As we reflect on the past year, we imagine a conversation between a Sarasin client and their manager as they review their portfolio returns and consider the risks and opportunities in 2019.

After nearly a decade of rising equity prices, was a ‘down year’ well overdue?

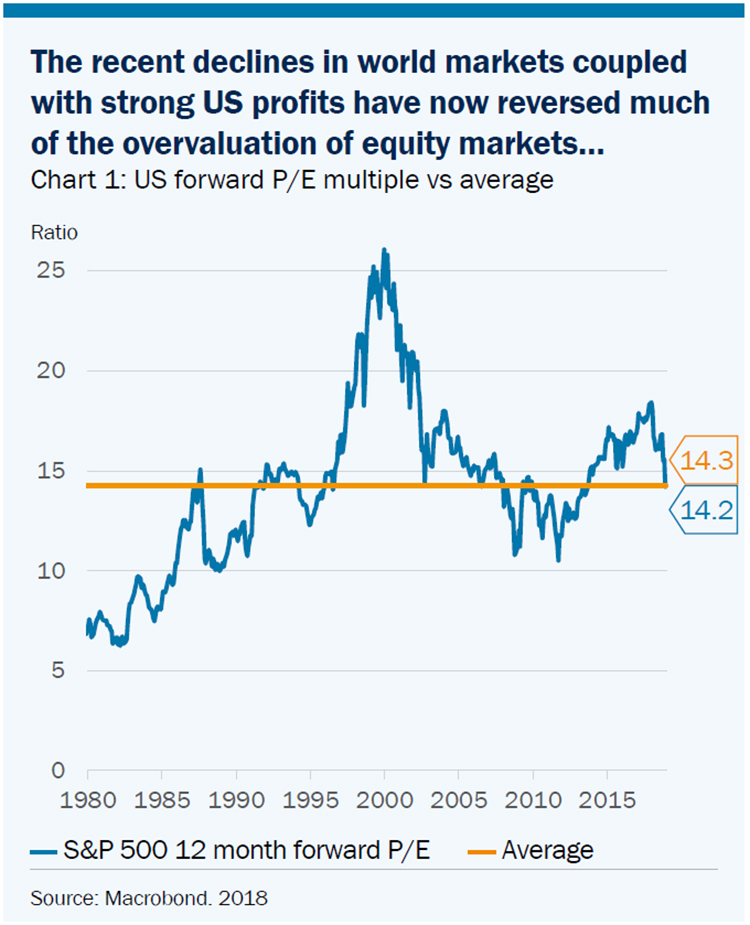

After nine US rate rises and the steady dial-back of central bank ‘QE’, investors are now starting to feel the swell. While US corporate earnings rose by more than 20% in 2018, thanks to tax cuts and a domestic growth surge, equity market multiples fell by even more – the result is the first year of negative returns for the US market since the credit crisis and double-digit losses for Europe and Asia. For the first year in seven, US equity prices underperformed US corporate profits – so yes, market valuations are normalising but after a very strong 2017.

I see we cannot live in the ‘calm waters’ of QE forever, but December’s market volatility was extraordinary - is something more sinister happening?

Thin holiday season trading volumes likely exaggerated the moves, but more frequent bursts of volatility across asset classes (we saw them in February too) will be a fact of investment life as monetary policy is regularised. Central bank support and near-zero rates have kept equity volatility (measured by the VIX index) at an average of 15.3% over the last five years, less than three-quarters of the average level that prevailed in the twenty years prior to that, so some normalisation is inevitable. Typically, tighter money means lower valuations and lower real returns across all asset classes– so I fear 2018 was almost ‘text book’ in terms of the market response.

The US President’s criticism of Jerome Powell, chair of the Federal Reserve, breaks a number of taboos – will this hurt world markets?

Donald Trump’s blizzard of tweets criticising the US central bank is clearly attempting to change the debate about how US monetary policy should be conducted – it leaves the ‘Fed’ less insulated from politics and it’s natural for investors to demand a premium for this. There is rumour that President and Chairman will meet and ‘make up’ and there is precedent for this - Greenspan, Bernanke and Yellen all attended such meetings but more to inform the President than to answer criticism. So yes, Trump’s comments are contributing to volatility but as long as inflation remains under control (and the President would say we have him to thank for low oil prices), the risk is probably not yet material.

Should we worry about rising bond spreads (especially in high yield credit markets)?

Yes – investment grade bond spreads (the additional yield they afford over government bonds) have now widened back to the levels we saw in mid-2016, with all of the tightening that resulted from Trump’s election and his ‘business–friendly’ agenda more than fully reversed. The IMF for example is concerned that while governments and consumers have reigned in deficits, absolute levels of corporate debt are still high (especially in Asia). The leveraged loan market in particular is showing that some excesses of 2008 are again re-emerging. This supports a deliberately conservative bond strategy at Sarasin – our balanced funds for example target an average credit rating of A+, and we are increasingly cautious of high yield and other specialist strategies.

1 January 2019 marks exactly 20 years since the first eleven countries joined the euro. Today, Brexit, budget woes and the prospect of an Italian recession are not encouraging but could 2019 herald a surprise renaissance for the European economy?

The short-term outlook is not promising; German inflation recently slowed to the weakest in 8 months (1.7%), while output contracted in two of the three largest economies in the region in the third quarter, with Italy close to technical recession. All of this suggests that the deflationary forces that have plagued the eurozone remain a threat just as the European Central Bank steps back. Further fundamental reform could be possible in 2019 after European parliamentary elections in May with new heads of the Commission and ECB. With Chancellor Merkel’s successor also now assured, a renewed urgency for reform (especially financial) could emerge. This has the potential to stabilise the selloff in European banks (currently trading at just half the price-book ratio of their US counterparts) and hence to drive a broader re-rating of European equities – in short value is clear but investors will need (even more) patience…

Many of the highest profile individual stock moves in 2018 were attributable to environmental, social or governance (ESG) issues – does this mark a sea change for investor attitudes?

Ultimately, good governance and ethics are always critical for investment returns, but our long-term commitment to deep analysis of ESG issues was especially useful in reducing risk in 2018. The MSCI World Autos index (where we thankfully held no direct exposure in main accounts in 2018) fell by nearly 20%, much of this driven by the aftermath of the ‘Dieselgate’ scandals. Nissan, battered by the arrest of its Chairman Carlos Ghosn, was a stock we were pleased to have sold in spring 2017 after strong concerns (even then) about lack of board oversight and controls.

It was also very rewarding to see Shell introduce carbon emission targets that will be directly tied to executive pay (although we would like them to go further and incorporate these goals in their annual report). Finally, we and other managers have campaigned hard on audit reform and it was very welcome to see publication of two UK government reports that will trigger reform of the regulator and a reshaping of the way that auditors do business. So for us, ESG is a key part of our portfolio-wide risk control and it is very encouraging to see much greater attention being paid to it by government and other investors alike.

So, your biggest worry for 2019?

The shorter maturity segment of the US treasury yield curve is gradually inverting, indicating that we are ‘late’ in the economic cycle and hence face a rising risk of recession, although it does not provide a precise timetable. My growth worries though are not in the West, where unemployment is low and consumer confidence and corporate profits are still robust, but in China. Economic visibility is poor with manufacturing survey data now looking consistently weak; for President Xi, President Trump’s trade tariffs were not well-timed with the New Export Orders component of the PMI survey slipping to 46.6 in December, the worst since the depth of the China ‘growth scare’ in 2015. Yes, the Chinese government will react (probably with tax cuts) but on a recent trip to the IMF by our Sarasin economist team, it was thought that this would offset only some of the trade-related drag. In short, global growth ‘ex-China’ will be difficult to achieve – hence, a more defensive equity strategy with an emphasis on sustainable dividend growth alongside higher than normal cash positions remains our broad policy until we know more.

So where do I look for portfolio opportunities?

The greatest opportunity for investors is that the past year’s correction has left equity markets relatively inexpensive versus recent history. Cash and government bonds offer little yield competition to global equities. Central banks can certainly afford to be patient so interest rate risk is modest whilst the price of oil and other commodities are subdued. Most compelling though is that our analysts are still finding many genuine thematic growth opportunities that will stand out in a slower growth world.

In particular, we see strong investment ideas emerging from our ageing theme; rich and poor world health services are slowly converging, assisted by rapid medical innovation, while in the US there is finally bipartisan support to prioritise medical efficiency. Climate change, while a huge global challenge, is also a large investment opportunity – offshore wind, solar, battery and emissions technologies are all part of our portfolios, while we see carbon neutral growth strategies attracting premium investor valuations. The steady move to digitisation supported by AI and Big Data has been little interrupted by the selloff in technology stocks – indeed many new economy investments are now available at (or close to) old economy valuations. Even the woes of the high street are a sign that many new consumption patterns and models are emerging – with this year’s selloff taking the good down with the bad. Our buy list is full of growth at increasingly reasonable valuations…

Finally, I suppose I must ask you - what does the Brexit countdown mean for portfolios?

From a purely investment perspective the biggest risk actually lies with a sudden agreement on a deal or the announcement of a new referendum. To date, our portfolios have been insulated from domestic uncertainty by a distinct global bias. Were a deal concluded with Europe or even a new referendum announced, then the rally in sterling and in UK domestic assets could be pronounced as international flows to the UK normalise, and a stronger pound means global portfolios could suffer. The challenge is that neither of these outcomes are wholly in the power of Mrs May’s government – it needs Brussels to make concessions on the ‘backstop’ or Labour (and the sphinx-like Jeremy Corbyn) to support a referendum. Being alert to currency moves, making use of currency futures and offering GBP-hedged share classes for all our core funds is probably the best protection until calmer waters return...at least for British politics.