Deglobalisation and decarbonisation are probably the greatest headwinds facing the world economy today.

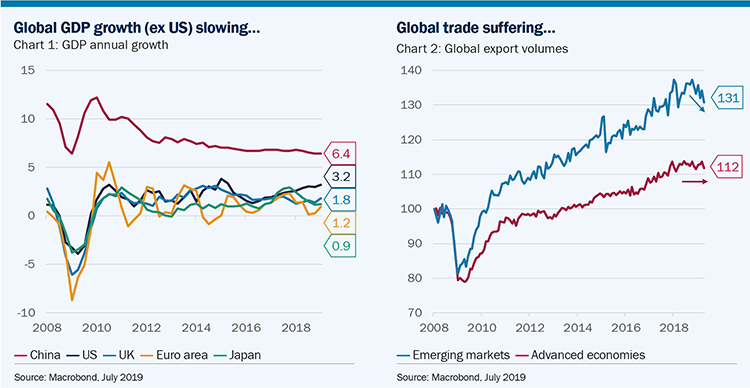

The former reflects the increasing use of trade restrictions to negotiate geopolitical advantage, while the latter is driven by the growing imperative for climate action. Both, by chance, are happening simultaneously and so putting considerable strain on the countries and industries at the apex of these trends. Germany is suffering as the world’s largest net exporter and centre of the global auto-industry, China remains locked in a trade and technology struggle with the US, while for the UK, the risk of a ‘no-deal’ trade shock is now dominating investment and business sentiment.

Despite a robust US economy, these trends are taking their toll on manufacturing worldwide. While a global recession is not imminent, the economic risk is now enough to set alarm bells ringing at the world’s central banks. They know they have little monetary ammunition left to fight a new downturn, with interest rates already below zero in Europe and Japan and balance sheets swollen from previous rounds of quantitative easing. There is much talk of precautionary rate cuts, new rounds of ‘QE’ and even co-ordinated fiscal and monetary stimulus. The world’s bond investors have been quick to read the tea leaves – the result is one of the sharpest falls in bond yields in recent memory. A staggering $13 trillion of debt worldwide now trades with a negative yield1 including almost every German government bond in existence.

By contrast and somewhat reassuringly, outside of manufacturing and especially the auto industry, much of the rest of the world economy is in comparatively good shape. Consumer confidence remains robust in the US (consumer spending is 70% of GDP) and is still positive even in Europe. Unemployment is close to 40-year lows in the UK and America (where last month saw a solid 224,000 new non-farm jobs created) and is falling steadily in Europe to a near nine-year low of 7.8%. Indeed almost every major economy boasts real wage growth with labour participation rising (in the UK for example the female employment rate is 71.4% - the highest in recorded history).2

A powerful cocktail for equity markets...

For equity markets, we have then a rather powerful cocktail. There is enough fear to ‘crash’ the yield on bonds and suppress any desire by central bankers to raise rates, but still enough growth and employment to drive profits and dividends (which rose another 7.8% year-on-year).3 World equities are already trading at an unprecedented yield premium relative to bonds - ten year German Bunds for example yield close to -0.4% while eurozone equities yield 3.5%.4 Against this backdrop, there is a strong incentive for investors to switch from bonds to equities, a key factor behind the extraordinary 17% rise in the MSCI World equity Index5 for the year to 30 June.

We have taken advantage of these trends with an overweight to equities throughout our balanced funds and mandates. Yes, we have been underweight bonds, but mostly to finance the equity positioning as well as holdings in infrastructure and renewables. In more risk-averse portfolios, we have included a dividend tilt in our equity selection, precautionary positions in gold and, where appropriate, portfolio insurance programmes. It is noticeable that within our equity selection, those with an environmental, social and governance (ESG) bias have performed particularly strongly. In many cases, this has been due to the absence or low exposure to oil, banks and serial polluters as global investors align themselves with Paris targets and the UN’s principles of responsible investment.

So, what are the investment priorities for the second half of 2019?

So where to from here? First, for all the unpredictability of the Trump administration, their policy is often strangely dovish. Not only has President Trump launched fewer military interventions6 than any recent predecessor has at this stage of the presidential cycle, but he has repeatedly sought reductions in America’s military forces in the Middle East. The unexpected détente with North Korea last month, the flip-flop on export restrictions on Huawei and even the move to demure on a military retaliation for the shooting down by Iran of a US drone, argue for limits to the escalation the White House desires. Whether there is a hidden caution in the President or simply that he has an eye on November 2020 is not clear, but for equity markets this is somewhat reassuring. Indeed the target of his Twitter feed seems less his foreign adversaries and more the perceived hawkishness (!) of the US Federal Reserve. In short, the Trump ‘Electoral Put’, or the notion that a strong stock market is a high priority for Presidential re-election remains in place.

Second, we believe that strong ‘ESG’ factors will continue to be powerful drivers of equity returns both positive and negative. We have for example sold our holdings in Coca Cola, not because of the defensive nature of the company but rather for the costs and challenges faced in disposing and recycling of their plastic bottling and in responding to the growing global obesity epidemic. We have also exited our holdings in Shell across our Climate Active strategies, less because management is failing to recognise climate challenges, but rather because capital-spending remains so heavily skewed toward fossil fuels (90%) and, capital could be at risk under a Paris aligned world. Note we have not currently extended this divestment to our wider mandates.

At the same time though, we are actively buying companies that are clear beneficiaries from a new low carbon economy – the global opportunity is immense and was perhaps best summarised by a paper from the Global Commission on Climate and the Economy:

“We are on the cusp of a new economic era: one where growth is driven by the interaction between rapid technological innovation, sustainable infrastructure investment, and increased resource productivity. This is the only growth story of the 21st century. It will result in efficient, liveable cities; low-carbon, smart and resilient infrastructure; and the restoration of degraded lands while protecting valuable forests. We can have growth that is strong, sustainable, balanced, and inclusive.”7

Our portfolios already invest in wind (principally offshore), solar, enzyme technologies, batteries and several utilities prioritising alternative energy generation. Our real estate funds target ‘smart’, low emission buildings while our exposure to industrial processes and controls manufacturers that optimise emissions is steadily rising.

Finally, I fear, the spectre of Brexit hangs over any discussion of trade and ‘deglobalisation.’ We are cognisant of a possible snap British election in the coming months alongside likely heated initial discussions with Brussels in the run-up to 31st October , although we remain somewhat more optimistic on a final deal. First, the strong language used by our likely next Prime Minister is crafted for a Eurosceptic Tory membership and from the EU’s perspective only sets out the UK’s position for the start of negotiations. Second, the opposition to no deal of the UK parliament appears resolute – The Times reports that there are “30 plus Conservative MPs looking at legislative options to prevent no-deal” while Labour is poised to vote for a referendum on any deal. Third, both sides would dearly wish to avoid no-deal, with lead economic indicators weakening sharply in the UK and eurozone (the EU runs a £95 billion annual surplus on goods exports to the UK). Ironically, with our high global equity exposure, client portfolios should be well-protected in absolute terms in the event of a ‘no-deal’ – it is managing a flow of funds into Sterling and UK assets on the inkling of a deal that is, for us, the harder challenge.

In summary, deglobalisation and decarbonisation (or trade and climate) are two of today’s greatest influences on both investment markets and, of course, central bankers. For the moment, the latter are responding with ultra-loose policies that are forcing yields lower and the price of risk assets higher. We must use the breathing space this creates to prepare portfolios for the longer term, where both a low-carbon economy and a world that relies less on extended global supply chains and more on domestic growth priorities, are the new realities.

1 Bloomberg Barclays Global Aggregate Negative Yielding Debt Index 7 July 2019

2 House of Commons Library – Women and the Economy March 2019

3 Janus Henderson Global Dividend Index Q1 2019

4 Euro STOXX50 T12 Div Yield

5 MSCI ACWI Index

6 Wall Street Journal

7 Unlocking the inclusive growth story of the of the 21st Century - The Global Commission on the Economy and Climate