Sarasin achieves A+ rating with the UN Principles for Responsible Investment

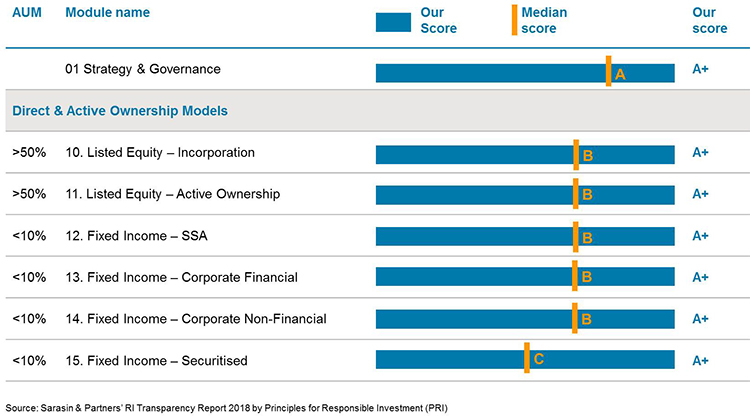

As signatories to the United Nations-backed Principles for Responsible Investment (PRI), we are pleased to have been graded A+ for our stewardship approach.

The PRI has published the results of its annual assessment, covering almost 2,000 investors with over $80 trillion under management. This considers how each signatory has fulfilled their commitments to integrate ESG issues into the investment process and to engage with companies across their portfolio, as well as assessing the quality of reporting and collaboration with other investors.

We have maintained our high scores from last year, and improved our scores for active ownership and fixed income. “As references to responsible investment become increasingly commonplace among asset managers, the PRI’s assessment provides an opportunity to benchmark the quality of our approach” comments Stewardship Analyst Dominic Burke. Sarasin and Partners is also a Tier 1 signatory to the UK Stewardship Code.

What are the Principles for Responsible Investment?

The six Principles for Responsible Investment are a set of voluntary aspirations which investors commit to adopt and implement in their investment process:

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

We also commit to evaluate the effectiveness and improve the content of the Principles over time. We believe this will improve our ability to meet commitments to beneficiaries as well as better align our investment activities with the broader interests of society.