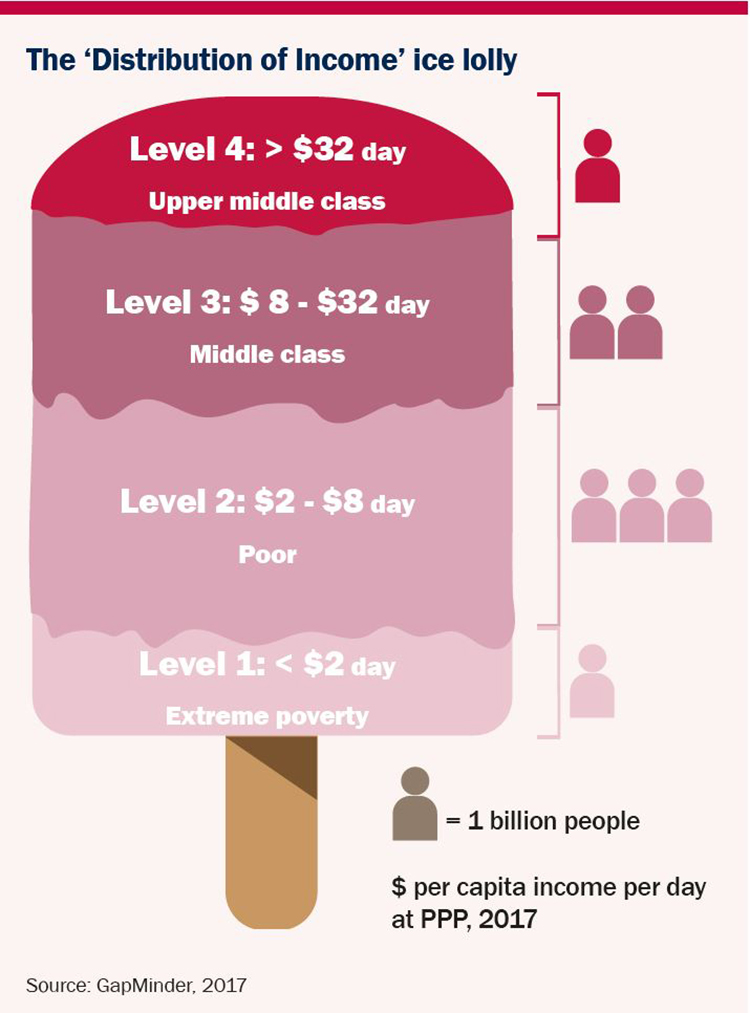

The late, great social thinker Hans Rosling intended to steer away from what he called the ‘gap instinct’ of observers to look at things in black and white. In his book, Factfulness, he talks about “the stress-reducing habit of only carrying opinions for which you have strong supporting facts”. Rather, he proposed a variety of more nuanced ways of looking at the world – among them an income hierarchy of levels one to four, defining the points through time where humans have changed consumption. The distribution of income model looks similar to an ice-lolly; with the largest part of the population sitting in the $2 - $8 a day part of the distribution, while incomes of $8 - $32 a day occupy the largest section of humanity.

It is profoundly important to attempt to gauge the tastes, motivations and consumption changes for these particular consumers over the next generation as they make up the majority of the population. By 2030, developing countries and emerging markets will be home to an estimated 80% of the world’s middle class. Urbanisation, falling demographic dependency ratios, higher standards of education and governance are all leading to improved standards of living for hundreds of millions of people as incomes converge with those in the developed world.

New patterns are emerging

In the developed world, too, new patterns of consumption are emerging. Generation Z is now entering the workplace and thus becoming influential consumers with different priorities to those of older generations. Consumers are spending an increasing proportion of income on fitness, health and wellbeing. Diets are also improving. Experiences and travel are becoming higher priorities, and entertainment preferences are shifting towards gaming, E-Sports, smartphones and on-demand video.

Our thinking around the evolving consumption theme takes us in many directions with numerous stocks to consider:

- Discount retail is the trend in trading down where market share gains are driven by lower prices in companies such as Costco or Associated British Foods, which owns Primark

- Formalisation occurs largely in less developed economies where fragmented markets are usurped by better standards and scale advantages. Examples include drinks company FEMSA (through its very successful OXXO convenience stores) in Mexico, or car retailer Carmax in the US, which has formalised the process for buying used cars and made it more pleasant and considerably less stressful

- Premiumisation uses a strategy of quality over quantity to increase returns with examples such as Coca Cola (smaller bottle sizes) or Treasury Wines in Australia, with so-called ‘masstige’ wines or premium mass-market wines

- This is different from a trend towards luxury, which is geared towards new wealth and the plethora of mass affluent and high net worth individuals, particularly in Asia, with companies such as Kering benefiting

- Fitness, health and wellness combined is another trend that yields investment opportunities in companies like Nike for fitness and Shimano, which makes critical components for bicycles

- Shifts in dietary preferences are generating a tectonic move in the food landscape. Jeneiv Shah’s article on our Food & Agriculture fund illustrates one way to invest in this trend by using ideas centring on changing habits with stocks such as WH Group benefitting from increasing Chinese demand for meat

- Environmental and social awareness is growing, leading to an increased emphasis on veganism, craft and natural products, and the importance of provenance. Beneficiaries include the food ingredients company Givaudan, which is profiting from a greater desire for healthier ingredients. Other areas of interest include electric vehicles

- A seemingly inexorable rise in global travel reflects changing tourism habits. While we are cognisant of the risk of over-tourism, companies such as Marriott, Samsonite and Airbus all benefit from the crossover of cheaper travel costs and rising incomes

- One of the main enablers of all the aforementioned consumption changes is the pervasive influence of e-commerce and digital media, which increasingly inform consumer habits. We attempt to look beyond the more obvious behemoths of Amazon to companies such as online fashion retailer ASOS, or where businesses can be transformed by cutting out distributors, such as Nike. Netflix is another example of a highly disruptive company benefitting from rapidly changing preference for media consumption

Finding the most exciting opportunities through thematic investing

Global consumers are hugely diverse, and new product channels are constantly being created through technology and innovation. Frugal consumers everywhere are benefiting from improved price transparency; retailers with the lowest prices are able to rapidly win share, and those without are struggling. Collectively, these evolving consumers lead to a broad range of exciting investment themes. Personal consumption expenditure represents the largest single component of GDP. Changes in demographic, technological and socio-economic factors are transforming global consumer behaviour. As part of our thematic investment process, we map out pockets of consumer development that we believe will enjoy excellent secular growth, as well as remaining mindful of the areas to avoid.